What is Ahead for Markets Next Week?

What is Ahead for Markets Next Week?

Europe is switching to daylight saving time in the new week - don't miss the changes in the trading schedule.

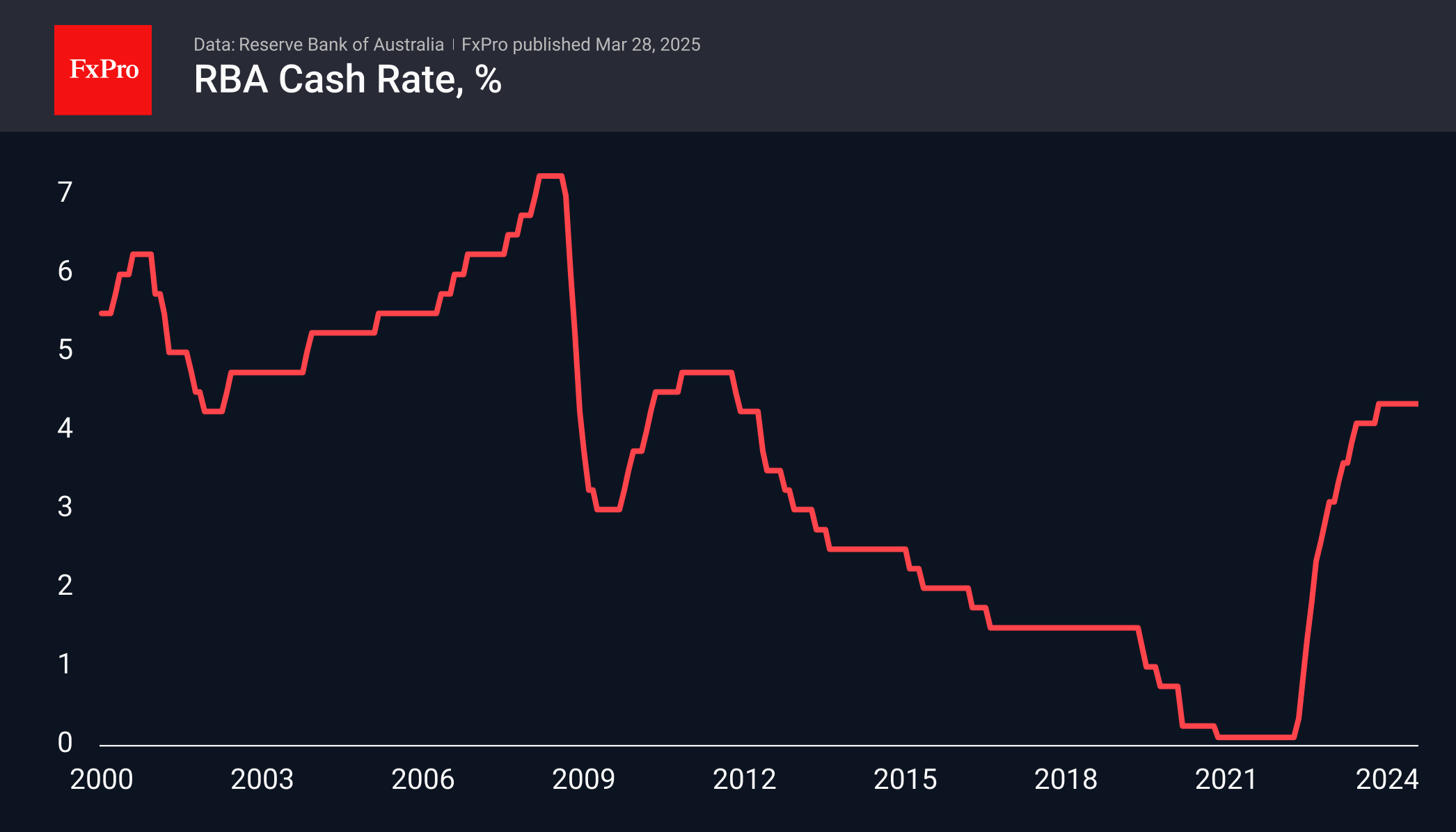

Among the key events on the 1st of April, we highlight the Reserve Bank of Australia's decision. The rate is expected to remain at 4.1% after a cut in February. Inflation only ticked down last month, and GDP growth remains healthy, so it is hardly prudent to ease policy too sharply.

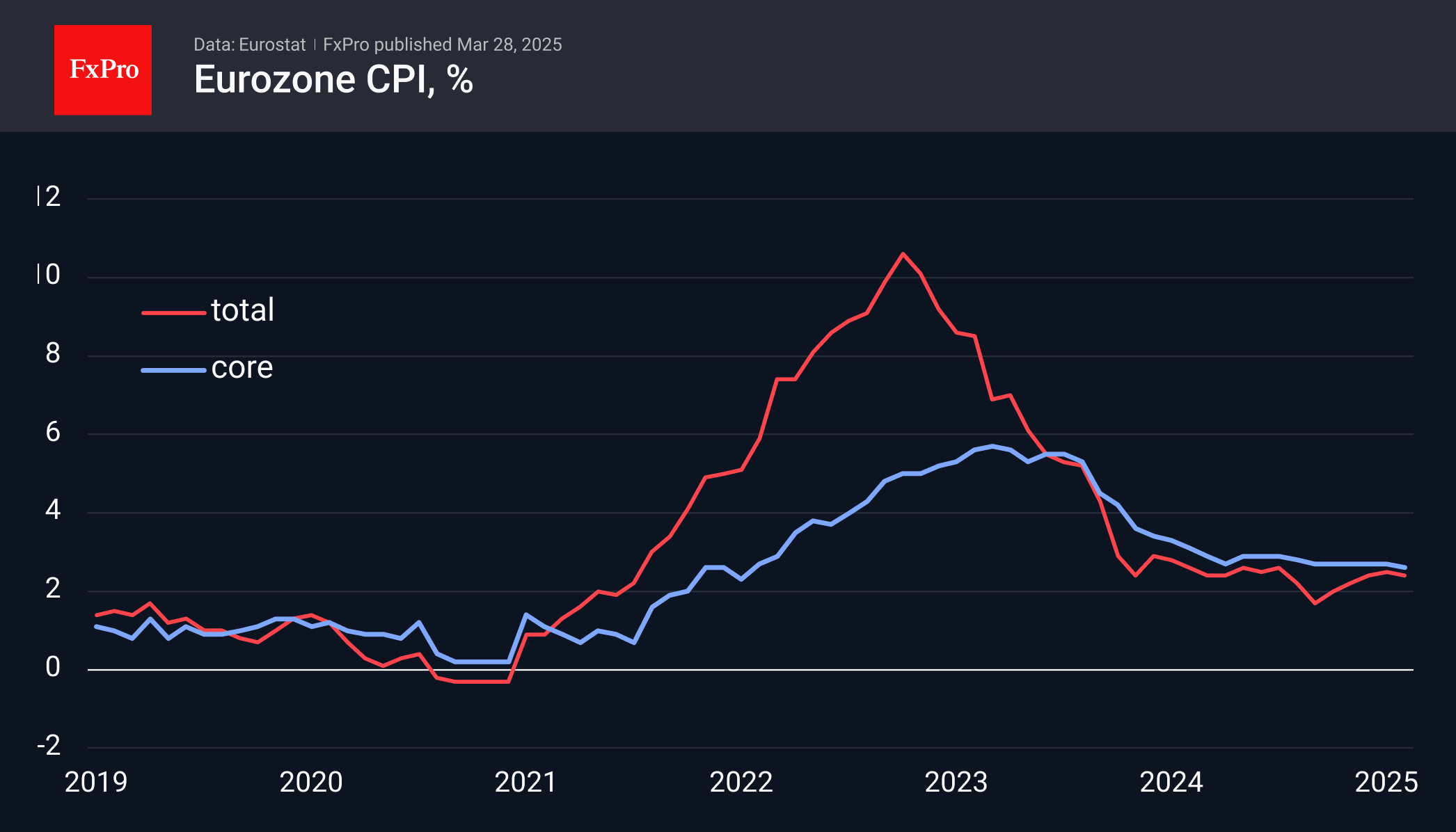

Also, on April 1st, the preliminary estimate of eurozone inflation will be released. Recent data showed a slowdown to 2.3% annually, and the new soft data will increase speculation about further ECB policy easing.

Oil traders' attention is on the OPEC meeting on Thursday, April 3rd. As oil is rising, no changes are expected, but surprises cannot be ruled out, which could affect the price.

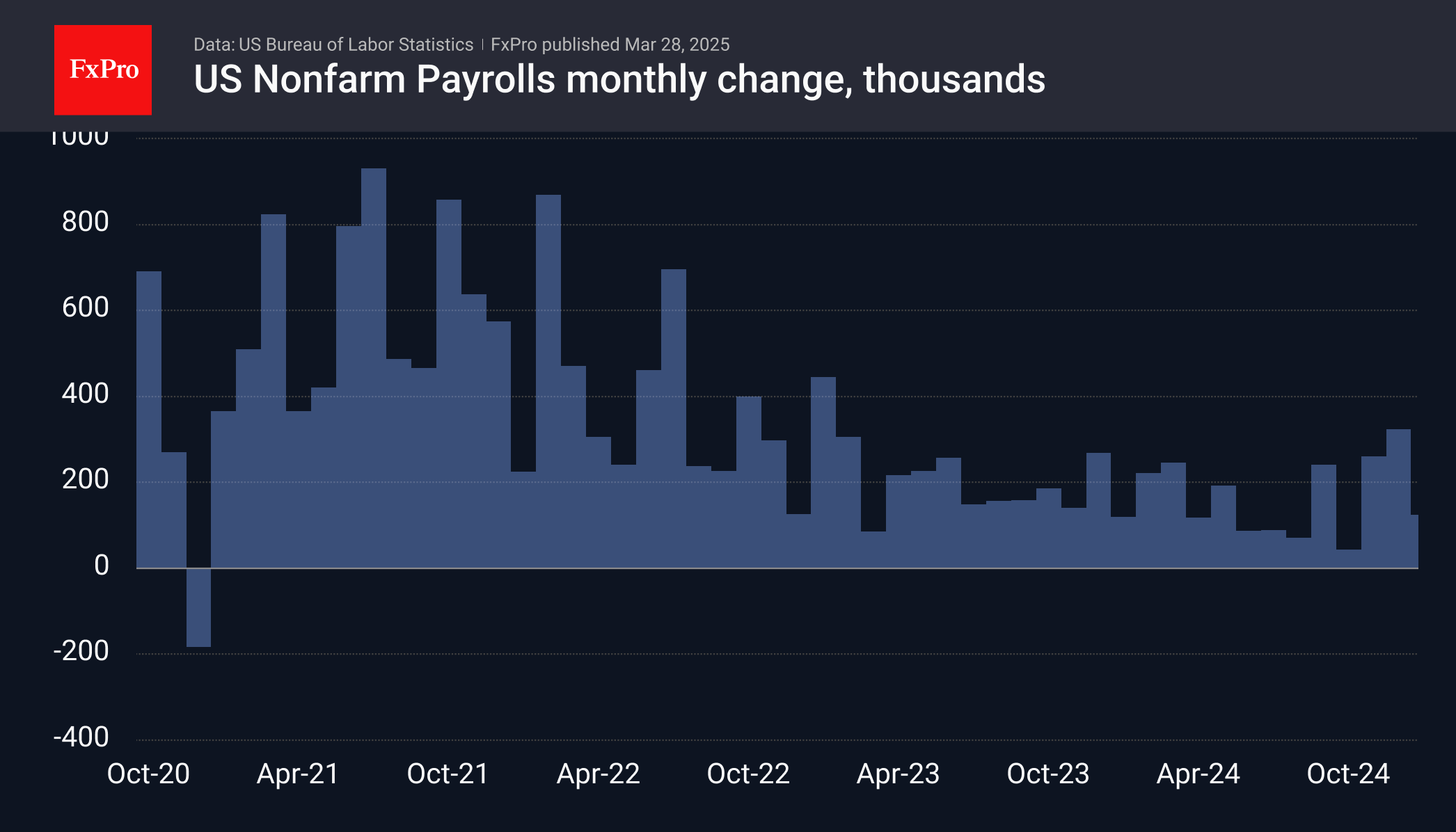

The main news on Friday will be the March US labour market data. The market has been adding below-trend rates for a couple of months, and a dip could be a new dose of negativity for the dollar.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)