- Strona główna

- Społeczność

- Ogólne

- Brokers - Why do we still pay spreads?

Advertisement

Edit Your Comment

Brokers - Why do we still pay spreads?

Uczestnik z Mar 29, 2012

191 postów

Jan 16, 2014 at 12:56

Uczestnik z Mar 29, 2012

191 postów

This is a question I was wondering about the current business model of brokers. I understand that brokers need to be remunerated for their service but I don't understand why nobody ever came up with an alternative such as a broker that would ask for a monthly subscription with only the LP's spread instead of always adding an extra fee? Is it even possible?

Do you know what brokers pay to LPs in order to propose their feed to the customers?

Just some thoughts ;-)

Do you know what brokers pay to LPs in order to propose their feed to the customers?

Just some thoughts ;-)

A smooth sea never made a skillful sailor.

forex_trader_150670

Uczestnik z Sep 12, 2013

104 postów

Jan 16, 2014 at 20:48

Uczestnik z Sep 12, 2013

104 postów

I think because it's about liquidity and arbitrage trade

Uczestnik z Mar 29, 2012

191 postów

Jan 16, 2014 at 20:58

Uczestnik z Mar 29, 2012

191 postów

SwissManagement posted:

I think because it's about liquidity and arbitrage trade

Could you develop a bit more?

A smooth sea never made a skillful sailor.

forex_trader_28881

Uczestnik z Feb 07, 2011

691 postów

Jan 17, 2014 at 06:36

Uczestnik z Feb 07, 2011

691 postów

There are fixed cost brokers. Some have spreads minimal spreads of 0.5 pips. Just have to look around a bit.

Jan 18, 2014 at 10:47

Uczestnik z Dec 07, 2013

22 postów

@Thalantas @TheCyclist

1. Would still be volume based (as fixed fee would be unfair to smaller accounts)

2. Different pairs have different liquidity, so spreads would still exist.

1. Would still be volume based (as fixed fee would be unfair to smaller accounts)

2. Different pairs have different liquidity, so spreads would still exist.

Uczestnik z Mar 29, 2012

191 postów

Jan 18, 2014 at 13:06

Uczestnik z Mar 29, 2012

191 postów

ma2000 posted:

@Thalantas @TheCyclist

1. Would still be volume based (as fixed fee would be unfair to smaller accounts)

2. Different pairs have different liquidity, so spreads would still exist.

I am not saying that we can trade at zero spread as you'll always have the liquidity provider's spread but still you could pay a subscription and not a spread to the broker on top of the LP's spread? Whatever the amount on the account, anyone would have to pay, say 30 or 40$ (like a VPS price) and wouldn't suffer any spread beside the LP's.

The "mass" of client would overcome the fixed expenses.

A smooth sea never made a skillful sailor.

forex_trader_169857

Uczestnik z Dec 31, 2013

164 postów

Jan 20, 2014 at 19:03

Uczestnik z Dec 31, 2013

164 postów

Thalantas posted:ma2000 posted:

@Thalantas @TheCyclist

1. Would still be volume based (as fixed fee would be unfair to smaller accounts)

2. Different pairs have different liquidity, so spreads would still exist.

I am not saying that we can trade at zero spread as you'll always have the liquidity provider's spread but still you could pay a subscription and not a spread to the broker on top of the LP's spread? Whatever the amount on the account, anyone would have to pay, say 30 or 40$ (like a VPS price) and wouldn't suffer any spread beside the LP's.

The "mass" of client would overcome the fixed expenses.

Trader A does 5 trades a month on $100 account. Trader B does 500 trades a month on $10000 account. Trader A should pay same monthly subscription as Trader B? Is that what you want to say?

Uczestnik z Mar 29, 2012

191 postów

Jan 20, 2014 at 19:23

Uczestnik z Mar 29, 2012

191 postów

MyFxTrader posted:Thalantas posted:ma2000 posted:

@Thalantas @TheCyclist

1. Would still be volume based (as fixed fee would be unfair to smaller accounts)

2. Different pairs have different liquidity, so spreads would still exist.

I am not saying that we can trade at zero spread as you'll always have the liquidity provider's spread but still you could pay a subscription and not a spread to the broker on top of the LP's spread? Whatever the amount on the account, anyone would have to pay, say 30 or 40$ (like a VPS price) and wouldn't suffer any spread beside the LP's.

The "mass" of client would overcome the fixed expenses.

Trader A does 5 trades a month on $100 account. Trader B does 500 trades a month on $10000 account. Trader A should pay same monthly subscription as Trader B? Is that what you want to say?

Yes.

It would obviously not be of interest for accounts lower than 5-10k$. Which is for the good I guess, as liquidity provider doesn't accept micro lots. Very frequent from small accounts.

A smooth sea never made a skillful sailor.

forex_trader_169857

Uczestnik z Dec 31, 2013

164 postów

Jan 21, 2014 at 07:26

Uczestnik z Dec 31, 2013

164 postów

Thalantas posted:MyFxTrader posted:Thalantas posted:ma2000 posted:

@Thalantas @TheCyclist

1. Would still be volume based (as fixed fee would be unfair to smaller accounts)

2. Different pairs have different liquidity, so spreads would still exist.

I am not saying that we can trade at zero spread as you'll always have the liquidity provider's spread but still you could pay a subscription and not a spread to the broker on top of the LP's spread? Whatever the amount on the account, anyone would have to pay, say 30 or 40$ (like a VPS price) and wouldn't suffer any spread beside the LP's.

The "mass" of client would overcome the fixed expenses.

Trader A does 5 trades a month on $100 account. Trader B does 500 trades a month on $10000 account. Trader A should pay same monthly subscription as Trader B? Is that what you want to say?

Yes.

It would obviously not be of interest for accounts lower than 5-10k$. Which is for the good I guess, as liquidity provider doesn't accept micro lots. Very frequent from small accounts.

I believe the current spread system is much better than what you proposed. Spread allows the flexibility to pay per trade. A fixed monthly subscription fee would only accrue to the benefit of high frequency traders at the expanse of traders who trade less frequently. Lots sizes for every position entered need to be dealt with individually and it's insurmountable if a predefined fixed monthly subscription fee is being used.

Uczestnik z Nov 21, 2011

1601 postów

Jan 21, 2014 at 20:23

Uczestnik z Nov 21, 2011

1601 postów

Hi,

I guess Thalantas hasn't presented all the concept, but there is no doubt that a third generation of brokers could be implemented.

FX brokers do not charge for opening accounts, maintenance, closing account... whatever the services. You know why? Just because they make a lot of money while we trade!!!

I have been trading for 5 years and if I calculate what I paid to the brokers since... I would be mad. This cost could be so high that I could feel dizzy.

Let's imagine a broker that stop charging you if you have traded a minimum of lots/month. It's a kinda subscription.

There is obviously a way to make it cheaper for the retail traders, because brokers are the ripp off into Forex market.Iif you loose or win a trade they don't care... they are always 100% wining.

Ps: It's like SMS for phone. It became free because sending a SMS doesn't cost anything and it's included into monthly fees.

I don't think that the price we pay each time we trade is fair.

Thanks to Myfxbook or other community... Imagine we can gather 1000 traders. We could propose the cheapest Broker in the world with same conditions (fast execution,.....)

I guess Thalantas hasn't presented all the concept, but there is no doubt that a third generation of brokers could be implemented.

FX brokers do not charge for opening accounts, maintenance, closing account... whatever the services. You know why? Just because they make a lot of money while we trade!!!

I have been trading for 5 years and if I calculate what I paid to the brokers since... I would be mad. This cost could be so high that I could feel dizzy.

Let's imagine a broker that stop charging you if you have traded a minimum of lots/month. It's a kinda subscription.

There is obviously a way to make it cheaper for the retail traders, because brokers are the ripp off into Forex market.Iif you loose or win a trade they don't care... they are always 100% wining.

Ps: It's like SMS for phone. It became free because sending a SMS doesn't cost anything and it's included into monthly fees.

I don't think that the price we pay each time we trade is fair.

Thanks to Myfxbook or other community... Imagine we can gather 1000 traders. We could propose the cheapest Broker in the world with same conditions (fast execution,.....)

Uczestnik z Nov 21, 2011

1601 postów

Jan 23, 2014 at 02:21

Uczestnik z Nov 21, 2011

1601 postów

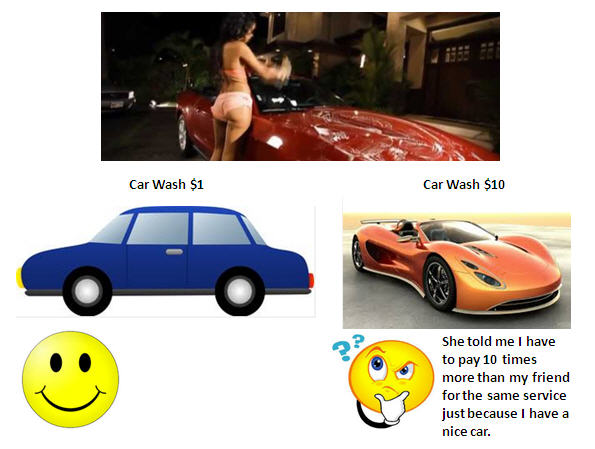

Who think it's normal that broker take proportional commission regarding your lotsize?

That means we don't get charge for the cost of processing an order.

Imagine we had to pay our SMS depending on the number of characters? => This is the same !!!

That means we don't get charge for the cost of processing an order.

Imagine we had to pay our SMS depending on the number of characters? => This is the same !!!

Uczestnik z Nov 21, 2011

1601 postów

Jan 23, 2014 at 11:51

Uczestnik z Nov 21, 2011

1601 postów

vmstrader posted:

What is a wide spread for you?

And, with commissions are you referring to the swap only? Or other commissions as well ??

Thanks, I like your idea

-V-

Well If I have 1000 traders interested and committed like you to change broker we could create the cheapest one.

I wasn't even thinking about Swap... because they also take a percentage into it because whatever the position you hold... the negative swap will always be above the positive swap.

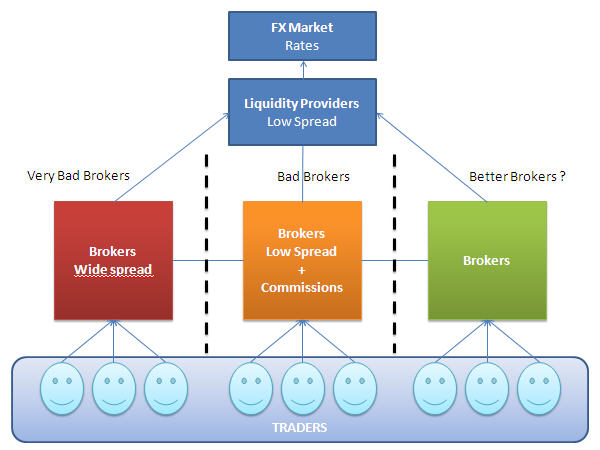

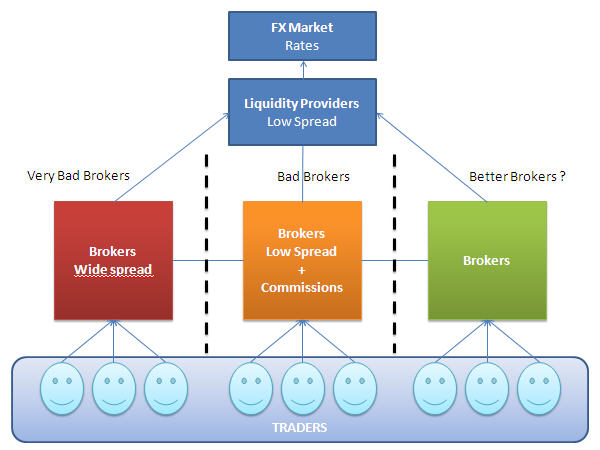

That's why i say actually we have 2 types of brokers into the market: The very bad ones & The bad ones

The very bad ones: Like InstaForex for example (Im sorry to pick up this one... The first one to come into my mind)

They provide to their clients a huge spread. (over 10 pips for some pairs). Then they pretend to provide a big cashback on each trade. In fact the difference between the wide spread and cashback it's a pain for the client's performance account.

The bad ones:

They don't wide the spread. So they are able to provide from 0 pips spread. So to get paid, they add a commission that depends your lotsize.

The better one:

It could provide cheaper cost for the same service.

Uczestnik z Feb 22, 2011

4573 postów

Jan 23, 2014 at 12:37

Uczestnik z Feb 22, 2011

4573 postów

Why don't you use some broker with reasonable spread?

Armada

IcMarkets

Thinkforex

Armada

IcMarkets

Thinkforex

Uczestnik z Nov 21, 2011

1601 postów

Jan 23, 2014 at 12:43

Uczestnik z Nov 21, 2011

1601 postów

togr posted:

Why don't you use some broker with reasonable spread?

Armada

IcMarkets

Thinkforex

I think thoses broker belongs the "Bad one broker".

They provide low spread... but they apply a commission that depends your lotsize.

It's kinda ripp off according to me.

Uczestnik z Feb 22, 2011

4573 postów

Jan 23, 2014 at 15:24

Uczestnik z Feb 22, 2011

4573 postów

CrazyTrader posted:togr posted:

Why don't you use some broker with reasonable spread?

Armada

IcMarkets

Thinkforex

I think thoses broker belongs the "Bad one broker".

They provide low spread... but they apply a commission that depends your lotsize.

It's kinda ripp off according to me.

And what? Cost of trade is spread + markup + commission.

The total amount counts not just spread or just commission.

+ execution, latency, leverage, support, withdrawal...

Give some better if you know some:)

Uczestnik z Nov 21, 2011

1601 postów

Jan 23, 2014 at 16:13

Uczestnik z Nov 21, 2011

1601 postów

And what? Cost of trade is spread + markup + commission.

The total amount counts not just spread or just commission.

+ execution, latency, leverage, support, withdrawal...

Give some better if you know some:)

Cost of trade is: spread + markup + commission ((proportional Lotsize) ) => very bad broker.

Cost of trade is: spread + commission (proportional Lotsize) => bad broker.

Cost of trade is: spread + commission (NOT proportional Lotsize) => Better broker.

Let's remember that a broker is 100% winning because we feed them twice every single trade.

Here we are a community of retail traders. We have the potential to change things because we are so many.

I propose to create a new type of broker:

A "retail" Broker designed by retail traders for retail traders.

If we do so, we will all be more profitable as actual conditions can kill some of us.

If you are with an ECN broker that applies commission... please go to see all your own accounts and check commissions eanrt by your broker. After years, this is going to be inane amount. It can be over your initial deposit.

If you trade with no commissions... The cost would be twice this amount lol.

Obviously this "retail" broker will provide same quality of service ( + execution, latency, leverage, support, withdrawal... )

"Yes we can" if we all want to make it change.

Uczestnik z Feb 22, 2011

4573 postów

Jan 23, 2014 at 16:57

Uczestnik z Feb 22, 2011

4573 postów

CrazyTrader posted:

And what? Cost of trade is spread + markup + commission.

The total amount counts not just spread or just commission.

+ execution, latency, leverage, support, withdrawal...

Give some better if you know some:)

Cost of trade is: spread + markup + commission ((proportional Lotsize) ) => very bad broker.

Cost of trade is: spread + commission (proportional Lotsize) => bad broker.

Cost of trade is: spread + commission (NOT proportional Lotsize) => Better broker.

Let's remember that a broker is 100% winning because we feed them twice every single trade.

Here we are a community of retail traders. We have the potential to change things because we are so many.

I propose to create a new type of broker:

A "retail" Broker designed by retail traders for retail traders.

If we do so, we will all be more profitable as actual conditions can kill some of us.

If you are with an ECN broker that applies commission... please go to see all your own accounts and check commissions eanrt by your broker. After years, this is going to be inane amount. It can be over your initial deposit.

If you trade with no commissions... The cost would be twice this amount lol.

Obviously this "retail" broker will provide same quality of service ( + execution, latency, leverage, support, withdrawal... )

"Yes we can" if we all want to make it change.

That's waste of time. Stop accusing the brokers. There are obviously some very bad but if you earn $1 each trade why do not let broker has its share like $0.1. Focus your energy to have good trading system. Stick to it.

Uczestnik z Nov 21, 2011

1601 postów

Jan 23, 2014 at 17:31

Uczestnik z Nov 21, 2011

1601 postów

I don't debate really for myself... I'm fine with my strategies.

It's just a topic to help 90% looser traders.

Let's be honest here: Only 10% retail traders are winning... so if nobody is interested to save money.

Well let's broker making easy money.

"if you earn $1 each trade why do not let broker has its share like $0.1" for 0.1 Lot"if you earn $10 each trade why do not let broker has its share like $1" for 1 Lot"if you earn $100 each trade why do not let broker has its share like $10" for 10 Lots

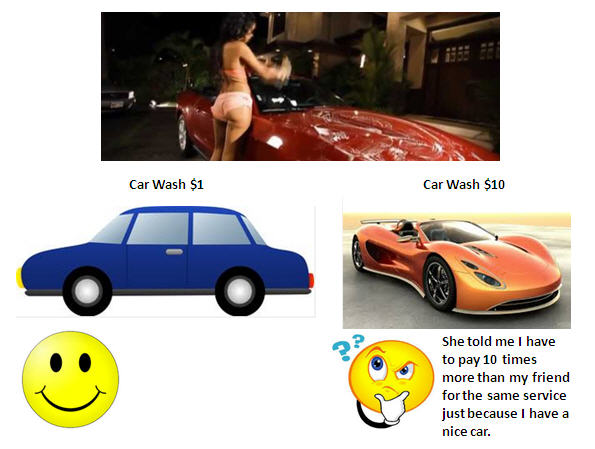

The question is why guys would you accept to pay more for the same service.

It's just a topic to help 90% looser traders.

Let's be honest here: Only 10% retail traders are winning... so if nobody is interested to save money.

Well let's broker making easy money.

"if you earn $1 each trade why do not let broker has its share like $0.1" for 0.1 Lot"if you earn $10 each trade why do not let broker has its share like $1" for 1 Lot"if you earn $100 each trade why do not let broker has its share like $10" for 10 Lots

The question is why guys would you accept to pay more for the same service.

*Komercyjne wykorzystanie i spam są nieprawidłowe i mogą spowodować zamknięcie konta.

Wskazówka: opublikowanie adresu URL obrazu / YouTube automatycznie wstawi go do twojego postu!

Wskazówka: wpisz znak@, aby automatycznie wypełnić nazwę użytkownika uczestniczącego w tej dyskusji.