USDCAD continues its bullish surge, eyes 1.4300 area

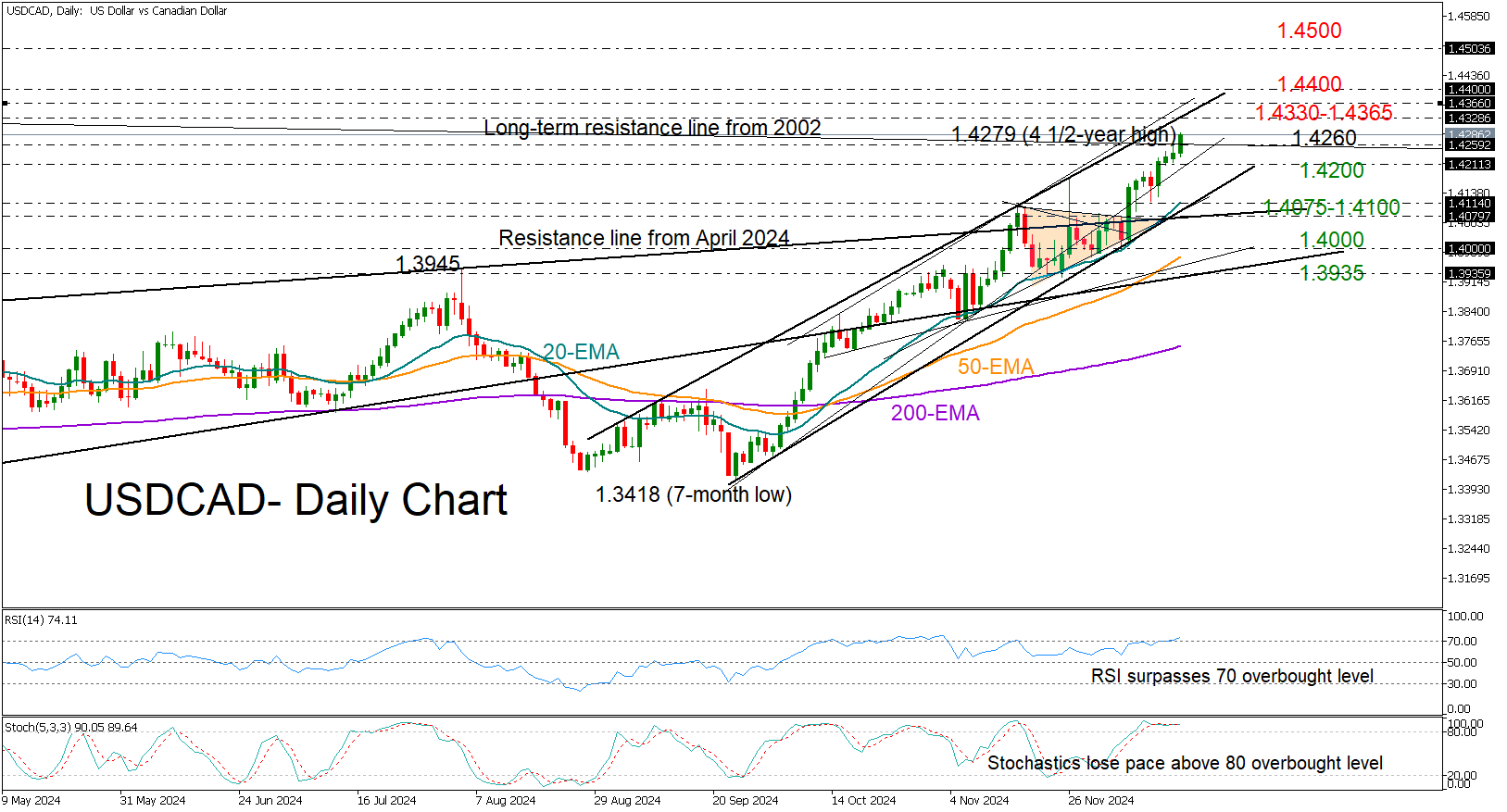

USDCAD has been performing exceptionally well after forcefully breaking a symmetrical triangle on the upside.

The pair unlocked a four-and-a-half year high of 1.4279 earlier today, continuing to press toward the upper band of a bullish channel. The 1.4330-1.4365 area is now in sight as the US and Canadian CPI inflation data loom in the calendar. A break higher could propel the price toward the 1.4500 level, last seen in March 2020, unless the 1.4400 psychological mark caps the bullish action beforehand.

According to the RSI and the stochastic oscillator, the market is treading in overbought waters, and a slowdown might be imminent. Perhaps if the 1.4260 blocks the way up, forcing a close below 1.4200, the price may seek shelter within the 1.4075-1.4100 territory, where the 20-day exponential moving average (EMA) and the lower band of the two-month-old bullish channel are sitting. Failure to pivot there could confirm additional losses toward the 1.4000 level and the 50-day EMA.

All in all, USDCAD is in a clear bullish trend and may have some extra room for improvement before it takes a breather. Key resistance is located in the 1.4330-1.4360 range, while the 1.4200 level could offer support in the event of a pullback.

.jpg)