- Главная

- Сообщество

- Новые трейдеры

- The fallacy of Martingale/Grid systems

Advertisement

Edit Your Comment

The fallacy of Martingale/Grid systems

Участник с Mar 17, 2021

17 комментариев

May 03, 2024 at 10:52

Участник с Mar 17, 2021

17 комментариев

The vast majority of martingale/grid grid systems, or variations of are destined to blow up accounts (or result in unrecoverable drawdown). New traders may not be aware of these gambling methods, which require a near infinite source of funds to pull off.

How to spot a martingale/grid system

1) Short account life.

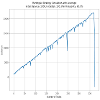

2) Unrealistic equity curves that only ever go up (unless they blow up!).

3) Equity will have significant areas of drawdown if the account hasn't blown up.

4) Increasing position sizes as the account gets further into drawdown.

Be wary of these systems, they look great until they aren't. This is a form of time-based gambling. (an very small minority of scenarios may be an exception).

Example equity curve attached.

How to spot a martingale/grid system

1) Short account life.

2) Unrealistic equity curves that only ever go up (unless they blow up!).

3) Equity will have significant areas of drawdown if the account hasn't blown up.

4) Increasing position sizes as the account gets further into drawdown.

Be wary of these systems, they look great until they aren't. This is a form of time-based gambling. (an very small minority of scenarios may be an exception).

Example equity curve attached.

Участник с May 08, 2024

3 комментариев

May 11, 2024 at 04:38

(отредактировано May 11, 2024 at 04:38)

Участник с May 08, 2024

3 комментариев

I have yet to see one prune outlier trades effectively. I'm not saying it can't be done, it just I've never seen it. Anyone I have heard of that uses them, plans on running them until failure, while doing withdrawals until they blow up. Then they start over and see how far they can get.

Argue for your limitations, and sure enough, they are yours.

Участник с May 03, 2024

1 комментариев

Jun 01, 2024 at 10:32

Участник с May 03, 2024

1 комментариев

So what's the alternate solution for this?

Участник с Mar 17, 2021

17 комментариев

Jun 01, 2024 at 10:40

Участник с Mar 17, 2021

17 комментариев

Trading multiple uncorrelated edges over a portfolio with appropriate risk management - which is what everyone should be aiming for.

Участник с Jun 05, 2024

10 комментариев

Jun 05, 2024 at 13:01

Участник с Jun 05, 2024

10 комментариев

Soooo many "experts" are using martingale / grid systems it is shocking. I am surprised how long some of these systems work but eventually they always fail

Участник с Apr 17, 2024

15 комментариев

Jun 15, 2024 at 07:04

Участник с Apr 17, 2024

15 комментариев

Gwydaer posted:

The vast majority of martingale/grid grid systems, or variations of are destined to blow up accounts (or result in unrecoverable drawdown). New traders may not be aware of these gambling methods, which require a near infinite source of funds to pull off.

How to spot a martingale/grid system

1) Short account life.

2) Unrealistic equity curves that only ever go up (unless they blow up!).

3) Equity will have significant areas of drawdown if the account hasn't blown up.

4) Increasing position sizes as the account gets further into drawdown.

Be wary of these systems, they look great until they aren't. This is a form of time-based gambling. (an very small minority of scenarios may be an exception).

Example equity curve attached.

Dude, one thing you have to understand is that with any EA strategy, you have to have manual wind control or you may end up failing. This is because there are so many uncertainties in the market, such as the Fed meeting, or the monthly non-agricultural employment data.

So, it is very necessary to trade with artificial dare and good risk control. Moreover, many trading strategies, can only be applied to a certain market situation, for example, some strategies are only applicable to the up and down vibration of the market, but in the unilateral market, it is easy to lose money.

Therefore, the strategy I use, with 24-hour manual risk control, 2 years of time, very stable.

Newton once said: If I can see farther than others, it is because I am standing on the shoulders of giants.

Участник с Jun 12, 2024

6 комментариев

Jun 17, 2024 at 17:09

Участник с Jun 12, 2024

6 комментариев

What do you mean by " manual wind control "?

Участник с Apr 17, 2024

15 комментариев

Jun 23, 2024 at 07:12

Участник с Apr 17, 2024

15 комментариев

ScoutQueen posted:

What do you mean by " manual wind control "?

Because the machine can not recognize the reality of the situation, for example, today's meeting of the Federal Reserve announced a major decision, but the bot can not be recognized, this time the market appeared in the bot prediction of the opposite trend, then your bot trading strategy will be a serious loss.

Because the bot trading I used before had no human manual risk control, I ended up losing a lot of money.

Now I use bot trading strategy are manual risk control strategy.

Newton once said: If I can see farther than others, it is because I am standing on the shoulders of giants.

Участник с May 17, 2024

2 комментариев

Jul 11, 2024 at 12:00

Участник с May 17, 2024

2 комментариев

stalin22 posted:

So what's the alternate solution for this?

use it smart, or don't use it...

Action makes perfect.

Участник с Feb 21, 2024

2 комментариев

Jul 11, 2024 at 13:51

Участник с Feb 21, 2024

2 комментариев

I use two martingal systems on gold...

I have drawdown protection on both, I turn it off at major events.

Runs great.

I have drawdown protection on both, I turn it off at major events.

Runs great.

Участник с Oct 29, 2009

74 комментариев

Jul 12, 2024 at 09:54

Участник с Oct 29, 2009

74 комментариев

In some world they call it layering.... There are a lot of cases I see in ticktok that they just fill the screen with small little lots.

Quite interesting though... but Johnson's right use it smart or don't use it at all.

Quite interesting though... but Johnson's right use it smart or don't use it at all.

NEVER say DIE!!!

Участник с Jul 12, 2024

7 комментариев

Jul 12, 2024 at 10:37

Участник с Jul 12, 2024

7 комментариев

OptiflowCapital posted:

I use two martingal systems on gold...

I have drawdown protection on both, I turn it off at major events.

Runs great.

As with all martingale systems. It will run great......until is doesn't and your account will blow up

Участник с Dec 30, 2023

5 комментариев

Jul 12, 2024 at 12:32

Участник с Dec 30, 2023

5 комментариев

OptiflowCapital posted:

I use two martingal systems on gold...

I have drawdown protection on both, I turn it off at major events.

Runs great.

Same here, it's not the system that matters, but the approach and methodology used to trade it. And, by the way, martingale is not the same as grid-based system, besides multiplying position sizes they have nothing it common.

*Коммерческое использование и спам не допускаются и могут привести к аннулированию аккаунта.

Совет: Размещенные изображения или ссылки на Youtube автоматически вставляются в ваше сообщение!

Совет: введите знак @ для автоматического заполнения имени пользователя, участвующего в этом обсуждении.