Risk sentiment on the mend as investors gear up for Fed decision

Countdown to Wednesday’s Fed meeting commences

A defining week has just started, with investors counting down to Wednesday’s pivotal Fed meeting. Developments over the past 45 days have shifted the Fed narrative, as softer jobs data and growing market expectations have gradually pushed most Fed members towards supporting a restart of the easing cycle.

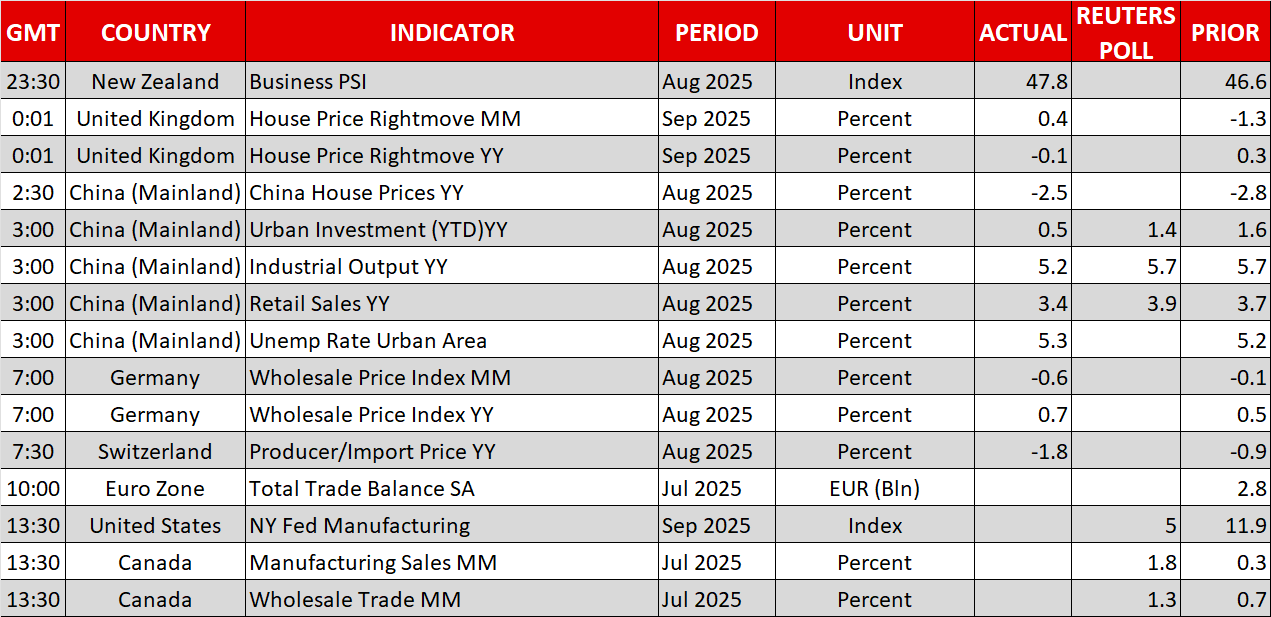

With last week’s producer and consumer inflation reports failing to surprise on the upside - thus easing concerns about the impact of tariffs on inflation - Wednesday’s decision appears to be a relatively straightforward one from an economic perspective.

Notably, the overwhelming majority of investment houses are on board with the 25bps rate cut, while also forecasting a series of consecutive cuts extending until the first quarter of 2026. That looks reasonable since the Fed tends to avoid announcing one-off moves.

Interestingly, investors pondered the idea of a 50bps rate cut, mostly due to the signaling power of such a move. However, despite softer US data, markets are pricing in a 3% probability of a 50bps cut at the moment.

Most Fed officials are expected to vote against such a strong move, aiming to send a message that pressure from US President Trump has no impact on their decisions. That said, pro-Trump FOMC members will make their preferences known. And these voices could get a boost if Miran is approved by the Senate in time to join the two-day Fed gathering commencing on Tuesday.

Meanwhile, the saga over Fed Governor Cook’s firing continues. A court is expected to rule today on whether Trump’s decision to fire Cook will be enforced, potentially blocking Cook from participating in this week’s meeting and Powell losing an ally. If the court denies Trump’s bid, the case will most likely reach the Supreme Court.

Markets are in anticipation mode

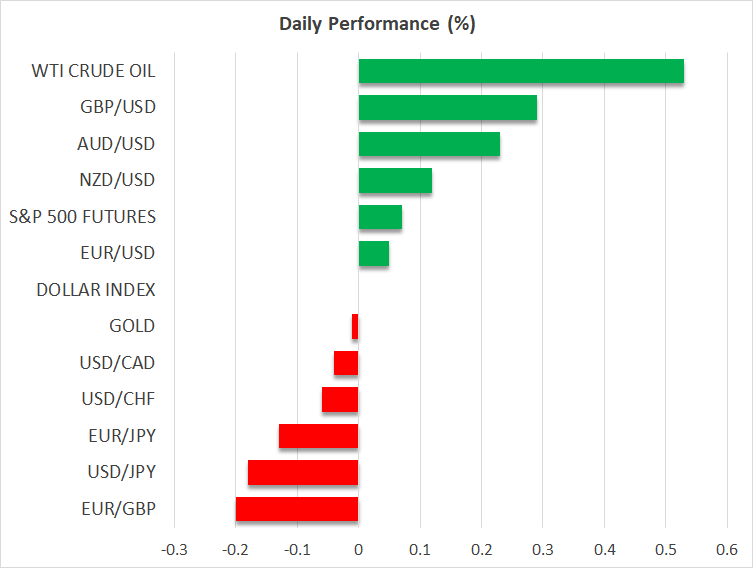

After a relatively positive week for riskier assets – with Asian stocks leading the rally - risk appetite is on the rise again today. Following a difficult Asian session, overshadowed by weak Chinese data and the lack of significant progress in Sunday’s US-China talks in Spain, European equity indices are edging higher, with the DAX 40 index appearing cheerful today.

Similarly, cryptocurrencies carry some momentum from last week’s positive performance, with bitcoin testing the $117k level again following reports that one of the oldest mutual fund houses has increased its exposure to the crypto market.

On the flip side, the dollar had a tough week, particularly against second-tier currencies like the aussie and the kiwi. Today, euro/dollar is hovering around 1.1730, 50 pips below last week’s high, as chances of a 50bps rate cut have fizzled out. The downgrade of France’s sovereign rating from AA- to A+ by Fitch does not appear to have caused much damage, but investors shouldn’t become complacent about the situation in France.

Interestingly, dollar/yen continues to experience moderate volatility, with the pair trading in a tight range since early August. The yen has reacted calmly to last week’s PM Ishiba’s resignation and the dented probability of another BoJ rate hike in 2025.

Finally, gold is trading at $3,535, at the time of writing, as Trump continues to pressure its NATO allies for increased sanctions on Russia, with China also potentially targeted for its sizeable purchases of Russian oil. Trump’s “carrot and stick” approach has yielded some results up to now, but it feels like the end of the 3.5-year conflict is no closer than it was nine months ago, when Trump took office.

.jpg)