Dollar slips as CPI data increase September Fed cut bets

Inflation miss seals the deal for September Fed rate cut

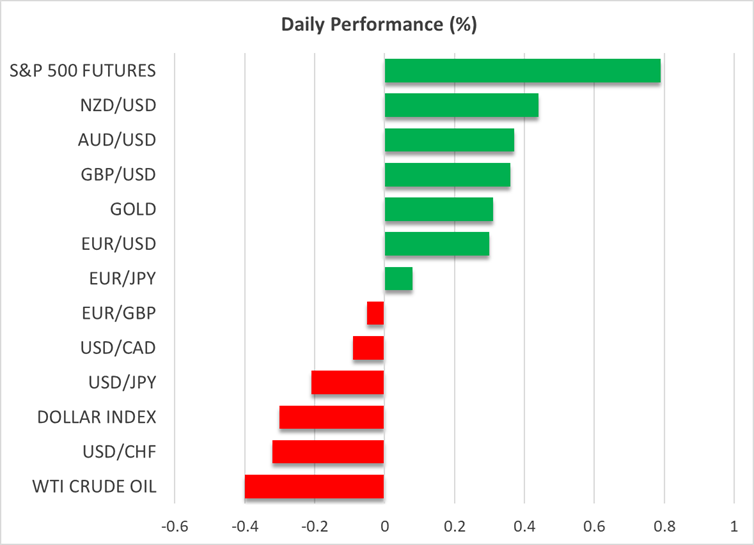

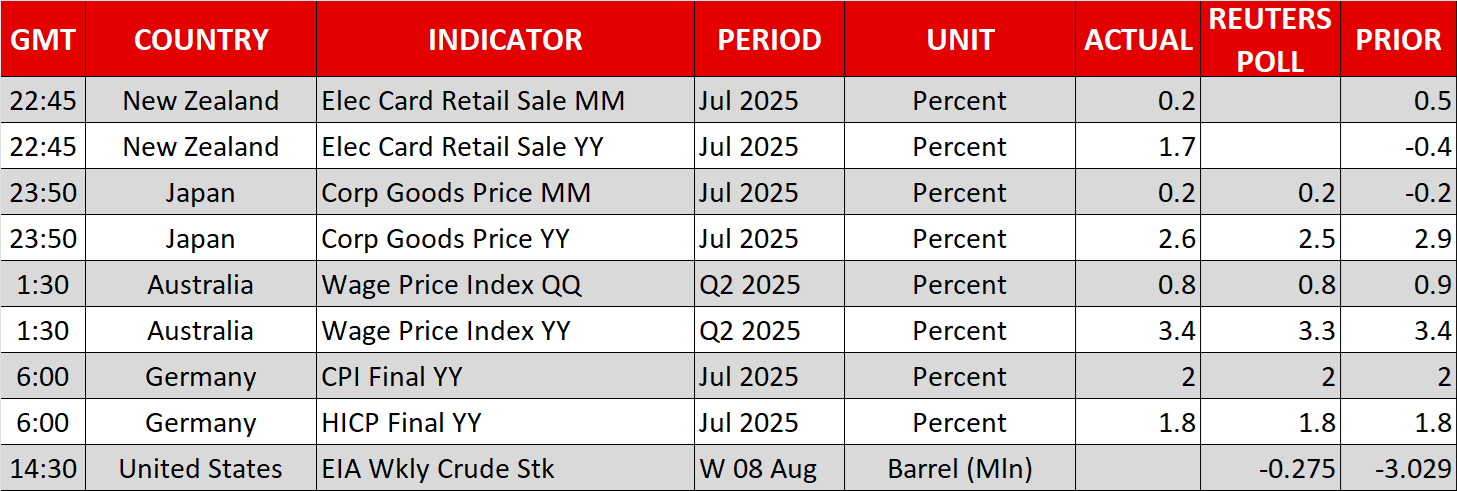

The US dollar slipped across the board on Tuesday after the US CPI data for July revealed that headline inflation missed expectations of a modest acceleration and instead held steady at 2.7% y/y.

Although core CPI, which excludes the volatile items of food and energy, accelerated to 3.1% y/y from 2.9%, investors kept their gaze locked on the headline rate, which they probably believe seals the deal for a September rate cut. Indeed, a 25bps reduction is now fully priced in for next month, while the total number of basis points expected to be cut by the end of the year remains at 60.

The focus for dollar traders now turns to tomorrow’s PPI numbers for July. If softness is revealed in producer prices as well, then investors may start thinking that core inflation could also ease at some point in the not-too-distant future and increase their bets about a third reduction before the turn of the year. A weak set of retail sales on Friday may enhance that view.

The dollar remains on the back foot against most of its major peers today, though the slide has moderated. Euro/dollar seems to be headed towards the high of July 24 at around 1.1790, the break of which could target the high of July 1 at 1.1830, which is the strongest level since September 2021.

Wall Street marches to new record highs

On Wall Street, both the S&P 500 and the Nasdaq hit fresh record highs, not only because the slowdown in inflation solidifies the case of a September rate cut, but also because the data suggests that tariffs have yet to have a serious impact on prices. The prospect of lower borrowing costs combined with hopes that tariffs may not result in inflation spiraling out of control could keep equities supported for a while longer, especially after the US and China extended their tariff truce until November 10.

Having said that though, whether upcoming economic data will reflect the actual picture of the economy remains a concern after Trump fired the head of the Bureau of Labor Statistics and replaced him with E.J. Antoni, the chief economist at the influential conservative think tank Heritage Foundation. Markets are also closely monitoring headlines regarding Fed Chair Powell’s successor.

With Trump attacking Powell for the umpteenth time and urging him to lower interest rates, the Fed’s independence is at high stake and anything suggesting that Fed’s successor will be politically influenced could hurt investors’ trust of the US financial system.

Gold traders await Trump-Putin talks on Ukraine war

Gold moved slightly higher after the US inflation data were out, but the rebound was not proportionate to the dollar’s slide. Perhaps traders of the precious metal refrained from initiating large positions as they await the talks between US President Trump and his Russian counterpart Vladimir Putin.

If the Russian President does not show willingness to end the war in Ukraine, speculation that Russia will face more sanctions could result in some safe haven inflows. Oil prices could rally as well due to renewed fears about supply shortages.

.jpg)