- Beranda

- Komunitas

- Experienced Traders

- Market Fundamental Context

Market Fundamental Context

Markets turned risk-averse again overnight, with Wall Street weakness spilling into Asia as political and trade developments rattled sentiment. Expectations that the Fed will cut rates in September remain intact, but investors are struggling to look past threats to central bank independence and a fresh wave of tariff risks.

The flashpoint came Monday when US President Donald Trump announced he had fired Federal Reserve Governor Lisa Cook, citing alleged misconduct related to mortgage applications. Cook immediately rejected the move, saying the president had “no authority” to dismiss her and pledging to remain in her post. The confrontation has cast a cloud over the Fed just as it prepares for a pivotal September policy meeting.

The optics are striking: Cook, the first Black woman to serve on the Fed board, has become the focal point of a legal and political dispute that could test the institution’s autonomy. For markets, the drama only adds to uncertainty at a time when Fed credibility and consistency are paramount.

At the same time, Trump sharpened his trade rhetoric. He warned that countries imposing digital services taxes would face “substantial” new tariffs on exports to the U.S., along with restrictions on U.S. chip supplies. The warning targeted dozens of nations, reopening old disputes that many investors had assumed were on hold.

China was also singled out in particularly blunt terms. Trump threatened that the U.S. would impose another 200% tariff on Chinese exports if Beijing restricted shipments of rare-earth magnets to the U.S. He also boasted that U.S. withholding of Boeing aircraft parts had already grounded hundreds of Chinese planes. The comments risk destabilizing a fragile trade truce between the two economies.

U.S. equities closed higher overnight, but Asian markets turned mixed on Thursday as risk sentiment remained muted. Nvidia’s stronger-than-expected earnings beat on both revenue and profit dominated headlines but failed to deliver a sustained boost to risk appetite.

In currency markets, Dollar softened as this week’s rebound lost steam. Overall trading remained subdued with no major catalysts. Yen led gains on the day, followed by Loonie and Swiss Franc. On the downside, Euro lagged most, trailed by Dollar and Kiwi, while Sterling and Aussie held middle ground.

Focus in Europe was on the release of the ECB’s July meeting minutes. Policymakers left rates unchanged at 2.00% and subsequent data has pointed to stronger-than-expected growth alongside inflation holding near the 2% target. That combination has reduced the urgency for further easing in the near term.

Trump’s imposition of a 15% tariff on most EU goods has so far tracked with ECB assumptions, averting worst-case outcomes. As a result, markets now largely expect the ECB to stand pat again on September 11, barring sharp downside surprises in upcoming flash inflation and survey data. The debate has shifted toward whether there will be a case for more easing later in the year, but for now the bar remains high.

On the trade front, Japan’s top negotiator Ryosei Akazawa canceled a trip to Washington that was intended to cover tariff issues. Chief Cabinet Secretary Yoshimasa Hayashi said technical disagreements had surfaced, requiring continued talks at the administrative level instead.

Kyodo News reported no decision has been made on rescheduling, while Reuters suggested Akazawa could head to Washington next week. Tokyo has made clear it will press the U.S. to revise its reciprocal tariff order and seek lower duties on autos and parts. The delay highlights the fragility of trade talks even between close partners.

Goldman Sachs maintains a cautious bias on AUD, NZD, and CAD in light of dovish domestic policy paths, but stresses that another bout of USD weakness could still offer upside. The takeaway: commodity G10s may participate in Dollar weakness, but less consistently and with lower conviction compared to EUR or JPY.

BofA sees European FX leading the next leg of USD weakness, with SEK standing out as the most compelling bearish USD expression. While commodity FX may hold steadier, the quant and positioning picture favors selling the USD against EUR, GBP, CHF, and SEK.

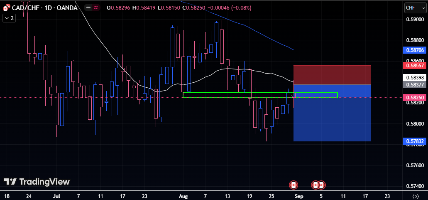

What a bad vacation start... ahah ( got BE on EURCHF on Monday and closed my CADCHF with small profit this morning) CADJPY got stopped out on dovish BoJ and strong dollar... Not so bad anyways... We do not control surprise data point that obviously come... Sometimes it is in our favor and other times not...

Yen dominated currency moves in an otherwise subdued Asian session, with broad-based selling gathering pace. After weeks of range-bound trading, the Japanese currency may finally be breaking lower, particularly in the crosses where momentum is building.

Trade uncertainty is a central factor. Japan is still waiting for a formal executive order from U.S. President Donald Trump to reduce auto tariffs, a key sticking point in bilateral negotiations. Talks hit another setback last week when Tokyo’s top negotiator abruptly canceled a visit to Washington, leaving no new date on the calendar. Ryosei Akazawa confirmed today that no rescheduling has been arranged. The lack of progress casts doubt on Japan’s hopes for near-term relief, adding pressure to a currency that has already been undermined by shifting policy expectations.

At the same time, a senior BoJ official warned that the risk of a “larger-than-expected impact” from tariffs now deserves greater attention than the prospect of a mild slowdown. With a confirmed trade deal, the BoJ might be able to raise rates again later this year. But without clarity on the tariff front, comments from Deputy Governor Ryozo Himino suggest patience will be required. The central bank looks more likely to wait for stronger confirmation that trade risks are subsiding before adjusting policy again.

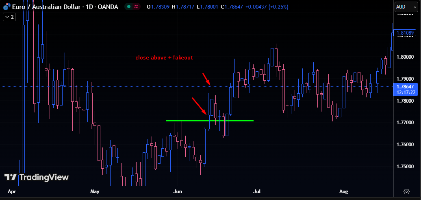

I decided to share with you three ways to trade reversals and continuation movements in swing trading that I personally use in my trading.

This is simply an advanced understanding of price action. It is not necessary to use fundamental analysis, although I strongly recommend being cautious in the event of important news. I recommend waiting for the results, as this can distort statistics and, in general, change the direction of the market. This approach works in the forex market but, unfortunately, is less effective in trending markets.

We will analyze everything using examples. The basis of everything is false breakouts and small details that are not noticeable to the eye of an ordinary trader. We use daily and weekly levels because they have real significance, unlike lower timeframes.

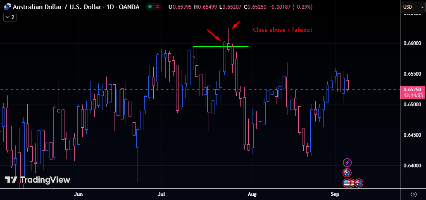

You will have to check all this yourself and not just take our word for it. 1) False breakout with closing above the level (the smaller and shorter, the better) 2) The price should give a false breakout the next day and form something like a small sideways movement, and when its limits are broken, we enter on the correction. 3) Stop loss above the level, taking into account a possible correction, and take profit in the 0.61 zone, as this is the most likely scenario.

Markets adopted a cautious tone again today, as attention swung back to U.S. economic data. Today’s ADP private payrolls and ISM services figures are seen as key precursors to tomorrow’s highly anticipated nonfarm payrolls. The numbers are expected to sharpen the Fed’s rate-cut calculus, with traders reluctant to take large positions before the release.

Fed officials have broadly indicated openness to a rate cut this month, reinforcing expectations of a 25-basis-point move. Fed fund futures now price the odds of such a cut above 97%, reflecting the market’s conviction that easing is imminent.

The debate, however, is less about September and more about what comes afterward. Even Fed Governor Christopher Waller, a known dove, refrained from endorsing consecutive cuts. While he expects multiple moves over the next three to six months, he stressed that there is no fixed schedule, leaving policymakers room to adapt to incoming data.

On the other end of the spectrum, Atlanta Fed President Raphael Bostic reiterated his preference for a single cut this year, arguing that inflation risks remain the dominant concern. The divide highlights how much weight upcoming data, including Friday’s NFP, will carry in shaping expectations for the policy path into year-end.

Trade risks are also back in focus. US President Donald Trump asked the Supreme Court to fast-track his appeal against lower court rulings that deemed most of his global tariffs illegal. The appeals court ruled last week that Trump overstepped his authority when imposing sweeping levies on nearly all U.S. trading partners.

Trump is pushing for arguments to be heard in November with a decision soon after, warning that a delay until June 2026 could see as much as USD 750 billion to USD 1 trillion in tariffs collected and then potentially unwound—an outcome he says would cause major disruption. Normally, the Supreme Court would not deliver a decision until next summer.

Separately, Japan’s top trade negotiator Ryosei Akazawa departed for Washington for ministerial-level talks, signaling progress in implementing the bilateral trade deal reached in July. “Both Japan and the U.S. have agreed to implement the agreement faithfully and swiftly,” Akazawa said before leaving Tokyo.

Right now we dont have any setups on this strategy so we will wait until we got some... NFP is very important, to be honest we should wait until NFP give us insights... Maybe we will wait until next week who knows...

We had GBPCAD setup yesterday but no confirmation from technical point so... no trade for me

WE ALREADY WENT UP... SO WONT TAKE IT... I USE SIMPLE BREAKOUTS AND MOVING AVERAGE TOUCH AS CONFIRMATION BUT WE SIMPLY GOT BREAKOUT

The foreign exchange market remains largely range-bound as traders await today’s U.S. non-farm payrolls report. Recent labor indicators, including ISM employment components, point to downside risk for NFP. Both manufacturing and services sub-indexes remain in contractionary territory, while ADP payrolls growth slowed sharply in August. This suggests a soft report is more likely than not.

Besides, the implications for Dollar are asymmetric. A weak payrolls print—particularly a sizeable miss—could spark a sustained wave of Dollar selling as traders price in more aggressive Fed action, including the possibility of back-to-back cuts. By contrast, a stronger report may only limit the pace of easing rather than shift the direction, implying any lift for the dollar would be temporary.

Canada’s employment report is also in focus, with markets watching closely to see if the data justify expectations that BoC could resume rate cuts this month.

On trade, US President Donald Trump signed an executive order Thursday to finalize the July agreement with Japan, imposing a 15% baseline tariff on most Japanese imports, including autos. The confirmation removes a significant uncertainty for the BoJ, which can now reassess the scope for further rate hikes later this year.

Trump also signaled fresh pressure on the tech sector, warning that “fairly substantial” tariffs are coming on semiconductor imports from firms that refuse to relocate production to the U.S. Companies with domestic expansion plans, such as Apple, would be spared.

For the week so far, Dollar remains the best performer. Aussie and Euro follow, while Yen lags as the weakest major. Kiwi and Swiss Franc also underperform, while Sterling and Loonie sit mid-table.

Dollar tumbled sharply in early New York trading Friday after much weaker-than-expected non-farm payrolls report. 10-year Treasury yield plunging through the 4.1% level while Gold also surged to fresh record high.

Traders moved swiftly to reprice Fed expectations, with a 25bps cut this month fully baked in and fresh speculation that policymakers may opt for a larger 50bps move. Looking ahead, odds of another 25bps cut in October spiked above 75%, underscoring market conviction that the central bank will need to move aggressively to shield the labor market.

That places next week’s CPI report in sharp focus. Should inflation show further signs of easing, it would open the door for the Fed to accelerate its easing cycle.

In weekly performance terms, Canadian Dollar is faring worst after its own dismal jobs data, while Yen remains under pressure but may recover some ground. Dollar is sliding toward the bottom of the performance table, likely to surpass Yen before the week closes. Euro leads gains, followed by the Aussie and Sterling, with Swiss Franc and Kiwi holding mid-pack.

CLEAR USD AND CAD WEAKNESS SO EVERYONE KNOW WHAT WE SHOULD DO

BANK REPORTS

Crédit Agricole warns that the 8 September French confidence vote is a pivotal event for the euro, with high odds of scenarios that could amplify political and fiscal uncertainty. Their analysis suggests EUR/USD risks are tilted lower, and markets may not be pricing in the full extent of potential volatility.

BofA sees the USD still modestly overvalued, but the drivers of further weakness are shifting away from valuation and more toward structural issues—stagflationary risks, Fed policy easing, and institutional credibility. The medium-term picture still points to gradual USD depreciation across G10.