All Eyes on OPEC+ Meeting

The surge in the U.S. Treasury prices has led to a decline in Treasury yields, placing the U.S. dollar under downward pressure. However, the recent release of better-than-expected U.S. GDP figures has temporarily buoyed the dollar, interrupting its bearish trend. Market attention is currently focused on the OPEC+ meeting scheduled for today, with widespread expectations that further oil production cuts will be on the agenda, potentially fueling a surge in oil prices. Meanwhile, in the Asia-Pacific region, Australia's Consumer Price Index (CPI) fell short at 4.9%, and coupled with a downbeat China Purchasing Managers' Index (PMI) reading, the Australian dollar eased by nearly 0.5% last night.

Current rate hike bets on 13rd December Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (95.0%) VS 25 bps (5%)

Market Movements

DOLLAR_INDX, H4

The US Dollar exhibited a slight rebound from three-month lows following robust economic data. The Bureau of Economic Analysis reported a remarkable surge in the US Gross Domestic Product (GDP) for the third quarter, surpassing market expectations at 5.2%, despite the overall bearish trend. However, the Federal Reserve's Beige Book signalled a persistently pessimistic economic outlook, tempering the Dollar's recovery.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 35, suggesting the index might extend its gains since the RSI rebounded sharply from oversold territory.

Resistance level: 103.25, 104.05

Support level: 102.50, 101.90

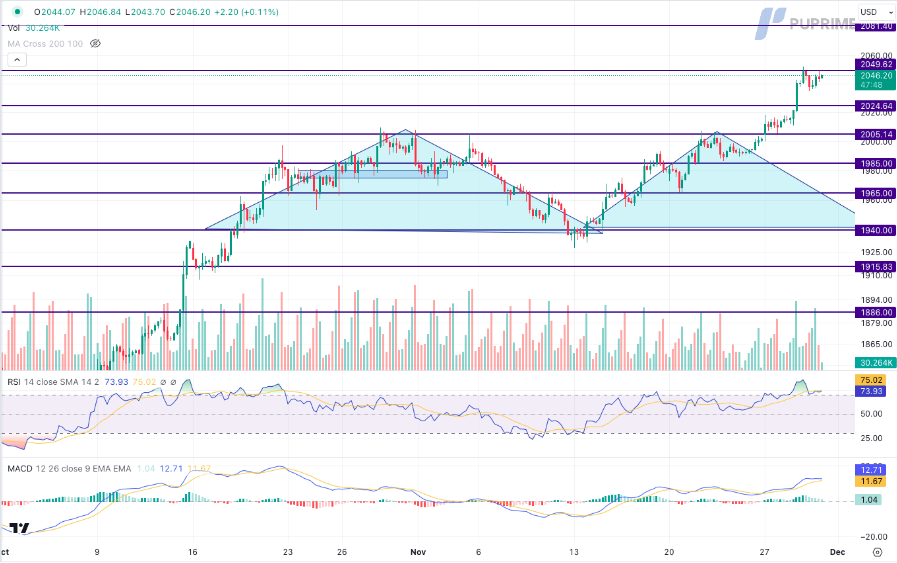

XAU/USD, H4

Gold prices continue to hover near the critical resistance level of 2050, with investors eagerly awaiting essential economic data for potential trading signals. The focus remains on the US Core PCE Price Index, a key inflation indicator for the Federal Reserve. A lower-than-expected reading could fuel hopes of a slowed inflation rate, influencing gold prices amid expectations of a potential shift in the Fed's monetary policy.

Gold prices are trading higher while currently testing the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 74, suggesting the commodity might enter overbought territory.

Resistance level: 2050.00, 2080.00

Support level: 2025.00, 2005.00

GBP/USD,H4

The bullish trend of the British Pound (Sterling) faced a momentary interruption due to the sudden strengthening of the dollar, with the Cable being held below its nearby resistance level at 1.2730. The dollar's resurgence was fueled by the upbeat U.S. Gross Domestic Product (GDP) reading, disclosed yesterday, suggesting that the economic performance in the U.S. remains positive. This positive economic outlook has led to speculation that the Federal Reserve (Fed) may have more room to consider raising interest rates.

Despite a minor retracement, the Cable is still trading at an elevated level, suggesting a bullish bias for the Cable. The RSI hovering near the overbought zone while the MACD continues to flow above the zero line suggests that the bullish momentum remains strong.

Resistance level: 1.2729 1.2815

Support level: 1.2630, 1.2528

EUR/USD,H4

The Euro has experienced a slight easing from its bullish trend, influenced by a strengthened U.S. dollar, although it is still trading within its established uptrend channel. The dollar gained strength following the release of optimistic GDP data, indicating positive economic performance in the U.S. As market attention shifts, all eyes are now on the Euro's Consumer Price Index (CPI), scheduled to be announced later today. This data release is anticipated to be a pivotal factor influencing the movement of the EUR/USD currency pair.

EUR/USD is hindered by the strengthened dollar and ease in bullish momentum but still trading in an uptrend manner. The MACD has a lower high pattern, but the RSI remains elevated, suggesting the pair is still trading with bullish momentum but has eased.

Resistance level: 1.1041, 1.1138

Support level: 1.0950, 1.0860

Dow Jones,H4US equity markets traded flat amidst a mixed economic sentiment, introducing uncertainty into the broader outlook. US Treasury yields remain stagnant as investors adopt a cautious stance. With the impending crucial PCE Index report, market participants hesitate to make definitive trading decisions, anticipating potential fluctuations in volatility later in the day.

The Dow is trading higher while currently testing the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 71, suggesting the index might enter overbought territory.

Resistance level: 35465.00, 35930.00

Support level: 34935.00, 34370.00

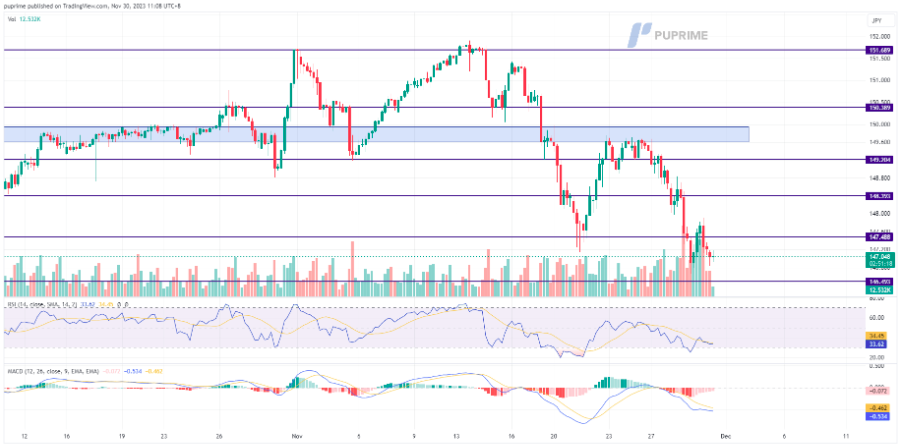

USD/JPY, H4

The USD/JPY pair persists in trading lower, reflecting the prevailing strength of the Japanese Yen, which has proven to be dominant over the U.S. dollar. Despite the brief respite provided by the upbeat U.S. Gross Domestic Product (GDP) data, which initially bolstered the U.S. dollar and hindered the bearish trend of the pair, the gains were swiftly erased. This swift reversal suggests that the Japanese Yen's strength remains resilient. In parallel, Japanese Retail Sales data fell short of the previous reading, declining from 6.2% to the current 4.2%. Surprisingly, this data did not have a significant impact on the Japanese Yen

The USD/JPY continues decline after a minor technical rebound suggests a bearish bias for the pair. The RSI is on the brink of breaking into the oversold zone while the MACD continues to decline below the zero line suggesting that the bearish momentum remains strong.

Resistance level: 147.48, 148.30

Support level: 146.50, 145.50

AUD/USD, H4

The Australian dollar experienced a decline, marking a deviation from its recent bullish run, with a nearly 0.5% decrease observed last night. This dip can be attributed to the lower-than-expected Australian Consumer Price Index (CPI) reading, which came in at 4.9%, signalling signs of easing inflation. Additionally, disappointing Purchasing Managers' Index (PMI) readings from China further contributed to the dampened strength of the Australian dollar.

Despite a retracement last night, the AUD/USD pair still traded firmly above its near-support level, suggesting that the bullish trend remains intact. The RSI constantly hovers at an elevated level while the MACD remains above the zero line, suggesting that the bullish momentum remains strong.

Resistance level: 0.6677, 0.6745

Support level: 0.6615,0.6560

CL OIL, H4

Oil prices extend their bullish momentum as market attention centres on the OPEC+ policy meeting. Anticipation of fresh supply cuts dominates discussions, though details are pending agreement. However, gains in the oil market face limitations following a downbeat US Crude Oil inventory report from the Energy Information Administration, revealing a higher-than-expected build at 1.609M.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 62, suggesting the commodity might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 78.30, 80.75

Support level: 74.50, 72.05