Why a Strong Swiss Franc Is Hurting Switzerland’s Economy—and What the Central Bank Might Do About It

The Swiss franc (CHF) has long been considered a "safe haven" currency, attracting investors during global uncertainty. But in 2025, its strength is starting to become a problem—especially for Switzerland itself.

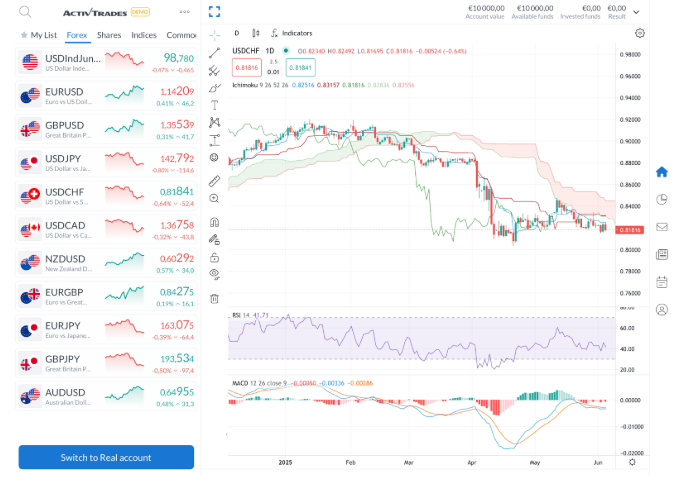

Since the start of the year, the franc has appreciated by around 10% against the U.S. dollar. It recently hit its strongest level in years, with $1 buying just 0.82 francs. While this strength is a sign of international confidence in Switzerland’s stability, it’s also pushing the country into deflation—and complicating the Swiss National Bank’s monetary policy.

Inflation Turns Negative in Switzerland

Inflation has steadily decreased since its 3.5% peak in August 2022, dropping to 0% in April and now turning negative.

Switzerland experienced its first annual deflation in four years in May, with prices falling 0.1% compared to May 2024. According to ING, this isn’t a new phenomenon for the country. Switzerland also saw deflationary periods during the pandemic (March 2020 to March 2021), from September 2014 to November 2016, and from October 2011 to October 2013.

Consumer prices dropped across key categories such as transport, food, and household goods. And as we’ve said, much of this decline can be traced back to cheaper imports, made even more affordable by the stronger franc.

Core inflation, which strips out volatile items, remains positive at 0.5%—but the headline figure is now below the SNB’s target range of 0–2%. With inflation well under control (perhaps too much so), markets are bracing for the Swiss National Bank (SNB) to act again.

How the Strong Franc Fueled Deflation in Switzerland

May inflation figures are likely to have been dragged down mostly by external factors, especially lower prices from imported goods due to its strong currency (and around 23% of the CPI basket is made by exports).

The logic is simple: when the franc rises, imported goods become cheaper. Since Switzerland imports a significant share of consumer products, the strong currency has a deflationary effect.

This might sound like good news—especially at a time when other economies are struggling with persistent inflation. But falling prices can lead consumers to delay spending, hurting growth. It also tightens profit margins for domestic producers and exporters, who must compete with cheaper foreign goods while earning revenue in a strong currency.

So far this year, the USD/CHF is down almost 10%. Global markets have been rattled in recent weeks by U.S. President Donald Trump’s trade policies, which have created significant uncertainty about their impact on global economic growth. This has prompted investors to seek out safer havens for their capital during episodes of higher market stress like in April 2025. Among the prime beneficiaries of this increased market volatility has been the Swiss franc.

Daily USD/CHF Chart - Source: ActivTrader

The franc has long held its reputation as a safe-haven asset. Switzerland's long-standing political neutrality and stable democratic institutions create a very secure and predictable environment for investors. On top of that, the Swiss economy itself is remarkably strong and varied, marked by low unemployment, a high GDP per capita, and a sophisticated financial sector.

This economic strength is complemented by conservative monetary policies from the SNB and a consistently low inflation environment, which helps preserve purchasing power. The country’s strong fiscal policies, including low public debt, further reinforce confidence in its currency, making the Swiss franc a preferred choice for investors looking to protect their assets during periods of macroeconomic or geopolitical uncertainty.

Monetary Policy Response: Interest Rates and Currency InterventionThe SNB has already started cutting rates this year, bringing its key policy rate down from 1.75% in early 2024 to just 0.25% today. With May’s deflation reading, traders are increasingly expecting a further rate cut at the central bank’s next meeting on June 19.

Some expect a drop to zero; others are even predicting a return to negative interest rates—something Switzerland last saw in 2022 after nearly a decade of sub-zero rates. Falling yields on Swiss government bonds, many of which are now negative out to six years, suggest markets are preparing for a prolonged period of ultra-loose monetary policy.

Another tool in the SNB’s toolbox is direct intervention in currency markets. In the past, the bank has sold francs and bought foreign currencies to weaken the CHF and support inflation. But that path is now politically sensitive.

The Trump Factor

With Donald Trump back in the White House, Switzerland faces new geopolitical hurdles. During Trump’s first term, the U.S. Treasury labeled Switzerland a currency manipulator after the SNB intervened to keep the franc from rising too far, too fast. The SNB denied any wrongdoing, but the label sparked tensions and led to retaliatory tariffs.

Now, with trade and currency issues back on the Trump administration’s agenda, any fresh SNB intervention risks reigniting those tensions—limiting the central bank’s room for maneuver.

Bottom Line

For currency traders, the Swiss franc's recent appreciation serves as a potent reminder of how swiftly global uncertainty can redirect capital into safe-haven assets. This dynamic underscores the complex tightrope central banks must walk, continuously balancing an array of political, economic, and monetary forces.

For equity and bond traders, the implications are just as important. The persistent deflationary pressures in Switzerland suggest that the SNB is likely to maintain a dovish monetary policy for the foreseeable future, potentially even considering negative rates again.

While this accommodative stance could provide a supportive backdrop for broader risk assets by keeping borrowing costs low, it simultaneously presents challenges. Prolonged low or negative rates can compress the profitability of Swiss banks and exert downward pressure on export-heavy Swiss companies, whose goods become more expensive for international buyers due to a stronger franc.

And for all market participants, the big question is: how much longer can Switzerland tolerate a strong franc before policymakers step in more forcefully?

-362025100.png)

-362025100.png)