USDJPY sinks as US tariffs cause headache

USDJPY slumped by 1.6% to 147.79 as Trump's reciprocal tariffs turned out stricter than expected in some regions, including China. This development has heightened investor concerns over the implications of the US trade policy.

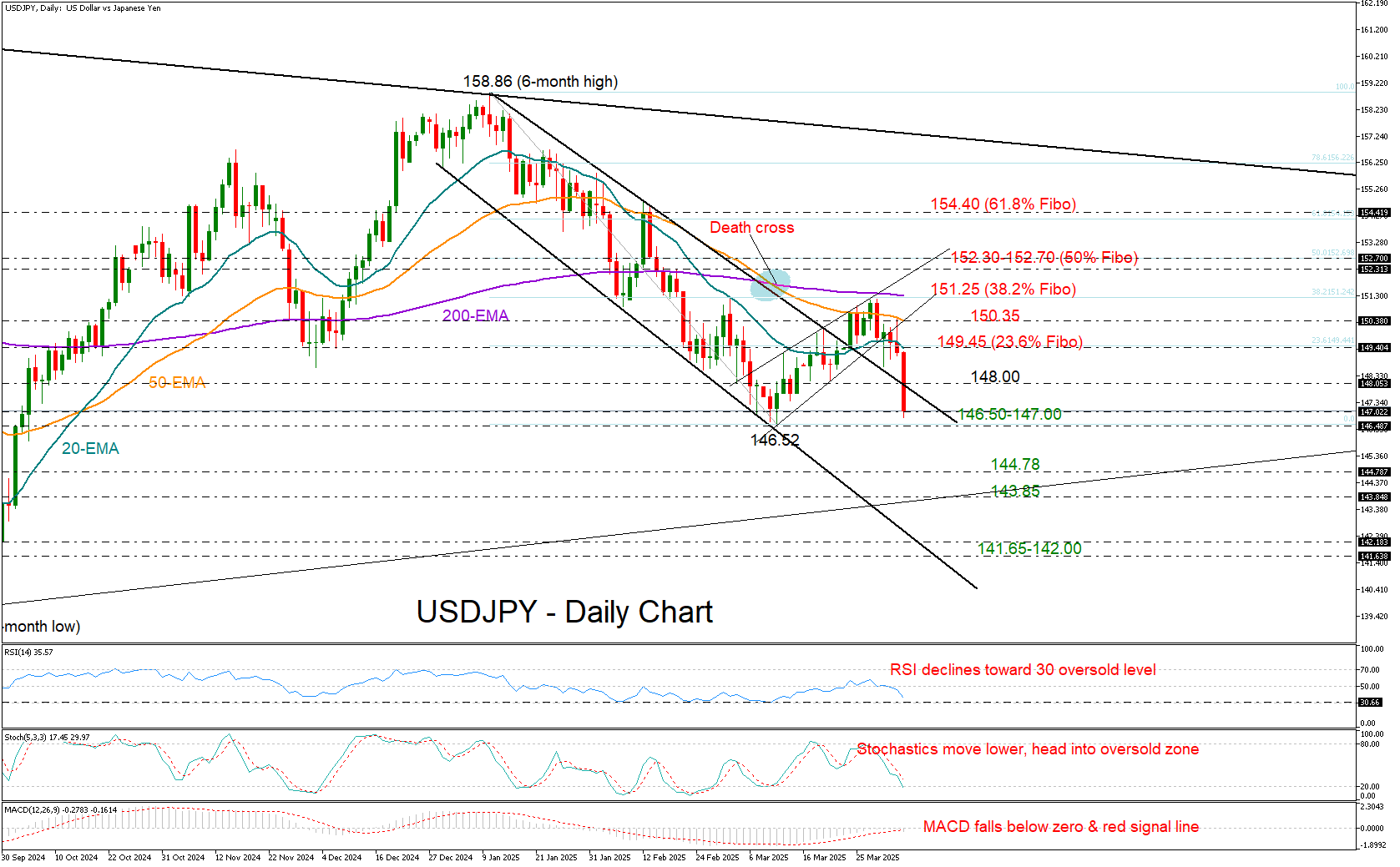

With attention shifting to potential retaliatory actions against the US, USDJPY may struggle to find support. However, sellers will wait for a close below 147.00 and the March low of 146.52 to reinforce a bearish outlook. In this case, the pair could undergo an aggressive decline toward 143.85, unless the 144.78 territory provides a footing beforehand. A deeper drop could push the price into the 141.65–142.00 constraining zone, last seen in September 2024.

The short-term risk has deteriorated as the technical indicators drifted lower. With the MACD falling below its red signal line in the negative area and the gap between the 50-day and 200-day exponential moving averages (EMAs) further widening following the death cross, the price could stay trapped in a bearish trajectory.

However, a temporary pause in the decline cannot be ruled out in the coming sessions, as the RSI and stochastic oscillator approach oversold levels. If the price manages to hold above the upper boundary of the bearish channel near 148.00, a rebound could retest the 20-day EMA at 149.45. Additional increases from there may encounter resistance at the 50-day and 200-day EMAs at 150.35 and 151.25, respectively. Beyond that, the recovery phase could stall near the 152.30-152.70 barrier.

In summary, USDJPY may face challenging sessions ahead, with further losses anticipated once the bears break below 146.50. Conversely, a bounce back above 148.00 could generate fresh upside momentum.

.jpg)