- หน้าหลัก

- ชุมชน

- นักเทรดมือใหม่

- high leverage

Advertisement

Edit Your Comment

high leverage

เป็นสมาชิกตั้งแต่ Feb 22, 2011

4573 โพสต์

Jun 26, 2018 at 10:42

เป็นสมาชิกตั้งแต่ Feb 22, 2011

4573 โพสต์

hankway10 posted:

High leverage should go with small lots to effectively control your risks. A lot of new traders fantasize about double their funds with high leverage, but end up throwing their money into the ocean..

High leverage allow high lots

Low leverage allow low lots

Risk is controlled by other tools than leverage

เป็นสมาชิกตั้งแต่ Mar 12, 2018

39 โพสต์

Jun 26, 2018 at 11:41

เป็นสมาชิกตั้งแต่ Mar 12, 2018

39 โพสต์

togr posted:hankway10 posted:

High leverage should go with small lots to effectively control your risks. A lot of new traders fantasize about double their funds with high leverage, but end up throwing their money into the ocean..

High leverage allow high lots

Low leverage allow low lots

Risk is controlled by other tools than leverage

Perfect!

เป็นสมาชิกตั้งแต่ Jun 26, 2018

9 โพสต์

Jul 01, 2018 at 05:48

เป็นสมาชิกตั้งแต่ Jun 12, 2018

3 โพสต์

togr posted:hankway10 posted:

High leverage should go with small lots to effectively control your risks. A lot of new traders fantasize about double their funds with high leverage, but end up throwing their money into the ocean..

High leverage allow high lots

Low leverage allow low lots

Risk is controlled by other tools than leverage

Yes.

What I'm saying is for those new traders who dream of using small funds with high leverage to flip their profits. I'm just say for beginners it's not a good idea

เป็นสมาชิกตั้งแต่ Apr 18, 2018

17 โพสต์

Jul 06, 2018 at 10:34

เป็นสมาชิกตั้งแต่ Apr 18, 2018

17 โพสต์

YellowStoneFX posted:

My broker only allows 1:50 at most. Is that normal? I thought you could get 1:500

Before taking a decision to choose broker, it's necessary to choose your suitable leverage first. Only then would you find the right broker that suits your needs.

In average, brokers offers maximum leverage of 500:1.

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1097 โพสต์

Jul 07, 2018 at 01:00

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1097 โพสต์

YellowStoneFX posted:

My broker only allows 1:50 at most. Is that normal? I thought you could get 1:500

If you are a trader in the United States, then absolutely.

That's the maximum leverage a retail forex trader has available.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

เป็นสมาชิกตั้งแต่ May 18, 2015

103 โพสต์

Jul 10, 2018 at 06:41

เป็นสมาชิกตั้งแต่ May 18, 2015

103 โพสต์

As far as picking a broker, just note and I find it funny that no one has mentioned the following... The broker takes more risk than the client because they offer the leverage. In the case of which a broker goes under, you can kiss you money good bye. Ask the people who lost money even though they werent in CHF pairs when the black swan account happened. No one has shown proof of getting their funds back and FXCM is a REGISTERED COMPANY IN THE US STOCK EXCHANGE NASDAQ. All in all, one needs to find a fool proof system before they even deposit in forex because if you dont, then you will be like tgor and with blown accounts by the dozen. Time will pass and you will have spent so much time and money only to get nothing out of it.

My avatar explains "social trading" perfectly.

เป็นสมาชิกตั้งแต่ Jun 26, 2018

9 โพสต์

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1097 โพสต์

Jul 12, 2018 at 16:22

(แก้ไขแล้ว Jul 12, 2018 at 16:22)

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1097 โพสต์

goyankees85 posted:

As far as picking a broker, just note and I find it funny that no one has mentioned the following... The broker takes more risk than the client because they offer the leverage. In the case of which a broker goes under, you can kiss you money good bye. Ask the people who lost money even though they werent in CHF pairs when the black swan account happened. No one has shown proof of getting their funds back and FXCM is a REGISTERED COMPANY IN THE US STOCK EXCHANGE NASDAQ. All in all, one needs to find a fool proof system before they even deposit in forex because if you dont, then you will be like tgor and with blown accounts by the dozen. Time will pass and you will have spent so much time and money only to get nothing out of it.

Interesting that you would consider tgor a bad trader with "blown accounts by the dozen", Especially since tgor is a WELL ESTABLISHED member of the community.

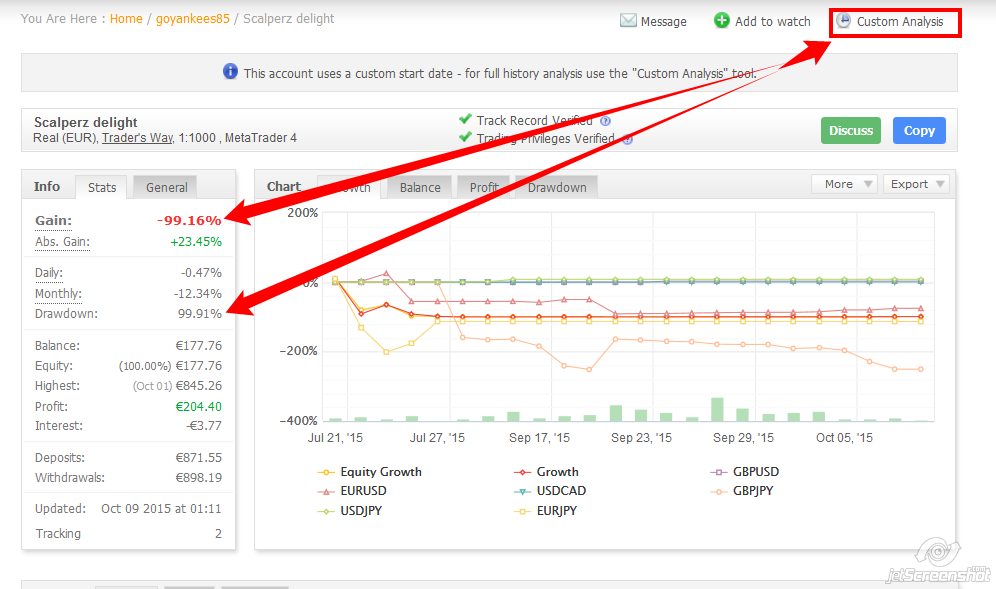

You blew your own acount with a 99.9% DD.

If you are going to participate, at least be somewhat knowledgeable about the subject matter you are discussing.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1097 โพสต์

Jul 12, 2018 at 16:53

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1097 โพสต์

goyankees85 posted:

All in all, one needs to find a fool proof system before they even deposit in forex because if you dont, then you will be like tgor and with blown accounts by the dozen. Time will pass and you will have spent so much time and money only to get nothing out of it.

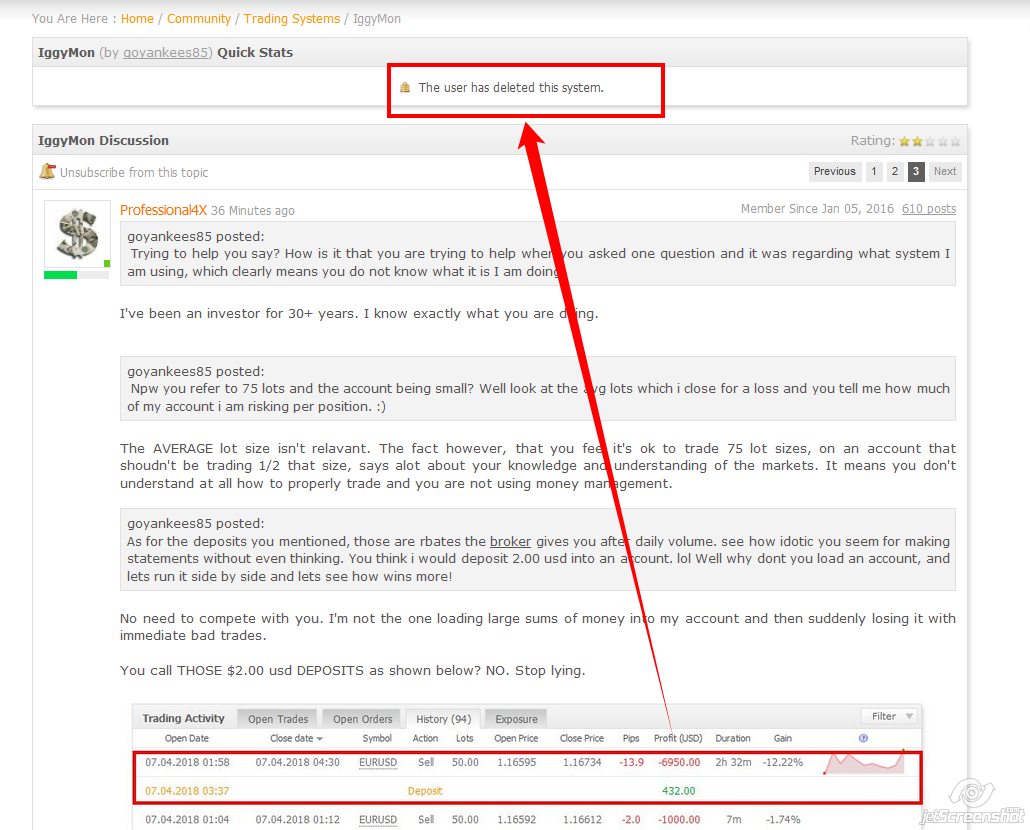

I find it interesting that you decided to delete your BLOWN account so that people wouldn't see the proof.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1097 โพสต์

Jul 12, 2018 at 16:54

(แก้ไขแล้ว Jul 12, 2018 at 16:58)

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1097 โพสต์

Like I said. If you are going to participate, then you should at least be knowledgeable about the subject matter. Thank you.

Also... Here is the link to the archives of the discussion for your blown account. Enjoy.

https://www.myfxbook.com/community/trading-systems/iggymon/1639844,1

Also... Here is the link to the archives of the discussion for your blown account. Enjoy.

https://www.myfxbook.com/community/trading-systems/iggymon/1639844,1

If it looks too good to be true, it's probably a scam! Let the buyer beware.

เป็นสมาชิกตั้งแต่ Jun 28, 2018

10 โพสต์

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1097 โพสต์

Jul 14, 2018 at 02:28

(แก้ไขแล้ว Jul 14, 2018 at 02:29)

เป็นสมาชิกตั้งแต่ Jan 05, 2016

1097 โพสต์

Downtobusines posted:

This isn't the first and won't be the last blown account. I doubt that leverage has anything to do with it. Just poor risk management

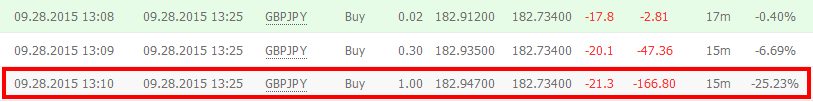

Trading MULTIPLE full lot sizes on a $200.00 account? That's a newbie trader trying to get rich quick.

High leverage trading and a complete lack of risk management and absolutely NO MONEY MANAGEMENT.

ESPECIALLY against the GBP/JPY pair. That's a great way for a newbie trader to blow an account.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

*การใช้งานเชิงพาณิชย์และสแปมจะไม่ได้รับการยอมรับ และอาจส่งผลให้บัญชีถูกยกเลิก

เคล็ดลับ: การโพสต์รูปภาพ/youtube url จะฝังลงในโพสต์ของคุณโดยอัตโนมัติ!

เคล็ดลับ: พิมพ์เครื่องหมาย @ เพื่อป้อนชื่อผู้ใช้ที่เข้าร่วมการสนทนานี้โดยอัตโนมัติ