- ホーム

- コミュニティ

- 経験豊富なトレーダー

- Swing Trading Analysis & Results

Advertisement

Edit Your Comment

Swing Trading Analysis & Results

Nov 19, 2014からメンバー

157 投稿

Apr 21, 2015 at 19:50

(編集済みのApr 21, 2015 at 16:50)

Nov 19, 2014からメンバー

157 投稿

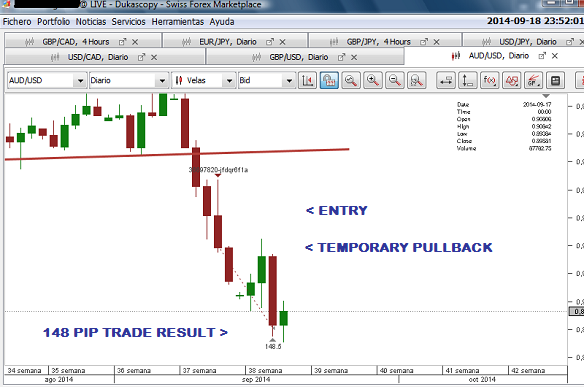

This Thread will show how I Analyze and Trade the major Currency Pairs for 100 to 200 Pips per trade.

The Swing Trading approach focuses on the larger time frames of the Daily and 4 Hour Charts where the patterns and signals are more stable relative to the Smaller Time Frames. My main tools include Candlestick Signals, Consolidation Patterns and Trend Lines.

Feel free to share your style of Swing Trading or Day Trading that can provide similar results.

Comments, questions and best of all Criticisms are all welcomed.

Lets get to it.

Duane

N.B. I am not advertising a System nor Soliciting Business. I am simply showing my style of trading according to my Methodology and the results it has provided.

The Swing Trading approach focuses on the larger time frames of the Daily and 4 Hour Charts where the patterns and signals are more stable relative to the Smaller Time Frames. My main tools include Candlestick Signals, Consolidation Patterns and Trend Lines.

Feel free to share your style of Swing Trading or Day Trading that can provide similar results.

Comments, questions and best of all Criticisms are all welcomed.

Lets get to it.

Duane

N.B. I am not advertising a System nor Soliciting Business. I am simply showing my style of trading according to my Methodology and the results it has provided.

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

Apr 21, 2015 at 19:50

Nov 19, 2014からメンバー

157 投稿

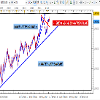

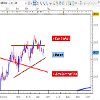

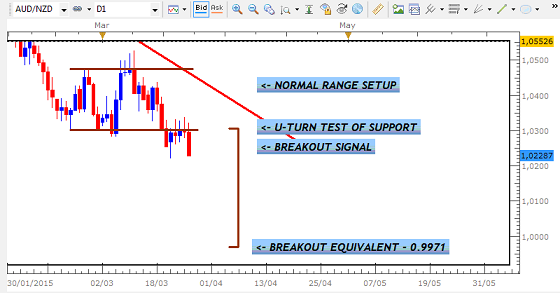

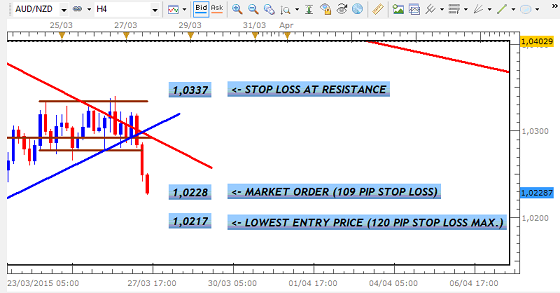

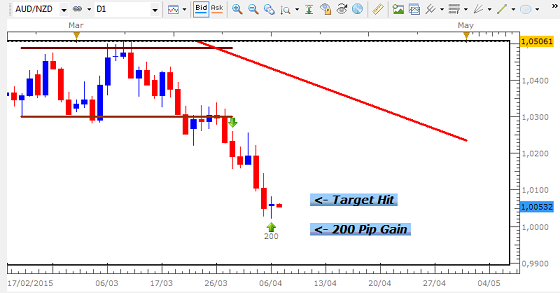

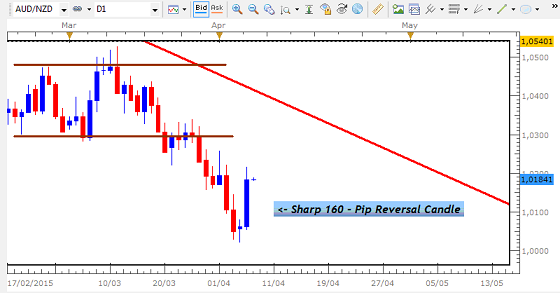

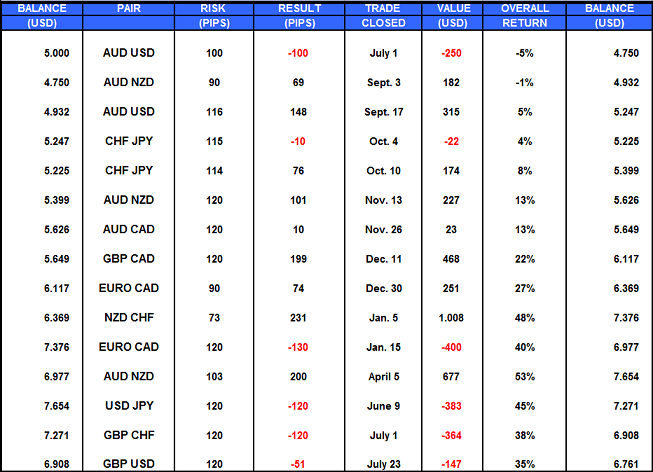

200- PIP AUD NZD TRADE

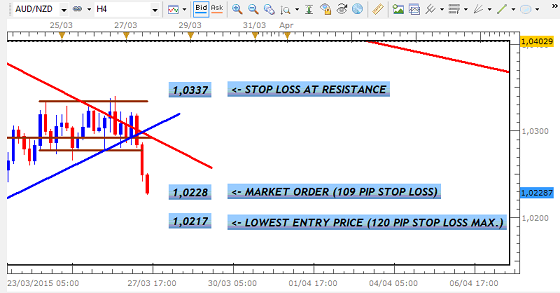

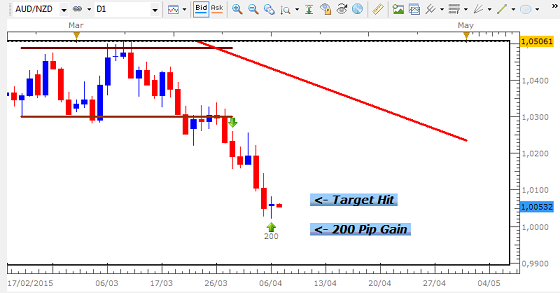

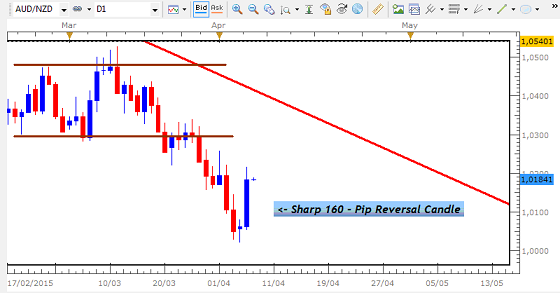

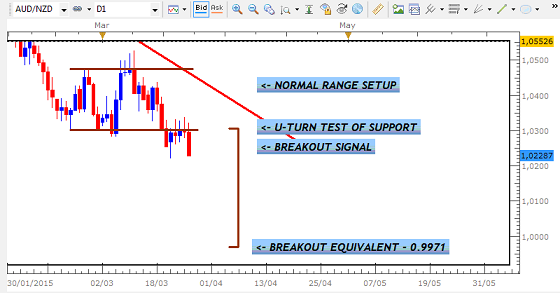

The most recent trade in keeping with this approach was on the AUD NZD. The Setup was a Consolidation Range that broke out short below its Support.

After determining that the overall Setup was in sync with my strategy, the trade was executed with an Entry Setup on the 4 Hour Chart.

After a few days, the target was hit for the preset amount..

... leading to an increase in the trend of gains so far...

https://www.myfxbook.com/members/DRFXTRADING/duane/1079693

MAIN ASPECTS OF TRADE

- Consolidation Breakout Theory

- Range Setups for Stop Loss Placement

- Holding Trades for a few days

- Correct choice of targets ahead of pullbacks....

The most recent trade in keeping with this approach was on the AUD NZD. The Setup was a Consolidation Range that broke out short below its Support.

After determining that the overall Setup was in sync with my strategy, the trade was executed with an Entry Setup on the 4 Hour Chart.

After a few days, the target was hit for the preset amount..

... leading to an increase in the trend of gains so far...

https://www.myfxbook.com/members/DRFXTRADING/duane/1079693

MAIN ASPECTS OF TRADE

- Consolidation Breakout Theory

- Range Setups for Stop Loss Placement

- Holding Trades for a few days

- Correct choice of targets ahead of pullbacks....

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

Apr 22, 2015 at 19:32

Nov 19, 2014からメンバー

157 投稿

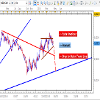

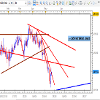

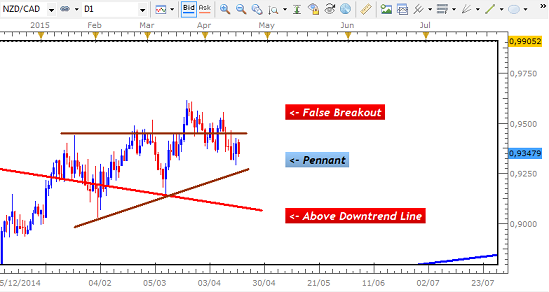

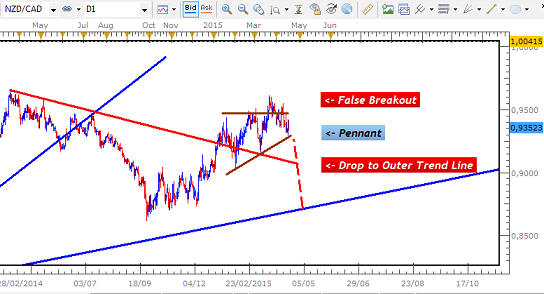

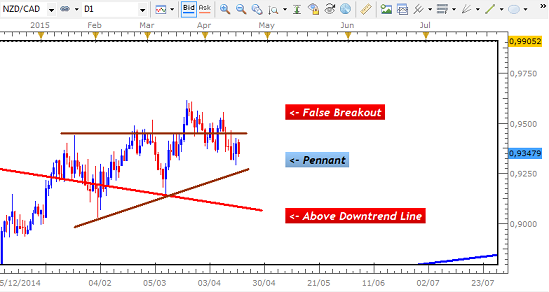

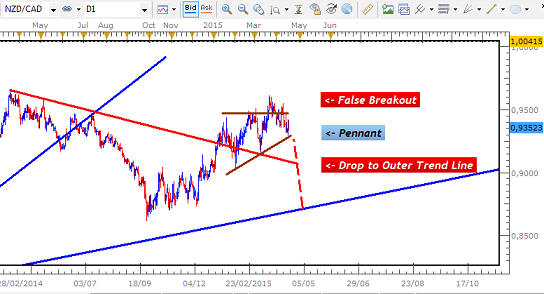

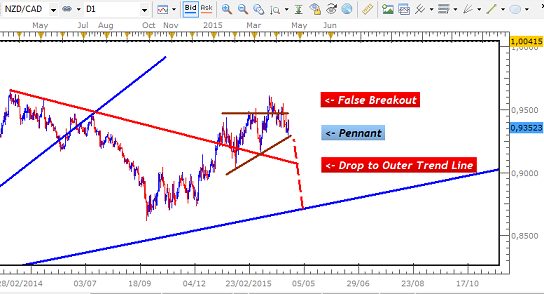

NZD CAD - SHARP FALSE BREAKOUT AHEAD?

After breaking below its Inner Uptrend Line between June and July of 2014, this pair has since begun a rally above the Downtrend Line that could resume the overall Uptrend. The chart below shows the sharp U-Turn that took place just above its Outer Uptrend Line that led to the break above the Downtrend Line.

In breaking above this Downtrend Line, the pair then started to lose momentum as it formed a Pennant Setup above this boundary. Eventually, there was an attempted rally above Resistance that would have seen the Kiwi resume its gains against the Yen, but this was short-lived. The market become volatile, taking out those Bullish Candles before pulling back inside of the Pennant near the Support.

This is in keeping with the theory of False Breakouts and their tendency to move to the other end of the Consolidation.

GBP CAD TRADE

4TH Trade seen here https://www.myfxbook.com/members/DRFXTRADING/duane/1079693

Given the current scenario and the volatile nature of the candles, a larger bearish pullback below the Pennant seems the most likely outcome. Such movements - breaking out at the opposite end of a Consolidation - are also very common following a False Breakout. If this materializes, a sharp drop to the Outer Uptrend Line is likely.

As a Swing Trader using Price Action, the next step will be to wait for the appropriate setups and signals as the pair breaks below the Support and the Downtrend Line. Break below this Downtrend Line will provide added confirmation of this direction, providing the confidence required to capture that next 200-Pip trade.

After breaking below its Inner Uptrend Line between June and July of 2014, this pair has since begun a rally above the Downtrend Line that could resume the overall Uptrend. The chart below shows the sharp U-Turn that took place just above its Outer Uptrend Line that led to the break above the Downtrend Line.

In breaking above this Downtrend Line, the pair then started to lose momentum as it formed a Pennant Setup above this boundary. Eventually, there was an attempted rally above Resistance that would have seen the Kiwi resume its gains against the Yen, but this was short-lived. The market become volatile, taking out those Bullish Candles before pulling back inside of the Pennant near the Support.

This is in keeping with the theory of False Breakouts and their tendency to move to the other end of the Consolidation.

GBP CAD TRADE

4TH Trade seen here https://www.myfxbook.com/members/DRFXTRADING/duane/1079693

Given the current scenario and the volatile nature of the candles, a larger bearish pullback below the Pennant seems the most likely outcome. Such movements - breaking out at the opposite end of a Consolidation - are also very common following a False Breakout. If this materializes, a sharp drop to the Outer Uptrend Line is likely.

As a Swing Trader using Price Action, the next step will be to wait for the appropriate setups and signals as the pair breaks below the Support and the Downtrend Line. Break below this Downtrend Line will provide added confirmation of this direction, providing the confidence required to capture that next 200-Pip trade.

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

Apr 30, 2015 at 19:56

Nov 19, 2014からメンバー

157 投稿

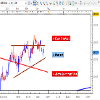

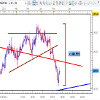

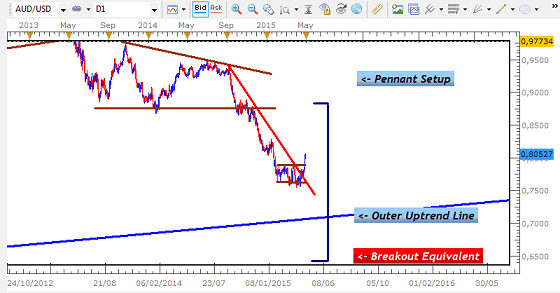

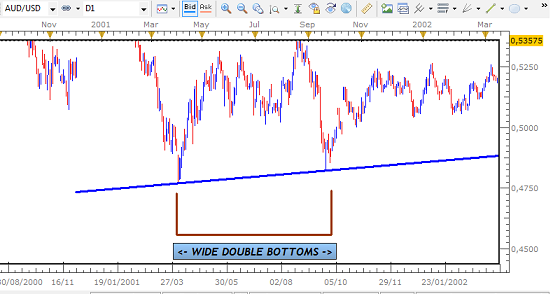

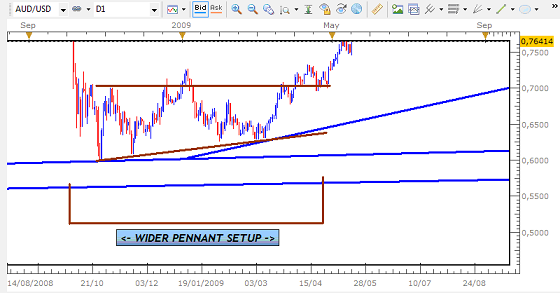

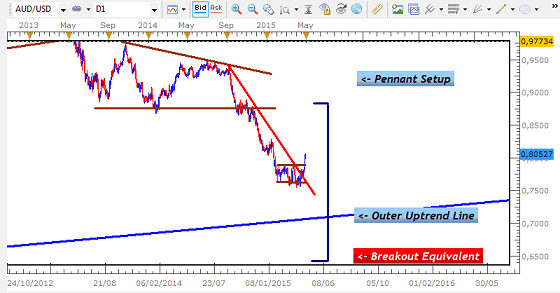

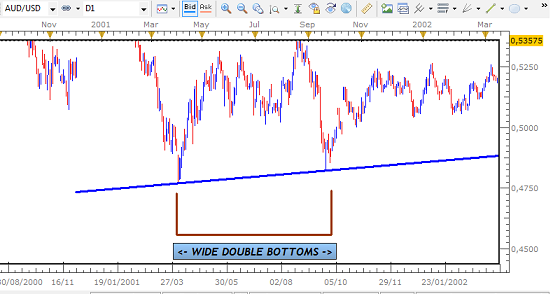

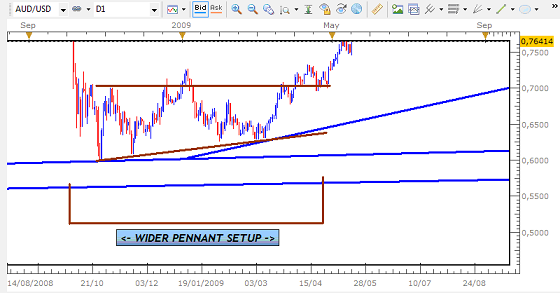

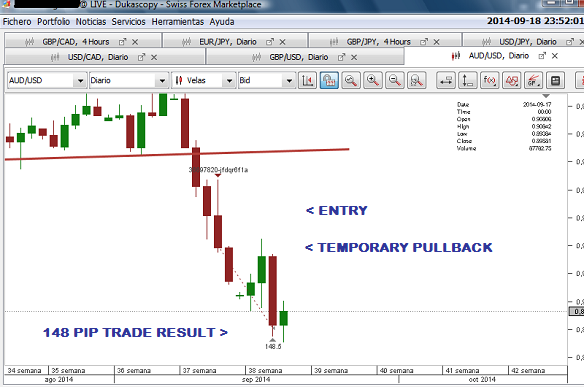

PREDICTED FALSE BREAKOUT ON AUD USD NOW STARTING?

This pair had given a strong Bullish Breakout Signal above its Range Setup on the Daily Chart, indicating a possible move higher.

But because of the following 3 Factors, it was unlikely to go much higher.

1. Pennant Consolidation had not yet reached its target - "Breakout Equivalent"

2. We were still some distance away from the Outer Uptrend Line

3- The Range Setup was small in comparison to the 2 Previous Support Points that formed the Outer Uptrend Line in 2001 and 2008

For these reasons, it had a very low chance of providing a profitable trade. It is therefore no surprise that since then, the pair has started to pullback sharply to take out that Bull Candle...

Stick with the Larger Time Frames as we can often miss key Technical Factors that will prevent an attractive Trade Setup from providing the gains we are looking for.

This pair had given a strong Bullish Breakout Signal above its Range Setup on the Daily Chart, indicating a possible move higher.

But because of the following 3 Factors, it was unlikely to go much higher.

1. Pennant Consolidation had not yet reached its target - "Breakout Equivalent"

2. We were still some distance away from the Outer Uptrend Line

3- The Range Setup was small in comparison to the 2 Previous Support Points that formed the Outer Uptrend Line in 2001 and 2008

For these reasons, it had a very low chance of providing a profitable trade. It is therefore no surprise that since then, the pair has started to pullback sharply to take out that Bull Candle...

Stick with the Larger Time Frames as we can often miss key Technical Factors that will prevent an attractive Trade Setup from providing the gains we are looking for.

Trade Less, Earn More

Oct 11, 2013からメンバー

769 投稿

Nov 19, 2014からメンバー

157 投稿

Nov 19, 2014からメンバー

157 投稿

May 13, 2015 at 06:39

Nov 19, 2014からメンバー

157 投稿

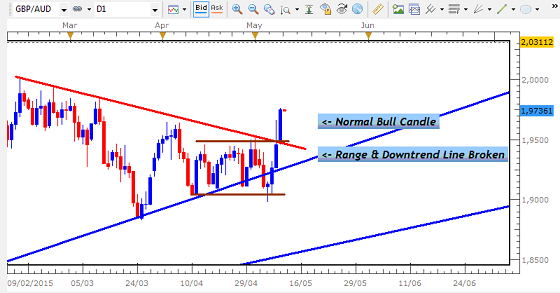

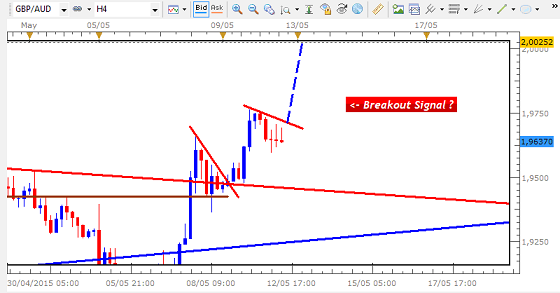

VIDEO ANALYSIS OF GBP AUD CONSOLIDATION BREAKOUT

/MAY_2_GBP_AUD_DAILY_1.png" target="_blank" rel="noopener noreferrer nofollow">

In pulling to that trend line, the pair formed a Downtrend Line/Counter Trend Line and a small Range below this area. This was eventually broken on Monday May 11th with a strong Bull Candle.

This Range that is being broken is what is known as a Normal Consolidation. This is one of the smaller Consolidations that you will see across the market on the Daily Chart. The distance between the Resistance and Support is very small and the breakout from these setups usually take a few days for their target - known as the Breakout Equivalent- to be hit.

If this breakout bullish going to continue, then we are likely to see a Bull Candle above the CTL of this 4 Hour Chart.

Once this takes place, the Stop Loss would be placed below the low of the CTL and the target set for 200 Pips.

Normal Consolidations are seen across all time frames, but they offer larger profits with greater stability on the Large Time Frames.

Lets see how this unfolds, hopefully we can some good Pips from this.

Duane

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

May 14, 2015 at 14:13

Nov 19, 2014からメンバー

157 投稿

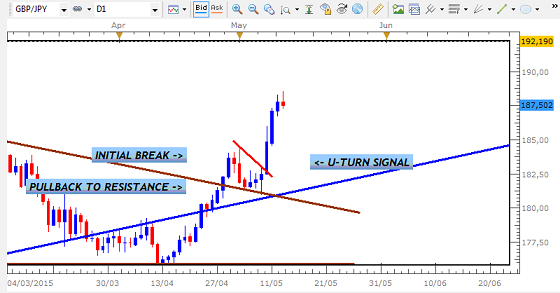

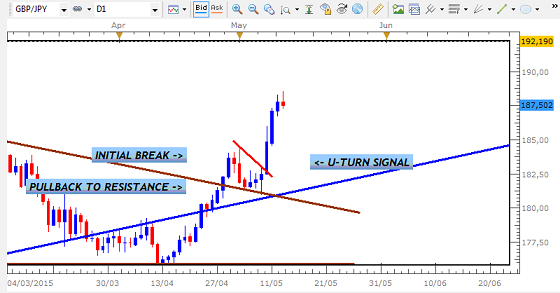

GBP JPY DAILY VIDEO ANALYSIS

/MAY_2_GBP_JPY_DAILY_1.png" target="_blank" rel="noopener noreferrer nofollow"> /MAY_2_GBP_JPY_DAILY_1.png"/>

/MAY_2_GBP_JPY_DAILY_1.png"/>

We can now see that it has started to breakout from this 2nd Pennant with strong Bullish Candles above Resistance.

DAILY CHART - CONSOLIDATION BREAKOUT

The manner in which this started is one of 3 ways in which these Consolidation setups tend to be broken in this market.

1) The First is when the market simply provides a Single Breakout Candle without any pullbacks.

2) The Second way is when the market pulls back on the inside of the barrier and then U-Turns to provide the breakout signal

3) The Third way- which is what has taken place here - is when the market initially breaks the barrier, U-Turns to test the barrier before U-Turning to give the signal that leads to the breakout.

DAILY CHART - BREAKOUT SIGNAL

As attractive as this signal has been on the Daily Chart, the size of the Stop Losses required to trade this breakout on the 4 Hour Chart have been too large.

Based on where we would have entered at the close of the Daily Candle, the Stop Loss would have been 332 Pips for the 1st entry option. With the 2nd Bullish Signal, the Stop would have been 169 Pips- both of which are too large for the average Retail Trader.

4 HOUR CHART

So the overall setup and breakout signal on the Daily Chart were strong, but unfortunately can’t be traded based on the Stop Losses required.

In these situations, we simply either wait on another setup on this pair that offers a smaller Stop Loss, or move on to another pair.

/MAY_2_GBP_JPY_DAILY_1.png" target="_blank" rel="noopener noreferrer nofollow">

We can now see that it has started to breakout from this 2nd Pennant with strong Bullish Candles above Resistance.

DAILY CHART - CONSOLIDATION BREAKOUT

The manner in which this started is one of 3 ways in which these Consolidation setups tend to be broken in this market.

1) The First is when the market simply provides a Single Breakout Candle without any pullbacks.

2) The Second way is when the market pulls back on the inside of the barrier and then U-Turns to provide the breakout signal

3) The Third way- which is what has taken place here - is when the market initially breaks the barrier, U-Turns to test the barrier before U-Turning to give the signal that leads to the breakout.

DAILY CHART - BREAKOUT SIGNAL

As attractive as this signal has been on the Daily Chart, the size of the Stop Losses required to trade this breakout on the 4 Hour Chart have been too large.

Based on where we would have entered at the close of the Daily Candle, the Stop Loss would have been 332 Pips for the 1st entry option. With the 2nd Bullish Signal, the Stop would have been 169 Pips- both of which are too large for the average Retail Trader.

4 HOUR CHART

So the overall setup and breakout signal on the Daily Chart were strong, but unfortunately can’t be traded based on the Stop Losses required.

In these situations, we simply either wait on another setup on this pair that offers a smaller Stop Loss, or move on to another pair.

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

May 17, 2015 at 06:37

Nov 19, 2014からメンバー

157 投稿

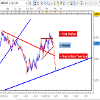

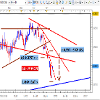

VIDEO ANALYSIS OF NZD CAD FALSE BREAKOUT

/MAY_2_NZD_CAD_1_FALSE.png" target="_blank" rel="noopener noreferrer nofollow">

Based on this movement and the fact that False Breakouts usually lead to breaks at the opposing end of the Pennant, we had projected the pair to break towards the major Outer Uptrend Line.

DAILY CHART - PROJECTED DECLINE

Looking at the current situation on the Daily Chart, we can see that this forecast had in fact materialized over the last few weeks. Starting from the high of the start of the reversal, the pair has declined sharply by approximately 800 Pips.

DAILY CHART - SHARP DECLINE

Now, how could you have taken advantage of this profitable move?

Having seen the start of the breakout below the Support of the Pennant, the first thing to do would have been to draw the Downtrend Lines that were being formed.

DAILY CHART - DOWNTREND LINES

These Downtrend Lines can be used for the placement of Stop Losses with the assurance that your profits will be protected throughout the trade. The next step would have been to enter short at around the 0,9100 area, with a Stop Loss of 100 Pips placed above the Inner Downtrend Line. Your Limit Order would initially be set to the Outer Uptrend Line for a profit of 370 Pips.

DAILY CHART - ENTRY SETUP

As the market began to move in you favour, you would have moved your Stop Loss lower, breaking even initially and then locking in profits below your Entry. This would have continued until the market started to reverse bullish just above the Outer Uptrend Line target. Your Stop Loss would “sadly” have been taken out and you would have pocketed 300 Pips in gains.

DAILY CHART - 300 PIP PROFIT

This is one of the ways in which Breakouts and False Breakouts can be profitably traded in this market. Many of these opportunities are likely to continue to present themselves for us given the current environment of low liquidity that now characterizes the major Currency Pairs. As Swing Traders, we simply need to spot these setups and the appropriate signals provided to take advantage of them, for continued monetary reward.

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

May 19, 2015 at 06:33

Nov 19, 2014からメンバー

157 投稿

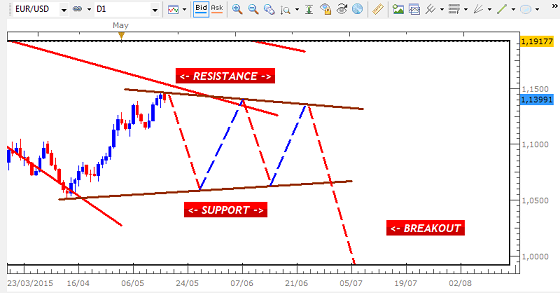

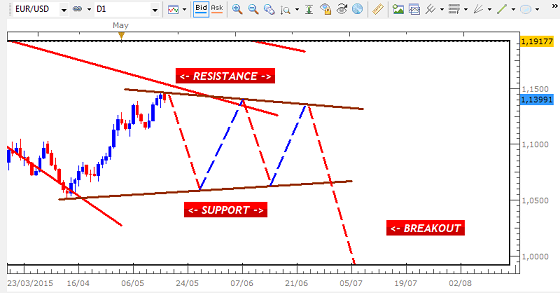

EURO USD FORMING CONSOLIDATION SETUP

The EURO USD may be in the early stages of forming a Consolidation Setup based on the nature of the sharp rally that has taken place over the last few days. If we see this play out over the course of the next few weeks, there may be an opportunity for us to trade within the boundaries of Support and Resistance until a breakout takes place.

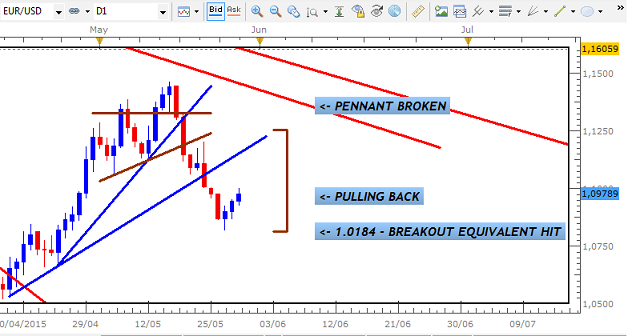

As we can see in the chart below, the pair has finally broken the Large Pennant Consolidation that was formed between 2008 and 2014.

DAILY CHART - PENNANT BREAKOUT

Given the size of this Consolidation, we should expect this breakout to continue in favour of the USD for the Medium to Long-Term heading into 2016. However, as we can appreciate more clearly from the chart below, the EURO has started to rally in defiance of this overall outlook.

DAILY CHART - BREAK OF INNER TREND LINE

The Inner Downtrend Line was broken with a pair of Double Bottoms. This has been followed by a sharp rally that appears to be taking the pair to the Outer Downtrend Line. If that barrier is hit, the pair could continue even higher towards the Long-Term Downtrend Line before breaking back inside of the Pennant.

On the other hand, it could also U-Turn bearish to resume the overall direction of the Consolidation Breakout at either the Outer or Long-Term Downtrend Line.

DAILY CHART - FORECAST SCENARIOS

Despite the possibility of a bullish scenario that takes us back inside of the Pennant, the current strength of the Downtrend makes a bearish U-Turn the more likely outcome over the next few weeks. Another reason for this bearish outlook has to do with the nature of the candles that have led to the current rally taking place. The sharp movement, the small candles and the fact that the reversal follows a very long trend, are some of the signs of the start of a Consolidation Setup.

This means that we could see a pullback at either of those two Trend Lines to form the 1st Resistance point of a Consolidation Setup.

DAILY CHART - PROJECTED CONSOLIDATION

If this materializes, then we will have opportunities to trade between Support and Resistance until the breakout takes place. We will do this by firstly determining the time frame that is controlling the signals and then analyze and trade accordingly for our 100 to 200 Pip Targets.

Duane

The EURO USD may be in the early stages of forming a Consolidation Setup based on the nature of the sharp rally that has taken place over the last few days. If we see this play out over the course of the next few weeks, there may be an opportunity for us to trade within the boundaries of Support and Resistance until a breakout takes place.

As we can see in the chart below, the pair has finally broken the Large Pennant Consolidation that was formed between 2008 and 2014.

DAILY CHART - PENNANT BREAKOUT

Given the size of this Consolidation, we should expect this breakout to continue in favour of the USD for the Medium to Long-Term heading into 2016. However, as we can appreciate more clearly from the chart below, the EURO has started to rally in defiance of this overall outlook.

DAILY CHART - BREAK OF INNER TREND LINE

The Inner Downtrend Line was broken with a pair of Double Bottoms. This has been followed by a sharp rally that appears to be taking the pair to the Outer Downtrend Line. If that barrier is hit, the pair could continue even higher towards the Long-Term Downtrend Line before breaking back inside of the Pennant.

On the other hand, it could also U-Turn bearish to resume the overall direction of the Consolidation Breakout at either the Outer or Long-Term Downtrend Line.

DAILY CHART - FORECAST SCENARIOS

Despite the possibility of a bullish scenario that takes us back inside of the Pennant, the current strength of the Downtrend makes a bearish U-Turn the more likely outcome over the next few weeks. Another reason for this bearish outlook has to do with the nature of the candles that have led to the current rally taking place. The sharp movement, the small candles and the fact that the reversal follows a very long trend, are some of the signs of the start of a Consolidation Setup.

This means that we could see a pullback at either of those two Trend Lines to form the 1st Resistance point of a Consolidation Setup.

DAILY CHART - PROJECTED CONSOLIDATION

If this materializes, then we will have opportunities to trade between Support and Resistance until the breakout takes place. We will do this by firstly determining the time frame that is controlling the signals and then analyze and trade accordingly for our 100 to 200 Pip Targets.

Duane

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

May 21, 2015 at 07:17

Nov 19, 2014からメンバー

157 投稿

GBP USD - SETTING UP FOR FALSE BREAKOUT

This pair looks to be heading back inside of the Large Consolidation Pennant on the Daily Chart after 2 failed attempts to breakout short. Its now back at the Support area and may be getting ready to rally again after briefly pulling back to the Daily Uptrend Line.

(See Video Analysis)

Duane

This pair looks to be heading back inside of the Large Consolidation Pennant on the Daily Chart after 2 failed attempts to breakout short. Its now back at the Support area and may be getting ready to rally again after briefly pulling back to the Daily Uptrend Line.

(See Video Analysis)

Duane

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

May 22, 2015 at 07:16

Nov 19, 2014からメンバー

157 投稿

USD JPY LIKELY TO PULLBACK LOWER DESPITE BULLISH SIGNAL

Expect a pullback bearish over the next 24 hours at least before any bullish movement continues.

We are near a Resistance of the large Pennant and something on the 4H Chart (related to a rule about when Trends end) is going to prevent the pair from breaking higher.

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

Nov 19, 2014からメンバー

157 投稿

May 29, 2015 at 07:50

Nov 19, 2014からメンバー

157 投稿

This False Breakout Setup and Signal that were seen a few days ago have now led to a strong Bearish reversal back inside of the Range Setup on the Daily Chart.

Some traders would have entered short after seeing the Double Tops appear above Resistance. With entry at this area and a target set for the Support, they could be now be earning close to 300 Pips from this trade. For others who waited for the break inside of the Resistance for added confirmation, they could be up between 90 to 200 Pips.

False Breakouts take place all the time with Consolidation, and the Double Tops/Bottoms are common signals that lead to these sharp moves.

Once the Support is hit, there are three possible scenarios that could unfold..

Duane

Some traders would have entered short after seeing the Double Tops appear above Resistance. With entry at this area and a target set for the Support, they could be now be earning close to 300 Pips from this trade. For others who waited for the break inside of the Resistance for added confirmation, they could be up between 90 to 200 Pips.

False Breakouts take place all the time with Consolidation, and the Double Tops/Bottoms are common signals that lead to these sharp moves.

Once the Support is hit, there are three possible scenarios that could unfold..

Duane

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

May 29, 2015 at 15:46

Nov 19, 2014からメンバー

157 投稿

EURO USD VIDEO ANALYSIS

/MAY_4_EURO_B.E._1_wN.png" target="_blank" rel="noopener noreferrer nofollow"> /MAY_4_EURO_B.E._1_wN.png"/>

/MAY_4_EURO_B.E._1_wN.png"/>

As expected, the pullback eventually started with small, but bullish candles appearing...

From here, we could either see a pullback that resumes the small Uptrend in favour of the EURO or a Bearsih signal that continues the predominant Downtrend.

/MAY_4_EURO_B.E._1_wN.png" target="_blank" rel="noopener noreferrer nofollow">

As expected, the pullback eventually started with small, but bullish candles appearing...

From here, we could either see a pullback that resumes the small Uptrend in favour of the EURO or a Bearsih signal that continues the predominant Downtrend.

Trade Less, Earn More

Oct 11, 2013からメンバー

769 投稿

Nov 19, 2014からメンバー

157 投稿

Jun 02, 2015 at 16:11

(編集済みのJun 02, 2015 at 16:14)

Nov 19, 2014からメンバー

157 投稿

Yes alex, spotting these pullback areas makes a big difference with our trading.

Thats one of the benefits of the Larger Time Frames - youre able to see these major pullback points which can take you by surprise when focusing on the Smaller Charts.

Thats one of the benefits of the Larger Time Frames - youre able to see these major pullback points which can take you by surprise when focusing on the Smaller Charts.

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

Jun 02, 2015 at 16:15

Nov 19, 2014からメンバー

157 投稿

EURO CAD VIDEO ANALYSIS

Bulls now attempting to take control of the Bull Crown setup by breaking above the Range Resistance.

First target will be the Outer Downtrend Line but from there, it could continue bullish or U-Turn bearish to resume the major Downtrend in favour of the CAD.

Bulls now attempting to take control of the Bull Crown setup by breaking above the Range Resistance.

First target will be the Outer Downtrend Line but from there, it could continue bullish or U-Turn bearish to resume the major Downtrend in favour of the CAD.

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

Aug 05, 2015 at 11:31

Nov 19, 2014からメンバー

157 投稿

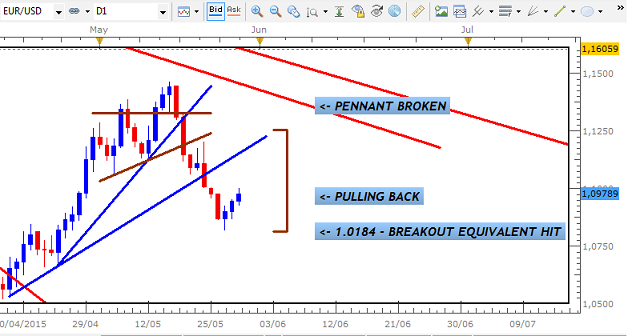

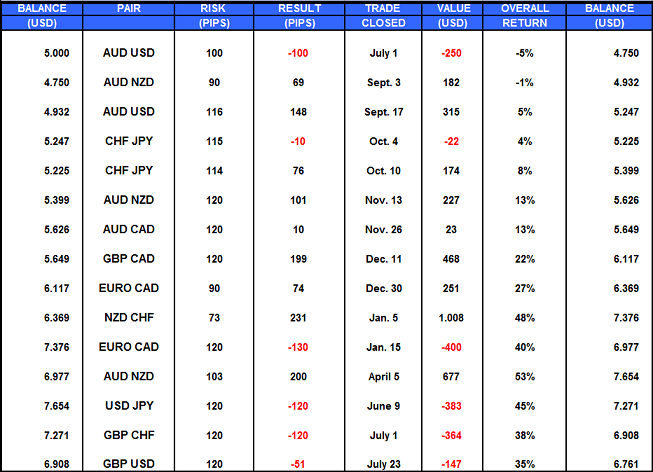

Hey everyone, been a long time, crazy few months.

Gonna get the ball rolling again with a Summary of the 35% Return I have generated from my Methodology. This includes trades made before the FXCM Accounts that you see here were opened.

JULY 1, 2014 - JULY 23, 2015

During this 13 - Month period, the Methodology targeted trades of between 100 and 200 Pips with some having to be closed below that 100- Pip Minimum. This was because they had not yet reached their targets at the end of the Holding Period. Once trades have not yet hit their targets by the end of this period they are closed regardless of their floating value. This is a way of ensuring that I do not hold out for more than the market is actually offering- the greed factor that gets in our way.

One of the challenges with these Swing Trades is the patience to wait for the trades to be closed over the Holding Period which can be as "many" as 7 Days. Compared to Day Trading where we are almost required to constantly check our trades every minute of the day, waiting several days can seem like an eternity. Ideally, it is always better if all our trades could reach their targets within 1 or 3 days to reduce our anxiety...

...but there are times when the market does force us to be patient when trades take longer, but the wait will usually be still worth it...

The latter part of the table shows that I have entered into a little bit of bad luck with 3 losing trades. This requires an even greater level of patience to be able to regain composure and confidence to then get back to winning ways. Swing Trading has the other advantage of allowing us time in between trades to regain our objectivity without the need to rush back into the market. Since we have more time in between trades and we only need to trade a few times per year to achieve strong rates of return, getting over this hurdle can be a less challenging.

The markets seem to be in a bit of a dry spell, but once there are breakouts that are in sync with the Methodology, profitable trades are likely to be offered.

Duane

DRFXTRADING

Gonna get the ball rolling again with a Summary of the 35% Return I have generated from my Methodology. This includes trades made before the FXCM Accounts that you see here were opened.

JULY 1, 2014 - JULY 23, 2015

During this 13 - Month period, the Methodology targeted trades of between 100 and 200 Pips with some having to be closed below that 100- Pip Minimum. This was because they had not yet reached their targets at the end of the Holding Period. Once trades have not yet hit their targets by the end of this period they are closed regardless of their floating value. This is a way of ensuring that I do not hold out for more than the market is actually offering- the greed factor that gets in our way.

One of the challenges with these Swing Trades is the patience to wait for the trades to be closed over the Holding Period which can be as "many" as 7 Days. Compared to Day Trading where we are almost required to constantly check our trades every minute of the day, waiting several days can seem like an eternity. Ideally, it is always better if all our trades could reach their targets within 1 or 3 days to reduce our anxiety...

...but there are times when the market does force us to be patient when trades take longer, but the wait will usually be still worth it...

The latter part of the table shows that I have entered into a little bit of bad luck with 3 losing trades. This requires an even greater level of patience to be able to regain composure and confidence to then get back to winning ways. Swing Trading has the other advantage of allowing us time in between trades to regain our objectivity without the need to rush back into the market. Since we have more time in between trades and we only need to trade a few times per year to achieve strong rates of return, getting over this hurdle can be a less challenging.

The markets seem to be in a bit of a dry spell, but once there are breakouts that are in sync with the Methodology, profitable trades are likely to be offered.

Duane

DRFXTRADING

Trade Less, Earn More

Nov 19, 2014からメンバー

157 投稿

Aug 05, 2015 at 11:41

Nov 19, 2014からメンバー

157 投稿

AUD USD ANALYSIS

This pair had come close to its major Outer Uptrend Line in the last few days, which could have offered traders up to 100 Pips by trading the expected movement towards this boundary. However, because of the tendency of the market to become volatile at these areas, trading this move was not advised.

/AUG_1_2015_AUD_USD_VOLATILE_TL.png" target="_blank" rel="noopener noreferrer nofollow">

BULL CANDLE - START OF REVERSAL?

As tempting as trading towards these boundaries can be especially with a Candlestick Signal given, their propensity for volatility due to a large build up of opposing Entry Orders makes this a risky move. The better move would be to wait on a Setup and Signal above the Outer Downtrend Line for a Long Position or a convincing break below the Outer Uptrend Line to go Short.

Duane

DRFXTRADING

Trade Less, Earn More

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。