EUR/USD bulls await rescue above 1.0500

EUR/USD is still struggling to secure a close above the 1.0500 ceiling, having briefly violated that threshold earlier today before losing steam marginally beneath January’s high of 1.0532 after the conservative CDU/CSU leader Friedrich Merz won Sunday’s election in Germany.

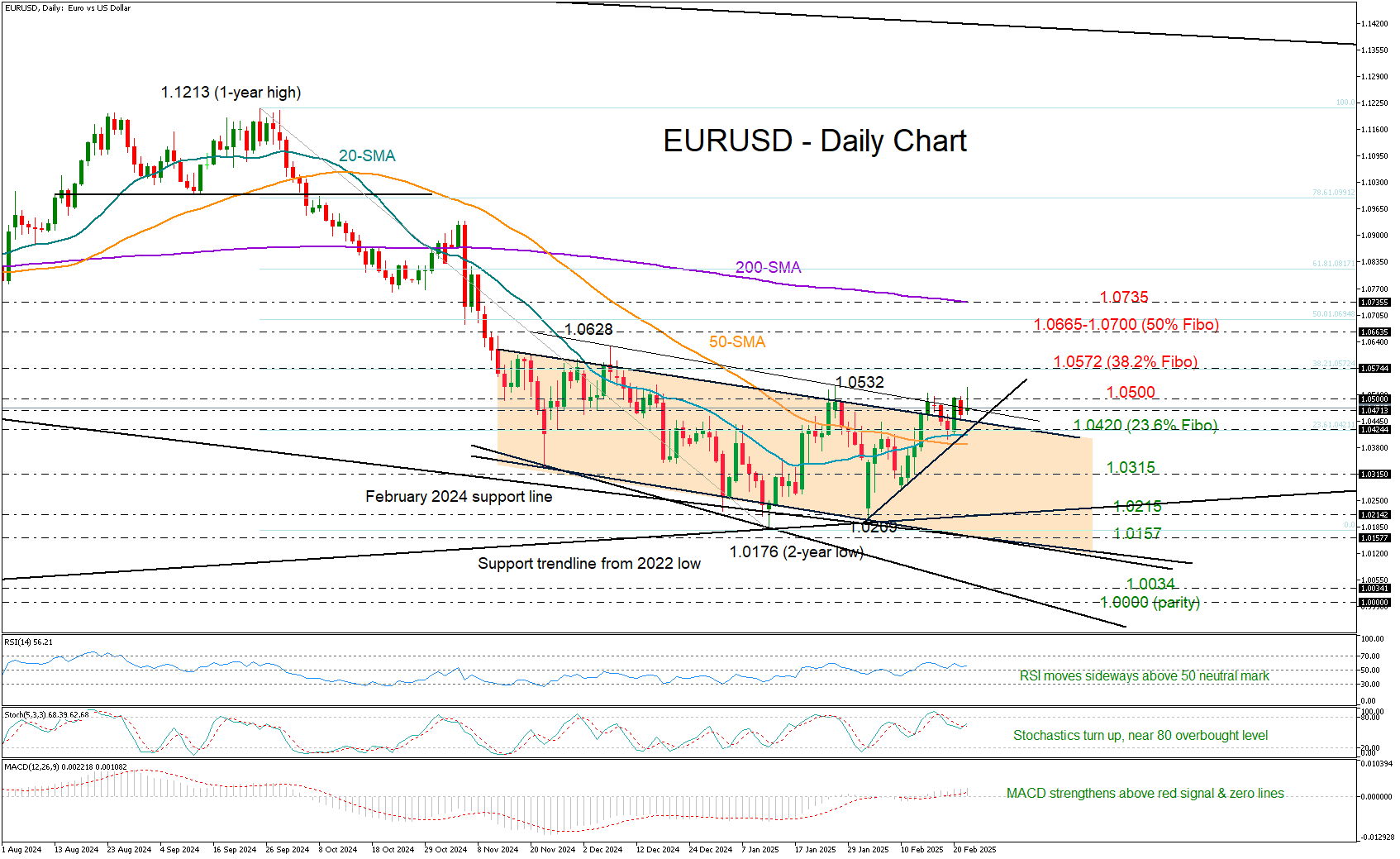

From a technical perspective, the short-term outlook remains bullish-to-neutral, with the RSI holding above its 50 mark and the stochastic oscillator pointing slightly higher but still below overbought levels. The MACD's momentum is positive, and a bullish crossover between the 20- and 50-day simple moving averages (SMAs) suggests buying interest is growing.

Given the support created within the trendline zone of 1.0450-1.0475, there is potential for an acceleration towards the 38.2% Fibonacci retracement of the September-January downleg at 1.0572 once the 1.0500 psychological level gives the green light. Further up, the bulls could speed up towards the 1.0665 barrier and the 50% Fibonacci mark of 1.7000, while the 200-day SMA could also come into play.

On the downside, the area around the 23.6% Fibonacci level of 1.0420, the 20-day SMA and the short-term support trendline could be critical for keeping buying appetite alive. If that floor collapses, the pair could forcefully drop towards 1.0315 and then straight down to the long-term ascending trendline drawn from the 2022 low at 1.0215. The lower boundary of the bearish channel at 1.0157, aligning with the falling trendline from February 2024, could serve as the next safety net.

In a nutshell, EUR/USD has not exited the caution area, despite the improvement in technical signals. A sustainable rally above 1.0500 could be key for a bullish continuation.

.jpg)