- หน้าหลัก

- ชุมชน

- ระบบการเทรด

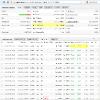

- IC MARKETS REAL 313166

Advertisement

IC MARKETS REAL 313166 (โดย BluePanther )

ผู้ใช้ได้ลบระบบนี้

Edit Your Comment

IC MARKETS REAL 313166 การสนทนา

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 13, 2014 at 23:14

(แก้ไขแล้ว Jan 13, 2014 at 23:30)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

...ah forget it. Perhaps I should just keep all 18 pairs I had before and if I hit the 200 trade limit then I close them all and start from 0 trades? I hate boredom! 😞

...nineteen pairs? Meh, I'm too tired. I need to go to sleep. Let's see how they go. RSI still 90/10 so should be more likely reversals only.

I figured that after losing $700 but making $1000+ from CHFJPY alone since 7/1/14, perhaps it is worth keeping all pairs, and perhaps I may not hit the limit so quickly, and even if I do I should still come away with more profit than the cost of closing all trades (I hope).

...nineteen pairs? Meh, I'm too tired. I need to go to sleep. Let's see how they go. RSI still 90/10 so should be more likely reversals only.

I figured that after losing $700 but making $1000+ from CHFJPY alone since 7/1/14, perhaps it is worth keeping all pairs, and perhaps I may not hit the limit so quickly, and even if I do I should still come away with more profit than the cost of closing all trades (I hope).

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 14, 2014 at 01:27

(แก้ไขแล้ว Jan 14, 2014 at 01:28)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

RSI back to 85/15. There is a reason the defaults are that setting: I could see the EA missing too many trading opportunities for quick profits, so I am returning to this setting.

So nothing has changed since hitting the trade limit, except the grid is still 8 on all pairs. Maybe I should return this to 10?

So nothing has changed since hitting the trade limit, except the grid is still 8 on all pairs. Maybe I should return this to 10?

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 14, 2014 at 02:12

(แก้ไขแล้ว Jan 14, 2014 at 02:21)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

No, I must remove some pairs - 137 trades after a couple of hours is not looking good. I think I should go with ten pairs, even though I am sure profitability will suffer. 😞

Now using ten pairs: AUDJPY, AUDNZD, AUDUSD, EURAUD, GBPAUD, GBPCHF, NZDJPY, USDCHF, XAUEUR, XAUUSD.

That should cut out a few trades... that cut about 47 trades, so now sitting around 90 trades. Hope that is okay!

Now using ten pairs: AUDJPY, AUDNZD, AUDUSD, EURAUD, GBPAUD, GBPCHF, NZDJPY, USDCHF, XAUEUR, XAUUSD.

That should cut out a few trades... that cut about 47 trades, so now sitting around 90 trades. Hope that is okay!

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 14, 2014 at 04:08

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Increasing the following pairs to 0.02 lots and the reason:

-EURAUD: average trade length is shortest of all pairs at 0.88 hours

-AUDJPY: net pips is +1122 and average trade length is 1.45 hours

-XAUUSD: worst trade is $7.72, net positive pips

-XAUEUR: worst trade is $2.58, net positive pips

-EURAUD: average trade length is shortest of all pairs at 0.88 hours

-AUDJPY: net pips is +1122 and average trade length is 1.45 hours

-XAUUSD: worst trade is $7.72, net positive pips

-XAUEUR: worst trade is $2.58, net positive pips

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 14, 2014 at 12:10

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Well, looks like this is the end of the road. Almost $0 margin. The account seemed to do okay, but AUDNZD trends too much also. I will avoid EURUSD and AUDNZD in future. Heck, perhaps I should avoid anything forex... I'll get ahead more by working and saving my money instead. 😞

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 15, 2014 at 09:02

(แก้ไขแล้ว Jan 15, 2014 at 09:10)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

sirius1fx posted:

what was the grid step you were using?

Setting=8 (pips?)

Okay, I managed to salvage a quarter of my account - AVOID ANY NZD PAIR! They seem to trend too much!

I have decided to revert back to the old strategy of requiring no RSI to enter a trade. This way trades occur more frequently and should produce quicker profits (albeit with higher risk).

I have cut my pairs to three: XAUUSD, XAUEUR, EURCHF. I plan to use "Close All" script to close all trades or specific pairs to reset any grid.

Let's see how this goes... the plan is to make greater profits than what I lose when I reset the grids. This way a strong trend won't blow my account because I will reset the grid and it will begin back at 0.01 lots.

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 15, 2014 at 09:57

(แก้ไขแล้ว Jan 15, 2014 at 10:15)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

I must remember IC Markets' 200 open trades limit. With this in mind, I will keep to a minimum of pairs (the three I have chosen), and simply increase risk as my account grows.

For now, I will aim for 0.01 lots per $10,000 as a simple method to associate account balance and trade risk.

Current rules:

1. 200 open trades

2. 3 pairs only: XAUUSD, XAUEUR, EURCHF (200/3 = 66 open trades per pair)

3. 0.01 lots per $10,000

4. No RSI for entry

5. Reset grids when: a) open loss = 10% of account balance or b) 200 open trade limit nears

6. Keep "optimised" grid (10, 5, 10, 8), with no max loss.

7. ...all whilst aiming for 2% daily profits, and contributing a minimum of $2000 per fortnight.

For now, I will aim for 0.01 lots per $10,000 as a simple method to associate account balance and trade risk.

Current rules:

1. 200 open trades

2. 3 pairs only: XAUUSD, XAUEUR, EURCHF (200/3 = 66 open trades per pair)

3. 0.01 lots per $10,000

4. No RSI for entry

5. Reset grids when: a) open loss = 10% of account balance or b) 200 open trade limit nears

6. Keep "optimised" grid (10, 5, 10, 8), with no max loss.

7. ...all whilst aiming for 2% daily profits, and contributing a minimum of $2000 per fortnight.

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 15, 2014 at 14:17

(แก้ไขแล้ว Jan 15, 2014 at 14:42)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Keeping current rules:

1. 200 open trades

2. Three pairs only: XAUUSD, XAUEUR, EURCHF (200/3 = 66 open trades per pair)

3. 0.01 lots per $10,000

4. No RSI for entry

5. Reset grids when: a) open loss = 10% of account balance or b) 200 open trade limit nears

6. Keep 'optimised' grid (10, 5, 10, 8), with no max loss.

7. ...all whilst aiming for 2% daily profits, and contributing a minimum of $2000 per fortnight.

------------------------------------------------------------------------------------------------------------------------------------

USDZAR looks like the kind of pair I have been looking for: highly volatile without the strong trends. I have trialled it live for an hour and it has impressed me, though I am concerned at the high activity and my limited margin. Currently downloading tick data to (hopefully) produce 99% accurate backtests on different pairs.

...on second-thought, it is a bit TOO hyperactive for now. Excellent opportunity in the future though. I am looking forward to putting this pair on my account when I reach, say, $100,000 available margin dedicated to JUST this pair (at the current grid settings). Had to manually close out all the USDZAR trades because the script doesn't work properly (or I don't know how to use it).

Hmph! Wouldn't you know it? I just closed out those trades right before a pullback. Well, too much risk too soon anyway.

Now I'd better stop meddling with my account - the more I meddle the more I lose. Gotta let the EA do its job. I am just a bit anxious... I shouldn't be losing sleep over this (but I am)! 😞

1. 200 open trades

2. Three pairs only: XAUUSD, XAUEUR, EURCHF (200/3 = 66 open trades per pair)

3. 0.01 lots per $10,000

4. No RSI for entry

5. Reset grids when: a) open loss = 10% of account balance or b) 200 open trade limit nears

6. Keep 'optimised' grid (10, 5, 10, 8), with no max loss.

7. ...all whilst aiming for 2% daily profits, and contributing a minimum of $2000 per fortnight.

------------------------------------------------------------------------------------------------------------------------------------

USDZAR looks like the kind of pair I have been looking for: highly volatile without the strong trends. I have trialled it live for an hour and it has impressed me, though I am concerned at the high activity and my limited margin. Currently downloading tick data to (hopefully) produce 99% accurate backtests on different pairs.

...on second-thought, it is a bit TOO hyperactive for now. Excellent opportunity in the future though. I am looking forward to putting this pair on my account when I reach, say, $100,000 available margin dedicated to JUST this pair (at the current grid settings). Had to manually close out all the USDZAR trades because the script doesn't work properly (or I don't know how to use it).

Hmph! Wouldn't you know it? I just closed out those trades right before a pullback. Well, too much risk too soon anyway.

Now I'd better stop meddling with my account - the more I meddle the more I lose. Gotta let the EA do its job. I am just a bit anxious... I shouldn't be losing sleep over this (but I am)! 😞

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 15, 2014 at 20:32

(แก้ไขแล้ว Jan 15, 2014 at 21:02)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

ahuruglica posted:

Why not AUDUSD, GBPUSD, or USDJPY?

They were more profitable than than XAUUSD, XAUEUR and EURCHF.

sirius1fx posted:

XAUUSD and AUDUSD is a good one for this i think.

The short answer:

Yes, AUDUSD, GBPUSD, USDJPY were more profitable if you look at the entire account history, but they required much more margin at times. Those pairs trended strongly at certain times with considerable drawdown. I want to avoid a repeat of the EURUSD and NZD pairs' margin call incidents.

The long answer:

I have changed strategy multiple times during this account's history. After doing custom analysis for the period 28 Nov to 26 Dec (when I used the current strategy) and selecting to analyse only a particular EA, you can see:

-USDJPY: Total trades = 351 Total pips = -465.5 Total profit = 1304.84 (negative pips is indicator of martingale working against strong trend)

GBPUSD: Short trades = 844 Short pips = -124.7 Short profits = 1619.10 (same as USDJPY)

...and since EURUSD was on my account longest, stats are skewed. Analysing from Dec 17 to Dec 26 (to the "killer spike"), the EURUSD grid closed at 1.38158 (sorting history by largest lot size). By sorting history by closing price (looking for 1.38158) and browsing back, I can see:

-the grid started at 1.36828

-51 trades were opened by the early manual close of this grid

-the EURUSD stopped rising at 1.38928. The size (both number of trades and total lots) was unsustainable on my limited margin.

Of course, I am only analysing a very short period of time and also during low volatility over Christmas/NY, so you can argue these stats are skewed to look unfavourable, or this was an extreme ("black swan") event. It certainly was a pronounced spike if you look at any EURUSD graph over late-Dec 2013.

I started blogging my strategy here from Jan 7 so you won't find it, but I was running a minimal grid size like now with no RSI as entry requirement. I have reverted back to the same strategy (as outlined in my "Current rules" for this system), and therefore I am avoiding EURUSD because there was no retracement during that spike which: a) can provide quick profits in the opposite direction of the trend to increase margin, and b) could have closed the grid sooner.

Also, the AUDUSD, USDJPY and EURUSD are called "majors" because they are popular trading pairs. This makes them an ideal candidate to be manipulated. I know the forex market is worth trillions and no "one bank" has that much money to move price, but countries' / central banks' policies can influence prices dramatically (eg. US quantitative easing, or Japan's money-printing - same thing, different country). Therefore:

1. if a broker wanted to "play games" with its customers it is more likely to do so on a popular instrument to make their "game" more effective (make more profits). They are less likely to choose an unpopular pair, and even less likely to chase a guy like me with no money! 😝

2. these pairs are "open" to strong moves (trends), especially since AUD tends to be considered a "risky play", and USD tends to be considered a "safe play".

But as they say: "there are lies, damn lies, and statistics". Basically numbers can say anything you like, but with "evidence". 😉

PS. Sorry, you asked about GBPUSD not EURUSD. GBPUSD: 1. tends to follow EURUSD, 2. manipulation (as said above). However, I am always considering pairs... 😎

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 16, 2014 at 20:08

(แก้ไขแล้ว Jan 16, 2014 at 20:10)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Not liking the EURCHF drawdown. Considering a new strategy of the following charts:

1. XAUUSD - no RSI

2. XAUUSD - with RSI

3. XAUEUR - with RSI

I find it hard to like any pair except these. Awaiting the drawdown to reduce so I can remove EURCHF.

Also, I think 0.01 lots per $10,000 per pair is important. This is the reason I have lost to the market twice on this account - because I had less margin than required. This means I must reach $30,000 before I consider adding further risk. ie. 3 pairs x $10,000

1. XAUUSD - no RSI

2. XAUUSD - with RSI

3. XAUEUR - with RSI

I find it hard to like any pair except these. Awaiting the drawdown to reduce so I can remove EURCHF.

Also, I think 0.01 lots per $10,000 per pair is important. This is the reason I have lost to the market twice on this account - because I had less margin than required. This means I must reach $30,000 before I consider adding further risk. ie. 3 pairs x $10,000

forex_trader_136673

เป็นสมาชิกตั้งแต่ Jun 28, 2013

842 โพสต์

Jan 16, 2014 at 20:32

เป็นสมาชิกตั้งแต่ Jun 28, 2013

842 โพสต์

I read an article on precious metals and remembered your post. I don't understand why do you chose to trade gold, if an asset moves 15% in two days best thing is to stay away from it. I am certain it is a grid killer.

In my mind best way is to trade currencies and not use too much leverage. Just my opinion.

If you have free time, read it. Interesting article.

tinyurl.com/lqva839

In my mind best way is to trade currencies and not use too much leverage. Just my opinion.

If you have free time, read it. Interesting article.

tinyurl.com/lqva839

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 17, 2014 at 00:30

(แก้ไขแล้ว Jan 17, 2014 at 00:45)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

lol @ZeroHedge's motto: "On a long enough timeline, the survival rate of everyone drops to zero." Yeah, we will all die some day. 😎

Ah, yes, you are correct there with manipulation. I heard rumors of this by certain big powers that want people to continue having faith in fiat currency and to try to undermine people's interest in gold (brings to mind the US Fed doing something of this sort).

But besides this, I think it is fantastic that an asset can move 15% in two days - I just gotta make sure I have enough margin to weather the moves! Greater volatility = greater profits!😎

The question is: will that be 15% in only one direction without any retracement during / after this move? I doubt that! Markets do not move in straight lines - they retrace, test support levels, spike, etc. 😎 Generally, the quicker a move in one direction, the sooner in the opposite direction. I would rather 15% in two days than a large drawdown lasting two weeks (and being a longer move means it is probably a greater fundamental shift in the asset's value and therefore less likely to retrace enough to allow EA to reach set target levels).

------------------------------------------------------------------------------------------------------------------------------

Margin levels were as low as 350% yesterday on $6000 (therefore, 1750% on $30,000) - uncomfortable... 😕 though 17.6% profit is excellent! 😎

Now trading only:

1. XAUUSD - no RSI

2. XAUUSD - with RSI

3. XAUEUR - with RSI

Same magics on XAUUSD so the EA will close all XAUUSD trades when it reaches set profit targets. 😎 I am hoping XAUUSD doesn't eat margin too quickly...

Aiming for:

- $30,000 before increasing risk (ie. adding pairs, increasing lot sizes).

- 2% daily profit on $30,000 = $600 (if I better this - great!)

Ah, yes, you are correct there with manipulation. I heard rumors of this by certain big powers that want people to continue having faith in fiat currency and to try to undermine people's interest in gold (brings to mind the US Fed doing something of this sort).

But besides this, I think it is fantastic that an asset can move 15% in two days - I just gotta make sure I have enough margin to weather the moves! Greater volatility = greater profits!😎

The question is: will that be 15% in only one direction without any retracement during / after this move? I doubt that! Markets do not move in straight lines - they retrace, test support levels, spike, etc. 😎 Generally, the quicker a move in one direction, the sooner in the opposite direction. I would rather 15% in two days than a large drawdown lasting two weeks (and being a longer move means it is probably a greater fundamental shift in the asset's value and therefore less likely to retrace enough to allow EA to reach set target levels).

------------------------------------------------------------------------------------------------------------------------------

Margin levels were as low as 350% yesterday on $6000 (therefore, 1750% on $30,000) - uncomfortable... 😕 though 17.6% profit is excellent! 😎

Now trading only:

1. XAUUSD - no RSI

2. XAUUSD - with RSI

3. XAUEUR - with RSI

Same magics on XAUUSD so the EA will close all XAUUSD trades when it reaches set profit targets. 😎 I am hoping XAUUSD doesn't eat margin too quickly...

Aiming for:

- $30,000 before increasing risk (ie. adding pairs, increasing lot sizes).

- 2% daily profit on $30,000 = $600 (if I better this - great!)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 17, 2014 at 12:37

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Big jump in GBPUSD - RSI would not even have helped me in this case (I would be in huge drawdown).

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 17, 2014 at 12:42

(แก้ไขแล้ว Jan 17, 2014 at 12:42)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 17, 2014 at 12:48

(แก้ไขแล้ว Jan 17, 2014 at 13:03)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

So my rules have changed (again):

1. 200 open trades (UNCHANGEABLE)

2. Two pairs only: XAUUSD, XAUEUR (200/2 = 100 open trades per pair)

3. 0.01 lots per $10,000 (account balance is below $10,000 so both pairs are at 0.01 lots)

4. RSI for both, and third chart with XAUUSD no RSI

5. Reset grids when: a) open loss = 10% of account balance or b) 200 open trade limit nears

6. Keep 'optimised' grid (10, 5, 10, 8), with no max loss.

> 7. DO NOT ADD A THIRD PAIR UNTIL REACHING $30,000!!! <

...all whilst aiming for 2% daily profits, and contributing a minimum of $2000 per fortnight.

-------------------------------------------------------------------------------------------

I must watch and see how this goes for at least a week. I must lower my expectations to avoid margin calls.

Account was 2000% (20x) - a bit on the low side. Now back to 17573.56% (175x) - much better!

Slow going for now... 2000% @ $10,000 = 6000% @ $30,000 (is this enough margin...?)

I wish there was a chart that could visually display my margin levels! That would be so useful!

1. 200 open trades (UNCHANGEABLE)

2. Two pairs only: XAUUSD, XAUEUR (200/2 = 100 open trades per pair)

3. 0.01 lots per $10,000 (account balance is below $10,000 so both pairs are at 0.01 lots)

4. RSI for both, and third chart with XAUUSD no RSI

5. Reset grids when: a) open loss = 10% of account balance or b) 200 open trade limit nears

6. Keep 'optimised' grid (10, 5, 10, 8), with no max loss.

> 7. DO NOT ADD A THIRD PAIR UNTIL REACHING $30,000!!! <

...all whilst aiming for 2% daily profits, and contributing a minimum of $2000 per fortnight.

-------------------------------------------------------------------------------------------

I must watch and see how this goes for at least a week. I must lower my expectations to avoid margin calls.

Account was 2000% (20x) - a bit on the low side. Now back to 17573.56% (175x) - much better!

Slow going for now... 2000% @ $10,000 = 6000% @ $30,000 (is this enough margin...?)

I wish there was a chart that could visually display my margin levels! That would be so useful!

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 17, 2014 at 13:09

(แก้ไขแล้ว Jan 17, 2014 at 13:09)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

"FinFX just received the information that due to Martin Luther King, Jr. Day on 20 January 2014, there are some changes in the opening hours of precious metals.

The Gold (XAUUSD) and Silver (XAGUSD) pairs will close on Monday 20 January 2014 at 18:00 GMT / 1 PM EST and reopen again at 23:00 GMT / 6 PM EST!"

----------------------------------------------------------------------------------------------

WHAT THE HELL IS THAT? If this was really an important day, the entire world would honor this day (eg. Christmas Day). What crap! Pftftftftftftftftftftftft!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!😂

The Gold (XAUUSD) and Silver (XAGUSD) pairs will close on Monday 20 January 2014 at 18:00 GMT / 1 PM EST and reopen again at 23:00 GMT / 6 PM EST!"

----------------------------------------------------------------------------------------------

WHAT THE HELL IS THAT? If this was really an important day, the entire world would honor this day (eg. Christmas Day). What crap! Pftftftftftftftftftftftft!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!😂

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Jan 17, 2014 at 13:24

(แก้ไขแล้ว Jan 17, 2014 at 13:36)

เป็นสมาชิกตั้งแต่ Jan 25, 2010

1288 โพสต์

Changed RSI level to 6 (from default of 5). Not liking the fast drawdown of XAUEUR, even with RSI(5) as entry criterion. Account margin 1022%. Slight concern...

Error 1 and Error 33 with XAUUSD sell orders in Experts tab - kind of explains why I have only been seeing Buys all day... 😞

Reset MT4 and it seems to be okay... for now. Hmm, that's certainly impacted profits today. I was concerned at the low returns I was getting.

Error 1 and Error 33 with XAUUSD sell orders in Experts tab - kind of explains why I have only been seeing Buys all day... 😞

Reset MT4 and it seems to be okay... for now. Hmm, that's certainly impacted profits today. I was concerned at the low returns I was getting.

*การใช้งานเชิงพาณิชย์และสแปมจะไม่ได้รับการยอมรับ และอาจส่งผลให้บัญชีถูกยกเลิก

เคล็ดลับ: การโพสต์รูปภาพ/youtube url จะฝังลงในโพสต์ของคุณโดยอัตโนมัติ!

เคล็ดลับ: พิมพ์เครื่องหมาย @ เพื่อป้อนชื่อผู้ใช้ที่เข้าร่วมการสนทนานี้โดยอัตโนมัติ