Canadian inflation to slow to lowest since 2021

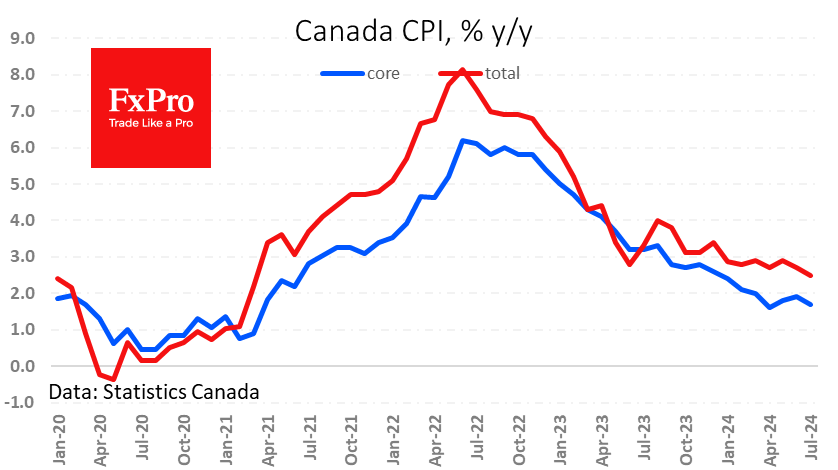

Canadian inflation slowed to 2.5% y/y, the lowest since March 2021, in line with expectations. Several core indices tracked by the Bank of Canada (common, median and trimmed) also fell back to three-year levels. In this case, prices rose more slowly than the average forecast of market analysts.

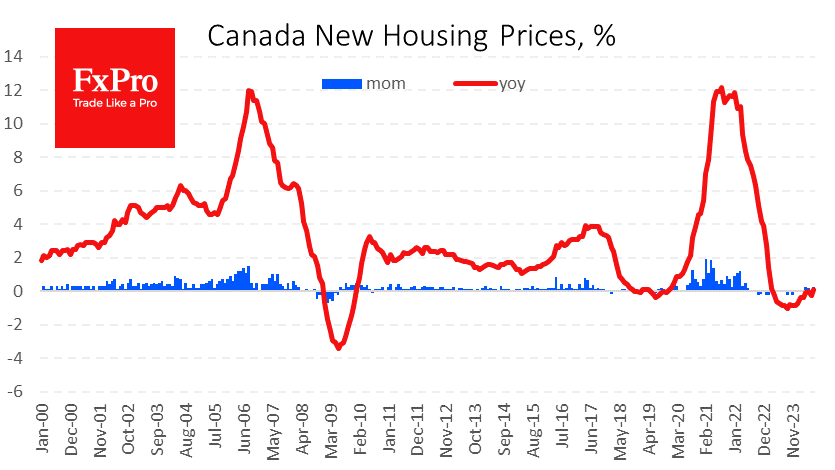

House prices are back in positive territory at year-ago levels and 0.9% below the nominal index's historical peak.

The Bank of Canada cut interest rates twice in June and July, from 5.00% to 4.50%, although price growth remains above target. The question remains whether the pace of policy easing is too fast.

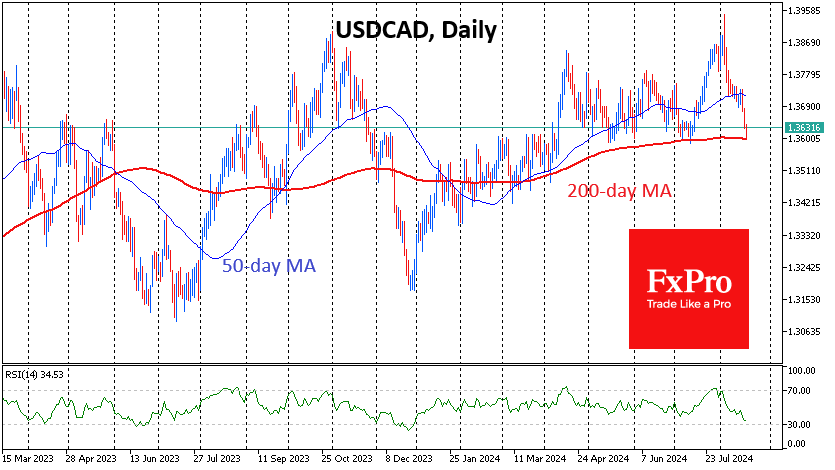

The USDCAD is down 2.5% from its peak on August 5th, when it again failed to consolidate above 1.39. The pair has not been consistently higher since September 2022, and dips above 1.40 in the past six years have been short-lived and coincided with the oil crash in late 2015 and March 2016. However, USDCAD has been falling for the past three weeks, despite a two-week decline in oil, and has reached the 200-day average and the lower end of its range since May. A break below (if the bears have the strength to do so) would be a very important signal of North American traders' sentiment towards the USD.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)