Bitcoin accelerated growth

Market picture

Gold's historic highs and the surge in risk demand at the end of last week did not spare cryptocurrencies. Cryptos experienced impressive gains on Monday, but one cannot leave aside the weekend bull run as well. The crypto market capitalisation reached 1.55 trillion, adding 10.5% in seven days.

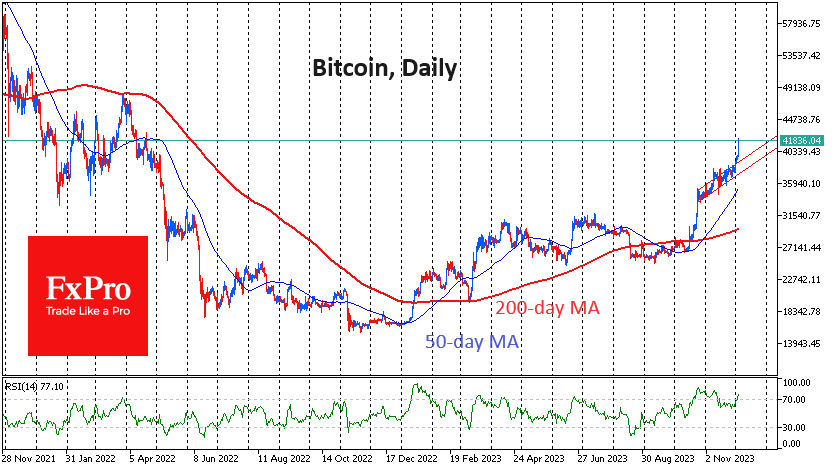

Bitcoin proved that the smooth uptrend since late October was just a long consolidation before a new upward spurt. Bitcoin has added over 11.5% since Friday, surpassing $42K at one point on Monday. While Bitcoin is overbought on daily timeframes, this is not necessarily a reason for a correction. In this mode, the first cryptocurrency can move for many more days, drawing more and more layers of investors into FOMO. Technically, up to $46K is thin-air territory for Bitcoin, and price swings between $40K and $46K can be pretty wild.

News background

Matrixport reiterated its forecast for Bitcoin to rise to $63K by April 2024 and $125K by the end of next year. Among the reasons for the rally are halving; geopolitical, monetary, and macroeconomic factors.

Grayscale expects that the emergence of spot bitcoin-ETFs has the potential to reduce the supply of BTC in the market, which in turn will have a positive impact on the first cryptocurrency's rate. Halving in April will also reduce supply from mining companies.

DeFi and NFT activity is showing "tentative" signs of recovery from a two-year slump as the pending approval of spot bitcoin-ETFs has improved sentiment in the crypto market, JPMorgan noted.

Cryptocurrency exchange Kraken, which has been charged by the SEC, is going to fight the regulator and answer all complaints in court, the company's general counsel said. He said the authorities' accusations that "Kraken is a clearing house and a broker-dealer are completely made up."

Circle, the issuer of the USDC stablecoin, denied reports of illegal funding and ties to the TRON Foundation, HTX and Tron founder Justin Sun.

Meanwhile, Cryptocurrency exchange Binance has entered into an agreement with an unnamed bank for the sake of attracting large legal entity investors and eliminating counterparty risk. Binance is preparing the foundation for the launch of spot bitcoin-ETFs in the US, which many market players have been waiting for a long time.

By the FxPro Analyst team

-11122024742.png)

-11122024742.png)