Tariff wars made the dollar a risky asset

Tariff wars made the dollar a risky asset

The fall in the U.S. dollar accelerated at the start of April as the shock of trade tariffs caused capital flight from U.S. assets. We don’t know yet how long this trend will be. In finance, it is often said, “America sneezes, and the world gets a fever.” Even if the problems originated in the US, the impact on the markets of other countries will be more substantial.

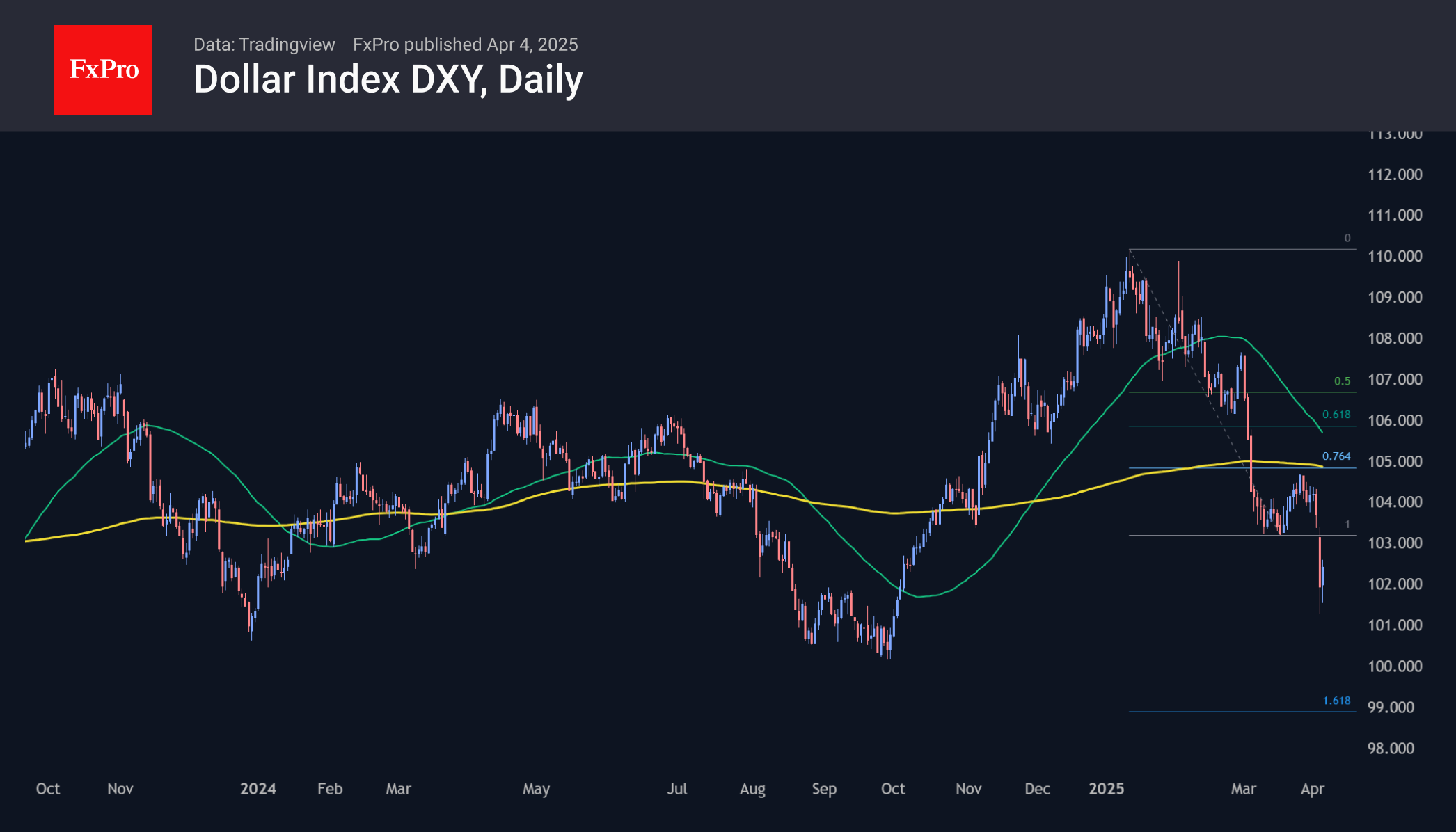

The dollar index moved sharply below its previous support, confirming the prevailing downtrend. The technical target of the current drop now looks like the area from 99 to 100. The lower boundary represents the Fibonacci extension of the first impulse. The upper boundary passes through the psychologically significant round level, which stopped the dollar's decline in September-October last year.

Among the dollar's competitors, the euro and the yen are the biggest gainers so far. These are the next two largest capital markets after the dollar, where investors are hoping to weather the storm. The euro returned to local highs against the dollar and the pound. EURUSD has also been near the upper boundary of the trading range for the last three years, and it is ready to break it and move further up.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)