Risk appetite improves on US-China trade deal optimism

Cocktail of developments fuels risk-on trading

All three of Wall Street’s main indices hit fresh record highs on Friday, with the tech-heavy Nasdaq leading the ride. Asian equities and US stock futures are also in the green today, suggesting improving risk sentiment, with the drivers including the softer than expected US CPI data on Friday, more upbeat earnings results, and positive US-China trade developments over the weekend.

US CPI data ease concerns of tariff-induced inflation

Getting the ball rolling with the CPIs, the headline inflation rate rose to 3.0% y/y from 2.9%, but it fell short of hitting the 3.1% forecast, while the core rate slipped to 3.0% from 3.1%. Although both rates are still well above the Fed’s objective of 2%, they eased concerns about inflation spiraling out of control again due to US President Trump’s tariff policies, thereby allowing investors to maintain their dovish bets about the Fed’s future course of action.

According to Fed funds futures, market participants remain convinced that the Fed will cut interest rates by 25bps at each of the remaining meetings for 2025, and they are still penciling in nearly three additional reductions in 2026, although the Fed has signaled only one quarter-point cut for next year.

The Fed will decide on monetary policy this Wednesday and a rate cut is fully priced in. Therefore, all the attention will fall on the forward guidance and remarks by Fed Chair Jerome Powell at the press conference.

US and China agree on trade framework, Trump-Xi meeting eyed

On Sunday, US and Chinese officials agreed on a framework for a trade deal that US President Trump and his Chinese counterpart Xi will examine and decide on later this week.

US Treasury Secretary Bessent said that the talks held in Malaysia had eliminated the threat of 100% additional tariffs from the US on Chinese imports, adding that China agreed to delay the implementation of its rare earth licensing program by a year, while the policy is re-examined. That said, Chinese officials were more guarded, offering little information about the meeting.

Investors may now be eagerly awaiting the Trump-XI meeting on Thursday on the sidelines of the Asia-Pacific Economic Cooperation summit in South Korea, to see whether the presidents will agree to seal the deal.

Central Bank decisions and tech earnings also on tap

But apart from the Trump-Xi verdict and the Fed meeting, investors will have to incorporate into their decision three more central bank meetings. The BoC is expected to lower interest rates a few hours ahead of the Fed, while the ECB and the BoJ are expected to stand pat.

Investors will be eager to find out whether the ECB is planning to cut interest rates again at some point in the foreseeable future, while the BoJ may debate when a rate hike could be appropriate, especially following the election of Sanae Takaichi as Japan’s prime minister.

And, as if all this is not enough, the earnings season continues with tech-giants Microsoft, Alphabet, Meta, Apple and Amazon announcing results.

Over 140 companies in the S&P 500 have reported and 87% of them beat on earnings estimates, prompting analysts to revise higher their aggregate earnings growth forecast to 10.4% y/y from 8.8% on October 1. More upbeat numbers could allow Wall Street to jump even higher, despite the US government shutdown entering its 27th day.

Risk-linked currencies celebrate US-China progress, gold slides

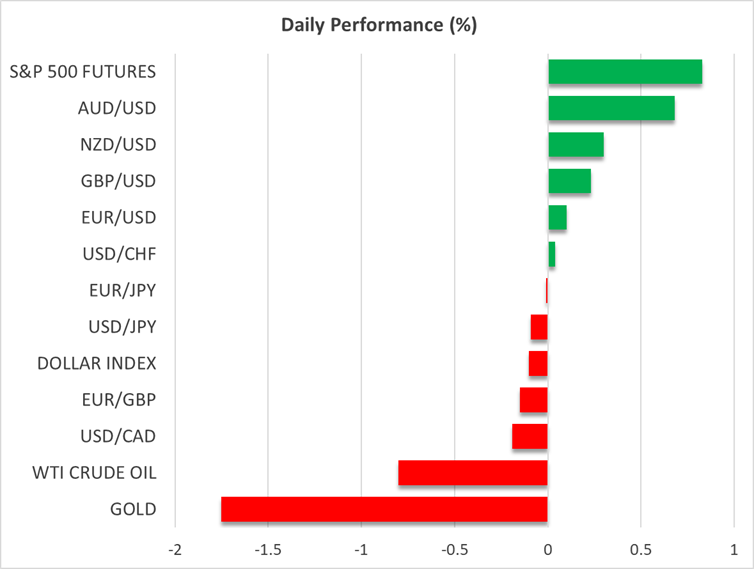

In the FX world, the risk-linked currencies aussie, kiwi and loonie are on the rise today, with the aussie gaining the most as it opened the week with a strong positive gap.

Gold, on the other hand, dropped below $4,060 amid safe-haven outflows, with the bears appearing willing to close the day below the uptrend line drawn from the low of August 22. From a technical standpoint, this could invite more bears into the action and push the metal towards the low of October 10 at $3,950.

.jpg)