AUDUSD remains in the red; sellers seem cautious

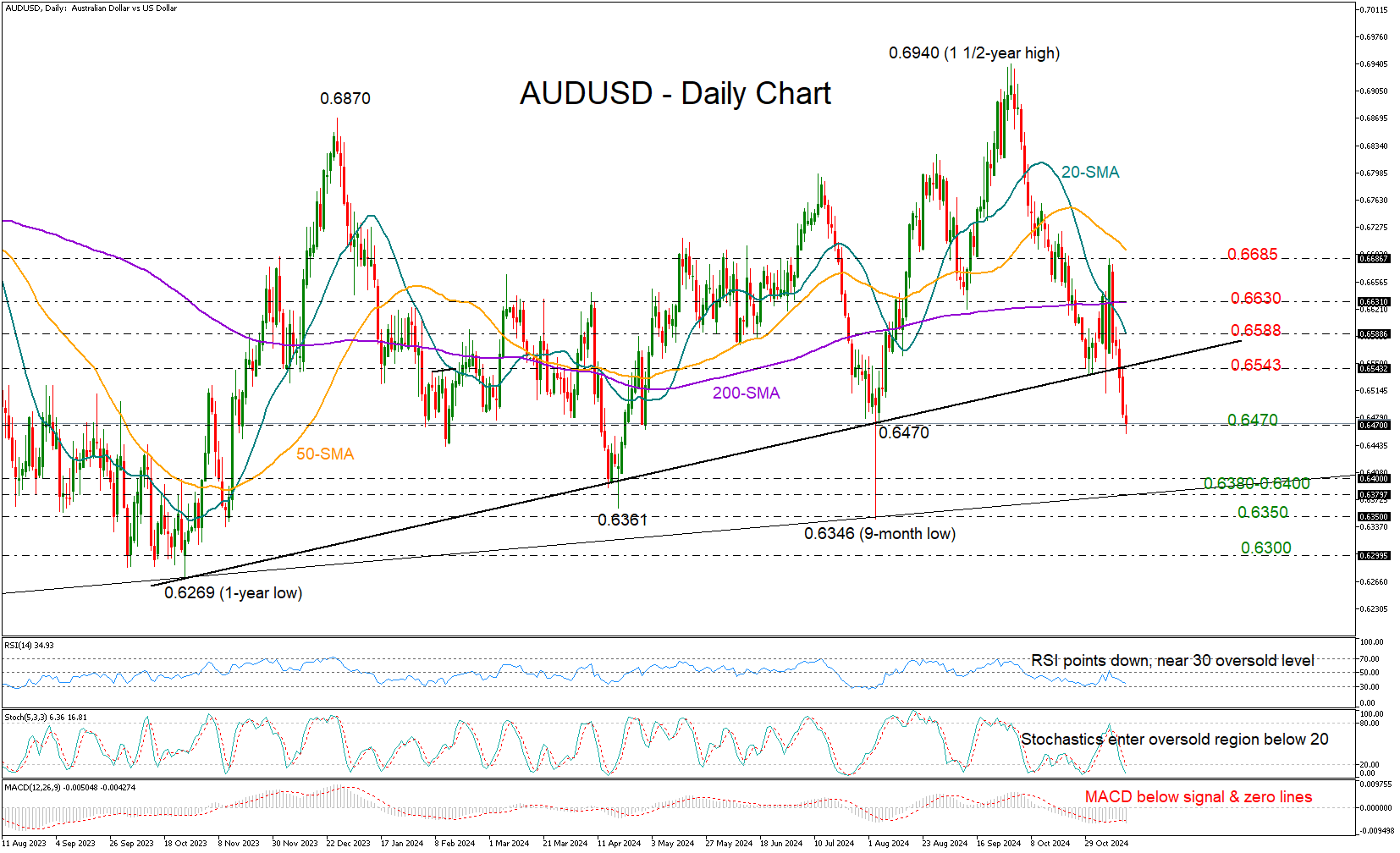

AUDUSD continues its bearish slide, hitting a seven-month low of 0.6458 in the wake of weaker-than-expected Australian jobs data early on Thursday.

Having slumped below the key support trendline that delivered two impressive bullish cycles earlier this year, the pair might be at risk of a bearish continuation, though with the price returning above the August base of 0.6470, hesitation among sellers is evident.

Moreover, with the RSI and stochastic oscillator fluctuating near oversold levels, a rebound is possible. In the opposite case, additional losses could target the 0.6380-0.6400 zone, where the important 2022 trendline is positioned. A close below that floor could initially stall near 0.6350 and then around the October 2023 base of 0.6300.

On the upside, an upside reversal could challenge the broken trendline at 0.6543. If that proves easy to claim, the bulls may next head for the 20-day SMA at 0.6588 and then toward the flattening 200-day SMA at 0.6630. A sustained rally above the previous high of 0.6685 could signal a shift in the downtrend.

Overall, while AUDUSD is facing a bearish situation, the technical signals suggest selling pressure could soon lose pace.

.jpg)