Edit Your Comment

Profit / loss analysis and trading talks

Biedrs kopš

321 ieraksti

Apr 24, 2024 at 19:44

Biedrs kopš

321 ieraksti

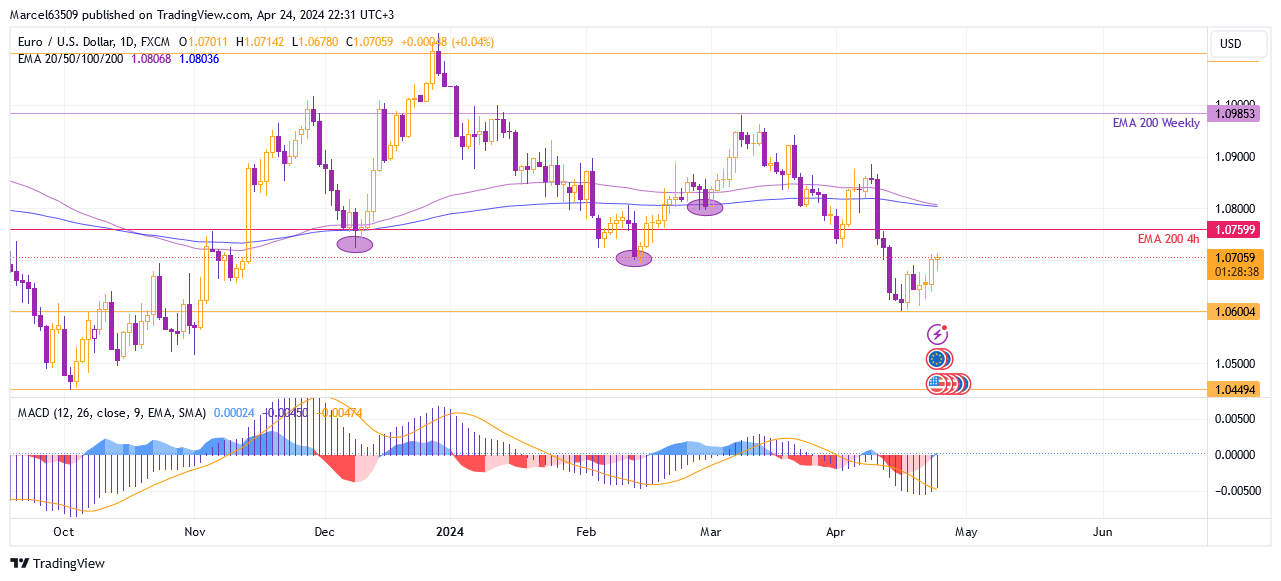

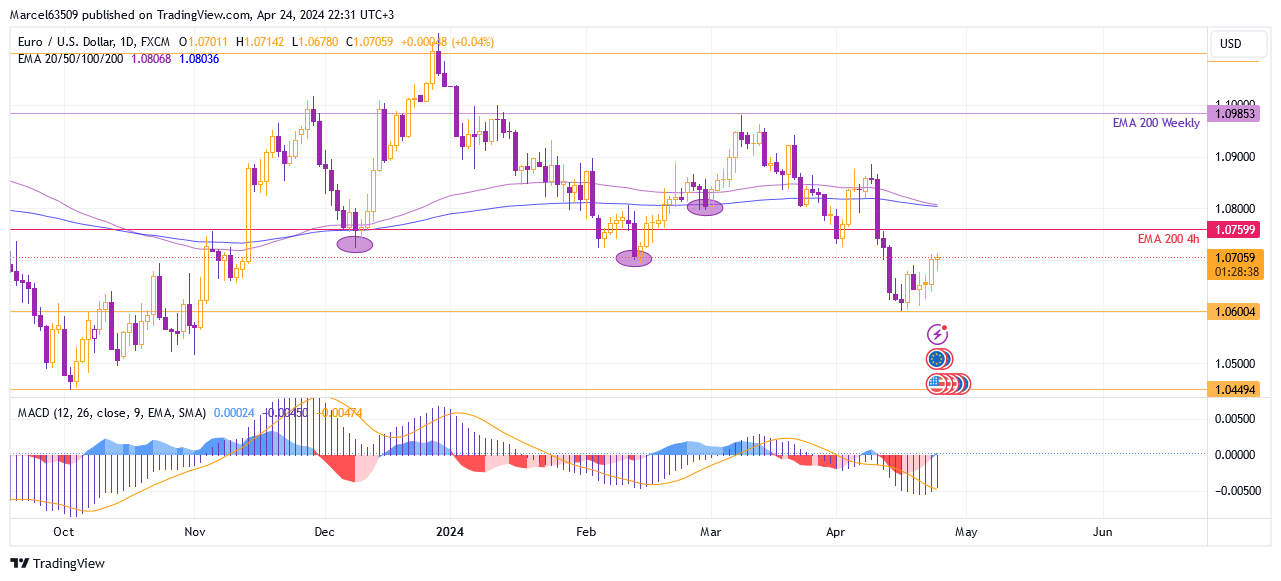

Some EUR/USD trading talks.

EUR/USD is trying to regain the level lost last week, starting a correction after falling to 1.06000. However, I see the possibility of the fall continuation and even an attempt to decline to 1.04500.

On the four-hour chart, the Euro Dollar is now trying to cross the EMA 100, which coincides with the key resistance level of 1.07000. Thus, the currency pair will face a strong obstacle to growth, which may lead to further decline. In addition to the EMA 100 level, on the four-hour chart I would highlight the EMA 200 level, which will be a marker for buying if nevertheless the market overcomes 1.07000 and has the power to grow further. But even in case of growth, the prospect of possible targets does not look attractive, because at the level of 1.08100 the currency pair will encounter additional resistance, which is also the level of the current daily EMA 100, 200. The next level will be located nearby, at 1.08800.

In my opinion, at the moment, it is more likely that the correction will end, it’s already exhausted, and will fall again to 1.06000. However, this may be the beginning of some correctional channel with several stages of fluctuations, but nevertheless, if 1.06000 is passed, then a fall to 1.04500 will be a logical continuation. If in the near future, after testing the four-hour EMA 100 at 1.07150, the price does not go higher, but begins to fall, then the MACD will confirm the prospect of a further fall deeper, moving into the negative zone.

EUR/USD is trying to regain the level lost last week, starting a correction after falling to 1.06000. However, I see the possibility of the fall continuation and even an attempt to decline to 1.04500.

On the four-hour chart, the Euro Dollar is now trying to cross the EMA 100, which coincides with the key resistance level of 1.07000. Thus, the currency pair will face a strong obstacle to growth, which may lead to further decline. In addition to the EMA 100 level, on the four-hour chart I would highlight the EMA 200 level, which will be a marker for buying if nevertheless the market overcomes 1.07000 and has the power to grow further. But even in case of growth, the prospect of possible targets does not look attractive, because at the level of 1.08100 the currency pair will encounter additional resistance, which is also the level of the current daily EMA 100, 200. The next level will be located nearby, at 1.08800.

In my opinion, at the moment, it is more likely that the correction will end, it’s already exhausted, and will fall again to 1.06000. However, this may be the beginning of some correctional channel with several stages of fluctuations, but nevertheless, if 1.06000 is passed, then a fall to 1.04500 will be a logical continuation. If in the near future, after testing the four-hour EMA 100 at 1.07150, the price does not go higher, but begins to fall, then the MACD will confirm the prospect of a further fall deeper, moving into the negative zone.

@Marcellus8610

Biedrs kopš

43 ieraksti

Apr 25, 2024 at 06:54

Biedrs kopš

43 ieraksti

I love your insights on EUR/USD trading! Your analysis is thorough and provides a clear picture of potential market movements. Keep up the great work; your expertise is truly valuable!

Biedrs kopš

68 ieraksti

Apr 25, 2024 at 12:33

Biedrs kopš

68 ieraksti

MarcellusLux posted:

Some EUR/USD trading talks.

EUR/USD is trying to regain the level lost last week, starting a correction after falling to 1.06000. However, I see the possibility of the fall continuation and even an attempt to decline to 1.04500.

On the four-hour chart, the Euro Dollar is now trying to cross the EMA 100, which coincides with the key resistance level of 1.07000. Thus, the currency pair will face a strong obstacle to growth, which may lead to further decline. In addition to the EMA 100 level, on the four-hour chart I would highlight the EMA 200 level, which will be a marker for buying if nevertheless the market overcomes 1.07000 and has the power to grow further. But even in case of growth, the prospect of possible targets does not look attractive, because at the level of 1.08100 the currency pair will encounter additional resistance, which is also the level of the current daily EMA 100, 200. The next level will be located nearby, at 1.08800.

In my opinion, at the moment, it is more likely that the correction will end, it’s already exhausted, and will fall again to 1.06000. However, this may be the beginning of some correctional channel with several stages of fluctuations, but nevertheless, if 1.06000 is passed, then a fall to 1.04500 will be a logical continuation. If in the near future, after testing the four-hour EMA 100 at 1.07150, the price does not go higher, but begins to fall, then the MACD will confirm the prospect of a further fall deeper, moving into the negative zone.

https://www.myfxbook.com/files/MarcellusLux/EurUsd_trading_talks_April_24_%28ce07vr%29_lj.png

You say EMA 200 as a buy signal? That's if we clear the hurdle at 1.07000.

But the way I see it, the charts are whispering 'sell' more than 'buy' right now.

Biedrs kopš

68 ieraksti

Apr 26, 2024 at 10:06

Biedrs kopš

68 ieraksti

Made a short analyze of GBP/USD

GBP/USD bounced from 1.23000, showing buyers stepping in. The pair is testing the 1.26000 level; if it can hold above, we might see more rise. The key is if it can stay over the EMA 100 on the 4-hour chart. If it fails and falls below, the price could drop to 1.23000 again. Watch for a solid move beyond EMA 100 for a clear signal.

GBP/USD bounced from 1.23000, showing buyers stepping in. The pair is testing the 1.26000 level; if it can hold above, we might see more rise. The key is if it can stay over the EMA 100 on the 4-hour chart. If it fails and falls below, the price could drop to 1.23000 again. Watch for a solid move beyond EMA 100 for a clear signal.

Biedrs kopš

9 ieraksti

Apr 29, 2024 at 09:28

Biedrs kopš

9 ieraksti

Raven1209 posted:

Made a short analyze of GBP/USD

GBP/USD bounced from 1.23000, showing buyers stepping in. The pair is testing the 1.26000 level; if it can hold above, we might see more rise. The key is if it can stay over the EMA 100 on the 4-hour chart. If it fails and falls below, the price could drop to 1.23000 again. Watch for a solid move beyond EMA 100 for a clear signal.

Now the pair is still consolidating in the same area and will not break through the resistance level. I expected that after the gap the market movement would be more clear.

Biedrs kopš

57 ieraksti

Apr 30, 2024 at 12:28

Biedrs kopš

57 ieraksti

khalidkhan82118 posted:MarcellusLux posted:

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

I suppose it's more a mix of technical and fundamental analysis.

Biedrs kopš

43 ieraksti

Apr 30, 2024 at 14:27

Biedrs kopš

43 ieraksti

lexusxxx posted:khalidkhan82118 posted:MarcellusLux posted:

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

I suppose it's more a mix of technical and fundamental analysis.

It's definitely a mix of both! I've been incorporating both technical and fundamental analysis into my approach, but sometimes the market surprises us. Do you find one analysis method tends to carry more weight in your trading decisions, or do you prefer to blend them together like I do?

Biedrs kopš

41 ieraksti

Apr 30, 2024 at 16:45

Biedrs kopš

41 ieraksti

@MarcellusLux You say that you constantly manage to improve your system. How do you understand that it is getting better?

Biedrs kopš

41 ieraksti

Apr 30, 2024 at 16:47

Biedrs kopš

41 ieraksti

Raven1209 posted:Gert12 posted:Raven1209 posted:Michel_Dubois posted:

Well I have other question. Is there any point in doing a trade analysis if you trade with a scalping robot? I just wondering about my trade.

In any case, you can evaluate the overall picture of trading efficiency.

Can you give advice on how to analyze a large number of transactions? For example scalping strategy?

Where there is one trade I already roughly understand. But when are there many of them? Which method will be more effective?

For high-volume strategies like scalping, consider using automated tools like MT. This can make it easier to evaluate performance without getting lost in the details.

Thanks, but how to do this?

Biedrs kopš

57 ieraksti

May 01, 2024 at 11:24

Biedrs kopš

57 ieraksti

khalidkhan82118 posted:lexusxxx posted:khalidkhan82118 posted:MarcellusLux posted:

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

I suppose it's more a mix of technical and fundamental analysis.

It's definitely a mix of both! I've been incorporating both technical and fundamental analysis into my approach, but sometimes the market surprises us. Do you find one analysis method tends to carry more weight in your trading decisions, or do you prefer to blend them together like I do?

I trade advisors, and I buy them from time to time, because you are right, market conditions change and the same advisor that worked well before may no longer work so well.

Therefore, Idont make deep analysis, and fundamental analysis is not suitable for me, since I trade short periods. Nevertheless, I am interested in different methods of analysis in order to understand more. And I also noticed that it is very difficult to concentrate on only one type of market analysis. And what about you? Do you trade manually?

Biedrs kopš

43 ieraksti

May 01, 2024 at 13:45

Biedrs kopš

43 ieraksti

lexusxxx posted:khalidkhan82118 posted:lexusxxx posted:khalidkhan82118 posted:MarcellusLux posted:

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

I suppose it's more a mix of technical and fundamental analysis.

It's definitely a mix of both! I've been incorporating both technical and fundamental analysis into my approach, but sometimes the market surprises us. Do you find one analysis method tends to carry more weight in your trading decisions, or do you prefer to blend them together like I do?

I trade advisors, and I buy them from time to time, because you are right, market conditions change and the same advisor that worked well before may no longer work so well.

Therefore, Idont make deep analysis, and fundamental analysis is not suitable for me, since I trade short periods. Nevertheless, I am interested in different methods of analysis in order to understand more. And I also noticed that it is very difficult to concentrate on only one type of market analysis. And what about you? Do you trade manually?

I understand where you're coming from! Market conditions can shift quickly, making relying solely on one analysis method challenging. I also dabble in trading manually, but I've found that blending technical and fundamental analysis helps me navigate the fluctuations more effectively. It's all about finding the best for your trading style and adapting as needed. Exploring different analysis methods broadens your understanding of the market. It's an ever-evolving journey.

Biedrs kopš

57 ieraksti

May 02, 2024 at 11:45

Biedrs kopš

57 ieraksti

khalidkhan82118 posted:lexusxxx posted:khalidkhan82118 posted:lexusxxx posted:khalidkhan82118 posted:MarcellusLux posted:

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

I suppose it's more a mix of technical and fundamental analysis.

It's definitely a mix of both! I've been incorporating both technical and fundamental analysis into my approach, but sometimes the market surprises us. Do you find one analysis method tends to carry more weight in your trading decisions, or do you prefer to blend them together like I do?

I trade advisors, and I buy them from time to time, because you are right, market conditions change and the same advisor that worked well before may no longer work so well.

Therefore, Idont make deep analysis, and fundamental analysis is not suitable for me, since I trade short periods. Nevertheless, I am interested in different methods of analysis in order to understand more. And I also noticed that it is very difficult to concentrate on only one type of market analysis. And what about you? Do you trade manually?

I understand where you're coming from! Market conditions can shift quickly, making relying solely on one analysis method challenging. I also dabble in trading manually, but I've found that blending technical and fundamental analysis helps me navigate the fluctuations more effectively. It's all about finding the best for your trading style and adapting as needed. Exploring different analysis methods broadens your understanding of the market. It's an ever-evolving journey.

So true, that's why I'm here as an observer and one who learns some useful tips from the experienced ones.

Biedrs kopš

9 ieraksti

May 02, 2024 at 18:11

Biedrs kopš

9 ieraksti

@MarcellusLux I've been watching your trading for a long time. I added you to my contacts, please confirm. I also wrote you an email. Thank you.

Biedrs kopš

43 ieraksti

May 03, 2024 at 05:15

Biedrs kopš

43 ieraksti

lexusxxx posted:khalidkhan82118 posted:lexusxxx posted:khalidkhan82118 posted:lexusxxx posted:khalidkhan82118 posted:MarcellusLux posted:

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

I suppose it's more a mix of technical and fundamental analysis.

It's definitely a mix of both! I've been incorporating both technical and fundamental analysis into my approach, but sometimes the market surprises us. Do you find one analysis method tends to carry more weight in your trading decisions, or do you prefer to blend them together like I do?

I trade advisors, and I buy them from time to time, because you are right, market conditions change and the same advisor that worked well before may no longer work so well.

Therefore, Idont make deep analysis, and fundamental analysis is not suitable for me, since I trade short periods. Nevertheless, I am interested in different methods of analysis in order to understand more. And I also noticed that it is very difficult to concentrate on only one type of market analysis. And what about you? Do you trade manually?

I understand where you're coming from! Market conditions can shift quickly, making relying solely on one analysis method challenging. I also dabble in trading manually, but I've found that blending technical and fundamental analysis helps me navigate the fluctuations more effectively. It's all about finding the best for your trading style and adapting as needed. Exploring different analysis methods broadens your understanding of the market. It's an ever-evolving journey.

So true, that's why I'm here as an observer and one who learns some useful tips from the experienced ones.

Absolutely! Being an observer and learning from experienced traders is a fantastic approach. It's a dynamic space, and there's always something new to discover. Feel free to ask if you ever want to delve deeper into any aspect of trading or analysis!

Biedrs kopš

321 ieraksti

May 06, 2024 at 07:21

Biedrs kopš

321 ieraksti

Gert12 posted:

@MarcellusLux You say that you constantly manage to improve your system. How do you understand that it is getting better?

The initial parameters that can be considered are system profitability and consistency. But at the moment, when the system already shows good results, I am trying to improve trading by searching for the best combination of trading quality and trading frequency. In some cases, I work on certain market situations and see the result of changes when the trading system begins to make a profit on those patterns where there were previously mistakes and losses.

@Marcellus8610

Biedrs kopš

41 ieraksti

May 06, 2024 at 11:01

Biedrs kopš

41 ieraksti

MarcellusLux posted:Gert12 posted:

@MarcellusLux You say that you constantly manage to improve your system. How do you understand that it is getting better?

The initial parameters that can be considered are system profitability and consistency. But at the moment, when the system already shows good results, I am trying to improve trading by searching for the best combination of trading quality and trading frequency. In some cases, I work on certain market situations and see the result of changes when the trading system begins to make a profit on those patterns where there were previously mistakes and losses.

Okay, is there any chance to improve the working trading system, in which losses completely offset profits? Or is it easier to create again?

Biedrs kopš

9 ieraksti

May 06, 2024 at 17:31

Biedrs kopš

9 ieraksti

MarcellusLux posted:Gert12 posted:

@MarcellusLux You say that you constantly manage to improve your system. How do you understand that it is getting better?

The initial parameters that can be considered are system profitability and consistency. But at the moment, when the system already shows good results, I am trying to improve trading by searching for the best combination of trading quality and trading frequency. In some cases, I work on certain market situations and see the result of changes when the trading system begins to make a profit on those patterns where there were previously mistakes and losses.

I suppose your approach and, in particular, the analysis of profitable and losing trades is really very useful material. I began to understand a little about trades and analyze them. Perhaps later I will also share my success.

Biedrs kopš

57 ieraksti

May 07, 2024 at 14:11

Biedrs kopš

57 ieraksti

khalidkhan82118 posted:lexusxxx posted:khalidkhan82118 posted:lexusxxx posted:khalidkhan82118 posted:lexusxxx posted:khalidkhan82118 posted:MarcellusLux posted:

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

I suppose it's more a mix of technical and fundamental analysis.

It's definitely a mix of both! I've been incorporating both technical and fundamental analysis into my approach, but sometimes the market surprises us. Do you find one analysis method tends to carry more weight in your trading decisions, or do you prefer to blend them together like I do?

I trade advisors, and I buy them from time to time, because you are right, market conditions change and the same advisor that worked well before may no longer work so well.

Therefore, Idont make deep analysis, and fundamental analysis is not suitable for me, since I trade short periods. Nevertheless, I am interested in different methods of analysis in order to understand more. And I also noticed that it is very difficult to concentrate on only one type of market analysis. And what about you? Do you trade manually?

I understand where you're coming from! Market conditions can shift quickly, making relying solely on one analysis method challenging. I also dabble in trading manually, but I've found that blending technical and fundamental analysis helps me navigate the fluctuations more effectively. It's all about finding the best for your trading style and adapting as needed. Exploring different analysis methods broadens your understanding of the market. It's an ever-evolving journey.

So true, that's why I'm here as an observer and one who learns some useful tips from the experienced ones.

Absolutely! Being an observer and learning from experienced traders is a fantastic approach. It's a dynamic space, and there's always something new to discover. Feel free to ask if you ever want to delve deeper into any aspect of trading or analysis!

Yeah thank you I'll keep it in mind. This is actually why we are all here.

Biedrs kopš

68 ieraksti

May 08, 2024 at 11:16

Biedrs kopš

68 ieraksti

Jumped into a short on EUR/USD at 1.07717, anticipating a downturn. With the market's recent behavior, I sensed a drop was imminent. Kept the position open for two days, holding firm in my conviction of a bearish outcome. My take profit was initially set at 1.07407, but I opted to close the trade manually at 1.07461. Although slightly off from my target, this maneuver still secured a profit of $5,120. This manual close allowed me to capitalize on the optimal moment, showcasing the importance of staying adaptable in the forex game. Next time, I might tweak the exit strategy a bit more to fully capture potential gains.

Biedrs kopš

68 ieraksti

May 08, 2024 at 11:21

Biedrs kopš

68 ieraksti

Gert12 posted:Raven1209 posted:Gert12 posted:Raven1209 posted:Michel_Dubois posted:

Well I have other question. Is there any point in doing a trade analysis if you trade with a scalping robot? I just wondering about my trade.

In any case, you can evaluate the overall picture of trading efficiency.

Can you give advice on how to analyze a large number of transactions? For example scalping strategy?

Where there is one trade I already roughly understand. But when are there many of them? Which method will be more effective?

For high-volume strategies like scalping, consider using automated tools like MT. This can make it easier to evaluate performance without getting lost in the details.

Thanks, but how to do this?

Its easy.

In you MT trading history right click on any trade and " Save as a Report" or "save as detailed report".

For scalping you also can firstly choose a period choosing "Custom period".

Hope it will help😐

*Spams netiks pieļauts, un tā rezultātā var slēgt kontu.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.

_lj.png)