EBC Markets Briefing | Swiss franc gains on sweeping tariffs

The Swiss franc strengthened on Friday, while the euro was steady after Trump announced more aggressive-than-anticipated tariffs against major trading partners, jolting the markets as investors sought safe haven.

He declared a national economic emergency and announced tariffs of at least 10% across all countries, with rates going even higher for 60 countries deemed the “worst offenders,” according to White House officials.

The plan includes 34% tariffs on China, 20% on the EU, 46% on Vietnam and 32% on Taiwan. US tariffs on China will rise to 54% following the move.

Analysts said US trading partners would have little option but to retaliate against Trump's measures, raising the prospect of an economically damaging global trade war.

Trump showed a chart listing a levy of 31% on goods imported to the US from Switzerland. In 2024, the US was the largest partner for EU exports of goods, accosting for around 20% of total volume.

The SNB continued to lower interest rates in March, while highlighting that external geopolitical risks could still be a threat to the Swiss economy. A strong currency could put more downward pressures on inflation.

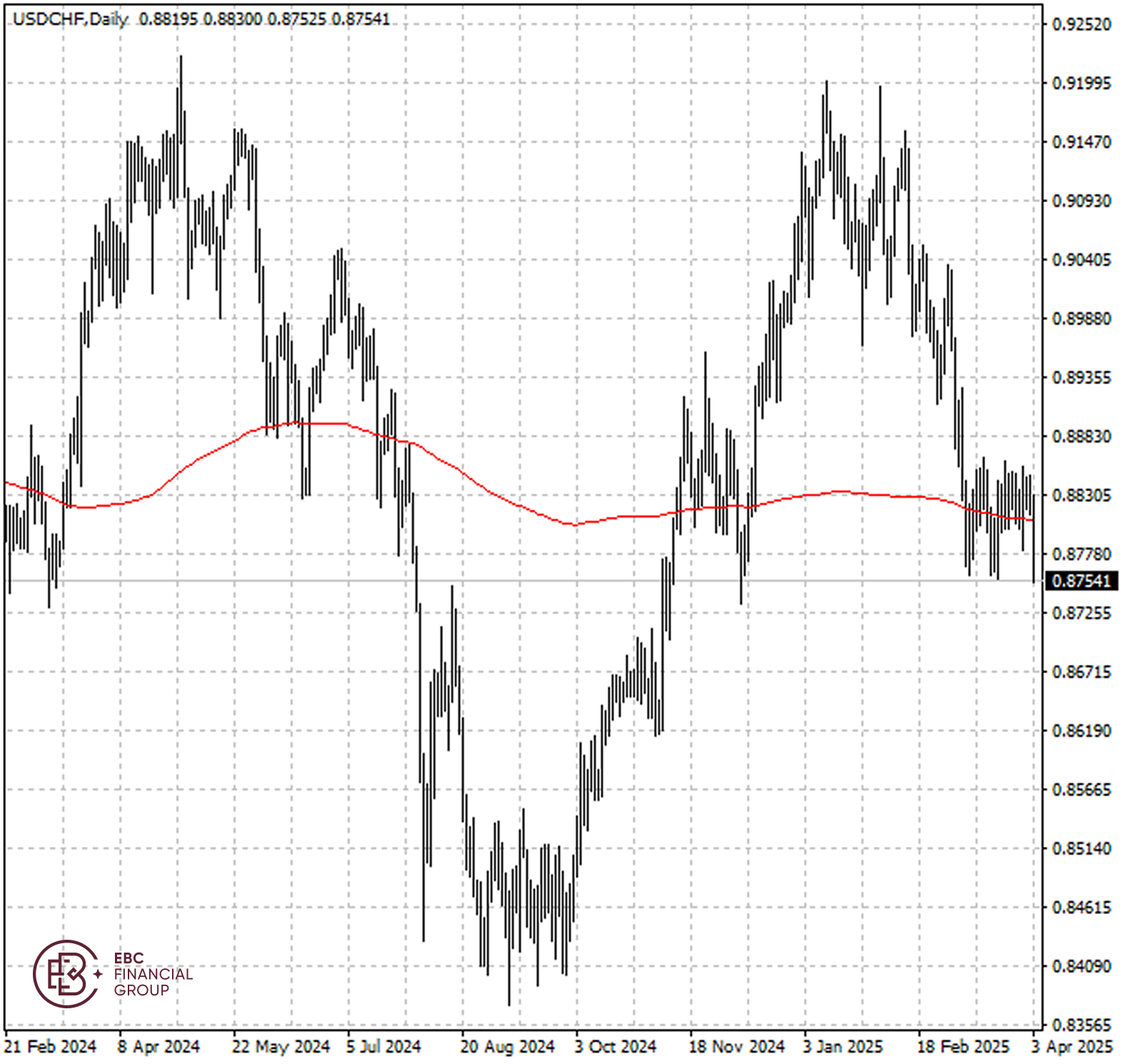

The Swiss franc has been hovering around its 200 SMA for nearly one month without any sign of breakout. As such the path of least resistance is a retreat towards 0.8800 per dollar.

EBC Wealth Management Expertise Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Corporate News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.