Altcoins recharging after rally

Market picture

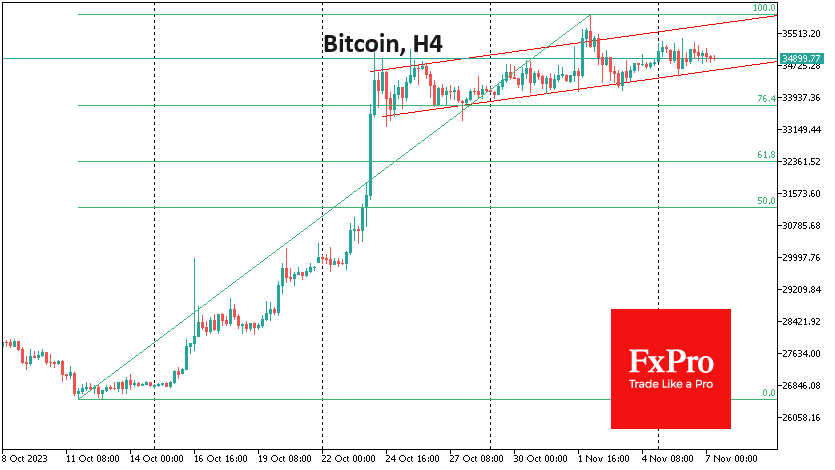

Crypto market capitalisation rose 0.6% over the past 24 hours to $1.33 trillion as altcoins outperformed, while top cryptocurrencies stabilised after a surge two weeks earlier.

According to CoinShares, investments in crypto funds rose sharply again last week, adding $261 million, the sixth consecutive week of inflows. Bitcoin investments increased by $229 million, Ethereum by $18 million and Solana by $11 million.

XRP rose to $0.73 by the end of the day on Monday. Reaching this level triggered a solid but short-lived wave of profit-taking. This sentiment has spread, albeit with less intensity, to other leading altcoins such as Solana, Cardano and Litecoin. So far, it looks like a quick recharge rather than the start of an extended correction, as the weakness is neither shared by Bitcoin and Ether nor by the equity markets.

Ethereum, which had seen limited gains recently, rose for the fifth day in a row on Tuesday, trading close to $1900, the highest level in four months.

News background

Attorney Steven Nerayoff has publicly accused Ethereum co-founders Vitalik Buterin and Joseph Lubin of fraudulent activity bigger than the collapse of the FTX cryptocurrency exchange. He said that "a small circle of ETH investors control about 75 per cent of the protocol's total assets" and that much of the exchange trading was "fake or fictitious".

Hong Kong's Securities and Futures Commission (SFC) is considering giving retail investors access to crypto spot ETFs. Launching crypto ETFs in Hong Kong could speed up the approval of similar funds in the US.

Berkshire Hathaway vice chairman Charlie Munger has expressed concern about the rise of Bitcoin, saying the first cryptocurrency is causing confusion between fiat currencies and traditional assets.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)