EUR/JPY falls slightly after meeting 3-month high

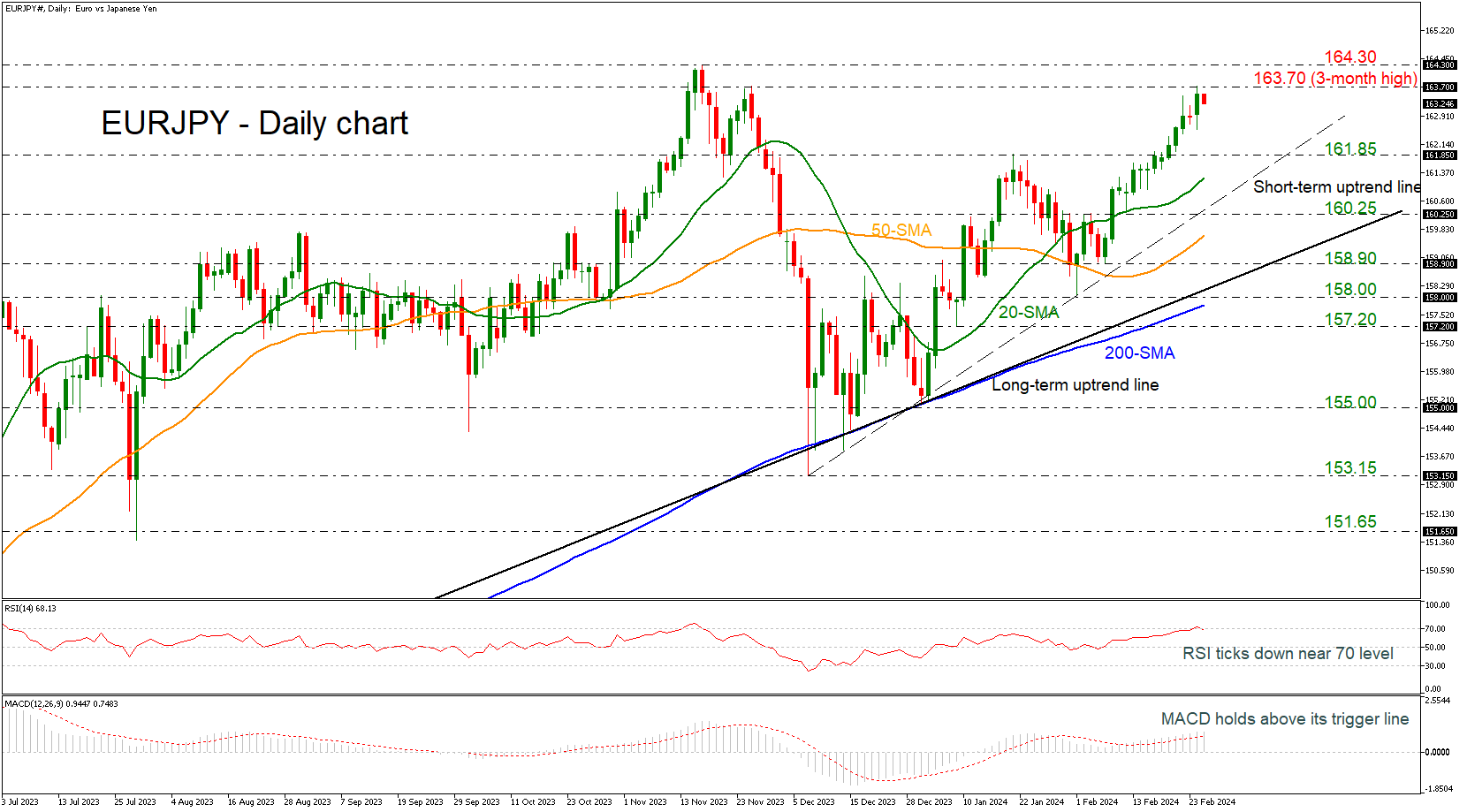

EUR/JPY is retreating somewhat after the aggressive buying interest towards the three-month high of 163.70. The price has been developing an upward trend since the rebound off the 153.15 support level confirming the bullish bias in the short- and long-term pictures.

Technically, the RSI indicator is pointing slightly down after it jumped above the 70 level; however, the MACD oscillator is still pointing to strengthening momentum above its trigger and zero lines.

If the market extends its upside move above the previous high, then it may reach the 164.30 resistance, taken from the peak on November 16. Surpassing this line, there is lot of room until the next resistance line at 170.00, registered in May 2008, so traders need to be cautious for the psychological levels between 164.00 and 170.00.

On the flip side, a bearish move could find immediate support at 161.85 ahead of the 20-day SMA at 161.25. Even lower, the market may retest the near-term rising trend line near the 160.25 barricade. A successful attempt to break beneath this line could open the way for a negative correction until the 50-day SMA at 159.65 and the long-term ascending trend line at 158.00.

To sum up, EUR/JPY seems bullish in all timeframes and only a drop beneath the 200-day SMA at 157.75 may change this outlook to bearish.

.jpg)