- घर

- कम्युनिटी

- नए ट्रेडरों

- NEW Traders beware the EASY ROAD to riches!

Advertisement

Edit Your Comment

NEW Traders beware the EASY ROAD to riches!

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

Oct 20, 2015 at 10:16

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

@remccloud24 That is a sure fire way to get whipsawed out of the market with a loss. The institutional bang both sides of the retail players in the market and blow your stops before ultimately moving the market where they want. I avoid NFP like the plague and usually all High impact news events.

As a new trader I would recommend studying volume and price action. Stay away from the inicator junkies that riddle this marketplace.

As a new trader I would recommend studying volume and price action. Stay away from the inicator junkies that riddle this marketplace.

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

Oct 21, 2015 at 13:08

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

Hendrik_FX posted:

Stephen, you said everything! Its incredible how the sharks bang up and down with spikes just to wipe out the suckers! I was one of them!

The reality is that they need liquidity to trade with the volume they have so they get a lot of it from the retail who doesn't know any better. That is why I'm a student of Volume and even then I'm only right 70% of the time.

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

Oct 24, 2015 at 11:11

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

Late to the party and I still made 1% in 10 minutes. Keep reading and become a student of volume.

Volume print is the brownish box dragged across chart. Massive price rejection with a close above at point 1. Sellers can't get any traction below. I would usually have gone long at point 2. as price closes above the volume print nicely. (I was away from the charts :(p...) The second opportunity to get in this trade that I took was as price breaks above the value area and has a low volume tap back to the top edge of value. Go long for the nice price spurt back higher and close out for a 1% return in 10 minutes. If price closes back down into value at point 3 then I'm out as PRICE has told me it's not ready to go higher.

I would typically have stayed for a few hours as price will usually reward me after this type of action. The fact is that I was tired and didn't want to hang around to shoot for a longer session play.

Questions?

Volume print is the brownish box dragged across chart. Massive price rejection with a close above at point 1. Sellers can't get any traction below. I would usually have gone long at point 2. as price closes above the volume print nicely. (I was away from the charts :(p...) The second opportunity to get in this trade that I took was as price breaks above the value area and has a low volume tap back to the top edge of value. Go long for the nice price spurt back higher and close out for a 1% return in 10 minutes. If price closes back down into value at point 3 then I'm out as PRICE has told me it's not ready to go higher.

I would typically have stayed for a few hours as price will usually reward me after this type of action. The fact is that I was tired and didn't want to hang around to shoot for a longer session play.

Questions?

तबसे मेंबर है Sep 20, 2014

342 पोस्टों

Oct 24, 2015 at 11:26

तबसे मेंबर है Sep 20, 2014

342 पोस्टों

@sbnelson2005

This is so hilarious.

Where exactly are you getting your volumes from? There are no accurate volume figures for fx. You're looking at ticks counts. What you're actually looking at is volatility, not volumes.

Unbelievable.

This is so hilarious.

Where exactly are you getting your volumes from? There are no accurate volume figures for fx. You're looking at ticks counts. What you're actually looking at is volatility, not volumes.

Unbelievable.

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

Oct 24, 2015 at 17:37

(एडिट हो रहा है Oct 24, 2015 at 17:37)

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

Everybody knows this. You are missing the point. It's price action in relation to increased activity and prices resulting action. Interesting how a review of all your post's shows nothing but antagonistic and badgering drivel. Stop bashing, put your track record online (don't see one in your profile) and actually contribute if you can. Otherwise find someone else to annoy and let those who need help learning ask their questions.

तबसे मेंबर है Sep 20, 2014

342 पोस्टों

Oct 24, 2015 at 23:11

(एडिट हो रहा है Oct 24, 2015 at 23:33)

तबसे मेंबर है Sep 20, 2014

342 पोस्टों

If you did look at my posts, as I pointed out to someone else, you'd notice I only react when I see something that's completely inaccurate or misleading or I think I can help. If you know you're not looking at volume then don't call it volume. Details are everything fx.

Volume and volatility are completely different concepts, the latter involves time and then period or frequency becomes critical. It's like calling the moon the sun, sure both hang in the sky but one is a huge burning ball of gas, the other a pile of rocks and dust.

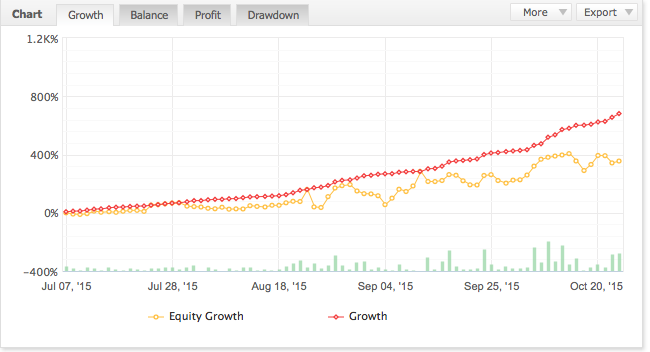

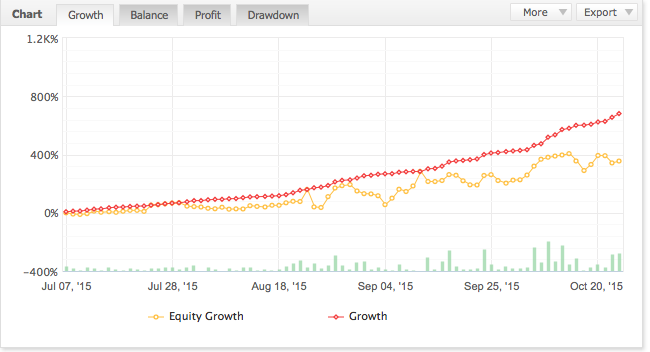

And no I don't post my results generally. I have no reason to, not looking for recognition or clients. However, I suppose I should prove that I do know what I'm talking about periodically. So here's one example:

Volume and volatility are completely different concepts, the latter involves time and then period or frequency becomes critical. It's like calling the moon the sun, sure both hang in the sky but one is a huge burning ball of gas, the other a pile of rocks and dust.

And no I don't post my results generally. I have no reason to, not looking for recognition or clients. However, I suppose I should prove that I do know what I'm talking about periodically. So here's one example:

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

Oct 24, 2015 at 23:39

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

Hmmmm...... You post a screenshot of someones results. Typically you'd post a link that is in someway associated with you???? Let's assume for a second it's yours. It's less than 4 months old with massive draw-downs and looks incredibly like yet another Martingale/Grid/Next Big Blow up.

Please stop wasting our time.

Please stop wasting our time.

तबसे मेंबर है Sep 20, 2014

342 पोस्टों

Oct 25, 2015 at 00:15

तबसे मेंबर है Sep 20, 2014

342 पोस्टों

The markets are openly and obviously manipulated, any good system will take that into account, but I will definitely not make that my system like you have. The spikes happen so infrequently , meanwhile there are about 25 000 to 40 000 ticks or value changes per day per pair you can profit from.

That's why I can run like this.

That's why I can run like this.

तबसे मेंबर है Sep 20, 2014

342 पोस्टों

Oct 25, 2015 at 00:19

(एडिट हो रहा है Oct 25, 2015 at 00:31)

तबसे मेंबर है Sep 20, 2014

342 पोस्टों

It's positional. The only reason the draw down is so big is the trade sizes. That account does thousands of percent a year. I'm not going to make it public for a pissing contest. And it will draw down on that growth, obviously.

Even if I cut the trade sizes by a factor of 10 it will still go parabolic. But I'd rather have that results than yours, that's for sure.

Even if I cut the trade sizes by a factor of 10 it will still go parabolic. But I'd rather have that results than yours, that's for sure.

तबसे मेंबर है Oct 24, 2015

1 पोस्टों

Oct 25, 2015 at 07:26

तबसे मेंबर है Oct 24, 2015

1 पोस्टों

Sorry I'm late to the discussion, the way I learned to trade the FX market was to play 60 second sets with progressive increases to the amount wagered. So if I play something for example USDEUR put $5 and it looses, play the same direction and the same pair again, but this time place the trade at lets say $13. and so on until you win the trade. The market can't swing one direction forever, and you cover your losses from the previous trades plus a profit in every play. As long as you have the money to back the method up its bound to work, and obviously you read the charts because you don't want to have to play 4,5, or 6 times before you win (I'm fairly new to trading but that is how I usually do it when I trade pairs in a high/low instance).

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

Oct 25, 2015 at 10:29

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

scrimpycoot posted:

Sorry I'm late to the discussion, the way I learned to trade the FX market was to play 60 second sets with progressive increases to the amount wagered. So if I play something for example USDEUR put $5 and it looses, play the same direction and the same pair again, but this time place the trade at lets say $13. and so on until you win the trade. The market can't swing one direction forever, and you cover your losses from the previous trades plus a profit in every play. As long as you have the money to back the method up its bound to work, and obviously you read the charts because you don't want to have to play 4,5, or 6 times before you win (I'm fairly new to trading but that is how I usually do it when I trade pairs in a high/low instance).

Unfortunately this is another version of a martingale and I would urge extreme caution.

तबसे मेंबर है Sep 12, 2015

1933 पोस्टों

Oct 25, 2015 at 14:54

तबसे मेंबर है Sep 12, 2015

1933 पोस्टों

sbnelson2005 posted:

Answers:

1. Of course we all know it's the Big Boys who control the market. These banks have the ability to move the market to enable them to get positioned on the right side of the market. When they want to short they don't just hit the sell button. they have to drive price higher to find buyers (ie all the stop resting above the market).

2. Volume! It is the only real indicator that matters and is the only one I have on my charts. Until you watch volume and how price reacts to those volumes you will be flipping a coin at best.

Do yourself a favor; strip all those indis off your charts (i know the guru's told you how important they are). Now add a basic volume indicator. Scroll back and look at what happens after a big volume spike and then how price reacts at that same level. I'm not talking about High impact news volume, but regular trade volume.

Practice,practice,practice. Keep at it and you will eventually realize that you don't need all those indi's that tell you what has already happened.

The flipping coin has been used before successfully!

"They mistook leverage with genius".

तबसे मेंबर है Sep 12, 2015

1933 पोस्टों

Oct 25, 2015 at 14:55

तबसे मेंबर है Sep 12, 2015

1933 पोस्टों

sbnelson2005 posted:goyankees85 posted:

Your response is way to vague. When you say that an experience traders WAITS FOR THE MARKET TO COME TO THEM, that is a very open ended statement. A person can have a plan, and once the market comes to them, they end up in red and never once see green. They were patient but never made the adjustment to what the market is doing.

As I said before, new traders should stay off the forums and try to learn price action. Price action is the key to winning in forex. You mention that experience traders cut their losses quick and move on, well is that something that you actually do?

Not sure how it's confusing so I'll try and clarify. I look at specific price action at high volume nodes and then react based on what price does. I don't chase the market if price doesn't come to "Where I'm willing to deal". Many new traders will just jump in and chase! Then have the market move against them and hope and pray it turns around. Not a good way to trade.

Where are you getting the volume from?forex doesn't have centralised volume.

"They mistook leverage with genius".

तबसे मेंबर है Sep 20, 2014

342 पोस्टों

Oct 25, 2015 at 22:15

तबसे मेंबर है Sep 20, 2014

342 पोस्टों

तबसे मेंबर है Jul 16, 2013

94 पोस्टों

Oct 26, 2015 at 23:45

(एडिट हो रहा है Oct 27, 2015 at 00:05)

तबसे मेंबर है Jul 16, 2013

94 पोस्टों

There are no easy roads for new traders! There is a middle road that can eventually be turned into an easy road! The question is how to go about it, to get there? Education, demo account trading, reading and learning about RMM ( risk & money management ). Starting small and growing it into bigger account with patient and time. Practising different instruments and trading platforms. To have a humble understanding on how the market works and how our own intellect works also will contribute to our goal to master the market place.

Google for rmm robot or rmmrobot, will give you some valuable links on how you might advance from the middle road to maybe the easy road of trading. It's not easy but it is certainly doable! It takes time, dedication and interest to advance, but the awards are great!

Google for rmm robot or rmmrobot, will give you some valuable links on how you might advance from the middle road to maybe the easy road of trading. It's not easy but it is certainly doable! It takes time, dedication and interest to advance, but the awards are great!

" Lock in the profit and minimize the draw down "

तबसे मेंबर है Sep 12, 2015

1933 पोस्टों

Oct 27, 2015 at 07:19

तबसे मेंबर है Sep 12, 2015

1933 पोस्टों

theHand posted:

@snapdragon1970

That's what I said, but apparently minor details like that doesn't matter.

The devil is in the detail,brokers like to play some fun games.

"They mistook leverage with genius".

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

Oct 27, 2015 at 12:09

तबसे मेंबर है Nov 01, 2011

37 पोस्टों

It's a shame that more people who actually have a published and verified track record are not willing to post. Even if they disagree with me. In this business you are only as good as your last months performance. For those new to this industry the hardest lesson to learn is filtering out the trash.

तबसे मेंबर है Feb 22, 2011

4573 पोस्टों

Oct 27, 2015 at 12:15

तबसे मेंबर है Feb 22, 2011

4573 पोस्टों

sbnelson2005 posted:

It's a shame that more people who actually have a published and verified track record are not willing to post. Even if they disagree with me. In this business you are only as good as your last months performance. For those new to this industry the hardest lesson to learn is filtering out the trash.

Make it FAQ

*व्यवसायिक इस्तेमाल और स्पैम को ब्रदाश नहीं किया जाएगा, और इसका परिणाम खाता को बन्द करना भी हो सकता है.

टिप: किसी चित्र या यूट्यूब या URL को पोस्ट करने से वे अपने आप आपके पोस्ट में आजाएगा!

टिप: @ चिन्ह को टाइप करें उपभोगता के नाम को अपने आप करने के लिए जो इस चर्चा में भाग ले रहा है.