Manufacturing ISM: inflation up, activity down

Manufacturing ISM: inflation up, activity down

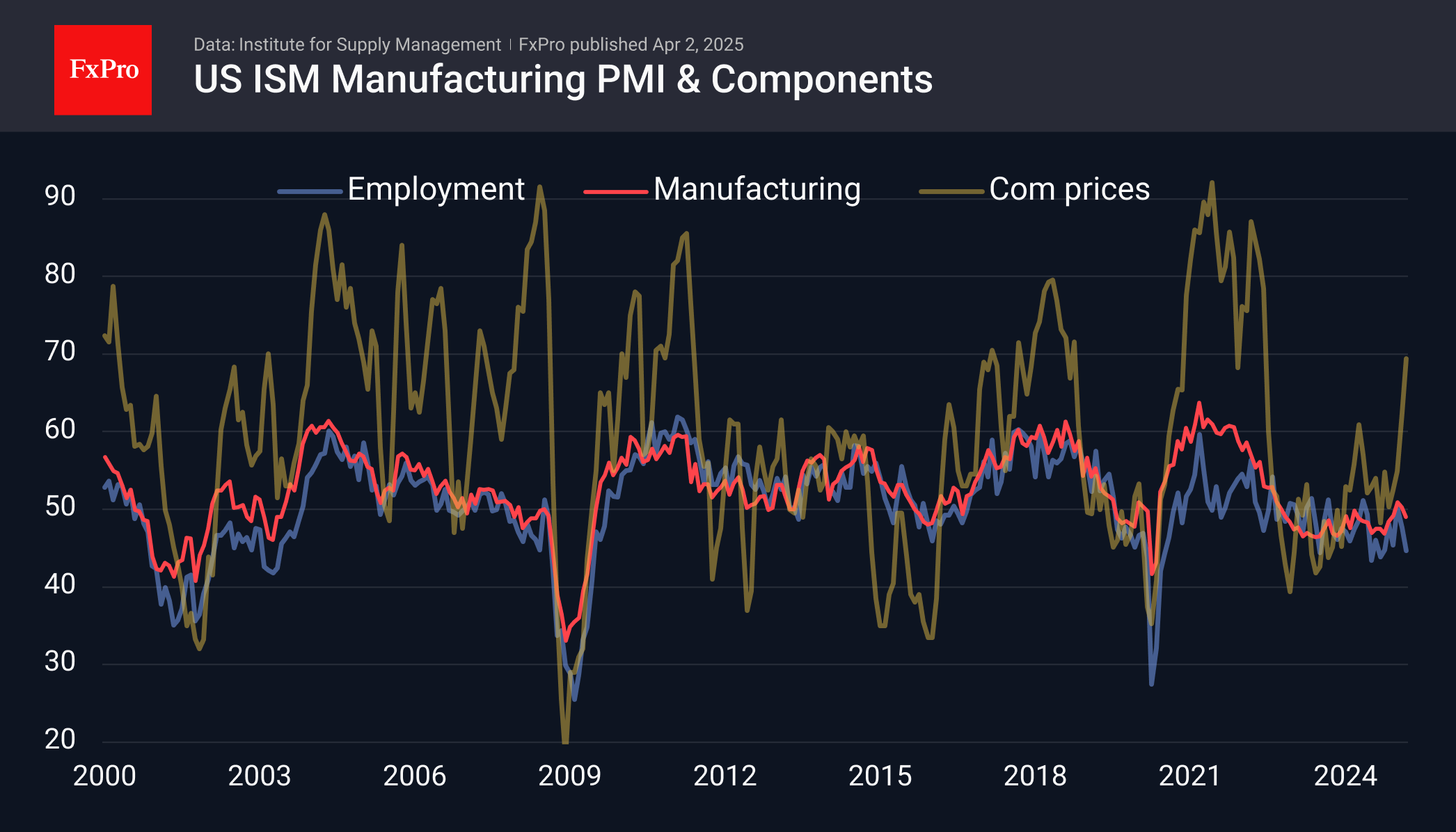

Tuesday's ISM Manufacturing Indicator confirmed a worrying divergence in the US economy: economic activity is down, and inflation is rising. Often, the latter follows the former, but not now. A prolonged period of such dynamics is called stagflation, and it forces the Fed to make difficult choices in its dual mandate.

The ISM manufacturing business activity index fell from 50.3 to 49 last month. Strictly speaking, this is contractionary territory for the sector's activity, but due to the greater resilience of the service sector, historically, US GDP has declined when the indicator falls below 42.3.

The price component climbed to 69.4, recording its highest value since mid-2022. Unlike the episode three years ago, this has nothing to do with the economy overheating. We recall that the University of Michigan previously noted a sharp jump in consumer inflation expectations, both one year and five years ahead. If we focus only on these indicators, the central bank should have prepared to raise the rate or actually hike it.

But at the same time, business activity and consumer sentiment are creeping down. Tuesday's data marked the employment component falling deeper into the below-50 area. The rate has been below that level for 16 of the last 18 months. This is a very worrisome signal for industrial production and is alarming relative to Friday's labour market data. In addition, the components of production and new orders have been in contractionary territory and inventories are rising. These are all signs of weakening demand. This set of components suggests the need for a rate cut.

Which side will the Fed choose? We are more accustomed to a relatively lenient Fed, which carries risks for the dollar. If the news continues in a similar vein, the USD may return to decline after stabilising and rebounding in the second half of March. This scenario will be technically confirmed if DXY slides below the previous lows at 102.8 with a near-term downside potential of 99-100.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)