What is ahead: RBA Rate, US CPI & UK GDP

What is ahead: RBA Rate, US CPI & UK GDP

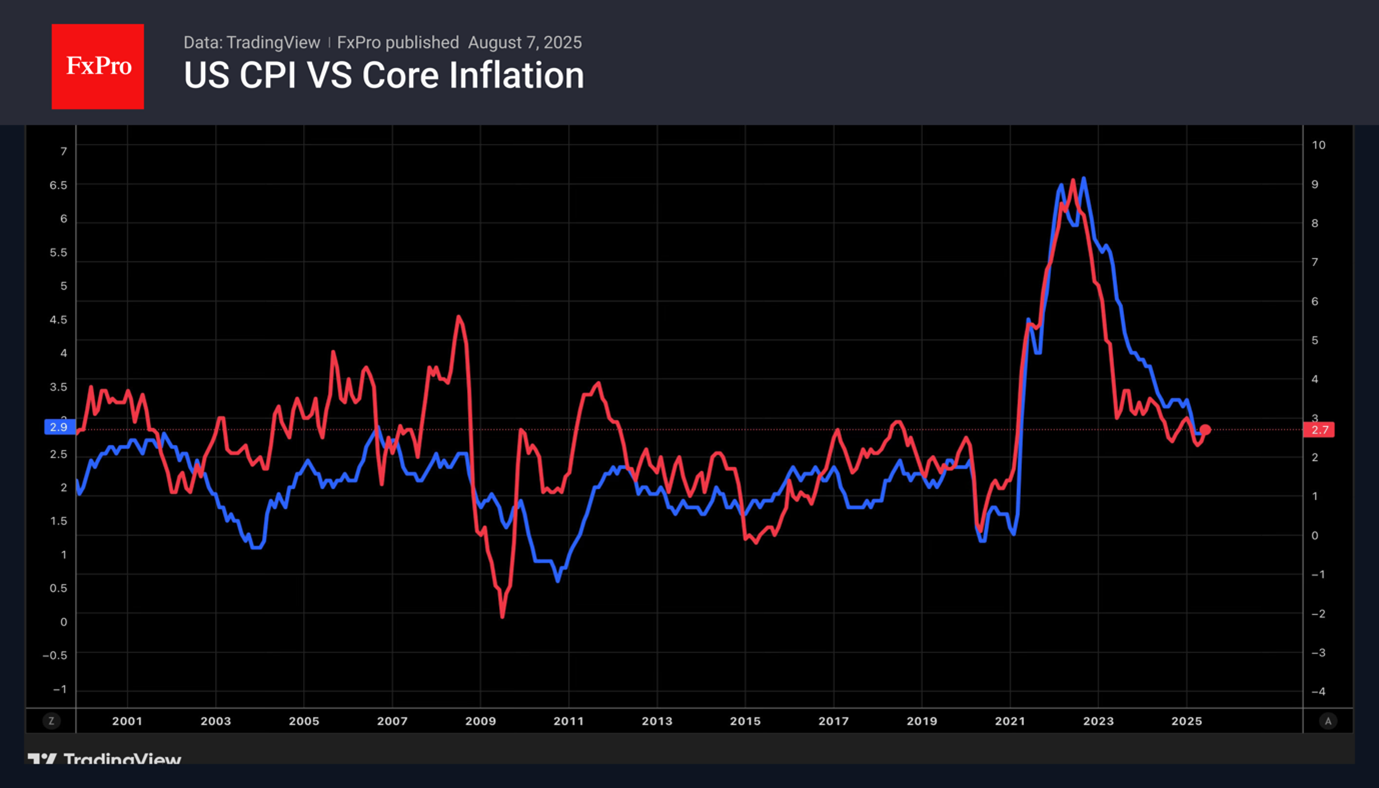

The key event of the week up to August 15th will be the release of US inflation data for July. Further acceleration in consumer prices due to White House tariffs could be an obstacle to lowering the federal funds rate. A decrease in the chances that the Fed will resume its cycle of monetary expansion in September will allow the US dollar to rise.

Conversely, anchored inflation or its slowdown will give the Fed a free hand in easing monetary policy. The futures market believes that the central bank will take three steps along this path in 2025. This will give bears on the USD index an opportunity to resume their downward trend.

The US negotiations with Russia will be of great importance to the markets. New sanctions and secondary tariffs for countries buying oil from Moscow could push up Brent and WTI prices. This will increase the risks of accelerating US inflation and force the Fed to be cautious about lowering rates. The main beneficiary will be the dollar.

Other events to highlight include the Reserve Bank of Australia meeting and the release of data on the British labour market and GDP. The GDP statistics for the eurozone and Japan for the second quarter will show whether these regions have experienced a decline in their economies.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)