Edit Your Comment

Profit / loss analysis and trading talks

Uczestnik z May 19, 2020

402 postów

Apr 24 at 19:44

Uczestnik z May 19, 2020

402 postów

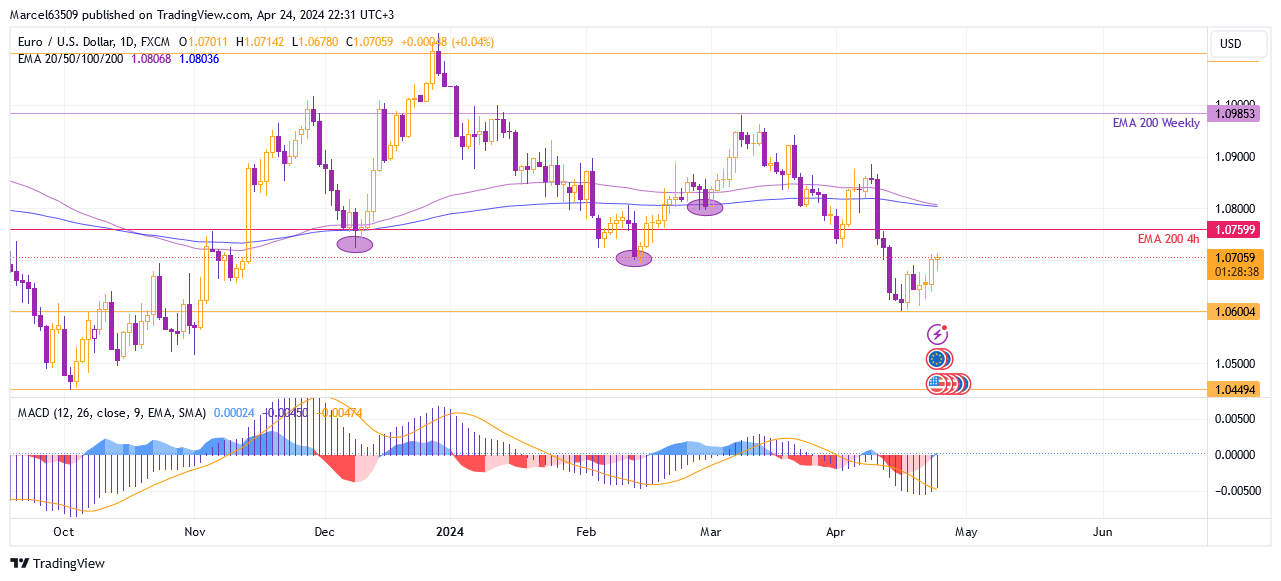

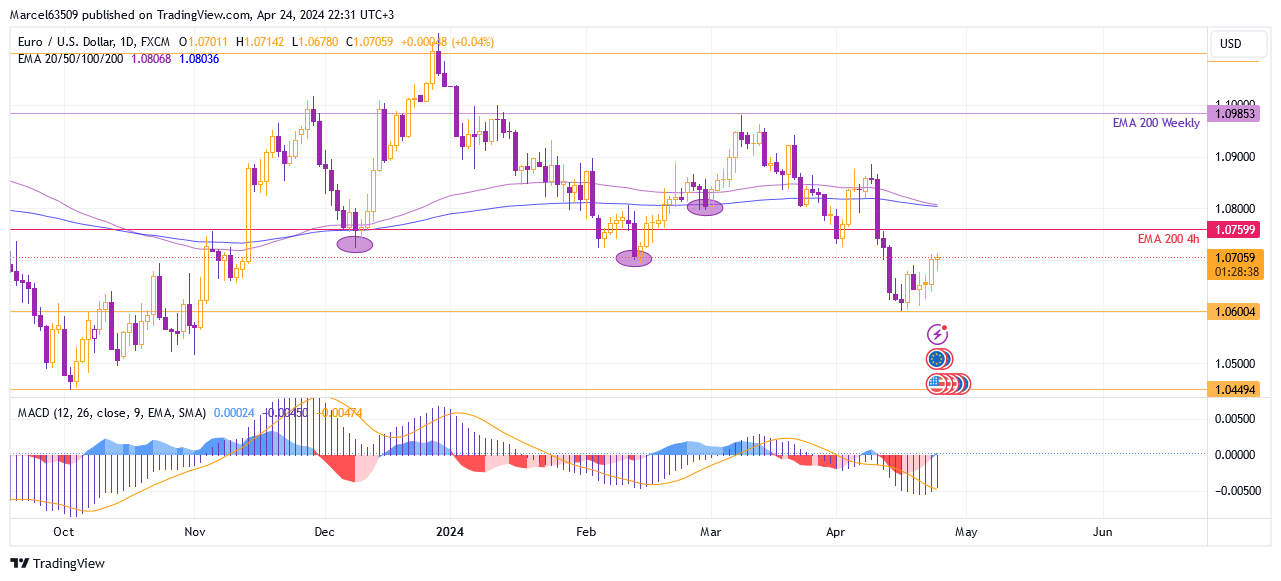

Some EUR/USD trading talks.

EUR/USD is trying to regain the level lost last week, starting a correction after falling to 1.06000. However, I see the possibility of the fall continuation and even an attempt to decline to 1.04500.

On the four-hour chart, the Euro Dollar is now trying to cross the EMA 100, which coincides with the key resistance level of 1.07000. Thus, the currency pair will face a strong obstacle to growth, which may lead to further decline. In addition to the EMA 100 level, on the four-hour chart I would highlight the EMA 200 level, which will be a marker for buying if nevertheless the market overcomes 1.07000 and has the power to grow further. But even in case of growth, the prospect of possible targets does not look attractive, because at the level of 1.08100 the currency pair will encounter additional resistance, which is also the level of the current daily EMA 100, 200. The next level will be located nearby, at 1.08800.

In my opinion, at the moment, it is more likely that the correction will end, it’s already exhausted, and will fall again to 1.06000. However, this may be the beginning of some correctional channel with several stages of fluctuations, but nevertheless, if 1.06000 is passed, then a fall to 1.04500 will be a logical continuation. If in the near future, after testing the four-hour EMA 100 at 1.07150, the price does not go higher, but begins to fall, then the MACD will confirm the prospect of a further fall deeper, moving into the negative zone.

EUR/USD is trying to regain the level lost last week, starting a correction after falling to 1.06000. However, I see the possibility of the fall continuation and even an attempt to decline to 1.04500.

On the four-hour chart, the Euro Dollar is now trying to cross the EMA 100, which coincides with the key resistance level of 1.07000. Thus, the currency pair will face a strong obstacle to growth, which may lead to further decline. In addition to the EMA 100 level, on the four-hour chart I would highlight the EMA 200 level, which will be a marker for buying if nevertheless the market overcomes 1.07000 and has the power to grow further. But even in case of growth, the prospect of possible targets does not look attractive, because at the level of 1.08100 the currency pair will encounter additional resistance, which is also the level of the current daily EMA 100, 200. The next level will be located nearby, at 1.08800.

In my opinion, at the moment, it is more likely that the correction will end, it’s already exhausted, and will fall again to 1.06000. However, this may be the beginning of some correctional channel with several stages of fluctuations, but nevertheless, if 1.06000 is passed, then a fall to 1.04500 will be a logical continuation. If in the near future, after testing the four-hour EMA 100 at 1.07150, the price does not go higher, but begins to fall, then the MACD will confirm the prospect of a further fall deeper, moving into the negative zone.

@Marcellus8610

Uczestnik z Apr 08, 2024

34 postów

Apr 25 at 12:33

Uczestnik z Sep 29, 2022

62 postów

MarcellusLux posted:You say EMA 200 as a buy signal? That's if we clear the hurdle at 1.07000.

Some EUR/USD trading talks.

EUR/USD is trying to regain the level lost last week, starting a correction after falling to 1.06000. However, I see the possibility of the fall continuation and even an attempt to decline to 1.04500.

On the four-hour chart, the Euro Dollar is now trying to cross the EMA 100, which coincides with the key resistance level of 1.07000. Thus, the currency pair will face a strong obstacle to growth, which may lead to further decline. In addition to the EMA 100 level, on the four-hour chart I would highlight the EMA 200 level, which will be a marker for buying if nevertheless the market overcomes 1.07000 and has the power to grow further. But even in case of growth, the prospect of possible targets does not look attractive, because at the level of 1.08100 the currency pair will encounter additional resistance, which is also the level of the current daily EMA 100, 200. The next level will be located nearby, at 1.08800.

In my opinion, at the moment, it is more likely that the correction will end, it’s already exhausted, and will fall again to 1.06000. However, this may be the beginning of some correctional channel with several stages of fluctuations, but nevertheless, if 1.06000 is passed, then a fall to 1.04500 will be a logical continuation. If in the near future, after testing the four-hour EMA 100 at 1.07150, the price does not go higher, but begins to fall, then the MACD will confirm the prospect of a further fall deeper, moving into the negative zone.

But the way I see it, the charts are whispering 'sell' more than 'buy' right now.

Apr 26 at 10:06

Uczestnik z Sep 29, 2022

62 postów

Made a short analyze of GBP/USD

GBP/USD bounced from 1.23000, showing buyers stepping in. The pair is testing the 1.26000 level; if it can hold above, we might see more rise. The key is if it can stay over the EMA 100 on the 4-hour chart. If it fails and falls below, the price could drop to 1.23000 again. Watch for a solid move beyond EMA 100 for a clear signal.

GBP/USD bounced from 1.23000, showing buyers stepping in. The pair is testing the 1.26000 level; if it can hold above, we might see more rise. The key is if it can stay over the EMA 100 on the 4-hour chart. If it fails and falls below, the price could drop to 1.23000 again. Watch for a solid move beyond EMA 100 for a clear signal.

Uczestnik z Apr 04, 2023

8 postów

Apr 29 at 09:28

Uczestnik z Apr 04, 2023

8 postów

Raven1209 posted:Now the pair is still consolidating in the same area and will not break through the resistance level. I expected that after the gap the market movement would be more clear.

Made a short analyze of GBP/USD

GBP/USD bounced from 1.23000, showing buyers stepping in. The pair is testing the 1.26000 level; if it can hold above, we might see more rise. The key is if it can stay over the EMA 100 on the 4-hour chart. If it fails and falls below, the price could drop to 1.23000 again. Watch for a solid move beyond EMA 100 for a clear signal.

Apr 30 at 12:28

Uczestnik z Sep 02, 2022

54 postów

khalidkhan82118 posted:I suppose it's more a mix of technical and fundamental analysis.MarcellusLux posted:Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Uczestnik z Apr 08, 2024

34 postów

Apr 30 at 14:27

Uczestnik z Apr 08, 2024

34 postów

lexusxxx posted:It's definitely a mix of both! I've been incorporating both technical and fundamental analysis into my approach, but sometimes the market surprises us. Do you find one analysis method tends to carry more weight in your trading decisions, or do you prefer to blend them together like I do?khalidkhan82118 posted:I suppose it's more a mix of technical and fundamental analysis.MarcellusLux posted:Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Apr 30 at 16:45

Uczestnik z Dec 28, 2023

28 postów

@MarcellusLux You say that you constantly manage to improve your system. How do you understand that it is getting better?

Apr 30 at 16:47

Uczestnik z Dec 28, 2023

28 postów

Raven1209 posted:Thanks, but how to do this?Gert12 posted:For high-volume strategies like scalping, consider using automated tools like MT. This can make it easier to evaluate performance without getting lost in the details.Raven1209 posted:Can you give advice on how to analyze a large number of transactions? For example scalping strategy?Michel_Dubois posted:In any case, you can evaluate the overall picture of trading efficiency.

Well I have other question. Is there any point in doing a trade analysis if you trade with a scalping robot? I just wondering about my trade.

Where there is one trade I already roughly understand. But when are there many of them? Which method will be more effective?

May 01 at 11:24

Uczestnik z Sep 02, 2022

54 postów

khalidkhan82118 posted:I trade advisors, and I buy them from time to time, because you are right, market conditions change and the same advisor that worked well before may no longer work so well.lexusxxx posted:It's definitely a mix of both! I've been incorporating both technical and fundamental analysis into my approach, but sometimes the market surprises us. Do you find one analysis method tends to carry more weight in your trading decisions, or do you prefer to blend them together like I do?khalidkhan82118 posted:I suppose it's more a mix of technical and fundamental analysis.MarcellusLux posted:Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Therefore, Idont make deep analysis, and fundamental analysis is not suitable for me, since I trade short periods. Nevertheless, I am interested in different methods of analysis in order to understand more. And I also noticed that it is very difficult to concentrate on only one type of market analysis. And what about you? Do you trade manually?

Uczestnik z Apr 08, 2024

34 postów

May 01 at 13:45

Uczestnik z Apr 08, 2024

34 postów

lexusxxx posted:I understand where you're coming from! Market conditions can shift quickly, making relying solely on one analysis method challenging. I also dabble in trading manually, but I've found that blending technical and fundamental analysis helps me navigate the fluctuations more effectively. It's all about finding the best for your trading style and adapting as needed. Exploring different analysis methods broadens your understanding of the market. It's an ever-evolving journey.khalidkhan82118 posted:I trade advisors, and I buy them from time to time, because you are right, market conditions change and the same advisor that worked well before may no longer work so well.lexusxxx posted:It's definitely a mix of both! I've been incorporating both technical and fundamental analysis into my approach, but sometimes the market surprises us. Do you find one analysis method tends to carry more weight in your trading decisions, or do you prefer to blend them together like I do?khalidkhan82118 posted:I suppose it's more a mix of technical and fundamental analysis.MarcellusLux posted:Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Therefore, Idont make deep analysis, and fundamental analysis is not suitable for me, since I trade short periods. Nevertheless, I am interested in different methods of analysis in order to understand more. And I also noticed that it is very difficult to concentrate on only one type of market analysis. And what about you? Do you trade manually?

May 02 at 11:45

Uczestnik z Sep 02, 2022

54 postów

khalidkhan82118 posted:So true, that's why I'm here as an observer and one who learns some useful tips from the experienced ones.lexusxxx posted:I understand where you're coming from! Market conditions can shift quickly, making relying solely on one analysis method challenging. I also dabble in trading manually, but I've found that blending technical and fundamental analysis helps me navigate the fluctuations more effectively. It's all about finding the best for your trading style and adapting as needed. Exploring different analysis methods broadens your understanding of the market. It's an ever-evolving journey.khalidkhan82118 posted:I trade advisors, and I buy them from time to time, because you are right, market conditions change and the same advisor that worked well before may no longer work so well.lexusxxx posted:It's definitely a mix of both! I've been incorporating both technical and fundamental analysis into my approach, but sometimes the market surprises us. Do you find one analysis method tends to carry more weight in your trading decisions, or do you prefer to blend them together like I do?khalidkhan82118 posted:I suppose it's more a mix of technical and fundamental analysis.MarcellusLux posted:Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Therefore, Idont make deep analysis, and fundamental analysis is not suitable for me, since I trade short periods. Nevertheless, I am interested in different methods of analysis in order to understand more. And I also noticed that it is very difficult to concentrate on only one type of market analysis. And what about you? Do you trade manually?

May 02 at 18:11

Uczestnik z Dec 09, 2022

16 postów

@MarcellusLux I've been watching your trading for a long time. I added you to my contacts, please confirm. I also wrote you an email. Thank you.

Uczestnik z Apr 08, 2024

34 postów

May 03 at 05:15

Uczestnik z Apr 08, 2024

34 postów

lexusxxx posted:Absolutely! Being an observer and learning from experienced traders is a fantastic approach. It's a dynamic space, and there's always something new to discover. Feel free to ask if you ever want to delve deeper into any aspect of trading or analysis!khalidkhan82118 posted:So true, that's why I'm here as an observer and one who learns some useful tips from the experienced ones.lexusxxx posted:I understand where you're coming from! Market conditions can shift quickly, making relying solely on one analysis method challenging. I also dabble in trading manually, but I've found that blending technical and fundamental analysis helps me navigate the fluctuations more effectively. It's all about finding the best for your trading style and adapting as needed. Exploring different analysis methods broadens your understanding of the market. It's an ever-evolving journey.khalidkhan82118 posted:I trade advisors, and I buy them from time to time, because you are right, market conditions change and the same advisor that worked well before may no longer work so well.lexusxxx posted:It's definitely a mix of both! I've been incorporating both technical and fundamental analysis into my approach, but sometimes the market surprises us. Do you find one analysis method tends to carry more weight in your trading decisions, or do you prefer to blend them together like I do?khalidkhan82118 posted:I suppose it's more a mix of technical and fundamental analysis.MarcellusLux posted:Absolutely, It gonna sharpened endlessly. BTW is this thing called Fundamental analysis?

Of course, with each new analysis I try to become better and grow, but after many years of practice, I realized that this sword can be sharpened endlessly.

Therefore, Idont make deep analysis, and fundamental analysis is not suitable for me, since I trade short periods. Nevertheless, I am interested in different methods of analysis in order to understand more. And I also noticed that it is very difficult to concentrate on only one type of market analysis. And what about you? Do you trade manually?

Uczestnik z May 19, 2020

402 postów

8 godzin temu

Uczestnik z May 19, 2020

402 postów

Gert12 posted:The initial parameters that can be considered are system profitability and consistency. But at the moment, when the system already shows good results, I am trying to improve trading by searching for the best combination of trading quality and trading frequency. In some cases, I work on certain market situations and see the result of changes when the trading system begins to make a profit on those patterns where there were previously mistakes and losses.

@MarcellusLux You say that you constantly manage to improve your system. How do you understand that it is getting better?

@Marcellus8610

4 godzin temu

Uczestnik z Dec 28, 2023

28 postów

MarcellusLux posted:Okay, is there any chance to improve the working trading system, in which losses completely offset profits? Or is it easier to create again?Gert12 posted:The initial parameters that can be considered are system profitability and consistency. But at the moment, when the system already shows good results, I am trying to improve trading by searching for the best combination of trading quality and trading frequency. In some cases, I work on certain market situations and see the result of changes when the trading system begins to make a profit on those patterns where there were previously mistakes and losses.

@MarcellusLux You say that you constantly manage to improve your system. How do you understand that it is getting better?

*Komercyjne wykorzystanie i spam są nieprawidłowe i mogą spowodować zamknięcie konta.

Wskazówka: opublikowanie adresu URL obrazu / YouTube automatycznie wstawi go do twojego postu!

Wskazówka: wpisz znak@, aby automatycznie wypełnić nazwę użytkownika uczestniczącego w tej dyskusji.

_lj.png)