EUR/JPY sits on the sidelines as ECB rate decision looms

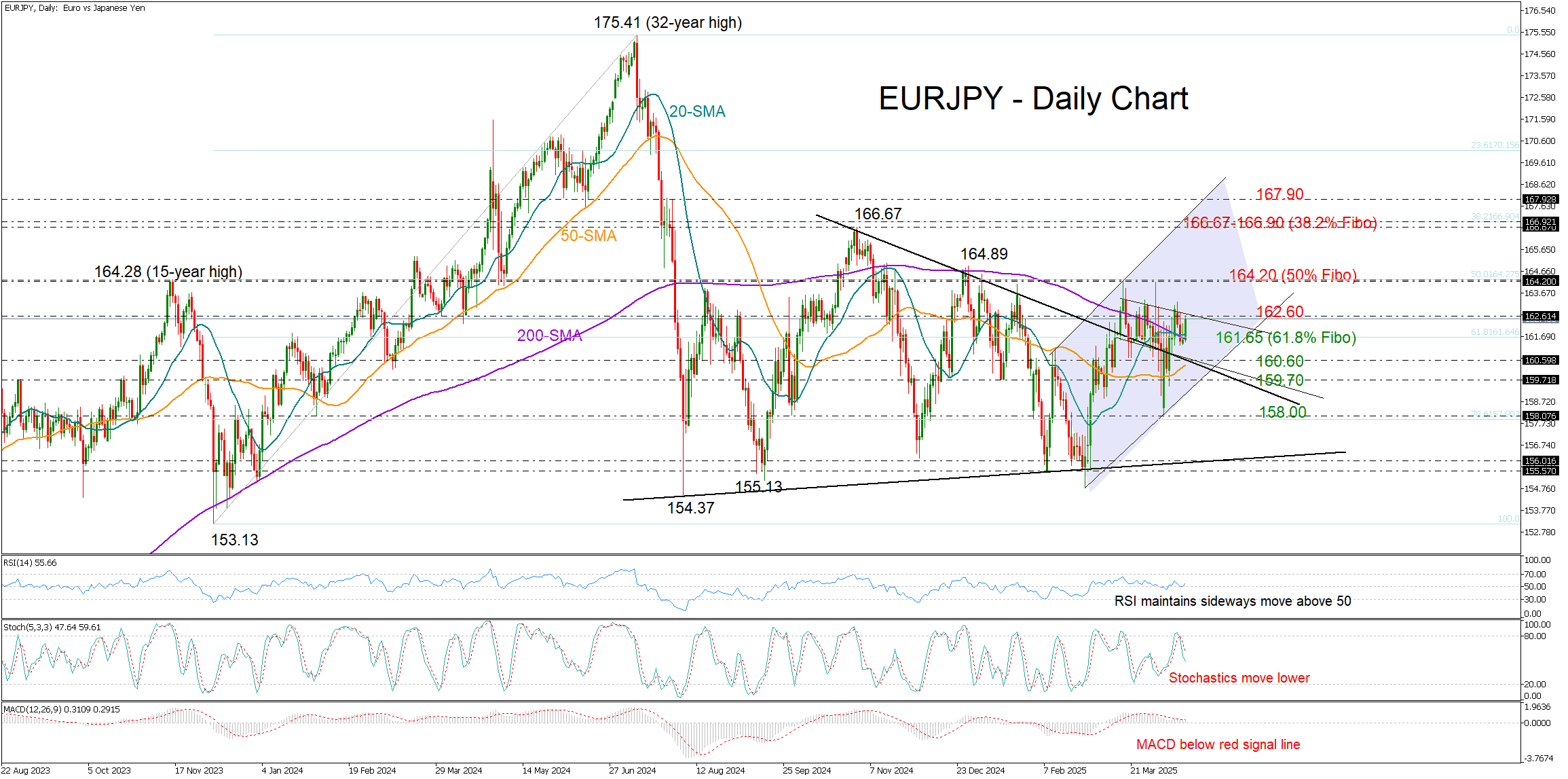

EURJ/PY has been range-bound after immediately recouping the steep drop to 158.14 last week. Persistent rejections around the 163.00 area have capped upside momentum, but not all signs are negative.

A bullish cross between the 20- and 200-day SMAs – the first since December 2023 – is providing a ray of hope to buyers. The pair also appears to be tracing an upward channel since February.

A move above the 162.60 zone could test the 164.20 area, aligning with the 50% Fibonacci retracement of the December - July uptrend. A breakout might open the way to October’s peak of 166.67 or even the 38.2% Fibonacci at 166.90. Then the bulls could meet the channel's upper band near 167.90, with 169.20 acting as the subsequent resistance.

On the downside, support is currently developing near the 200-day SMA and the 61.8% Fibonacci level of 161.65. The broken resistance trendline at 160.60 and the 50-day SMA could also protect the market from selling pressures. A drop below the ascending trendline at 159.70, however, could shift sentiment bearish, exposing the pair to the 158.00 region and potentially to 156.00.

In summary, EUR/JPY remains neutral ahead of today’s ECB rate decision. The central bank is expected to cut rates by 25bps but may avoid signaling future moves. A break above 164.20 or below 159.70 could end the current stalemate.