Advertisement

Edit Your Comment

Automated systems with 95% profitability - can this be true ?

Jan 24, 2015 부터 멤버

게시물18

Apr 15, 2015 at 07:15

Jan 24, 2015 부터 멤버

게시물18

I am watching some of the automated systems with profitability decisions of 95% meaning that 95 of all decisions going long or short was correct. ( example vortex trader pro ). I am wondering how is it possible to get an automated system so accurate ? And If you get it why the owners of it are not ultra billioners ? why people are not following them only instead of making own decsions ?

are those presented systems true ? or they found a way to present a fake true ? do anyone knows something more ?

are those presented systems true ? or they found a way to present a fake true ? do anyone knows something more ?

Low Leverage, long term trades, stay safe...

Apr 15, 2015 at 10:02

Feb 18, 2014 부터 멤버

게시물80

in most cases their average loss is bigger then the average gain. Meaning, when they lose, they lose big. Actually 90% accurate is not so complicated if you have very large SL and small TP. That is why you should never look at only 1 statistic/ratio when looking at a system, but several. Since each number will give you a piece of the puzzle, which is the total system.

I'm sure that as usual, many people will reply and say ""no no I can do it.."

I'm sure that as usual, many people will reply and say ""no no I can do it.."

forex_trader_165856

Dec 03, 2013 부터 멤버

게시물599

Apr 16, 2015 at 06:41

Dec 03, 2013 부터 멤버

게시물599

if you can risk 10 pips to make 10 pips with 95% win ratio, you can compound after each win and make a lot of money, but how much duration between each trade? Everyday, once a month, or a few trades a year?

@growthera Maybe a combination of Profitability Ratio, Pip Expectancy, Average Win , Average Loss .Trade Duration

@growthera Maybe a combination of Profitability Ratio, Pip Expectancy, Average Win , Average Loss .Trade Duration

forex_trader_236107

Mar 10, 2015 부터 멤버

게시물88

Apr 16, 2015 at 10:04

Mar 10, 2015 부터 멤버

게시물88

Very well said by @growthera

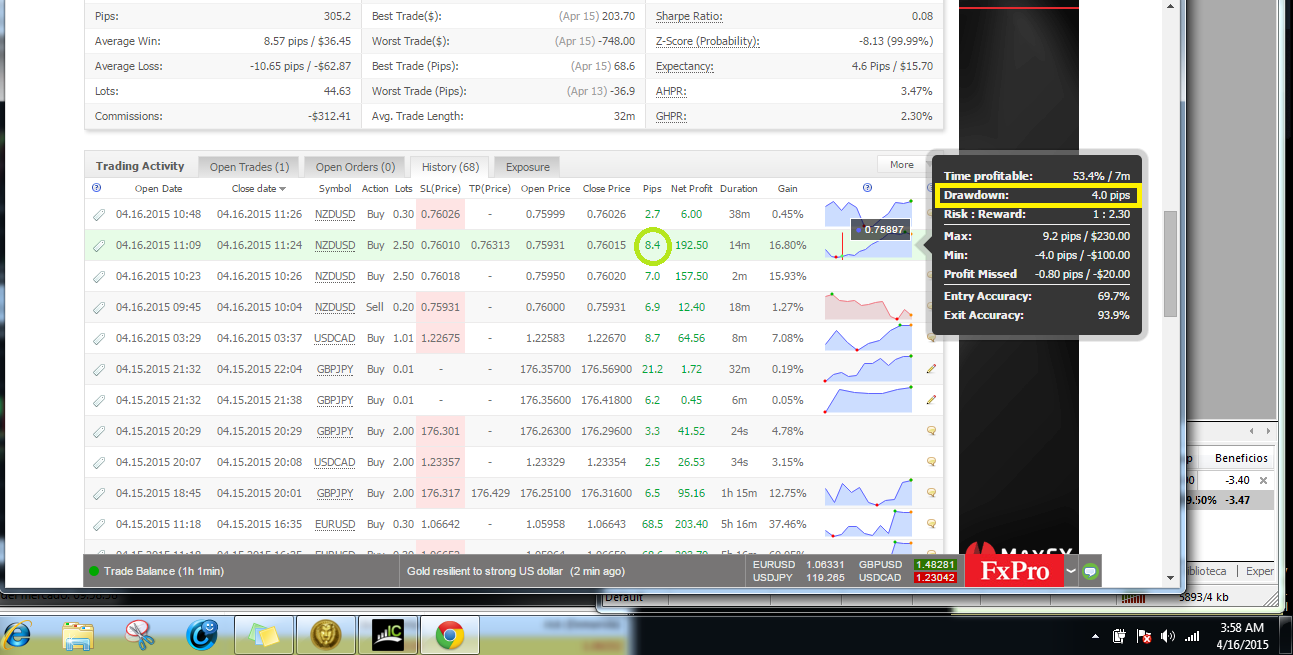

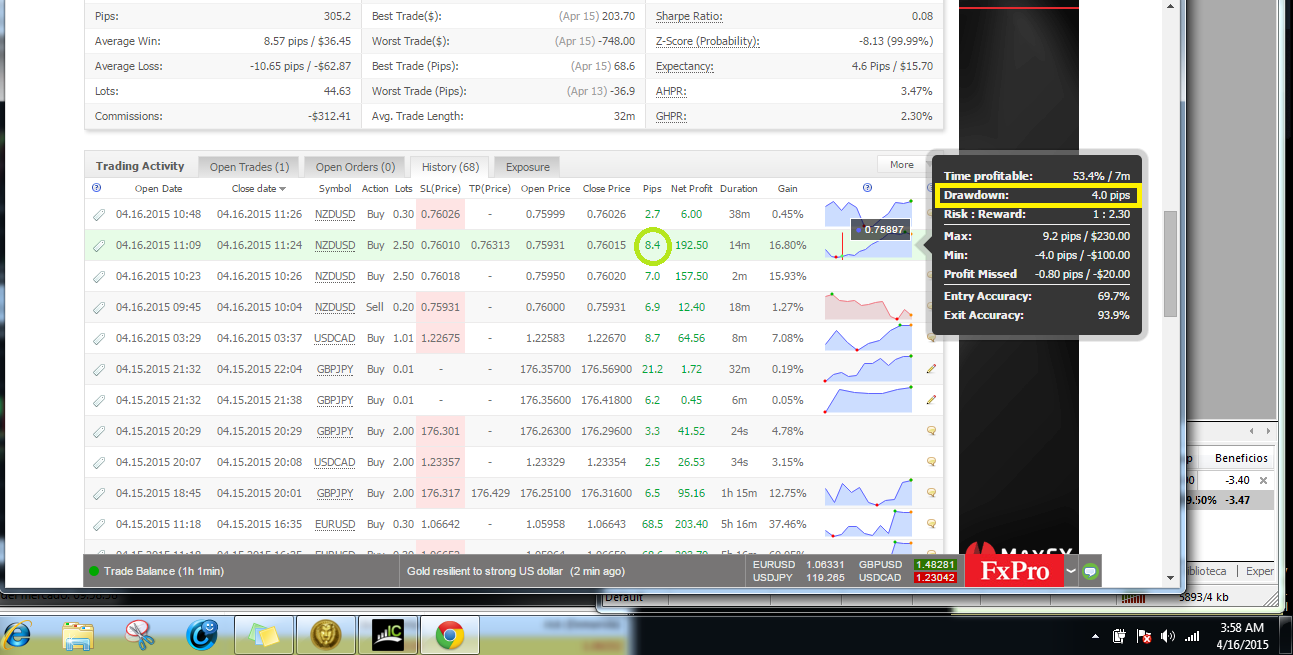

I'd also like to add that if you see someone with a very high % of win, have a look at the amount of pips their positions ends up in red. You can find that stat only if the account is "verified" by myfxbook. If the account is verified then click the "trade history tab", and hoover your mouse over the small little chart that each trade has. A pop will reveal something called "Pip-drawdown". That then plays into big SL and small TP. In other words if a person closed for 10 pips profit, but their "Pip-drawdown" WAS 500 pips, then it is clear to see that although the trade ended coming back to them, they spent 500 pips max in red, before they closed for profit.

You can see I earned 8 pips profit, but the most amount of pips I was in red for the life of the trade was only 4 pips.

I'd also like to add that if you see someone with a very high % of win, have a look at the amount of pips their positions ends up in red. You can find that stat only if the account is "verified" by myfxbook. If the account is verified then click the "trade history tab", and hoover your mouse over the small little chart that each trade has. A pop will reveal something called "Pip-drawdown". That then plays into big SL and small TP. In other words if a person closed for 10 pips profit, but their "Pip-drawdown" WAS 500 pips, then it is clear to see that although the trade ended coming back to them, they spent 500 pips max in red, before they closed for profit.

You can see I earned 8 pips profit, but the most amount of pips I was in red for the life of the trade was only 4 pips.

Jan 09, 2014 부터 멤버

게시물107

Jun 28, 2011 부터 멤버

게시물444

Apr 16, 2015 at 14:20

Jun 28, 2011 부터 멤버

게시물444

You can do even better than that, RISE https://www.myfxbook.com/members/ForexAssistant/rise-audcad/578913

uses the fact that currencies have to stay close to their counterparts, (the basic stuff in fundamental trading) and always trades towards the center. It never closes the trade but instead calculates the worst case scenario and has enough in the balance to cover for it. Its a different way of trading that is much safer than the way technical traders do it though it doesn't pay as well when compared to technical traders that happen to be winning.

People get brainwashed into one way of thinking and have a difficult time seeing some other way of doing things. It isn't a loss until the trade is closed, just don't close the trade until its in profit and keep enough in your balance that the broker has no call to close it either. There are real world market reasons that the price of any currency pair stays around a certain price. The price fluctuates around a norm and doesn't like to get too far away from that norm. Use that knowledge that no one ever talks about to design a safer system.

And that's what RISE does to get it's ultra high accuracy. In other words, don't let people that have one way of thinking try to convince you that someone is scamming you by using no stop-losses or very large ones. Evaluate that system, not someone else's opinion.

One word of caution, no matter how good something is, it isn't perfect. Remember to diversify as a way to lessen even that risk.

Bob

uses the fact that currencies have to stay close to their counterparts, (the basic stuff in fundamental trading) and always trades towards the center. It never closes the trade but instead calculates the worst case scenario and has enough in the balance to cover for it. Its a different way of trading that is much safer than the way technical traders do it though it doesn't pay as well when compared to technical traders that happen to be winning.

People get brainwashed into one way of thinking and have a difficult time seeing some other way of doing things. It isn't a loss until the trade is closed, just don't close the trade until its in profit and keep enough in your balance that the broker has no call to close it either. There are real world market reasons that the price of any currency pair stays around a certain price. The price fluctuates around a norm and doesn't like to get too far away from that norm. Use that knowledge that no one ever talks about to design a safer system.

And that's what RISE does to get it's ultra high accuracy. In other words, don't let people that have one way of thinking try to convince you that someone is scamming you by using no stop-losses or very large ones. Evaluate that system, not someone else's opinion.

One word of caution, no matter how good something is, it isn't perfect. Remember to diversify as a way to lessen even that risk.

Bob

where research touches lives.

forex_trader_236107

Mar 10, 2015 부터 멤버

게시물88

Apr 17, 2015 at 06:34

Mar 10, 2015 부터 멤버

게시물88

ForexAssistant posted:

You can do even better than that, RISE https://www.myfxbook.com/members/ForexAssistant/rise-audcad/578913

uses the fact that currencies have to stay close to their counterparts, (the basic stuff in fundamental trading) and always trades towards the center. It never closes the trade but instead calculates the worst case scenario and has enough in the balance to cover for it. Its a different way of trading that is much safer than the way technical traders do it though it doesn't pay as well when compared to technical traders that happen to be winning.

People get brainwashed into one way of thinking and have a difficult time seeing some other way of doing things. It isn't a loss until the trade is closed, just don't close the trade until its in profit and keep enough in your balance that the broker has no call to close it either. There are real world market reasons that the price of any currency pair stays around a certain price. The price fluctuates around a norm and doesn't like to get too far away from that norm. Use that knowledge that no one ever talks about to design a safer system.

And that's what RISE does to get it's ultra high accuracy. In other words, don't let people that have one way of thinking try to convince you that someone is scamming you by using no stop-losses or very large ones. Evaluate that system, not someone else's opinion.

One word of caution, no matter how good something is, it isn't perfect. Remember to diversify as a way to lessen even that risk.

Bob

The manner which you are trading is how the banks want us to trade. The longer we hold a position, then the higher the chances we have of a black swan event occuring to wipe out the account, even with the best "money management". Your method works in the DEMO world, but in the real world with real money things happens to occur much differently. One should spend LESS time in a position, not more time, and there is no reason to believe that this "center" median is even real. Sticking to the most basic form of trading "extension, reversal, and accumulation" should be what every trader aims for.

Jun 28, 2011 부터 멤버

게시물444

Apr 17, 2015 at 12:53

Jun 28, 2011 부터 멤버

게시물444

I will repeat "People get brainwashed into one way of thinking and have a difficult time seeing some other way of doing things. "

I have been doing this since April 2008 and we have had many so called black swan events but still solvent. However, I knew there would be one that had to say, that since you are showing a demo, oh and it isn't verified, and there must be some kind of a trick or someone is intentionally trying to rip someone off, Or any number of other such things to try to discredit something that they don't understand.

It's a Robot, for emotionless computer programs there is absolutely no difference between a demo account and a live account accept with a demo you are not telling every every government agent, identity thief or some sue happy lowlife, what you have to work with. When you think things through you just come to realize that all that stuff that you were brainwashed with is only true for your kind of trading which is in my mind, inferior to something that hasn't lost in 8 years.

But why take my word for it, absolutely anyone can download either program and use it for as long as the like on a demo account. They can read my book on why the robot is the system of now and tomorrow. Or they can listen to the old wives tells that are so prevalent on this forum. I will also repeat what I consider to be sound advice for everything including investing, "Evaluate the system, not someone else's opinion".

Good luck all.

Bob

I have been doing this since April 2008 and we have had many so called black swan events but still solvent. However, I knew there would be one that had to say, that since you are showing a demo, oh and it isn't verified, and there must be some kind of a trick or someone is intentionally trying to rip someone off, Or any number of other such things to try to discredit something that they don't understand.

It's a Robot, for emotionless computer programs there is absolutely no difference between a demo account and a live account accept with a demo you are not telling every every government agent, identity thief or some sue happy lowlife, what you have to work with. When you think things through you just come to realize that all that stuff that you were brainwashed with is only true for your kind of trading which is in my mind, inferior to something that hasn't lost in 8 years.

But why take my word for it, absolutely anyone can download either program and use it for as long as the like on a demo account. They can read my book on why the robot is the system of now and tomorrow. Or they can listen to the old wives tells that are so prevalent on this forum. I will also repeat what I consider to be sound advice for everything including investing, "Evaluate the system, not someone else's opinion".

Good luck all.

Bob

where research touches lives.

forex_trader_236107

Mar 10, 2015 부터 멤버

게시물88

Apr 17, 2015 at 17:16

Mar 10, 2015 부터 멤버

게시물88

ForexAssistant posted:

I will repeat "People get brainwashed into one way of thinking and have a difficult time seeing some other way of doing things. "

I have been doing this since April 2008 and we have had many so called black swan events but still solvent. However, I knew there would be one that had to say, that since you are showing a demo, oh and it isn't verified, and there must be some kind of a trick or someone is intentionally trying to rip someone off, Or any number of other such things to try to discredit something that they don't understand.

It's a Robot, for emotionless computer programs there is absolutely no difference between a demo account and a live account accept with a demo you are not telling every every government agent, identity thief or some sue happy lowlife, what you have to work with. When you think things through you just come to realize that all that stuff that you were brainwashed with is only true for your kind of trading which is in my mind, inferior to something that hasn't lost in 8 years.

But why take my word for it, absolutely anyone can download either program and use it for as long as the like on a demo account. They can read my book on why the robot is the system of now and tomorrow. Or they can listen to the old wives tells that are so prevalent on this forum. I will also repeat what I consider to be sound advice for everything including investing, "Evaluate the system, not someone else's opinion".

Good luck all.

Bob

Excellent. Until you put that "EA" on a live account no one will take you seriously.

forex_trader_169857

Dec 31, 2013 부터 멤버

게시물164

Jun 28, 2011 부터 멤버

게시물444

Apr 17, 2015 at 21:21

Jun 28, 2011 부터 멤버

게시물444

"You can't take a guy ",

Why should anyone take me anyway at all? Do you think I am going to be trading for you? I can post a live account, and have but I have learned in the past that you really don't care about what is, and all the work that I would do for you would just be in vain. I have seen the naysayers come and go on this forum. Check my membership date. I've got you guys down to a T.

Seriously Kid, don't take me serious, I don't want your business. It is true that I, well not me personally, will release 5,000 copies but I really don't care who gets them. I would prefer it be someone who's ego doesn't get in the way of their learning.

However, for those reasoning readers, let me pose this, every webpage that deals with investments, every brokerage firm and every robot has a warning page mandated by the governments of the world. If you scroll down to the bottom of this page, you will see just such a warning even on this page. Now if brokers demo trades were somehow different than live trade feeds don't you think that little inconsistency would have made it to the warnings page?

My friends on the forum that live trade say that the difference isn't in the feed but in the fact that when you are trading with real money the pressure is on and it effects you emotionally. Probably so, but robots don't have emotions. Well, not yet at any rate.

Use your logic and reasoning skills and you won't get waylaid by the silliness that sometimes goes around these places.

Tell you what, I will post that live account just so everyone can see how it never matters. They will say it was photoshopped, which is a graphics program of some type. However, since the subject of this thread is "can a computer program be that accurate?", I will make it available

This was from my first account in 2008-2009 that used the GoldenGrid system. It is 15 monthly reports from my broker at that time which was IBFX. These monthly reports are zipped for downloading. There was one loss for 8 cents on Feb 12, 2009 trade #34179349 when a power outage kept the program from adjusting the take profit. That was before VPS providers and before myfxbook so there is no fancy analyses available for it. But using this you will be able to see how it is possible for robots to do what humans can't.

https://www.forex-assistant.com/2008-2009.zip

Bob

Why should anyone take me anyway at all? Do you think I am going to be trading for you? I can post a live account, and have but I have learned in the past that you really don't care about what is, and all the work that I would do for you would just be in vain. I have seen the naysayers come and go on this forum. Check my membership date. I've got you guys down to a T.

Seriously Kid, don't take me serious, I don't want your business. It is true that I, well not me personally, will release 5,000 copies but I really don't care who gets them. I would prefer it be someone who's ego doesn't get in the way of their learning.

However, for those reasoning readers, let me pose this, every webpage that deals with investments, every brokerage firm and every robot has a warning page mandated by the governments of the world. If you scroll down to the bottom of this page, you will see just such a warning even on this page. Now if brokers demo trades were somehow different than live trade feeds don't you think that little inconsistency would have made it to the warnings page?

My friends on the forum that live trade say that the difference isn't in the feed but in the fact that when you are trading with real money the pressure is on and it effects you emotionally. Probably so, but robots don't have emotions. Well, not yet at any rate.

Use your logic and reasoning skills and you won't get waylaid by the silliness that sometimes goes around these places.

Tell you what, I will post that live account just so everyone can see how it never matters. They will say it was photoshopped, which is a graphics program of some type. However, since the subject of this thread is "can a computer program be that accurate?", I will make it available

This was from my first account in 2008-2009 that used the GoldenGrid system. It is 15 monthly reports from my broker at that time which was IBFX. These monthly reports are zipped for downloading. There was one loss for 8 cents on Feb 12, 2009 trade #34179349 when a power outage kept the program from adjusting the take profit. That was before VPS providers and before myfxbook so there is no fancy analyses available for it. But using this you will be able to see how it is possible for robots to do what humans can't.

https://www.forex-assistant.com/2008-2009.zip

Bob

where research touches lives.

forex_trader_169857

Dec 31, 2013 부터 멤버

게시물164

Apr 18, 2015 at 05:00

Dec 31, 2013 부터 멤버

게시물164

Multitude of words but apart from blowing your own trumpet, you proffer no explanation why the demo account is in the millions while the real account is in the red using the same EA.

Simple verdict: You were unable to defend your case because your notion is flawed.

www.myfxbook.com/members/bilalpakistani/100scalping/1160727

www.myfxbook.com/members/bilalpakistani/100scalperreal/1169315

Simple verdict: You were unable to defend your case because your notion is flawed.

www.myfxbook.com/members/bilalpakistani/100scalping/1160727

www.myfxbook.com/members/bilalpakistani/100scalperreal/1169315

forex_trader_236107

Mar 10, 2015 부터 멤버

게시물88

Apr 18, 2015 at 05:43

Mar 10, 2015 부터 멤버

게시물88

MyFxTrader posted:

You can't take a guy who says there's no difference between a demo and a real account seriously, can you?

www.myfxbook.com/members/bilalpakistani/100scalping/1160727

www.myfxbook.com/members/bilalpakistani/100scalperreal/1169315

Excellent point. lol

forex_trader_236107

Mar 10, 2015 부터 멤버

게시물88

Apr 18, 2015 at 05:44

Mar 10, 2015 부터 멤버

게시물88

MyFxTrader posted:

You can't take a guy who says there's no difference between a demo and a real account seriously, can you?

www.myfxbook.com/members/bilalpakistani/100scalping/1160727

www.myfxbook.com/members/bilalpakistani/100scalperreal/1169315

Yet of course ForexAssistant will use about 2 long paragraphs which will explain why he would not do the samething, but the reality is he has no clue as to what he is doing. Why do I say he has no clue. Well only because he has yet to post a live account. Yet, he can clearly send you a snapshot which was closed. lol.

Nov 21, 2011 부터 멤버

게시물1601

Apr 18, 2015 at 08:20

Nov 21, 2011 부터 멤버

게시물1601

MyFxTrader posted:

Multitude of words but apart from blowing your own trumpet, you proffer no explanation why the demo account is in the millions while the real account is in the red using the same EA.

Simple verdict: You were unable to defend your case because your notion is flawed.

www.myfxbook.com/members/bilalpakistani/100scalping/1160727

www.myfxbook.com/members/bilalpakistani/100scalperreal/1169315

If you want to show that there is at least one difference between demo vs Live performance you seems not aware of the main fact that produces difference. (it' called LPs, execution....)

In other words, you have to show 2 accounts where win/loss average are > 10 pips.... otherwise you don't prove anything as we already know brokerage conditions are responsible for such cases.

forex_trader_169857

Dec 31, 2013 부터 멤버

게시물164

Apr 18, 2015 at 08:49

(편집됨 Apr 18, 2015 at 09:03)

Dec 31, 2013 부터 멤버

게시물164

CrazyTrader posted:MyFxTrader posted:

Multitude of words but apart from blowing your own trumpet, you proffer no explanation why the demo account is in the millions while the real account is in the red using the same EA.

Simple verdict: You were unable to defend your case because your notion is flawed.

www.myfxbook.com/members/bilalpakistani/100scalping/1160727

www.myfxbook.com/members/bilalpakistani/100scalperreal/1169315

If you want to show that there is at least one difference between demo vs Live performance you seems not aware of the main fact that produces difference. (it' called LPs, execution....)

In other words, you have to show 2 accounts where win/loss average are > 10 pips.... otherwise you don't prove anything as we already know brokerage conditions are responsible for such cases.

Great, you just explained the difference. TQVM.

Nov 21, 2011 부터 멤버

게시물1601

Apr 18, 2015 at 09:23

Nov 21, 2011 부터 멤버

게시물1601

MyFxTrader posted:

Great, you just explained the difference. TQVM.

The difference mentionned above explained the difference between live and demo while SL & TP are below 10 pips.

It can't affect performance while SL & TP are above 10 pips.... unless you can prove it.

forex_trader_169857

Dec 31, 2013 부터 멤버

게시물164

Apr 18, 2015 at 10:14

Dec 31, 2013 부터 멤버

게시물164

CrazyTrader posted:MyFxTrader posted:

Great, you just explained the difference. TQVM.

The difference mentionned above explained the difference between live and demo while SL & TP are below 10 pips.

It can't affect performance while SL & TP are above 10 pips.... unless you can prove it.

Given that you agree with the difference under 10 pips, this is enough to justify that there is at least one difference. That pretty much sums it up. No further proof required to substantiate a second difference.

Nov 21, 2011 부터 멤버

게시물1601

forex_trader_169857

Dec 31, 2013 부터 멤버

게시물164

Apr 18, 2015 at 11:16

Dec 31, 2013 부터 멤버

게시물164

CrazyTrader posted:

Yes... so the conclusion you have made is there is no difference between demo vs Live while TP & SL are above 10 pips and accounts run by EA.

Yes, also according to you there is a difference if it's under 10 pips and I concur with you too. So the conclusion is there is a difference after all.

*상업적 사용 및 스팸은 허용되지 않으며 계정이 해지될 수 있습니다.

팁: 이미지/유튜브 URL을 게시하면 게시물에 자동으로 삽입됩니다!

팁: @기호를 입력하여 이 토론에 참여하는 사용자 이름을 자동으로 완성합니다.