Merry Christmas, Everyone! Markets Stay Subdued Amid Holiday Cheer

- Dollar Index flat and gold stagnant as markets slowed for Christmas.

- Santa Claus' rally continued, led by tech and chipmakers.

- Oil rose 1%+ on China’s stimulus, while Hong Kong surged on bullish 2025 policy expectations.

Market Summary

The Dollar Index remained flat as markets slowed down for Christmas, with limited economic data revealing continued contraction in the US manufacturing sector. Gold prices stayed stagnant during thin holiday trading, weighed down by the Fed's cautious stance on reducing borrowing costs, keeping a bearish tone in the market.

US equities closed higher in a shortened session, driven by tech giants and chipmakers like Broadcom (+3.2%) and Arm Holdings (+3.9%), marking the continuation of the Santa Claus rally despite rising Treasury yields.

Oil prices climbed over 1%, supported by tightening US crude supplies and optimism around China’s fiscal stimulus plans. Meanwhile, Hong Kong equities surged above the 20,000 level, their best performance in two weeks, fueled by expectations of aggressive economic policies from China for 2025.

Current rate hike bets on 29th January Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (91.4%) VS -25 bps (8.6%)

Market Movements

DOLLAR_INDX, H4

The Dollar Index traded flat as markets began winding down for the Christmas holidays. With a sparse economic calendar, minor releases like the Philadelphia Fed Non-Manufacturing Activity Index and the Richmond Fed Manufacturing Index highlighted ongoing contraction in the US manufacturing sector. Recent data confirmed the sector's persistent challenges, underscoring an economic slowdown in industrial activity.

The Dollar Index is trading flat while near the resistance level. However, MACD has illustrated increasing bearish momentum, while RSI is at 58, suggesting the index might edge lower since the RSI retreated from overbought territory.

Resistance level: 108.60, 109.50

Support level: 107.60, 106.75

XAU/USD, H4

Gold prices remained stagnant during thin holiday trading sessions. A more bearish sentiment prevails in the gold market as the Fed signals caution in lowering borrowing costs further, supported by stable unemployment rates and slow inflation improvements. Investors await clearer trends as the holiday lull continues and will focus on upcoming Fed decisions for future price direction.

Gold prices are trading lower while currently testing the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 47, suggesting the commodity might extend its losses after breakout since the RSI stays below the midline.

Resistance level: 2656.00, 2718.00

Support level: 2556.00, 2485.65

GBP/USD,H4

GBP/USD trades lower, pressured by the appreciation of the US Dollar. However, trading volumes remain subdued due to the Christmas holidays. On a broader scale, the Greenback retains its strength, supported by expectations of a slower pace of interest rate cuts from the Federal Reserve in the coming year. This outlook continues to weigh on GBP/USD's appeal.

GBP/USD is trading lower while currently near the support level. MACD has illustrated diminishing bullish momentum, while RSI is at 43, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 1.2620, 1.2700

Support level:1.2506, 1.2410

EUR/USD,H4

EUR/USD remains range-bound, mirroring the US Dollar's stability during North American trading hours on Tuesday. The US Dollar Index (DXY), which measures the Greenback’s strength against six major currencies, consolidates above the critical support level of 108.00. Thin trading volumes are attributed to holiday closures in Forex markets for Christmas and Boxing Day.

The EUR/USD is trading lower following the prior retracement from the resistance level. MACD has illustrated diminishing bullish momentum, while RSI is at 43, suggesting the pair might extend its losses since the RSI stays below the midline.

Resistance level: 1.0445, 1.0608

Support level: 1.0345, 1.0238

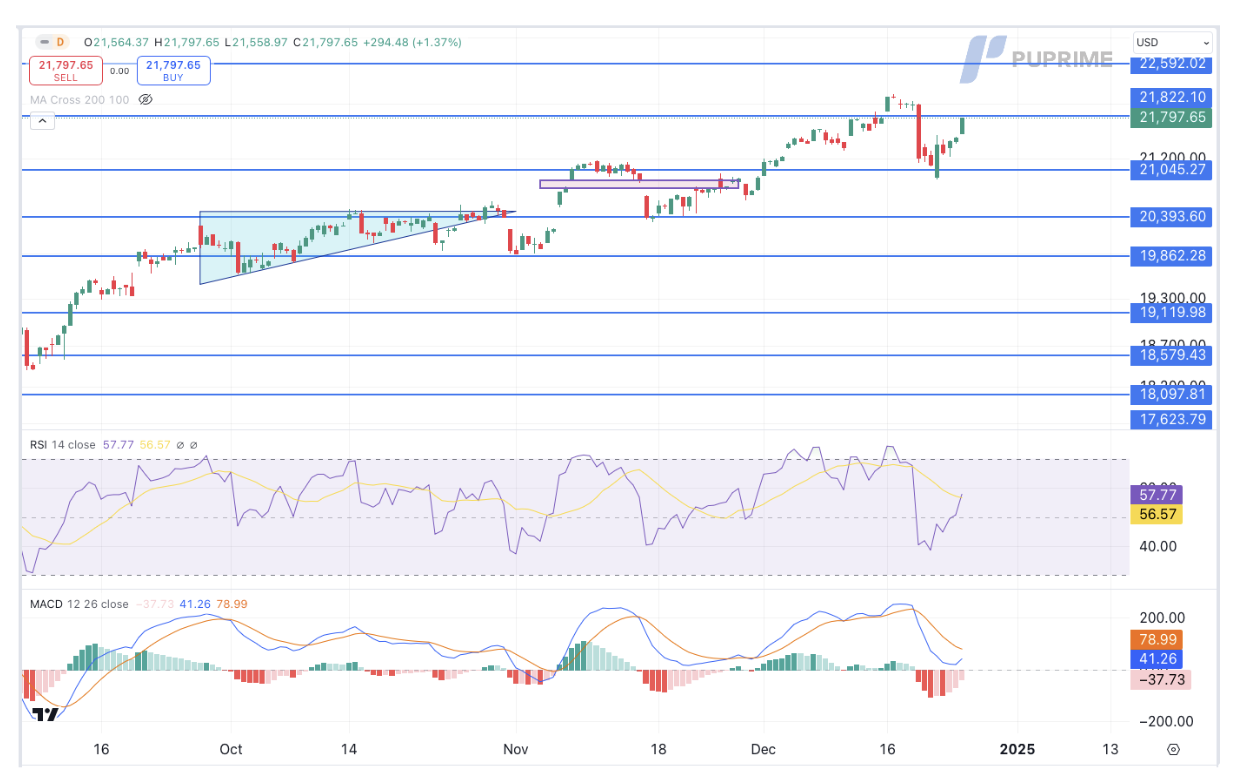

NASDAQ, H4

Wall Street's major indexes closed higher in a shortened Christmas Eve session. Gains in tech giants and growth stocks propelled indices, marking the onset of the seasonal Santa Claus rally. The S&P 500 extended its winning streak to three sessions, while the Dow Jones and Nasdaq posted gains for the fourth consecutive session. Strong performances by chipmakers like Broadcom (+3.2%), Nvidia (+0.4%), and Arm Holdings (+3.9%) contributed to the rally despite rising US Treasury yields.

Nasdaq is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 58, suggesting the index might extend its gains after breakout since the RSI stays above the midline.

Resistance level: 21820.00, 22590.00

Support level: 21045.00, 20395.00

HK50, H4

Hong Kong stocks surged, with the benchmark index exceeding the 20,000 level, marking its largest gain in nearly two weeks. Investor optimism followed expectations of further economic policies to stimulate growth in China. President Xi Jinping's economic work conference hinted at aggressive fiscal and monetary measures for 2025, including rate cuts and increased government spending, driving a bullish sentiment in the market.

The Hang Seng Index is trading higher while currently testing the resistance level. MACD has illustrated diminishing bearish momentum, while RSI is at 57, suggesting the index might extend its gains since the RSI stays above the midline.

Resistance level: 20115.00, 21260.00

Support level: 19070.00, 18290.00

CL OIL, H4

Oil prices climbed over 1% amid light trading, driven by tightening US crude supply data and optimism over China’s fiscal stimulus plans. API data showed a significant draw in crude and distillate inventories, while China's issuance of 3 trillion yuan in special treasury bonds provided additional support. Beijing’s increased fiscal spending is expected to boost oil demand and support WTI crude prices in the near term.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 59, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 71.20, 72.35

Support level: 69.90, 68.25