Stronger labour market continues to boost Pound

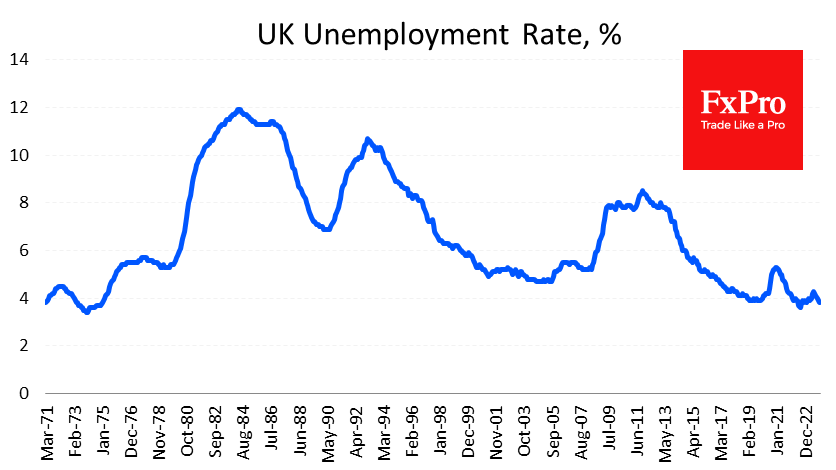

Economic data continues to be on the Pound's side, with another set of better-than-expected figures, this time from the labour market. The unemployment rate fell from 4.2% to 3.8% against expectations of 4.0%.

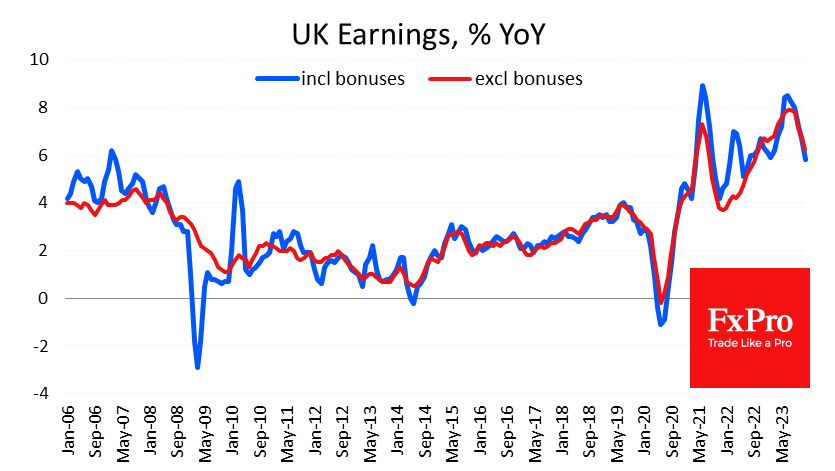

A fall in the number of active job seekers in the labour market increases competition among employers, helping to keep wages growing at a higher rate. Wages rose by 5.8% in the three months to December. That's a solid decline from 6.7% the previous month and a peak of 8.5% six months earlier, but more robust than the 5.8% expected.

The annual rate of wage growth has been above the rate of consumer inflation for half a year, narrowing the gap that had built up in previous years as prices had risen sharply. The slowdown in wage growth and the uptrend in the unemployment rate create an expectation that the Bank of England's next move will be to cut interest rates. However, more potent labour market data, especially if complemented by a further acceleration in inflation on Wednesday, will push back the expected date for policy easing.

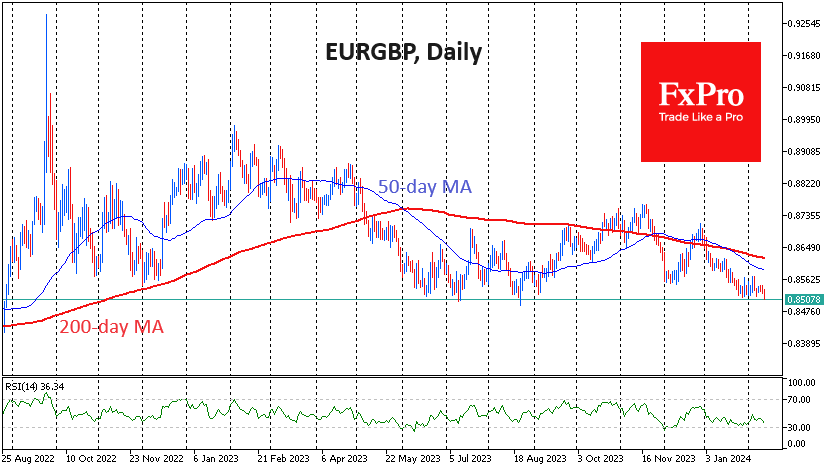

Better-than-expected employment figures have supported the Pound's gains, especially against the Euro and the Franc. The GBPUSD has primarily traded in a very tight range of 1.26-1.2650 over the past week. EURGBP is down 0.3% at 0.8510, the June-August 2023 pivot area, following the release. The pair's active bearish trend, which began earlier this year, suggests a renewal of multi-month lows with the potential for a drop to 0.83-0.84 before the end of the current quarter.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)