Pound Enters Correction Phase

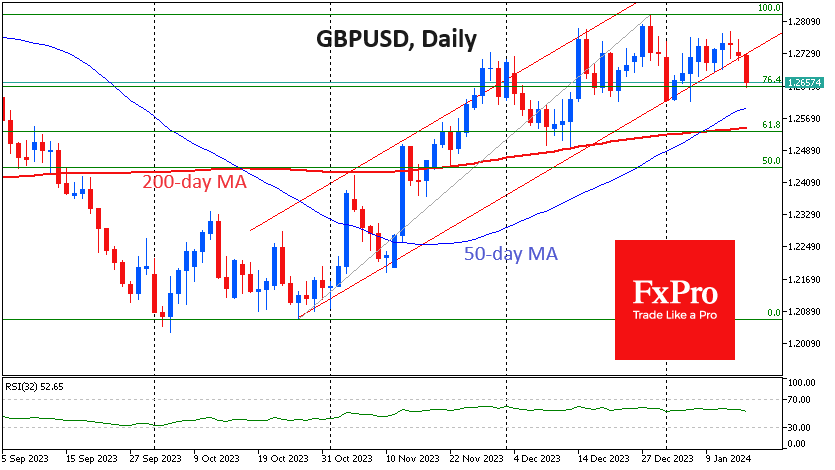

The British Pound has lost around 0.5% against the Dollar since the start of the day on Tuesday, falling to 1.2660. Markets have eased expectations for aggressive US interest rate cuts. In addition, UK employment data was released that provided new evidence of a slowdown.

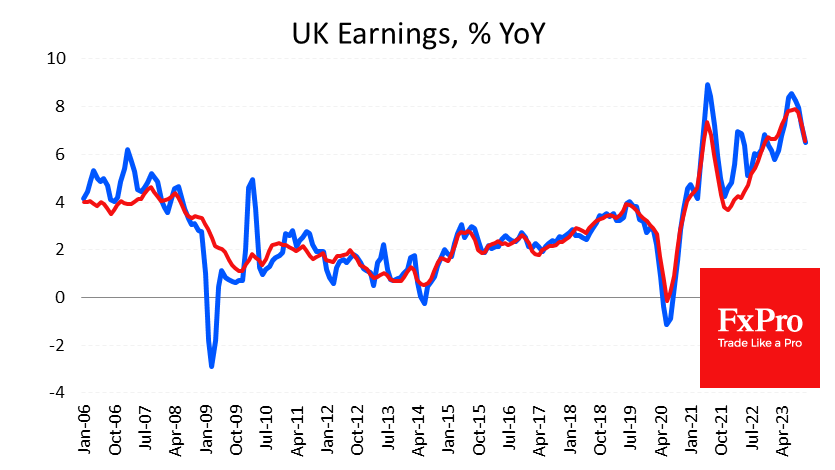

The fresh report for the three months to November showed that wages grew by 6.5% year-on-year, the lowest since March last year. This is weaker than the 6.8% expected and a marked slowdown from 7.2% in the previous month.

At the same time, jobless claims rose by 11.7K in November to 1.571M, the highest level since May last year.

The GBPUSD fell to its lowest level since 5 January, its third consecutive session of losses. This decline formally breaks the uptrend seen from the lows at the start of the year. The move lower raises the question of a broader uptrend from the late October lows. A break below 1.2610 would confirm the break of this trend. The initial decline may prove to be a technical correction after the gains of the last three months and could take the pound back to 1.2640, where the 200-day moving average and the 61.8% level of the rally.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)