Edit Your Comment

EUR/USD

Member Since Apr 08, 2014

1140 posts

Nov 29, 2018 at 10:31

Member Since Apr 08, 2014

1140 posts

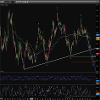

On yesterday session, the EURUSD initially fell but found enough buying pressure near 1.1267 to trim all of its losses and closed near the high of the day, in addition, managed to close above Tuesdays’ high, which suggests a strong bullish momentum.

The currency pair traded below the 10, 50 and the 200-day moving averages and all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1420 (resistance), the 10-day moving average at 1.1364 (resistance), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

The currency pair traded below the 10, 50 and the 200-day moving averages and all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1420 (resistance), the 10-day moving average at 1.1364 (resistance), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

"I trade to make money not to be right."

Member Since Jan 25, 2010

1288 posts

Nov 29, 2018 at 13:35

Member Since Jan 25, 2010

1288 posts

"In what could be a game changer in the medium term for stock and currency markets US Federal Reserve Chairman Jerome Powell has signalled during a speech on Wednesday the US Central Bank is close to where it needs to be with interest rates. Traders immediately began to price in the expectation the Fed may not raise rates in December and are currently only pricing in two more rate hikes in the coming 12 months vs the 4 they were expecting. The US Dollar was sharply lower following Powell’s comments with the Aussie and Kiwi Dollars sharply higher against the greenback as the Asian trading session opens. US stock indexes roared into life with the S&P 500 rising 2.5% for the day and pausing just below the 200 EMA on the daily chart. What has been causing the US Dollar to rise and stock markets to fall recently is US interest rates continually rising however the US Fed Chairman’s comments could be the end of the road for the US currency in the medium term and has the potential to send stocks back to their highs of 2018. The Fed was not going to be able to continue to raise rates at the same pace it has been for the past few years and Donald Trump will be licking his chops this morning after the man he openly criticized in recent days delivered just the speech the President was looking for. The Minutes from the latest US Fed meeting are due to be released today and may add more fuel to the fire that Jerome Powell lit on Wednesday."

Andrew Barnett

LTG Goldrock

https://to121.infusionsoft.app/app/hostedEmail/46816589/d3cdf578f1747ceb?

Andrew Barnett

LTG Goldrock

https://to121.infusionsoft.app/app/hostedEmail/46816589/d3cdf578f1747ceb?

Member Since Dec 10, 2017

210 posts

Nov 29, 2018 at 19:03

Member Since Dec 10, 2017

210 posts

On Thursday, the dollar stabilized after a decline in the previous session, caused by statements in favor of a milder version of the monetary policy made by Fed Chairman Jerome Powell. Powell said interest rate was close to neutral. The euro exchange rate slightly changed against the dollar: 1.1371.

Member Since Apr 08, 2014

1140 posts

Nov 30, 2018 at 09:33

Member Since Apr 08, 2014

1140 posts

On yesterday session, the EURUSD initially fell with a narrow range but found enough buying pressure near 1.1388 to trim all of its losses and closed near the high of the day, in addition, managed to close above Wednesday’s high, which suggests a strong bullish momentum.

The currency pair closed above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1418 (resistance), the 10-day moving average at 1.1358 (resistance), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

The currency pair closed above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1418 (resistance), the 10-day moving average at 1.1358 (resistance), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

"I trade to make money not to be right."

Dec 02, 2018 at 08:14

Member Since Nov 16, 2015

708 posts

EUR/USD: The euro fell on Friday after a weak report on the volume of retail sales in Germany. The EUR/USD pair slipped 0.46% to 1.1340. The volume of retail sales in Germany fell by 0.3% to a minimum in three months. Analysts predicted that this figure will grow by 0.4%.

Member Since Apr 08, 2014

1140 posts

Dec 03, 2018 at 09:58

Member Since Apr 08, 2014

1140 posts

On the last Friday’s session, the EURUSD fell with a wide range and closed near the low of the day, in addition, managed to close below Thursday low, which suggests a strong bearish momentum.

The currency pair closed below the 10-day moving average that should act as a dynamic resistance although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1410 (resistance), the 10-day moving average at 1.1346 (resistance), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

The currency pair closed below the 10-day moving average that should act as a dynamic resistance although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1410 (resistance), the 10-day moving average at 1.1346 (resistance), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

"I trade to make money not to be right."

Member Since Sep 12, 2015

1933 posts

Dec 03, 2018 at 13:39

Member Since Sep 12, 2015

1933 posts

I took a quick short from 13350 down to 13270 ,1% profit , aware of the spike it had earlier on the hourly at 1320 was bullish, 1350 test next.

"They mistook leverage with genius".

Member Since Sep 12, 2015

1933 posts

Dec 03, 2018 at 13:42

Member Since Sep 12, 2015

1933 posts

BluePanther posted:snapdragon1970 posted:

Cheers Powell !

Yep, very nice move. I missed most of it though. 😞

You usually don't miss much , it was a boring trade till that happened.

"They mistook leverage with genius".

Member Since Sep 12, 2015

1933 posts

Dec 03, 2018 at 13:44

Member Since Sep 12, 2015

1933 posts

Eur/Gbp heading for a breakout ,will we see 90 this week ?

"They mistook leverage with genius".

Member Since Apr 08, 2014

1140 posts

Dec 04, 2018 at 10:14

Member Since Apr 08, 2014

1140 posts

On yesterday session, the EURUSD went back and forward without any clear direction, consequently closed in the middle of the daily range, in addition, managed to close within Fridays’ range, which suggests being clearly neutral, neither side is showing control.

The currency pair closed above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1408 (resistance), the 10-day moving average at 1.1346 (support), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

The currency pair closed above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1408 (resistance), the 10-day moving average at 1.1346 (support), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

"I trade to make money not to be right."

Member Since Oct 11, 2013

769 posts

Dec 04, 2018 at 21:14

Member Since Oct 11, 2013

769 posts

The EURUSD reaches the 55 day EMA at the 1.1419 level and finds a good resistance at that moving average to drop back down to its symmetrical triangle on the daily chart. The 1.1300 level may act as support, while the 1.1200 level is its most relevant support.

Member Since Apr 08, 2014

1140 posts

Dec 05, 2018 at 10:09

Member Since Apr 08, 2014

1140 posts

On yesterday session, the EURUSD initially rose but found enough selling pressure near the 50-day moving average at 1.1408 to reverse and closed near the low of the day, however, managed to close within Mondays’ range, which suggests being slightly on the bearish side of neutral.

The currency pair is trading above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1403 (resistance), the 10-day moving average at 1.1339 (support), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

The currency pair is trading above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1403 (resistance), the 10-day moving average at 1.1339 (support), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

"I trade to make money not to be right."

Dec 05, 2018 at 15:50

Member Since Apr 21, 2018

45 posts

http://forexsignal.love/aggressive-trend-scalper-ea/ 5 days' trial period is available. Welcome to backtesting!

Member Since Apr 08, 2014

1140 posts

Dec 06, 2018 at 10:35

Member Since Apr 08, 2014

1140 posts

On yesterday session, the EURUSD initially fell but found enough buying pressure near 1.1302 to trim all of its losses and managed to close near the high of the day, however, closed within Tuesdays’ range, which suggests being slightly on the bullish side of neutral.

The currency pair is trading above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1400 (resistance), the 10-day moving average at 1.1340 (support), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

The currency pair is trading above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1400 (resistance), the 10-day moving average at 1.1340 (support), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

"I trade to make money not to be right."

Member Since Dec 06, 2018

12 posts

Dec 06, 2018 at 15:41

Member Since Aug 06, 2018

6 posts

Member Since Apr 08, 2014

1140 posts

Dec 07, 2018 at 09:40

Member Since Apr 08, 2014

1140 posts

On yesterday session, the EURUSD initially fell with a narrow range but found enough buying pressure near 1.1321 to trim all of its losses and closed in the middle of the daily range, in addition, managed to close above Wednesday’s high, which suggests a bullish momentum.

The currency pair is trading above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1398 (resistance), the 10-day moving average at 1.1349 (support), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

The currency pair is trading above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1398 (resistance), the 10-day moving average at 1.1349 (support), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

"I trade to make money not to be right."

Member Since Apr 08, 2014

1140 posts

Dec 10, 2018 at 11:11

Member Since Apr 08, 2014

1140 posts

On the last Friday’s session, the EURUSD went back and forward without any clear direction consequently closed in the middle of the daily range, in addition, managed to close within Thursday range, which suggests being clearly neutral, neither side is showing control.

The currency pair is trading above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1391 (resistance), the 10-day moving average at 1.1364 (support), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

The currency pair is trading above the 10-day moving average that should act as a dynamic support although is trading below the 50 and the 200-day moving averages, all should provide a dynamic resistance.

The key levels to watch: a daily resistance at 1.1555, a daily resistance at 1.1459, the 50-day moving average at 1.1391 (resistance), the 10-day moving average at 1.1364 (support), October low at 1.1302 (support), a daily support 1.1236, 2018 low at 1.1214 (support) and 100 Fibonacci expansion at 1.1189 (support).

"I trade to make money not to be right."

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.