GBP/USD takes a hit on UK budget jitters

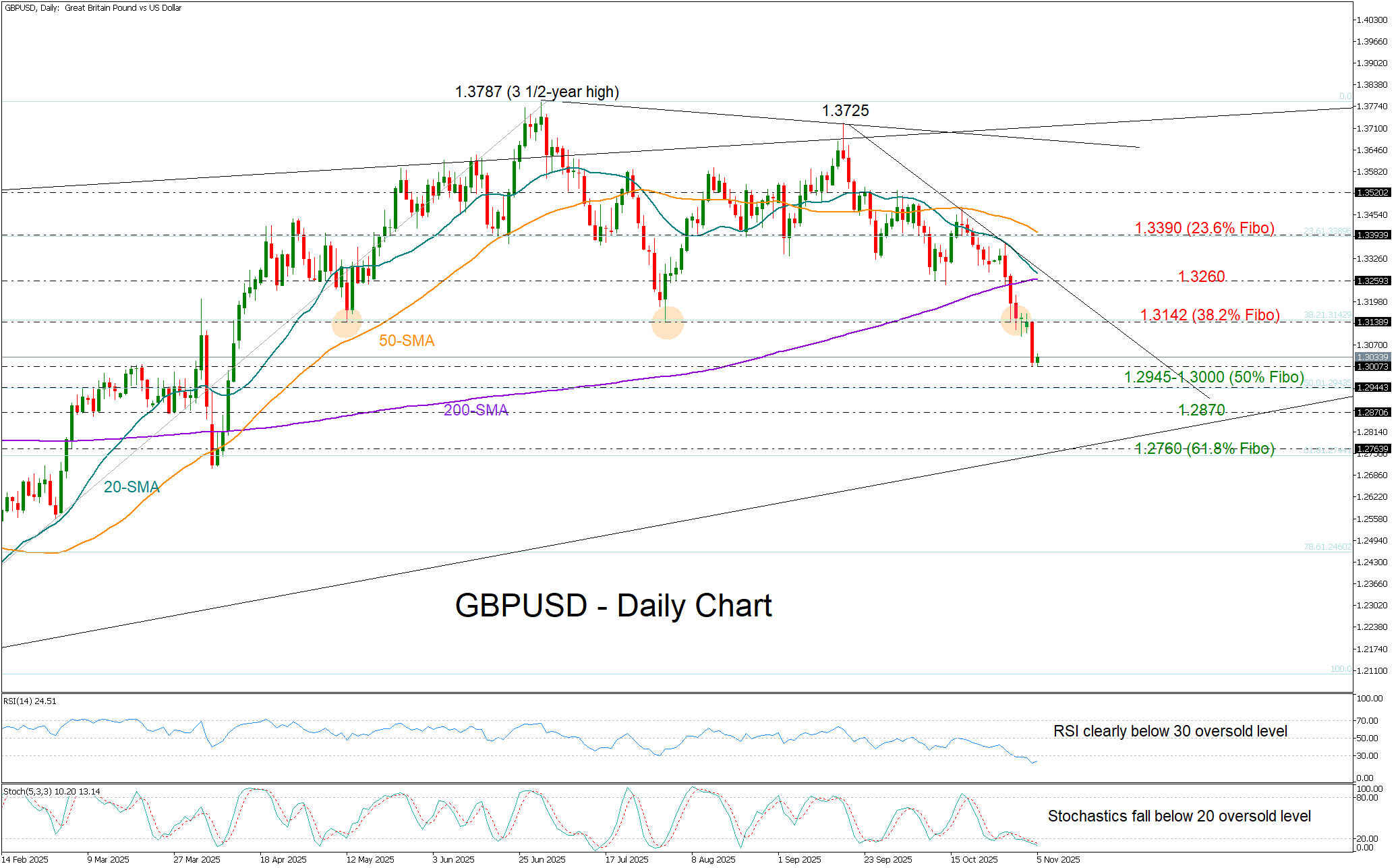

GBP/USD was hammered below the key 1.3142 support – a level that prevented a deeper outlook deterioration in August and helped the pair rebound toward the 1.3700 region. The sharp correction – extending three-week losses to over 3% – followed after UK Chancellor Rachel Reeves failed to rule out income tax hikes during her pre-Budget speech at Downing Street, fueling concerns that the government may break its pledge not to raise taxes.

The pair has now fallen well below its simple moving averages (SMAs), and with the RSI and stochastic oscillator fluctuating comfortably within oversold territory, the decline may attract fresh buying interest in the coming sessions. The 50% Fibonacci retracement level of the January–July uptrend, located near 1.2945, could also trigger bullish actions if the price dips below 1.3000. Even lower, traders may next focus on the 1.2870 support region from March.

To mitigate downside risks, the pair must first bounce back above the 1.3142 zone and then break the short-term resistance trendline near 1.3260, where the 200- and 20-day SMAs are currently converging. A decisive close above this area could confirm additional gains toward the 23.6% Fibonacci level at 1.3389 and the 50-day SMA.

In summary, the freefall in GBP/USD has disrupted the 2025 bullish trajectory, increasing the odds of further lower lows in the short term. However, selling forces may appear milder unless the price breaks below the 1.2935–1.3000 region.

.jpg)