Crypto market struggles with downtrend, Ethereum tests resistance

Market picture

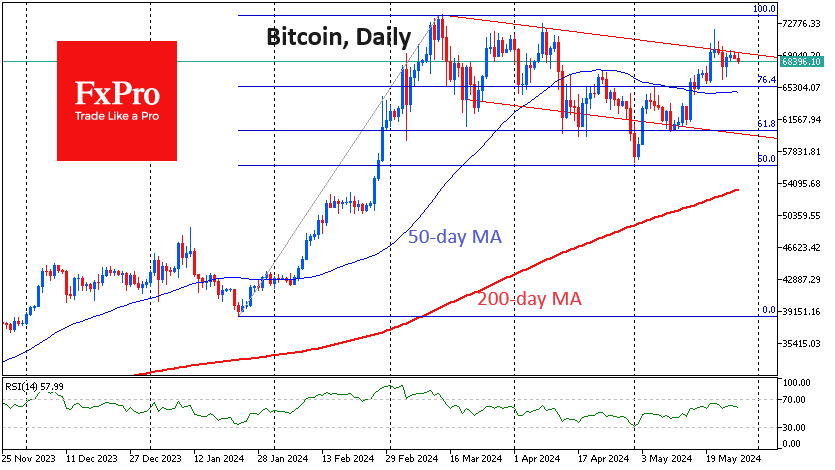

Crypto market capitalisation rose 6.2% in seven days to $2.57 trillion, approaching the area of this year's highs above $2.7 trillion. Bitcoin's price, like the overall market capitalisation chart, tests the upper boundary of the downward range that has been in force since March.

The break of this downtrend is the ability to consolidate above the last local high. For the crypto market, this is the $2.63 trillion area, and for Bitcoin, it is $71.6K. An alternative negative scenario suggests a return to the lower end of the range, just above $2.12 trillion and around $60K for Bitcoin.

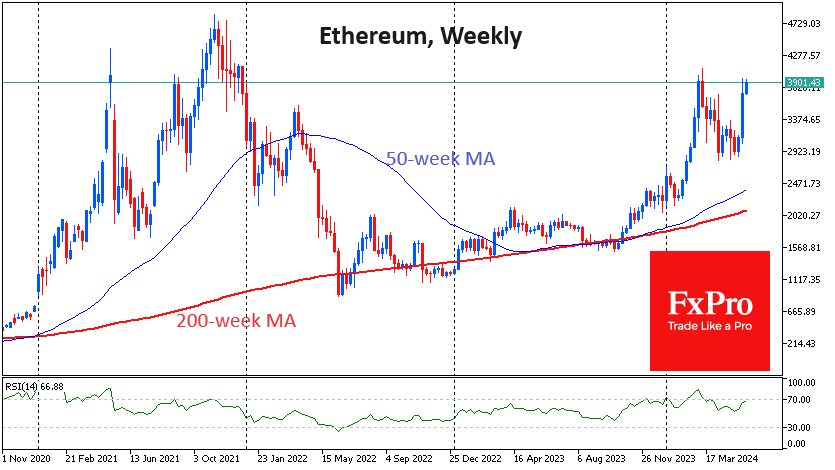

Ethereum has not abandoned its attempt to overcome $4000, hovering above $3900 early in the day on Monday. The ability to overcome this psychologically important round level could quickly take the price to the highs of November 2021, in the $4600-4800 area.

News background

According to JPMorgan, the SEC's approval of the spot Ethereum-ETF is a political decision ahead of the US presidential election. The decision was made immediately after the US House of Representatives approved the FIT21 bill on cryptocurrencies.

The new stage for crypto-ETFs may start in 2025. Standard Chartered believes that Solana and XRP are the next cryptocurrencies in line to launch ETFs. The bank predicts increased dominance of Bitcoin and Ethereum. TD Cowen admits that ETFs for a "basket of cryptocurrencies" will appear within a year.

Analyst Captain Faibik draws attention to the breakdown of the lower boundary of the "rising wedge" figure on the weekly chart of Bitcoin dominance. In his opinion, it means the beginning of the altcoin season. At the same time, the BTC dominance rate may fall from the current 54% to 45%.

Cinneamhain Ventures admits that the regulator's similar "way of thinking" may spread to tokens of other projects. However, some experts note that the SEC may still classify the staked-locked Ethereum as a security.

According to Bloomberg, the bankrupt FTX exchange has completed a series of auctions to sell $2.6bn worth of Solana (SOL) tokens at significant discounts to the market price. The coins are locked in vesting for four years, but the gradual unlocking will begin in a few months.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)