- Ev

- Topluluk

- Yeni Traderlar

- Successful trading

Advertisement

Edit Your Comment

Successful trading

Aug 09, 2017 zamanından beri üye

598 iletiler

Mar 01, 2019 at 13:34

Aug 09, 2017 zamanından beri üye

598 iletiler

Successful trading is depend on most powerful analyzing trade knowledge , on the other hand , despite of good trading knowledge that’s not possible at all to lead a successful trading life at all if you don’t have a reliable support from a credible trading broker , because the broker can affects the result of our trading with certainly.

Jun 10, 2017 zamanından beri üye

33 iletiler

Mar 03, 2019 at 07:14

Jun 10, 2017 zamanından beri üye

33 iletiler

The main way to be profitable is proper risk management. No other way around it.

Mar 04, 2019 zamanından beri üye

10 iletiler

Mar 04, 2019 at 15:22

Mar 04, 2019 zamanından beri üye

10 iletiler

Teejy88 posted:

The main way to be profitable is proper risk management. No other way around it.

MM will mean that you should not have huge fast losses but not amount of MM will make you have profit. For profit you need an edge in the market , a special strategy or insight that will create a positive expectancy. MM just tell you how much to trade but not good if use junk strategy

Aug 11, 2017 zamanından beri üye

870 iletiler

Apr 12, 2019 at 09:57

Aug 11, 2017 zamanından beri üye

870 iletiler

Teejy88 posted:

The main way to be profitable is proper risk management. No other way around it.

what you think there is any different between money and risk management ?

Jun 10, 2017 zamanından beri üye

33 iletiler

Apr 14, 2019 at 05:38

Jun 10, 2017 zamanından beri üye

33 iletiler

Mohammadi posted:Teejy88 posted:

The main way to be profitable is proper risk management. No other way around it.

what you think there is any different between money and risk management ?

Of course there is

Sep 20, 2012 zamanından beri üye

100 iletiler

Jun 11, 2019 at 07:18

Sep 20, 2012 zamanından beri üye

100 iletiler

Money Management is a part of risk management

Jan 05, 2016 zamanından beri üye

1097 iletiler

Jun 11, 2019 at 07:48

(Jun 11, 2019 at 07:50 düzenlendi)

Jan 05, 2016 zamanından beri üye

1097 iletiler

Select a broker that has strong regulations and a guarantee of asset protection.

Use strong money management to protect your investment capital.

It is better to have small profits over time, than to have massive losses at any time.

Trade smaller lot and unit sizes, you can always step additional tickets into your trade basket as the previous ones become profitable.

Lock in your profits using a break even SL.

Use REASONABLE stop loss levels.

Use REASONABLE take profit targets.

Do not allow your emotions to guide your trading.

Do not trade when sick, tired, intoxicated, or other wise not up to 100% performance.

Avoid taking deposit bonuses, there are generally stipulations to the acceptance of the bonus which could negatively impact your account.

These are just a few suggestions from my own rules.

Just my opinion of course.

Use strong money management to protect your investment capital.

It is better to have small profits over time, than to have massive losses at any time.

Trade smaller lot and unit sizes, you can always step additional tickets into your trade basket as the previous ones become profitable.

Lock in your profits using a break even SL.

Use REASONABLE stop loss levels.

Use REASONABLE take profit targets.

Do not allow your emotions to guide your trading.

Do not trade when sick, tired, intoxicated, or other wise not up to 100% performance.

Avoid taking deposit bonuses, there are generally stipulations to the acceptance of the bonus which could negatively impact your account.

These are just a few suggestions from my own rules.

Just my opinion of course.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Jun 11, 2019 zamanından beri üye

9 iletiler

Jun 11, 2019 at 10:57

Jun 11, 2019 zamanından beri üye

9 iletiler

Understanding risk management and how to calculate proper Lot size is very important as well. That has saved me from some big losses

Nov 17, 2012 zamanından beri üye

348 iletiler

Jun 14, 2019 at 06:15

Nov 17, 2012 zamanından beri üye

348 iletiler

i believe on profitable strategy ..

if ur strategy hit 8 TP among 10 trades , then u dont need money managemment or risk M.. or any other thing . u must should know what to do

if ur strategy hit 8 TP among 10 trades , then u dont need money managemment or risk M.. or any other thing . u must should know what to do

skype id millennium.analyst

Jan 05, 2016 zamanından beri üye

1097 iletiler

Jun 14, 2019 at 07:21

Jan 05, 2016 zamanından beri üye

1097 iletiler

fxsc1lper posted:

i believe on profitable strategy ..

if ur strategy hit 8 TP among 10 trades , then u dont need money managemment or risk M.. or any other thing . u must should know what to do

Anyone who advises people to ignore money management or risk management, clearly should be promptly ignored because they no real understanding of the markets.

No SL? Oh sure that's a really smart idea....

Enjoy those 3000 PIP flash spikes...

We've had more than one massive flash spikes in price movements in recent times.

And booom. Account blown...

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Oct 20, 2018 zamanından beri üye

283 iletiler

Jun 15, 2019 at 12:59

Oct 20, 2018 zamanından beri üye

283 iletiler

Imamul posted:

Successful trading is depend on most powerful analyzing trade knowledge , on the other hand , despite of good trading knowledge that’s not possible at all to lead a successful trading life at all if you don’t have a reliable support from a credible trading broker , because the broker can affects the result of our trading with certainly.

There`s a lot more things needed for successful trading like right mindset, money and risk management and etc.

momchil_slavov@

Nov 17, 2012 zamanından beri üye

348 iletiler

Jun 16, 2019 at 06:55

Nov 17, 2012 zamanından beri üye

348 iletiler

Professional4X posted:fxsc1lper posted:

i believe on profitable strategy ..

if ur strategy hit 8 TP among 10 trades , then u dont need money managemment or risk M.. or any other thing . u must should know what to do

Anyone who advises people to ignore money management or risk management, clearly should be promptly ignored because they no real understanding of the markets.

No SL? Oh sure that's a really smart idea....

Enjoy those 3000 PIP flash spikes...

We've had more than one massive flash spikes in price movements in recent times.

And booom. Account blown...

yah after spending 10 years in forex market ..of course i dont know .

i dont know 25 rules of money management and psychology

i dont know any fundementals

i dont know market structures

i dont know technical analysis more than 50 i dont want to write down here

i dont know 8 types of money management and risk management with depth

i dont know model of liquidity providers , security funds , and brokers secerts and methodology of work

of course i didnt read more than 3000 forex ebooks , didnt met with more than 10,000 forex traders , didnt attend more than 100 seminars, didnt study more than 10 ,000 forex strategies , didnt tried 1000 paid robots :)

didnt understand mafia of brokerage

didnt make many videos and wrote articles about forex

yah i dont real know understanding of the market , thankx for telling :).. dont know why every body think only he know the market .plz give respect to others :) every one has right to give his own opinion..

* the people who are using Stoploss making huge profit ? those are also lossing money , so point is not SL here i just shared my thoughts and experience :) as per u shared .. dont mind and thankx

skype id millennium.analyst

May 28, 2019 zamanından beri üye

14 iletiler

Jul 02, 2019 at 07:00

May 28, 2019 zamanından beri üye

14 iletiler

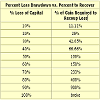

Risk management is important. However, I feel like most people on this thread are giving it way too much credit. I have attached an image of how much percentage gain it would take to recoup losses at different percentages and we can all see that as it gets to be a higher percentage loss the amount needed to come back increases at an increasing rate. That being said, the knowledge of how to make good proper trades is equally if not more important in my opinion than exact proper risk management, some people do 2%, some people do 1% some do less than that, it doesn't really matter as long as your not being ridiculous with it by risking 80% of account or something like that IF you have a solid system and are good at trading. For example, moving SL to BE, a strategy that doesn't need much DD, and proper TP technique. There are many other things that separate good traders from the losers but imo these are the most important 2 things.

Jun 29, 2019 zamanından beri üye

123 iletiler

Jul 03, 2019 at 05:48

Jun 29, 2019 zamanından beri üye

123 iletiler

Every trader requires profit and many may assume greater profit as greater success which is indeed a wrong concept for the forex traders. We can’t disregard the magnitude of carrying out our trading performance with complete awareness which can actually allow a trader to be a survivor here. Every trader who requires achievement should go through proper analysis, utilization of appropriate trading skills and working with reliable and proper broker here.

Jul 09, 2019 zamanından beri üye

32 iletiler

Jul 30, 2019 at 06:29

Jul 09, 2019 zamanından beri üye

32 iletiler

There is no single formula for becoming successful in trading. Success takes time be it any sphere of life. Similarly becoming successful in trading calls for a lot of patience, skill , knowledge base, inquisitiveness and discipline . All you can do is go step by step , analyse each and every trading related thing and balance your profit risk ratio.

Jul 31, 2019 zamanından beri üye

12 iletiler

Jul 31, 2019 at 08:44

Jul 31, 2019 zamanından beri üye

12 iletiler

blakeolson9 posted:

Risk management is important. However, I feel like most people on this thread are giving it way too much credit. I have attached an image of how much percentage gain it would take to recoup losses at different percentages and we can all see that as it gets to be a higher percentage loss the amount needed to come back increases at an increasing rate. That being said, the knowledge of how to make good proper trades is equally if not more important in my opinion than exact proper risk management, some people do 2%, some people do 1% some do less than that, it doesn't really matter as long as your not being ridiculous with it by risking 80% of account or something like that IF you have a solid system and are good at trading. For example, moving SL to BE, a strategy that doesn't need much DD, and proper TP technique. There are many other things that separate good traders from the losers but imo these are the most important 2 things.

Most sensible thing I have read on MyFXBook, To much credit is given to risk management but with all the risk management in the world you can still lose money (only slowly)

Mar 05, 2017 zamanından beri üye

17 iletiler

Jul 31, 2019 at 09:36

Mar 05, 2017 zamanından beri üye

17 iletiler

Imamul posted:

Successful trading is depend on most powerful analyzing trade knowledge , on the other hand , despite of good trading knowledge that’s not possible at all to lead a successful trading life at all if you don’t have a reliable support from a credible trading broker , because the broker can affects the result of our trading with certainly.

I totally agree!

Aug 11, 2017 zamanından beri üye

870 iletiler

Aug 04, 2019 at 07:13

Aug 11, 2017 zamanından beri üye

870 iletiler

Knowledge is the key to success in Forex. There is nobody who can make success from here without knowledge . so we have to emphasis on acquiring real trading knowledge and we can get most powerful analyzing trade knowledge by passing a long time. Otherwise that’s not possible at all.

Aug 09, 2017 zamanından beri üye

598 iletiler

Aug 04, 2019 at 08:16

Aug 09, 2017 zamanından beri üye

598 iletiler

for success , the most important trading tip , i think try to manage your money when trading in practical , only money management can change your trading life , otherwise no way to survive in here with successfully.

Jun 27, 2019 zamanından beri üye

1 iletiler

Aug 06, 2019 at 13:38

Jun 27, 2019 zamanından beri üye

1 iletiler

Yesterday I have taken a buy call in crude oil at 3890 and exited from the call 10:10 pm at 3957

Total Profit: 67

Total Profit: 67

*Ticari kullanım ve istenmeyen e-postalara müsamaha gösterilmez ve hesabın feshedilmesine neden olabilir.

İpucu: Bir resim/youtube urlsi yayınlamak, onu otomatik olarak gönderinize gömer!

İpucu: Bu tartışmaya katılan bir kullanıcı adını otomatik olarak tamamlamak için @ işaretini yazın.