US housing market: stabilisation at a low level

US housing market: stabilisation at a low level

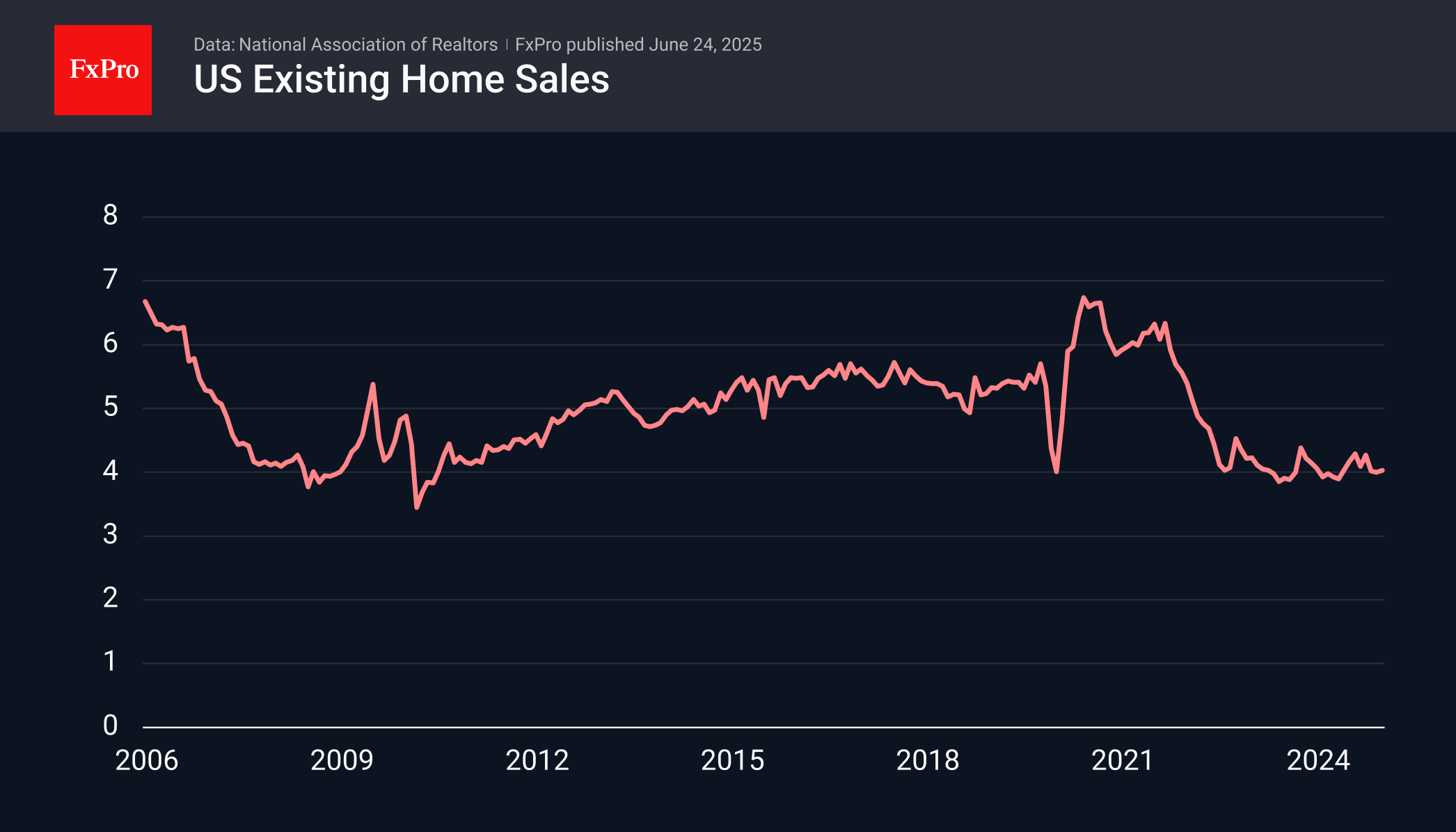

Sales in the US secondary housing market rose by 0.8% against an expected decline of 1.2%, following 5.9% and 0.5% in the previous two months. The data showed consolidation around an annual sales rate of 4 million homes. This is a low level compared to the peak of 6.74 at the end of 2020, and even significantly below the 2015–2019 plateau of 5.5 million. Stabilisation is an important positive after months of slowdown. Such data somewhat alleviates concerns about a decline in American consumer activity, which preceded the 2008 global financial crisis.

It alleviates them, but does not eliminate them, as unsold inventories are simultaneously growing to 4.6 months at current sales rates. This is the highest level in the last nine years, approaching the upper limit of the post-crisis recovery norm for the real estate market. This is another argument in favour of lowering the key rate. Also, working in this direction results in a mere 1.3% increase in prices compared to a year earlier.

However, we will hear the Fed's reasoning later on Tuesday and Wednesday at the semi-annual hearings in Congress and the House of Representatives. Powell will almost certainly focus on the pro-inflationary potential of trade disputes.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)