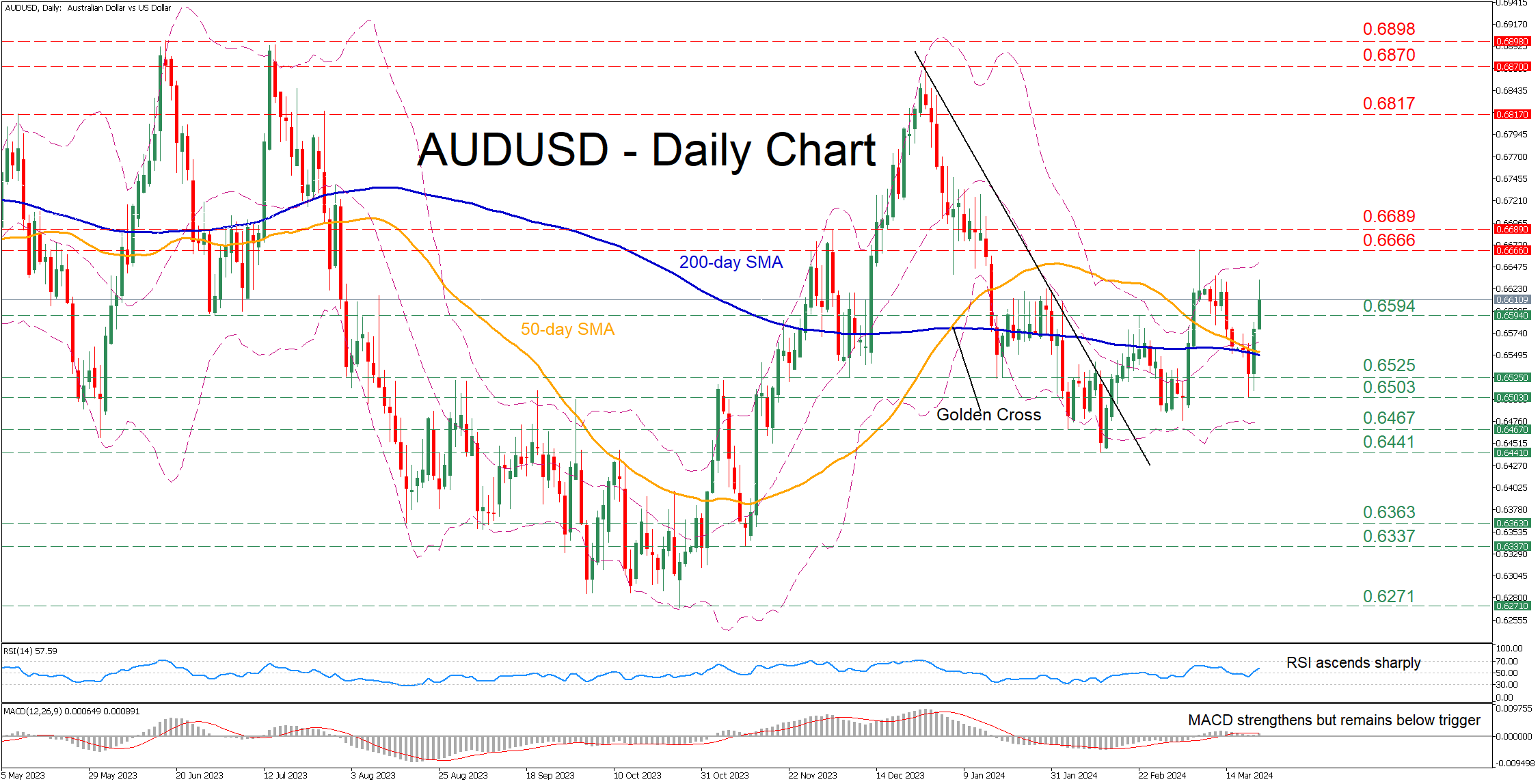

AUD/USD advances sharply in the FOMC aftermath

AUDUSD had been losing ground since the beginning of March, dropping below its descending 50- and 200-day simple moving averages (SMAs). However, the pair managed to pause its retreat and reverse back higher with some help from the dovish FOMC signals on Wednesday.

Should the advance resume, the price could initially test the March peak of 0.6666. Further upside attempts could then cease at the December 2023 resistance of 0.6689 ahead of the May 2023 high of 0.6817. If that hurdle also fails, the spotlight could turn to the December high of 0.6870.

On the flipside, bearish actions could send the price lower to test the recent resistance of 0.6594, which could serve as support in the future. A violation of that zone could pave the way for 0.6525, a region that provided both support and resistance in recent months. Even lower, the recent deflection point of 0.6503 could curb further declines.

In brief, AUDUSD managed to put an end to its recent slide and reclaim its converging 50- and 200-day SMAs. For the short-term picture to turn bullish though, the pair needs to jump above its March high of 0.6666.