Gold hits record highs as risk aversion dominates the market

By RoboForex Analytical Department

The price of gold surged to a new record on Monday, reaching 3,446 USD per troy ounce, approaching the peaks seen in April. The rise reflects intensified demand for safe-haven assets as investors react to heightened geopolitical tensions and a broadly weaker US dollar.

Geopolitical fears and monetary policy in focus

The ongoing conflict between Israel and Iran has escalated, prompting fears of a broader geopolitical fallout in the region. This environment is driving capital into defensive assets, such as gold, as risk appetite continues to wane.

Meanwhile, markets are shifting their attention to this week’s US Federal Reserve meeting, which begins on Tuesday and concludes on Wednesday evening. While the Fed is expected to hold interest rates steady, investors will closely watch for any forward guidance on rate cuts, especially following the release of weaker-than-expected US inflation data, which has reinforced speculation of a policy easing as early as September.

Additionally, market participants are awaiting details on President Donald Trump's next wave of tariffs, which the White House is reportedly preparing to implement in the coming weeks. These trade measures are key in evaluating the broader economic outlook.

The US dollar remains under pressure, which continues to support the bullish momentum in gold.

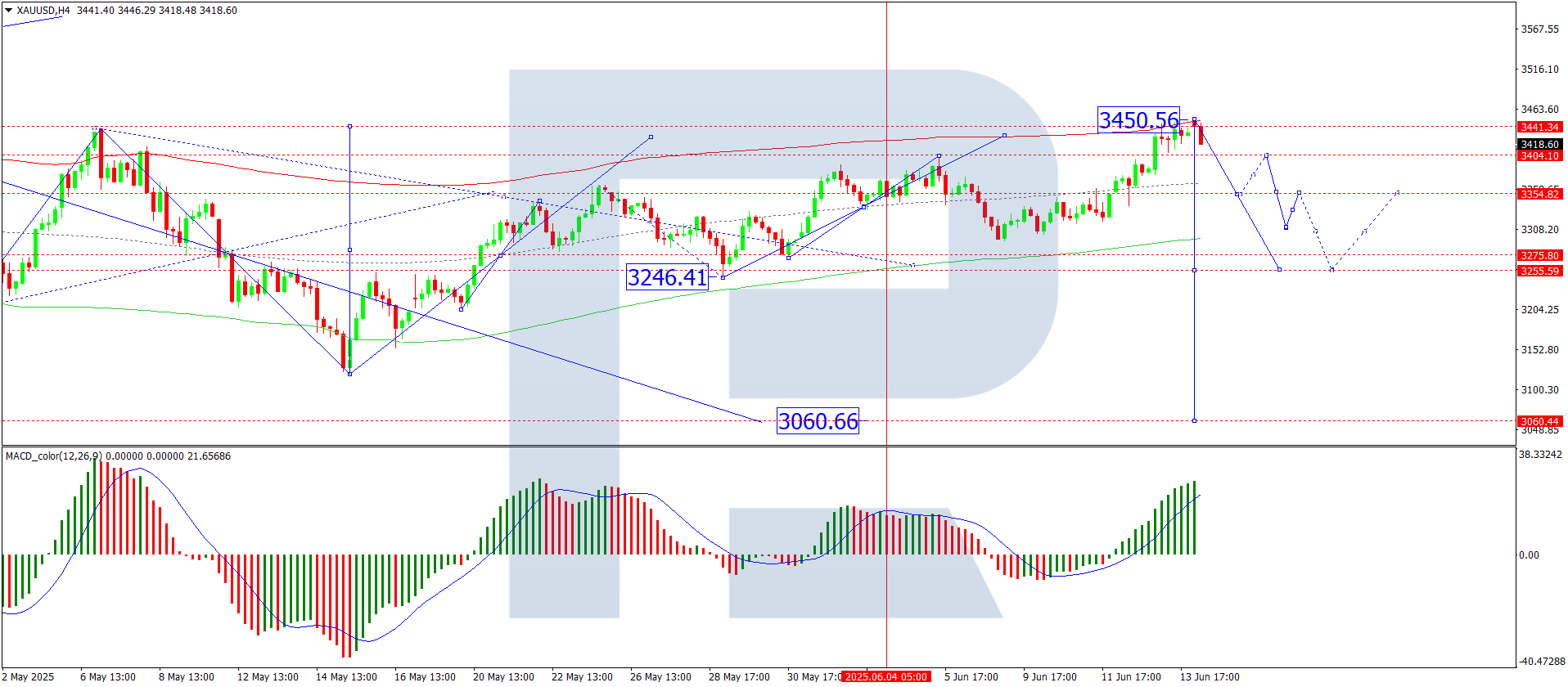

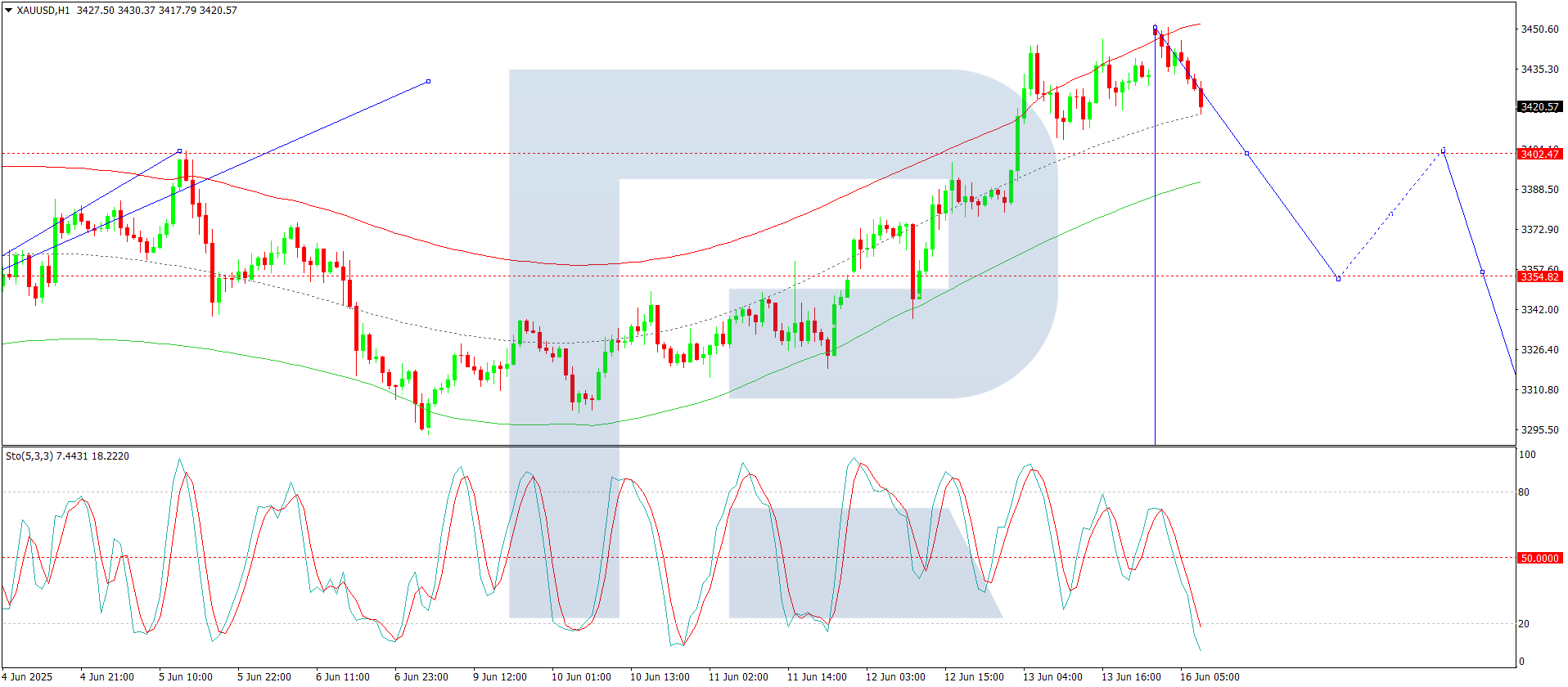

Technical analysis of XAU/USD

On the H4 chart, XAU/USD has completed the fifth wave of growth, reaching a peak at 3,450 USD. A new decline towards 3,400 USD is now expected. If this support is breached, the trend may extend further down to 3,350 USD. The MACD indicator supports this bearish outlook, with its signal line above zero, exiting the histogram zone and suggesting a potential reversal towards new lows.

On the H1 chart, the pair is building a downward wave structure targeting 3,400 USD. The price is currently testing the lower boundary of the consolidation range at the top of the wave. After reaching 3,400 USD, a correction towards 3,424 USD is anticipated, likely followed by the development of a new downward wave towards 3,375 USD, considered the next local target. The Stochastic oscillator supports this view, with its signal line below 50 and heading towards 20, indicating growing bearish momentum.

Conclusion

Gold remains strongly supported by geopolitical instability, a weak dollar, and dovish monetary policy expectations. While the asset is trading near record highs, technical indicators suggest a potential short-term pullback towards 3,400 USD and possibly deeper to 3,375-3,350 USD. However, the overall bullish trend remains intact as long as risk-off sentiment prevails and macro uncertainty lingers.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.