Narrow ranges ahead of US CPI inflation

OVERNIGHT

Asian equity markets are lower ahead of today’s key US CPI inflation report. Investors remain watchful of the US debt ceiling debate where political discussions have yet to lead to a breakthrough in the impasse. Both sides will reportedly resume negotiations on Friday. Separately, the Fed’s Williams indicated that he is open to a pause in hiking rates next month but saw no need for rate cuts, as priced by markets, this year.

THE DAY AHEAD

There are no major UK releases ahead of tomorrow’s Bank of England policy update. The RICS residential housing survey will be released early on Thursday and will provide an indicator of activity in the housing market in April. Earlier today, Germany’s EU-harmonised measure of CPI was confirmed at 7.6% for April, down from 7.8% in March. Italian industrial production for March is the only noteworthy release this morning and may post a small monthly rise. Already released German and French industrial output for March were weaker than expected.

Today’s focus will be on US CPI inflation for April. After falling for nine months in a row, we expect headline CPI to be unchanged at 5.0% with higher gasoline prices offsetting a slight fall in core CPI to 5.5% from 5.6%. However, the downtrend in headline CPI is likely to resume next month due to energy prices. That report will come ahead of the Fed’s June meeting and would provide support for a policy ‘pause’. Last week’s April labour market report, however, was stronger than expected, with the economy adding more jobs than forecast and earnings growth also rising unexpectedly. While a Fed pause still seems the more likely outcome next month, there will be some important data releases before policymakers make up their minds, including further updates on the labour market and, as mentioned, CPI inflation.

Chinese consumer and producer price inflation reports for April will be released early Thursday. CPI inflation is expected to remain subdued in April, falling to 0.3% from 0.7%, while PPI deflation is forecast to have deepened. That, combined with more recent softness in the PMI surveys, maintains the possibility of further policy support.

MARKETS

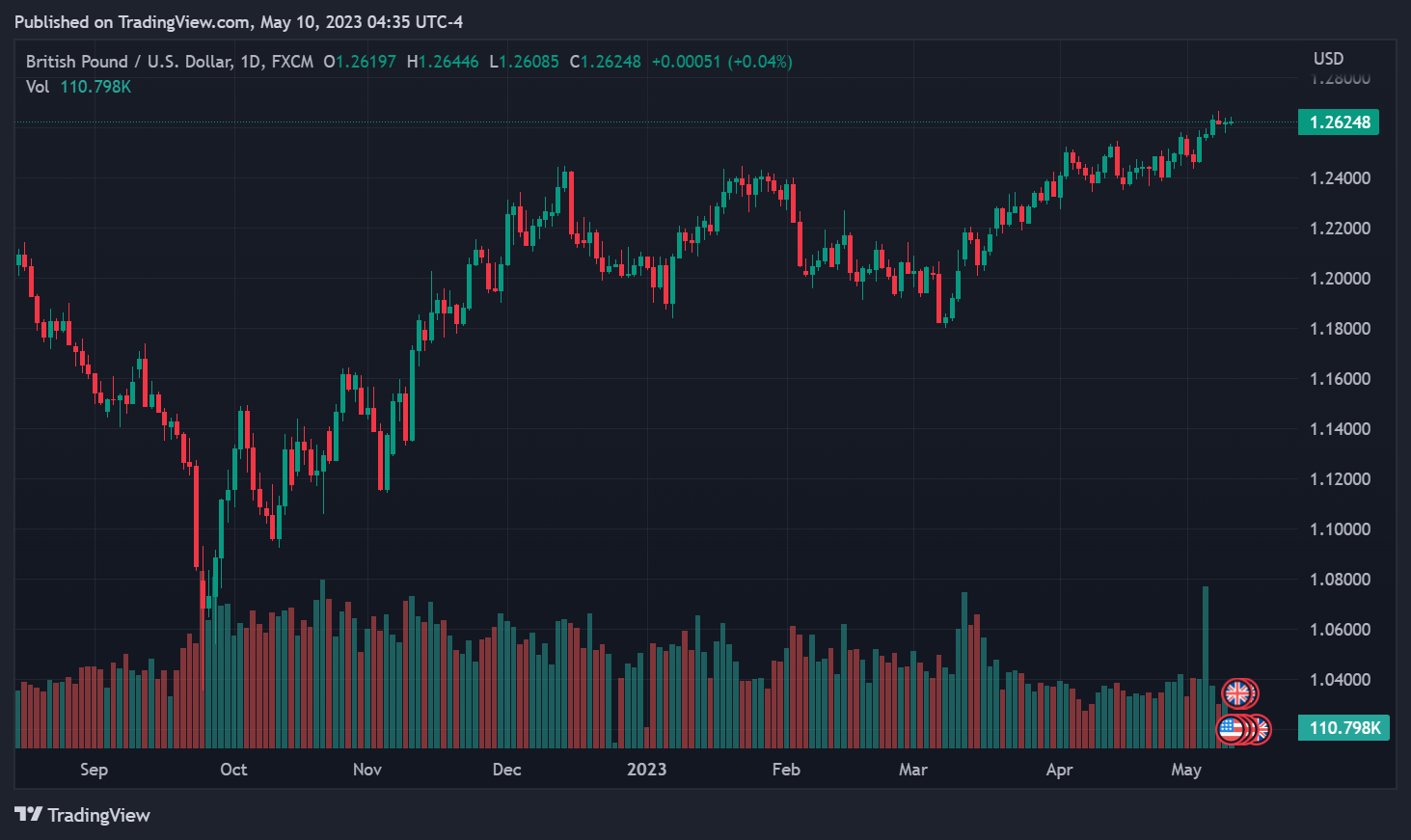

Markets are trading in narrow ranges ahead of US CPI inflation figures later today. The euro fell yesterday despite hawkish ECB comments and remained lower overnight. The pound is little changed against the US dollar ahead of tomorrow’s Bank of England policy announcement with a 25bp increase to 4.5% almost fully priced in by interest rate markets. Oil prices fell slightly after recent rises.