The Nasdaq 100’s all-time high proves the continuing strength of Big Tech

The Nasdaq 100’s all-time high proves the continuing strength of Big Tech

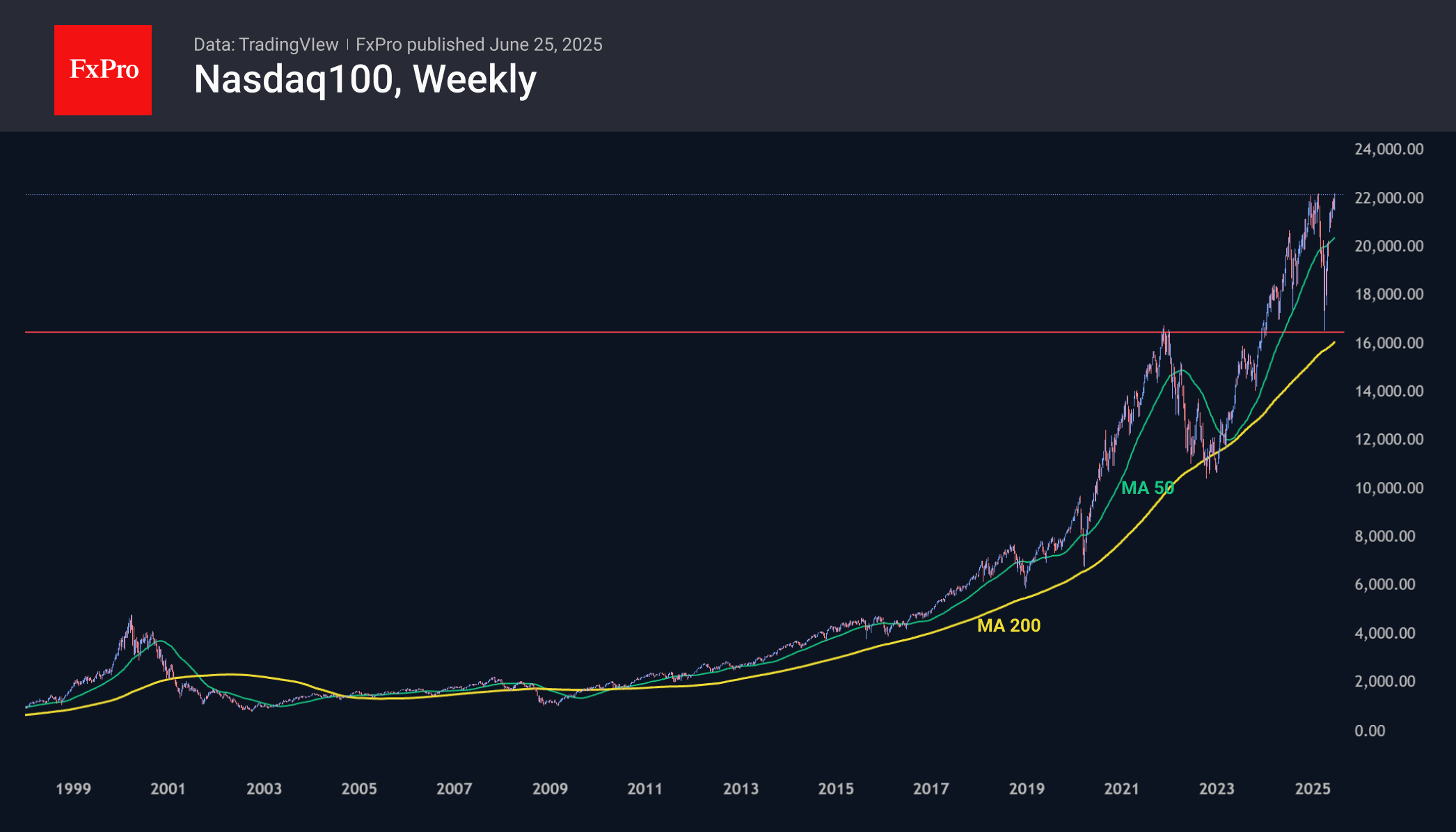

The American stock market is showing impressive growth after opening the week with a downward gap. The Nasdaq 100 has added about 36% to its lows in early April and was the first of the major US indices to update its historical highs.

The fact that the Big Tech-heavy index is showing the strongest recovery suggests that investors have not changed their preferences in recent years. They have maintained their focus on these companies at the expense of industrial giants (Dow Jones) or the broader market (S&P 500) and smaller companies (Russell 2000). This is logical because American technology, not industry or small business, rules the world now.

On Tuesday, the Nasdaq 100 updated its historical highs, and futures on Wednesday improved this figure slightly. The continuation of positive dynamics indicates the end of the correction from February to April, paving the way for further growth. The Nasdaq index will most likely maintain its leading momentum.

The positive sentiment is reinforced by the ‘golden cross’ signal, which was formally formed on Friday when the 50-day moving average exceeded the 200-day moving average. According to statistics, over a one-month horizon, the market is growing by 2.75% against an average of 1%, and over a 12-month horizon, the difference is 21.5% with the signal against 13% without it.

We also note that the recent correction stopped near the peak levels of the previous bull cycle, and approximately 50% of the growth from the lows in October 2022. The 200-week average level also remained intact, which sharply increased buyer activity.

The sell-off earlier this year removed the overheating from more than two years of market growth, formally clearing the way for further growth. About ten years ago, the Nasdaq100 spent about a year and a half and made numerous attempts without daring to update the historical highs of 2000. However, in the following years, updating the highs after the corrections ended raised the index impressively higher before buyers showed indecision. And most likely, this pattern will continue this time.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)