Risk-on sentiment fades as tariffs return to the spotlight

Thursday proved to be rather eventful

While the US is celebrating its Independence Day, investors are digesting the developments from the past 24 hours. The crucial jobs report delivered multiple upside surprises, with the nonfarm payrolls figure climbing to 147k, versus forecasts of a 110k increase, and the unemployment rate unexpectedly falling to 4.1%. On the flip side, average hourly earnings eased slightly to a new one-year low of 3.7%, matching the change seen in the prices paid sub-component of the ISM services PMI survey.

Meanwhile, after more than three months of negotiations, deliberations and backstage pressure, the House of Representatives voted in favour of the Senate-approved “Big Beautiful Bill” by a margin of four votes. Despite a small number of Republican Representatives expressing their disappointment about Medicaid cuts, only two members voted against this legislation, which also raises the debt ceiling by $5 trillion. The approved bill is now on its way to the White House, where US President Trump is scheduled to sign it at 21:00 GMT. This is undoubtedly a significant victory for the US President.

What does this mean for the Fed?

The US President has been quite vocal about the strong jobs data and the approval of the Budget Bill, with his social media accounts filled with extravagant headlines. However, this set of positive news – i.e. the combination of lower inflationary pressures from wage growth and a healthy labour market - is making the Fed’s job slightly easier in the short-term.

The lack of soft data will most likely dent the dovish Fedspeak, reduce the tensions within the FOMC, and, most importantly, ease the pressure for a July rate cut. The market has quickly priced out such an outcome, with the pre-jobs data probability of 21% falling to just 5%. Trump might quickly restart his aggressive rhetoric and name-calling against Powell, but the data justifies the current Fed stance. Therefore, most FOMC members can now sit back and monitor developments on the tariff front, mapping out their strategy for the September meeting.

Turn-around Thursday completed?

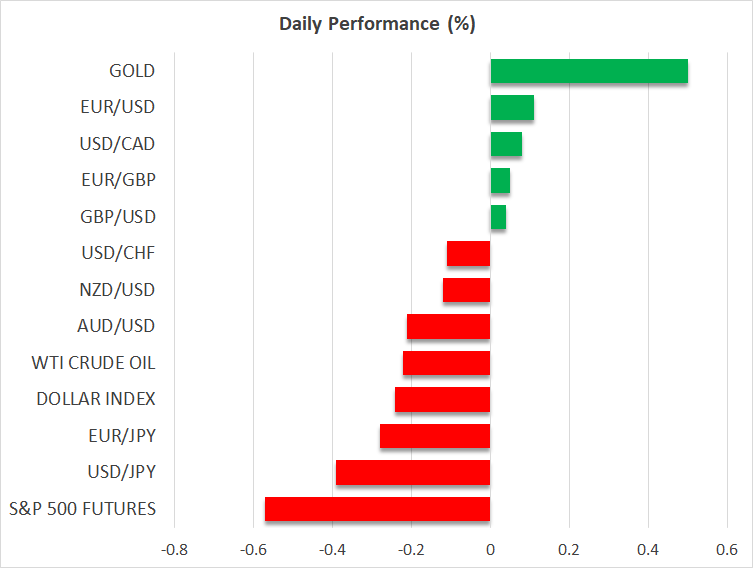

Contrary to the budget bill not really proving market-moving, the US data releases made an immediate impact. The US dollar got a sizeable boost across the board, with euro/dollar dipping by around one big figure following the nonfarm payrolls release. US equity indices rallied to new record highs and bitcoin touched $110k once again.

However, these moves did not last, partly due to Trump quickly shifting his focus to tariffs. Euro/dollar is trading slightly below 1.18 at the time of writing, and equities have gradually been giving back a decent chuck of yesterday’s rally. With both US stock and bond markets closed for Independence Day, markets will most likely experience small movements today.

Out of the frying pan and into the fire

Tariffs could materially reverse today's expected calmness. With the deal count doubling to two after the July 2 announcement of the US-Vietnam trade agreement, the US administration is shifting its focus to the tariff front. On Friday, at least 10 countries will receive ‘tariff letters’ detailing the trade restrictions to be implemented from August 1. Meanwhile, US Treasury Secretary commented overnight that at least 100 countries will face a minimum 10% reciprocal tax soon.

US officials are confident that a number of trade deals are going to be announced soon, but markets are mostly interested in the progress made with the key trade partners. Japan, South Korea and the EU are still in negotiations with the US administration, as they attempt to protect their critical sectors and minimize the tariff size, while there is only a framework US-China agreement, with lots of details still to be ironed out until there is a comprehensive deal.

Gold remains in demand, oil steady at $66 area

The risk-on reaction, following the stronger US data print on Thursday, had a relatively small impact on gold, with the precious metal quickly rising above $3,340. On the flip side, oil is still trying to recover from the recent sizeable drop. It is up 2% on a weekly basis, as investors prepare for the next OPEC+ production hikes.

.jpg)