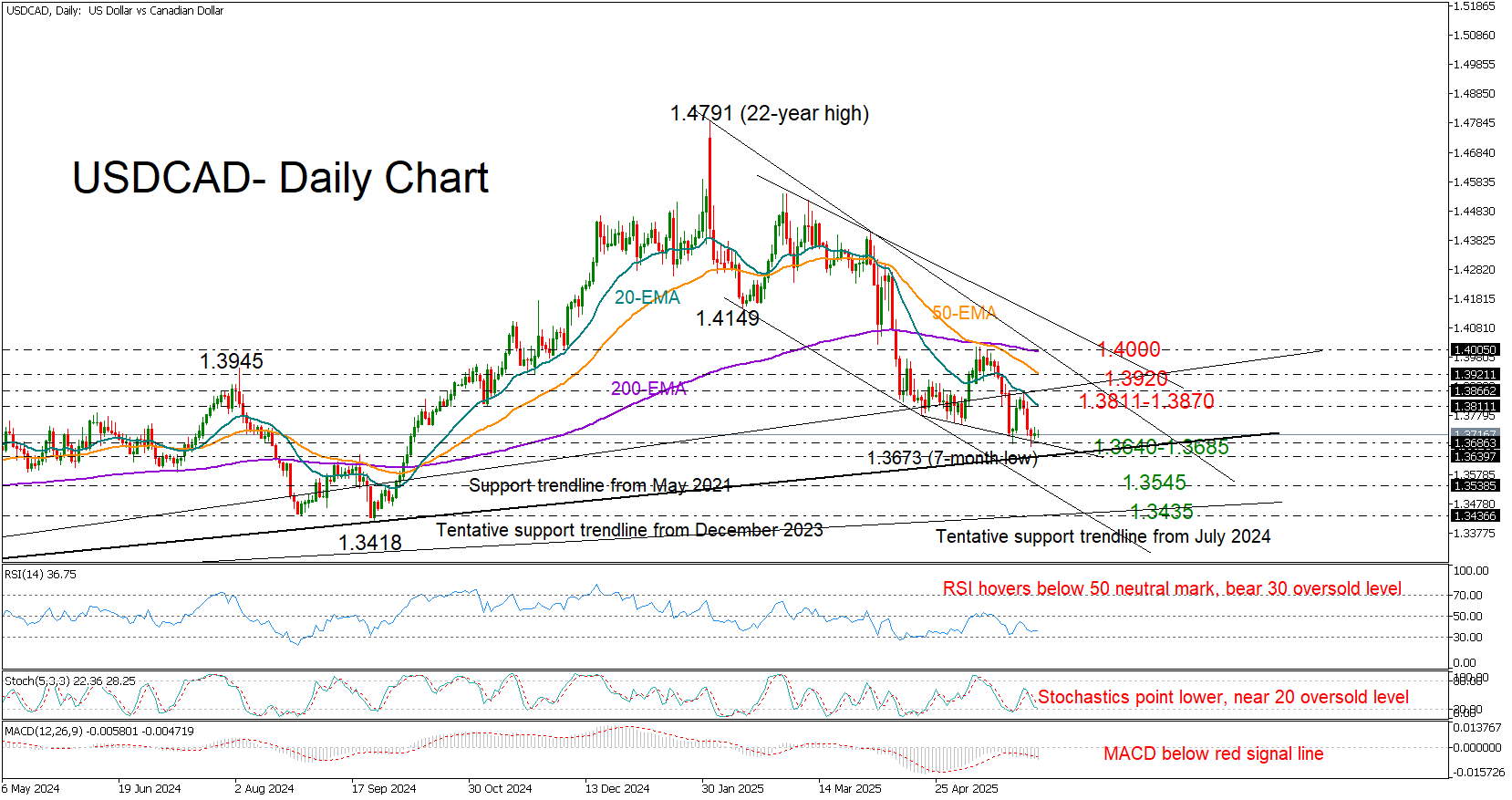

USD/CAD keeps focus on support trendline

USD/CAD remained subdued near its seven-month low of 1.3673, despite the US’s 50% tariffs on steel and aluminum taking effect. Traders appeared to be in a holding pattern ahead of the Bank of Canada’s rate decision later today (13:45 GMT) and awaited more definitive updates on trade negotiations between Canada and the US, which could result in an agreement before the G7 summit on June 15-17.

The central bank is widely expected to keep interest rates steady for a second consecutive meeting amid heightened trade tensions and ongoing US-Canadian political uncertainty. If the BoC signals a more patient stance on rate cuts, the bears may break below the crucial 1.3640–1.3685 base, opening the door toward the tentative support trendline at 1.3533. A drop below that could intensify selling pressure towards 1.3436, where a support line connecting the July and December 2023 lows currently lies.

Conversely, if policymakers hint at a more accommodative stance aimed at reviving the sluggish economy, the pair could rebound and retest the 20-day exponential moving average (EMA) at 1.3811 or advance towards the former resistance line near 1.3870. A break above the declining 50-day EMA could further fuel recovery toward the 200-day EMA and the strong resistance trendline both around 1.4000.

Note that the technical indicators continue to hover in bearish territory, suggesting that sellers currently hold the upper hand.

Overall, USDCAD maintains a negative bias, though the nearby support trendline around 1.3640 offers a glimmer of optimism. For a short-term bullish outlook to emerge, however, the pair would likely need a decisive rally above 1.4000.

.jpg)