Smart Forex Expert Signal (High Risk) (由 SFETrading )

The user has made his system private.

Edit Your Comment

Smart Forex Expert Signal (High Risk)讨论

会员从May 11, 2020开始

101帖子

Sep 25, 2020 at 08:39

会员从May 11, 2020开始

101帖子

This is called the HIGH RISK signal for a reason...I have said in the beginning that the expected DD can reach 50-60% and I am prepared for it.

Nevertheless, trading with high risk will also come high return, and it's a risk that I am willing to take with my $100K account running the SFE EAs. 😄

If you are not prepared to lose at all then you should not trade Forex, because losses are just part of a genuine long term profitable system. Those grid/martingale systems that seem to never lose, will all inevitably have a huge loss that will wipe out the entire account - and I am sure you have seem plenty of them. 😉

Also, this account is still up 18% since the inception. The DD is still just below 30% so it's still performing as I have expected. I don't understand why you guys sound like it's the end of the world? 🙄

Nevertheless, trading with high risk will also come high return, and it's a risk that I am willing to take with my $100K account running the SFE EAs. 😄

If you are not prepared to lose at all then you should not trade Forex, because losses are just part of a genuine long term profitable system. Those grid/martingale systems that seem to never lose, will all inevitably have a huge loss that will wipe out the entire account - and I am sure you have seem plenty of them. 😉

Also, this account is still up 18% since the inception. The DD is still just below 30% so it's still performing as I have expected. I don't understand why you guys sound like it's the end of the world? 🙄

Sep 25, 2020 at 10:34

会员从Feb 28, 2014开始

26帖子

Also, this account is still up 18% since the inception.

Adding funds to your account and trading profits are not the same. 12% is the number you are looking for.

SFETrading posted:

Nevertheless, trading with high risk will also come high return.

High risk and high returns are two very different things.

BUT

Higher risk = higher lot size = higher broker kickback.

How much clients money did you burn this month?

30K or more?

会员从May 11, 2020开始

101帖子

Sep 25, 2020 at 12:19

会员从May 11, 2020开始

101帖子

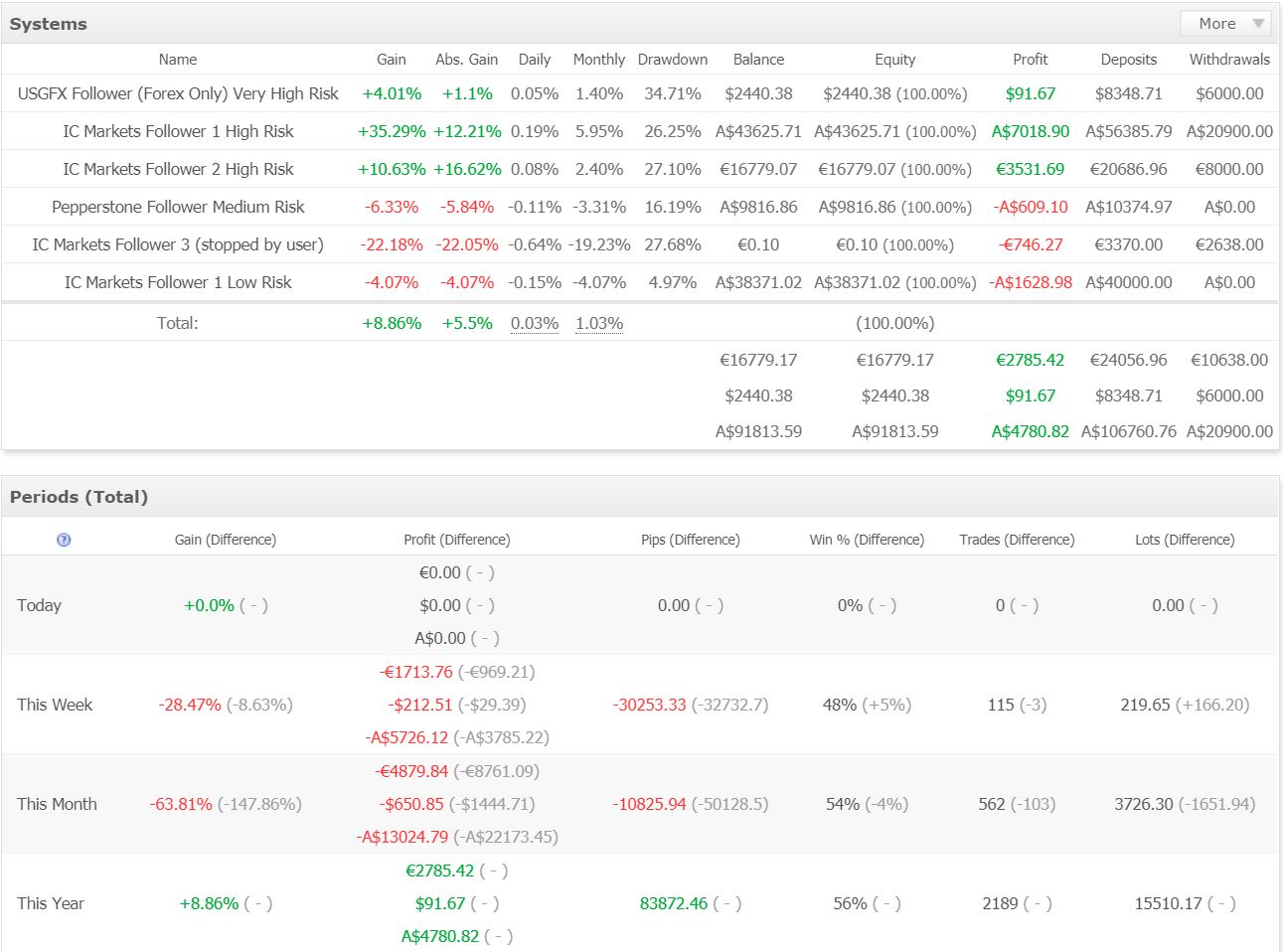

The total loss for follower accounts this month is about USD$15000 (-€4879.84, -US$650.85 and -A$13024.79)

But then again, the follower accounts are still positive overall since inception, so I don't really get why you guys are making such a big deal out of a DD that is well within the expectation of the system? 😂

But then again, the follower accounts are still positive overall since inception, so I don't really get why you guys are making such a big deal out of a DD that is well within the expectation of the system? 😂

Oct 12, 2020 at 05:22

会员从Oct 01, 2013开始

16帖子

JosefK posted:

Also, this account is still up 18% since the inception.

Adding funds to your account and trading profits are not the same. 12% is the number you are looking for.SFETrading posted:

Nevertheless, trading with high risk will also come high return.

High risk and high returns are two very different things.

BUT

Higher risk = higher lot size = higher broker kickback.

How much clients money did you burn this month?

30K or more?

I feel truly sorry for the account owner. Does he know what is done with his money?

会员从May 11, 2020开始

101帖子

Oct 12, 2020 at 11:57

会员从May 11, 2020开始

101帖子

Losses are part of trading, and people who are patient enough to stick to a long term profitable system will be rewarded eventually. It's about applying a strategy that has a long term edge over the market, but this long term trend will only become apparent when the number of trades are large enough to be statistically significant, which will need to be over several thousand trades at least.

A temporary drawdown can always happen even to the best trading system that has a long term edge over the market. The most important thing is to keep the drawdown manageable during unfavourable times, so that the losses can be recovered and profits made when the market becomes favourable again. If people are not prepared to accept losses as part of trading, then they should not trade in the first place.

A temporary drawdown can always happen even to the best trading system that has a long term edge over the market. The most important thing is to keep the drawdown manageable during unfavourable times, so that the losses can be recovered and profits made when the market becomes favourable again. If people are not prepared to accept losses as part of trading, then they should not trade in the first place.

Oct 12, 2020 at 14:43

会员从Oct 01, 2013开始

16帖子

SFETrading posted:

-----------------the number of trades are large enough to be statistically significant, which will need to be over several thousand trades at least.----------------

Academic research says you made this up.

https://www.statisticssolutions.com/sample-size-formula/#:~:text=Some%20researchers%20do%2C%20however%2C%20support,minimum%20sample%20size%20of%2030.

会员从May 11, 2020开始

101帖子

Oct 12, 2020 at 20:25

会员从May 11, 2020开始

101帖子

The sample size required for scientific research and the sample size required to prove a trading system’s long term edge are very different things.

In scientific research the end point is whether a treatment is effect of not, but in a trading system the long term edge is very small, so you will need a much larger number of trades / events to prove that small edge. It’s the same concept as to how casinos make money in the long term by offering games that have long term mathematical edge over the gamblers.

If you have studied gambling systems before you would have known a famous website called the Wizards of Odds, which was set up by a mathematician.

In one section he talked about how many hands are required to prove the casino’s house edge in Baccarat with 95% accuracy, and the answer - nearly 34,000 hands:

“what is the sample size required so that the sample mean will be within 1% of the actual mean with 95% probability? From my house edge section we see the standard deviation of the banker bet is 0.93 and of the player bet is 0.95. Since you go back and forth we’ll use the average of 0.94. Now I’ll wave my hands and get an answer of 33,944 hands. At 60 hands per shoe that comes to 566 shoes.”

While it will be difficult to quantify exactly how much edge our system has over the market in the long term, I would be happy to have just 1% edge over the market - which is about the same edge the casino has over the players in Baccarat over the long term. But as you can see, it will take over 30,000 trades to prove the system has that 1% edge over the market, with 95% accuracy. Obviously if our system’s edge is more than 1%, then less trades will be required to prove it, but I think you get the idea. A few thousand trades are definitely required as a bare minimum. 😉

In scientific research the end point is whether a treatment is effect of not, but in a trading system the long term edge is very small, so you will need a much larger number of trades / events to prove that small edge. It’s the same concept as to how casinos make money in the long term by offering games that have long term mathematical edge over the gamblers.

If you have studied gambling systems before you would have known a famous website called the Wizards of Odds, which was set up by a mathematician.

In one section he talked about how many hands are required to prove the casino’s house edge in Baccarat with 95% accuracy, and the answer - nearly 34,000 hands:

“what is the sample size required so that the sample mean will be within 1% of the actual mean with 95% probability? From my house edge section we see the standard deviation of the banker bet is 0.93 and of the player bet is 0.95. Since you go back and forth we’ll use the average of 0.94. Now I’ll wave my hands and get an answer of 33,944 hands. At 60 hands per shoe that comes to 566 shoes.”

While it will be difficult to quantify exactly how much edge our system has over the market in the long term, I would be happy to have just 1% edge over the market - which is about the same edge the casino has over the players in Baccarat over the long term. But as you can see, it will take over 30,000 trades to prove the system has that 1% edge over the market, with 95% accuracy. Obviously if our system’s edge is more than 1%, then less trades will be required to prove it, but I think you get the idea. A few thousand trades are definitely required as a bare minimum. 😉

会员从May 11, 2020开始

101帖子

Oct 13, 2020 at 09:02

会员从May 11, 2020开始

101帖子

The high risk account is called a high risk account for a reason...but with higher potential drawdown will also come higher return.

If people are not comfortable with the risk they can always use a lesser risk. For example, our Low Risk MAM account is only trading at 0.3x risk of the High Risk account, and the lifetime DD is expected to stay below 20%.

If people are not comfortable with the risk they can always use a lesser risk. For example, our Low Risk MAM account is only trading at 0.3x risk of the High Risk account, and the lifetime DD is expected to stay below 20%.

Oct 13, 2020 at 09:02

会员从Oct 01, 2013开始

16帖子

Come on. All that wizard, casino, baccarat and shoe talk is just smoke and mirrors.

From your mql profile. Last 7000 trades show what you try to hide so hard.

SFETrading posted:

Obviously if our system’s edge is more than 1%, then less trades will be required to prove it, but I think you get the idea. A few thousand trades are definitely required as a bare minimum. 😉

From your mql profile. Last 7000 trades show what you try to hide so hard.

会员从May 11, 2020开始

101帖子

Oct 13, 2020 at 09:27

会员从May 11, 2020开始

101帖子

Sleepless posted:

Come on. All that wizard, casino, baccarat and shoe talk is just smoke and mirrors.SFETrading posted:

Obviously if our system’s edge is more than 1%, then less trades will be required to prove it, but I think you get the idea. A few thousand trades are definitely required as a bare minimum. 😉

From your mql profile. Last 7000 trades show what you try to hide so hard.

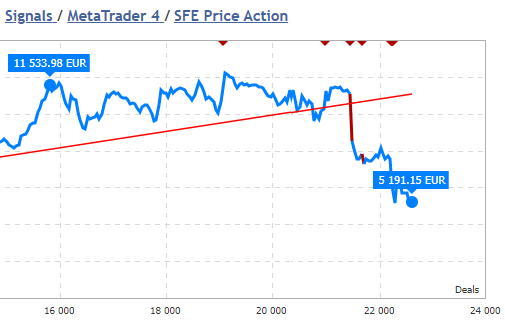

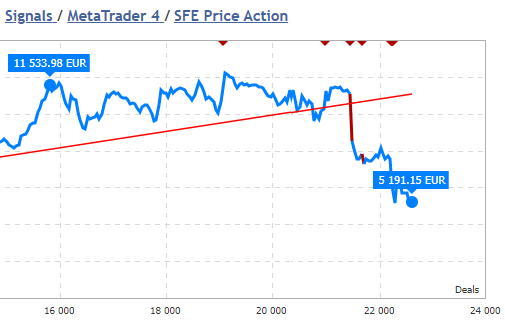

It's interesting that you would choose to use the balance graph to support your case, when there was a withdrawal that reduced the balance significantly.

If you look at the actual growth graph, one can clearly see that even though the system has been in stagnation for some time, it is certainly not losing over the long term. See the charts for comparison below:

Also, the information on Wizard of Odds is not just smoke and mirrors. Studying and learning about statistics and probability is the most essential thing to become a profitable trader in the long term. I cannot help you if you choose to turn a blind eye on it, but people who are serious about trading would understand the importance of applying statistics and probability into their trading.

If people still don't get what I mean, please look up and watch the video "Trade Like a Casino for Consistent Profits by Adam Khoo". I am not affiliated with him or endorse him in any way, but what he talked about in the video is exactly how our system has been applying the theory of statistics and probability into our trading in practice.

Oct 13, 2020 at 11:29

(已编辑 Oct 13, 2020 at 11:30)

会员从Oct 01, 2013开始

16帖子

SFETrading posted:

It's interesting that you would choose to use the balance graph to support your case, when there was a withdrawal that reduced the balance significantly.

Because you wrote that it requires a few thousands trades to prove how good or bad a system is. The graph several thousand trades from your system and the message here is clear.

The withdrawal is marked red and simple means that you stopped to believe in your own system 3000 trades ago.

SFETrading posted:

'Trade Like a Casino for Consistent Profits by Adam Khoo'

Your stats say that his theories are not working so well. Maybe you should try his other book: "Secrets of Building Multi-Million Dollar Businesses: How to take an idea from startup to a million dollars in 18 months." Or "The secret Code" of all secrets for just $3.99.

SFETrading posted:

If you look at the actual growth graph, one can clearly see that even though the system has been in stagnation for some time, it is certainly not losing over the long term.

Consider the performance fee and what will be left is that you earned 23thousand times commissions while the client lost money.

会员从May 11, 2020开始

101帖子

Oct 13, 2020 at 12:06

会员从May 11, 2020开始

101帖子

1. We have been in stagnation for about the last 8000 trades with SFE Price Action, but over the 22K+ trades since inception the account is up over 400%.

2. That official SFE Price Action account belongs to Joel the developer, not me. I do not know why he made the withdrawal at that time, but those who have been following me in the past few years would know that I have always increased risk or put more money into the system when it is in DD, so that I would catch more profit on recovery. In fact I have just decided to put in another $9965.09 into this account, to make the total deposit a nice round figure of $100K - and to prove to you that I full confidence in the system. 😄

3. While Adam Khoo's theory is correct, I don't believe it is that easy to achieve a significant long term statistical edge over the market. He talks about having 10-20% edge over the market in his video, which I believe is way over-exaggerated and too good to be true. I believe having a long term edge of 2% would already be an amazing achievement. After all, the casinos only have 1% edge over the players in Baccarat!

4. We only charge performance fee based on High Water Mark, so when clients are still in DD we will not charge any more performance fee until the account is back above the previous high. Also, our followers can use any broker of their choice and it is not compulsory for them to join under our IB. We do offer them discounted commission if they join under our IB, but the commission we receive from them is minimal - for example we only receive $0.50 per round turn lot if they join under our IB at IC Markets. This really is negligible compared to the wins and losses we generate on the accounts on a daily basis.

2. That official SFE Price Action account belongs to Joel the developer, not me. I do not know why he made the withdrawal at that time, but those who have been following me in the past few years would know that I have always increased risk or put more money into the system when it is in DD, so that I would catch more profit on recovery. In fact I have just decided to put in another $9965.09 into this account, to make the total deposit a nice round figure of $100K - and to prove to you that I full confidence in the system. 😄

3. While Adam Khoo's theory is correct, I don't believe it is that easy to achieve a significant long term statistical edge over the market. He talks about having 10-20% edge over the market in his video, which I believe is way over-exaggerated and too good to be true. I believe having a long term edge of 2% would already be an amazing achievement. After all, the casinos only have 1% edge over the players in Baccarat!

4. We only charge performance fee based on High Water Mark, so when clients are still in DD we will not charge any more performance fee until the account is back above the previous high. Also, our followers can use any broker of their choice and it is not compulsory for them to join under our IB. We do offer them discounted commission if they join under our IB, but the commission we receive from them is minimal - for example we only receive $0.50 per round turn lot if they join under our IB at IC Markets. This really is negligible compared to the wins and losses we generate on the accounts on a daily basis.

Oct 13, 2020 at 15:25

会员从Feb 28, 2014开始

26帖子

Jimmy says......

Jimmy forget what he said and says....

0.84 pips average slippage on user accounts (largest sample)

+

performance fee whenever you get lucky

+

commission markup

=

you will make money while you tell clients fairy tales that they can expect 100-200% growth yearly.

SFETrading posted:

You will need to use an IC Markets MT5 account or a Pepperstone MT5 account to copy our signals.

Jimmy forget what he said and says....

SFETrading posted:

Also, our followers can use any broker of their choice and it is not compulsory for them to join under our IB.

0.84 pips average slippage on user accounts (largest sample)

+

performance fee whenever you get lucky

+

commission markup

=

you will make money while you tell clients fairy tales that they can expect 100-200% growth yearly.

SFETrading posted:............ the yearly gain should be over 100-200%.

会员从May 11, 2020开始

101帖子

Oct 14, 2020 at 09:08

会员从May 11, 2020开始

101帖子

Due to Stock CFD symbols being very different across different brokers, initially we did ask people to copy the High Risk account (hosted at IC Markets) with an IC Markets account, and copy the Low Risk account (hosted at Pepperstone) with a Pepperstone account, so they won't miss out on the Stock CFD trades. But some clients have since told us that they are happy to just copy Forex trade, so we now allow people too copy with any broker they want, but they just need to be aware that they won't get Stock CFD trades if their follower account is not on same broker as our master account.

The account is only 6 months old...we shall see where it sits in another 6 months. Currently the market is just waiting for the US election and once the dust settles I expect strong breakouts as the monetary policies of various Central Banks become more clear. We will see by then if 100%-200% in a year is a fairy tale or not. 😉

The account is only 6 months old...we shall see where it sits in another 6 months. Currently the market is just waiting for the US election and once the dust settles I expect strong breakouts as the monetary policies of various Central Banks become more clear. We will see by then if 100%-200% in a year is a fairy tale or not. 😉

会员从May 11, 2020开始

101帖子

Oct 15, 2020 at 09:49

会员从May 11, 2020开始

101帖子

Excuse me...can you not see that we are trading $200K of our own money on our fully verified master accounts??🙄

We trust our own system 100% and that’s why we have put $200K into it. I don’t know what else you want?? If our system does not perform then we will lose more money than anyone else. So you think putting the money where our mouth is, means we are not taking responsibility for our trades and results?

If the market is unfavourable then you just need wait for it to become favourable again. There is no use to force trades. If you have no patience and long term view on trading then you will never get what I say, so I give up.😞

We trust our own system 100% and that’s why we have put $200K into it. I don’t know what else you want?? If our system does not perform then we will lose more money than anyone else. So you think putting the money where our mouth is, means we are not taking responsibility for our trades and results?

If the market is unfavourable then you just need wait for it to become favourable again. There is no use to force trades. If you have no patience and long term view on trading then you will never get what I say, so I give up.😞

*商业用途和垃圾邮件将不被容忍,并可能导致账户终止。

提示:发布图片/YouTube网址会自动嵌入到您的帖子中!

提示:键入@符号,自动完成参与此讨论的用户名。