- Domů

- Komunita

- Noví obchodníci

- Account size, Position Size and leverage

Advertisement

Edit Your Comment

Account size, Position Size and leverage

Členem od Mar 24, 2016

6 příspěvků

Apr 05, 2016 at 10:27

Členem od Mar 24, 2016

6 příspěvků

Hi guys,

Wish to ask fellow newbies / experienced traders on this.

Whats your account size, position size and leverage that you are using / have used when you

just started out trading your first live account?

Want to get an idea before i start my live account to get my feet wet a little.

Also what kind or return should i set as a benchmark for day trading / swing trading perspective

if you have any suggestions / experience in that for a newbie.

thanks in advance :D

Wish to ask fellow newbies / experienced traders on this.

Whats your account size, position size and leverage that you are using / have used when you

just started out trading your first live account?

Want to get an idea before i start my live account to get my feet wet a little.

Also what kind or return should i set as a benchmark for day trading / swing trading perspective

if you have any suggestions / experience in that for a newbie.

thanks in advance :D

Členem od Apr 08, 2016

8 příspěvků

Apr 09, 2016 at 10:39

Členem od Apr 08, 2016

8 příspěvků

When I started trading myself, I used to blow about 5K per month. Till now I have stopped this and started trusting professionals so I have begun to invest. Actually it is better to start with $1K, but it mostly depends on your possibilities

Money should work for you, not you for them

Členem od Sep 20, 2014

342 příspěvků

Apr 09, 2016 at 13:23

Členem od Sep 20, 2014

342 příspěvků

@BIGBEARBROTHER

That's spectacularly bad advice mate. No wonder you lost $5k a month.

@shienri

Your position size should be determined by your account size, leverage I pretty much ignore since my trade sizes are such that they are a reasonable percentage of my un-leveraged account size.

The problem with MT is the minimum trade size is to big for most accounts. At 0.01 lots on 100 000 unit lot size your minimum trade value on EuruUsd would be about $1 120 or so at current rates. If you have a $10k account that's over 10% of your account value. So obviously that's not sustainable. Few losses and you're out.

To get to a reasonable trade sizes on MT you basically need a $100k plus account. This the primary reason why so many people fail at fx. Read Von Tharps work for a more comprehensive explanation, he goes in depth into this.

One broker that doesn't have this issue is Oanda, where you can do a 1 unit trade or 1.12 or so. I very strongly suggest using them at first. Set the platform to use 1% of available account and take it from there till you are more familiar with the entire process. You'll quickly get a feel for how much appetite for risk you have and then you can determine trade sizes as a function of your draw down. So you make an informed decision.

This process will stop you from making the very basic mistake of trying to trade an account that's completely the wrong size for the minimum trade sizes like Edwin here used to do.

That's spectacularly bad advice mate. No wonder you lost $5k a month.

@shienri

Your position size should be determined by your account size, leverage I pretty much ignore since my trade sizes are such that they are a reasonable percentage of my un-leveraged account size.

The problem with MT is the minimum trade size is to big for most accounts. At 0.01 lots on 100 000 unit lot size your minimum trade value on EuruUsd would be about $1 120 or so at current rates. If you have a $10k account that's over 10% of your account value. So obviously that's not sustainable. Few losses and you're out.

To get to a reasonable trade sizes on MT you basically need a $100k plus account. This the primary reason why so many people fail at fx. Read Von Tharps work for a more comprehensive explanation, he goes in depth into this.

One broker that doesn't have this issue is Oanda, where you can do a 1 unit trade or 1.12 or so. I very strongly suggest using them at first. Set the platform to use 1% of available account and take it from there till you are more familiar with the entire process. You'll quickly get a feel for how much appetite for risk you have and then you can determine trade sizes as a function of your draw down. So you make an informed decision.

This process will stop you from making the very basic mistake of trying to trade an account that's completely the wrong size for the minimum trade sizes like Edwin here used to do.

Členem od Apr 08, 2016

8 příspěvků

Apr 11, 2016 at 06:20

Členem od Apr 08, 2016

8 příspěvků

theHand posted:

@BIGBEARBROTHER

That's spectacularly bad advice mate. No wonder you lost $5k a month.

Bad advise would be to keep on loosing $5K per month. After I let professionals manage my money things got to be better, so I have positive experience as investor😎

Money should work for you, not you for them

Členem od Mar 24, 2016

6 příspěvků

Apr 11, 2016 at 06:21

Členem od Mar 24, 2016

6 příspěvků

theHand posted:

@BIGBEARBROTHER

That's spectacularly bad advice mate. No wonder you lost $5k a month.

@shienri

Your position size should be determined by your account size, leverage I pretty much ignore since my trade sizes are such that they are a reasonable percentage of my un-leveraged account size.

The problem with MT is the minimum trade size is to big for most accounts. At 0.01 lots on 100 000 unit lot size your minimum trade value on EuruUsd would be about $1 120 or so at current rates. If you have a $10k account that's over 10% of your account value. So obviously that's not sustainable. Few losses and you're out.

To get to a reasonable trade sizes on MT you basically need a $100k plus account. This the primary reason why so many people fail at fx. Read Von Tharps work for a more comprehensive explanation, he goes in depth into this.

One broker that doesn't have this issue is Oanda, where you can do a 1 unit trade or 1.12 or so. I very strongly suggest using them at first. Set the platform to use 1% of available account and take it from there till you are more familiar with the entire process. You'll quickly get a feel for how much appetite for risk you have and then you can determine trade sizes as a function of your draw down. So you make an informed decision.

This process will stop you from making the very basic mistake of trying to trade an account that's completely the wrong size for the minimum trade sizes like Edwin here used to do.

I havent read von tharps et, will check up on it.

So if I am using $1,000 account, 1% = $10, I just use this as risk per trade right?

and using 0.01 lot to put me at a max stop loss of 100 pip?

Any suggested for total risk? like max concurrent trades / pending trades i should take note of?

ya i am looking to use oanda currently.

Členem od Mar 24, 2016

6 příspěvků

Apr 11, 2016 at 06:21

Členem od Mar 24, 2016

6 příspěvků

BIGBEARBROTHER posted:

When I started trading myself, I used to blow about 5K per month. Till now I have stopped this and started trusting professionals so I have begun to invest. Actually it is better to start with $1K, but it mostly depends on your possibilities

ya i am looking at starting small like $1k.

what you mean by trusting professionals? as in trading course?

Členem od Sep 12, 2015

1933 příspěvků

Apr 11, 2016 at 12:25

(Upravené Apr 11, 2016 at 12:39)

Členem od Sep 12, 2015

1933 příspěvků

You can read my posts if you have time or I would advise getting a good Trading Education from someone who has worked on a Trading floor/Dealing desk ,Goldmansacks,Barclays etc etc.Your going to need a basic grounding to stand any chance of making a profit.

Best of Luck!

Best of Luck!

"They mistook leverage with genius".

Členem od Sep 20, 2014

342 příspěvků

Apr 12, 2016 at 03:13

Členem od Sep 20, 2014

342 příspěvků

@shienri

I'm the wrong guy to ask about max risk per trade. It's just internet bullshit as far as I'm concerned. I don't trade, I use trades to manage positions. Very different concept.

But obviously at $10 a trade you're going to be measuring your profits in cents. The concept I'm trying to get across is that it's not how much you can afford to lose that should determine account size, but rather the technical aspects of the trading account, like minimum trade sizes. That determines how much you should put down minimum.

By the way, 100 pips SL on EurUsd and 100 pip SL on GbpUsd are two very different sized stop losses. You'd have a much higher hit rate on GbpUsd since 100 pips is a smaller percentage of GbpUsd current price. Devil is in the details....!!

I'm the wrong guy to ask about max risk per trade. It's just internet bullshit as far as I'm concerned. I don't trade, I use trades to manage positions. Very different concept.

But obviously at $10 a trade you're going to be measuring your profits in cents. The concept I'm trying to get across is that it's not how much you can afford to lose that should determine account size, but rather the technical aspects of the trading account, like minimum trade sizes. That determines how much you should put down minimum.

By the way, 100 pips SL on EurUsd and 100 pip SL on GbpUsd are two very different sized stop losses. You'd have a much higher hit rate on GbpUsd since 100 pips is a smaller percentage of GbpUsd current price. Devil is in the details....!!

Členem od Mar 24, 2016

6 příspěvků

Apr 12, 2016 at 06:54

Členem od Mar 24, 2016

6 příspěvků

snapdragon1970 posted:

You can read my posts if you have time or I would advise getting a good Trading Education from someone who has worked on a Trading floor/Dealing desk ,Goldmansacks,Barclays etc etc.Your going to need a basic grounding to stand any chance of making a profit.

Best of Luck!

Ya, I am currently at a trading course, they are not from former trading floor / dealing desk though.

Still doing some foundation stuff now, will just have to work at it

and test on demo for now.

Členem od Apr 08, 2016

8 příspěvků

Apr 12, 2016 at 11:24

Členem od Apr 08, 2016

8 příspěvků

shienri posted:BIGBEARBROTHER posted:

When I started trading myself, I used to blow about 5K per month. Till now I have stopped this and started trusting professionals so I have begun to invest. Actually it is better to start with $1K, but it mostly depends on your possibilities

ya i am looking at starting small like $1k.

what you mean by trusting professionals? as in trading course?

By trusting professionals I mean invest your funds to PAMM or buy signals or just entrust management of your account to those people who are highly involved in trading, trade constantly, watch for market for days and nights and just live by trading. If you've got a usual job or your business and trading is like a hoby for you, then believe me, you like other 95%+ traders are likely to face failure during your forex journey, and then it is only up to you whether you give up or not. if you like trading then you should trade on demos or mini/micro accounts. And only when you make constant profit for years, it is reasonable to open usual account. I myself have made the decision to trust professional far long ago and now I can see that that is the right decision.

Money should work for you, not you for them

Členem od Mar 24, 2016

6 příspěvků

Apr 14, 2016 at 06:27

Členem od Mar 24, 2016

6 příspěvků

BIGBEARBROTHER posted:shienri posted:BIGBEARBROTHER posted:

When I started trading myself, I used to blow about 5K per month. Till now I have stopped this and started trusting professionals so I have begun to invest. Actually it is better to start with $1K, but it mostly depends on your possibilities

ya i am looking at starting small like $1k.

what you mean by trusting professionals? as in trading course?

By trusting professionals I mean invest your funds to PAMM or buy signals or just entrust management of your account to those people who are highly involved in trading, trade constantly, watch for market for days and nights and just live by trading. If you've got a usual job or your business and trading is like a hoby for you, then believe me, you like other 95%+ traders are likely to face failure during your forex journey, and then it is only up to you whether you give up or not. if you like trading then you should trade on demos or mini/micro accounts. And only when you make constant profit for years, it is reasonable to open usual account. I myself have made the decision to trust professional far long ago and now I can see that that is the right decision.

I see what you mean, I plan to work on demos so that I am good at it before I trade.

I dont have large capital for a good return on managed account,

so I will have to work at it and see if ultimately i can be good and trade for a profit.

Členem od Apr 08, 2016

8 příspěvků

Apr 14, 2016 at 12:00

Členem od Apr 08, 2016

8 příspěvků

shienri posted:BIGBEARBROTHER posted:shienri posted:BIGBEARBROTHER posted:

When I started trading myself, I used to blow about 5K per month. Till now I have stopped this and started trusting professionals so I have begun to invest. Actually it is better to start with $1K, but it mostly depends on your possibilities

ya i am looking at starting small like $1k.

what you mean by trusting professionals? as in trading course?

By trusting professionals I mean invest your funds to PAMM or buy signals or just entrust management of your account to those people who are highly involved in trading, trade constantly, watch for market for days and nights and just live by trading. If you've got a usual job or your business and trading is like a hoby for you, then believe me, you like other 95%+ traders are likely to face failure during your forex journey, and then it is only up to you whether you give up or not. if you like trading then you should trade on demos or mini/micro accounts. And only when you make constant profit for years, it is reasonable to open usual account. I myself have made the decision to trust professional far long ago and now I can see that that is the right decision.

I see what you mean, I plan to work on demos so that I am good at it before I trade.

I dont have large capital for a good return on managed account,

so I will have to work at it and see if ultimately i can be good and trade for a profit.

Anyway, if you don't have money I'd advise you to trade demo (if you're a newbie), but it would be much better to trade micro accounts, where $1 equals $100. That is not going to be stressful for you and thus you will see how is it to be under real market conditions.

Money should work for you, not you for them

Členem od Jan 14, 2011

34 příspěvků

Jun 17, 2016 at 06:49

Členem od Jan 14, 2011

34 příspěvků

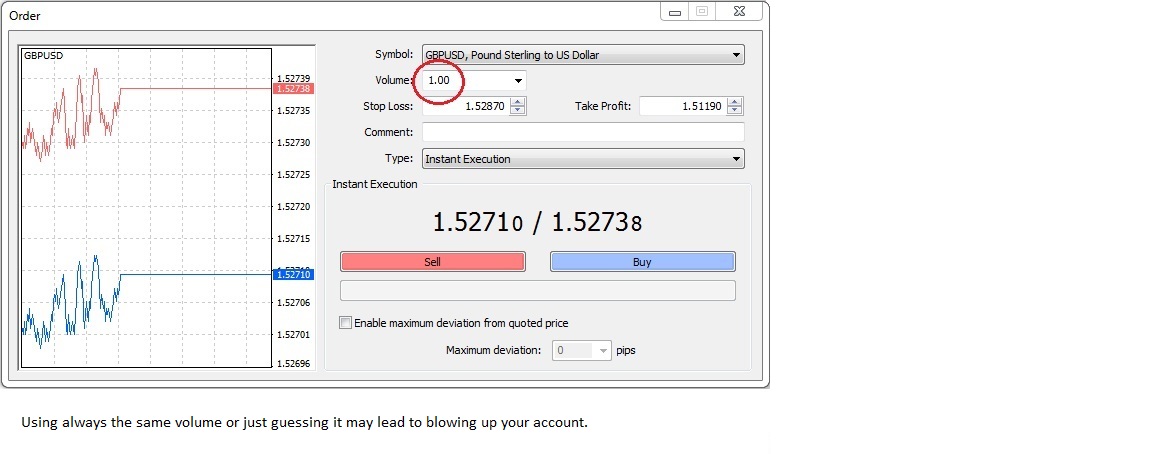

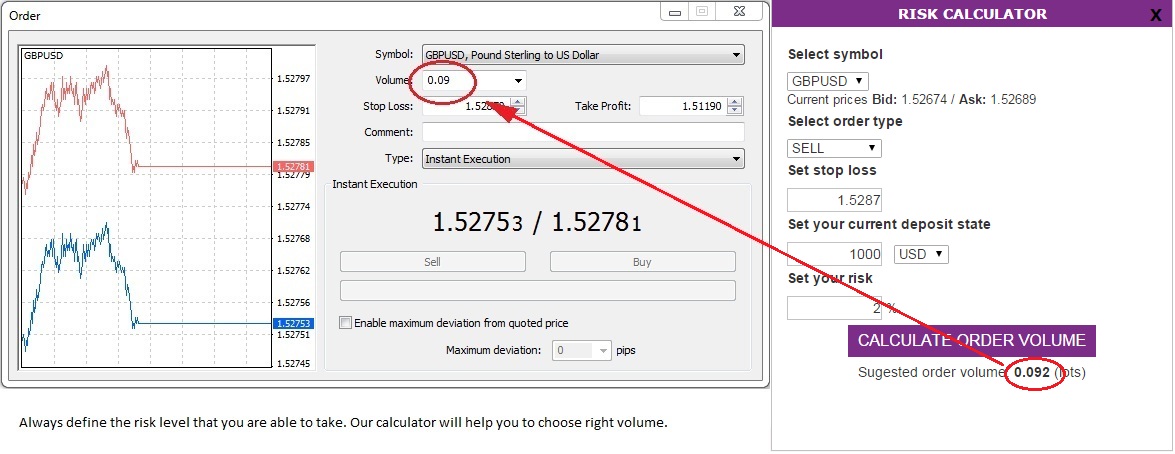

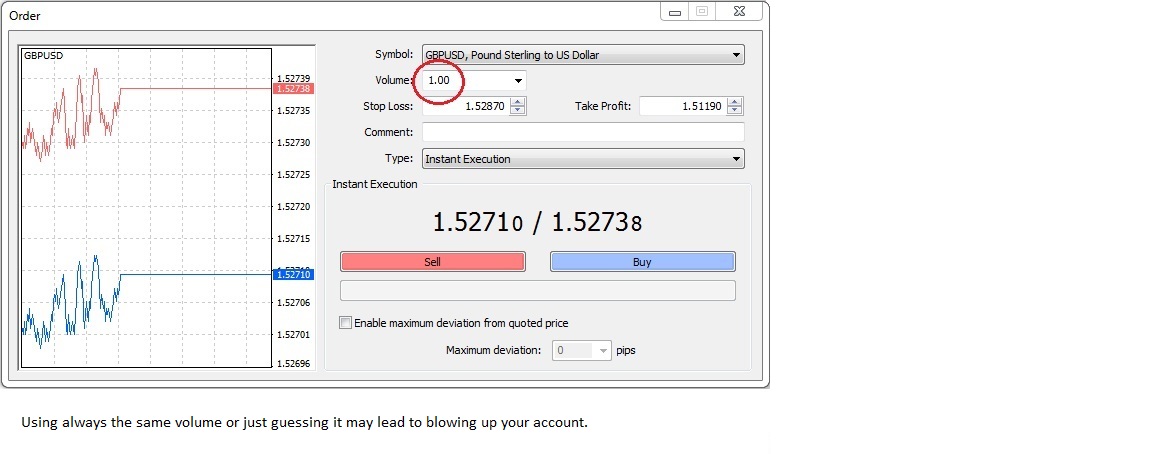

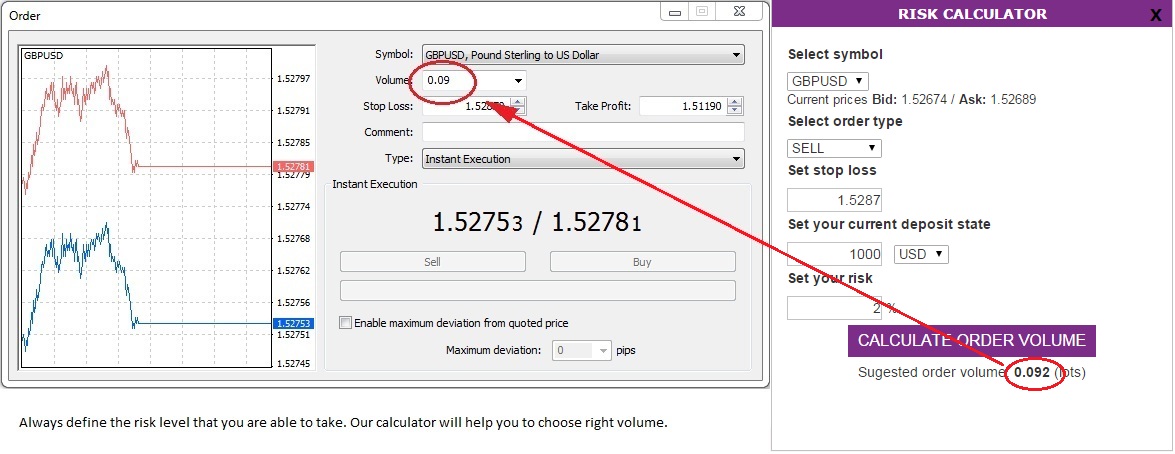

Calculate your position size

Calculating the exact size of your position is at the core of good money management. Because the calculation itself is not very straightforward, you can find a simple calculator on our website(www.consiliuminvest.com/strategies). To access it, just look at the right-hand edge of the window - you will see a button "RISK CALCULATOR". When you click on it, a window will appear. Then you need to choose the name of the instrument that you want to trade, the price of the order, your deposit and your desired percentage risk per one transaction. The result you get is the size of transaction in lots that matches your risk tolerance.

INCORRECT

CORRECT

Calculating the exact size of your position is at the core of good money management. Because the calculation itself is not very straightforward, you can find a simple calculator on our website(www.consiliuminvest.com/strategies). To access it, just look at the right-hand edge of the window - you will see a button "RISK CALCULATOR". When you click on it, a window will appear. Then you need to choose the name of the instrument that you want to trade, the price of the order, your deposit and your desired percentage risk per one transaction. The result you get is the size of transaction in lots that matches your risk tolerance.

INCORRECT

CORRECT

Členem od Jul 16, 2013

94 příspěvků

Jun 17, 2016 at 11:44

(Upravené Jun 17, 2016 at 11:48)

Členem od Jul 16, 2013

94 příspěvků

For you guys that are trading on cTrader instead of MT4. RMMRobot.com is a very good site on the subject of risk and money management. Also a lot of free downloads based on the same important principle of protection the trading account.

" Lock in the profit and minimize the draw down "

Členem od Apr 07, 2015

52 příspěvků

Oct 30, 2016 at 07:33

Členem od Apr 07, 2015

52 příspěvků

the best way to see how leverage, trade size and account size affect your results is to open the demo account and see how it all works when you open different positions. when you read explanations it may get difficult to understand all in one time.

Členem od Oct 01, 2015

47 příspěvků

Nov 03, 2016 at 15:30

Členem od Oct 01, 2015

47 příspěvků

Instead of asking , why not do the following - Find couple of brokers that you checked online and you are sure that they are no scam. Find the ones who are having free demo environment, and simply start testing yourself what ratio between account size, positions size , number of open positions leverage and etc. works perfectly for you. Because in here every trader will share his opinion which works the best for his needs, thus it might not work perfectly for you. I hope you are getting my point.

Členem od Mar 26, 2015

34 příspěvků

Nov 28, 2016 at 16:01

Členem od Mar 26, 2015

34 příspěvků

koval posted:

Calculate your position size

Calculating the exact size of your position is at the core of good money management. Because the calculation itself is not very straightforward, you can find a simple calculator on our website(www.consiliuminvest.com/strategies). To access it, just look at the right-hand edge of the window - you will see a button "RISK CALCULATOR". When you click on it, a window will appear. Then you need to choose the name of the instrument that you want to trade, the price of the order, your deposit and your desired percentage risk per one transaction. The result you get is the size of transaction in lots that matches your risk tolerance.

INCORRECT

CORRECT

Good tool that takes into account all the discussed variables. I find it helpful. Actually, the position size (micro, mini or standard lots) is quite important for the risk/money management. Personally, I prefer trading with many but small positions.

Once a trader, always a trader!

*Komerční použití a spam nebudou tolerovány a mohou vést ke zrušení účtu.

Tip: Zveřejněním adresy URL obrázku /služby YouTube se automaticky vloží do vašeho příspěvku!

Tip: Zadejte znak @, abyste automaticky vyplnili jméno uživatele, který se účastní této diskuse.