Another Dip in Crypto Capitalization

Market picture

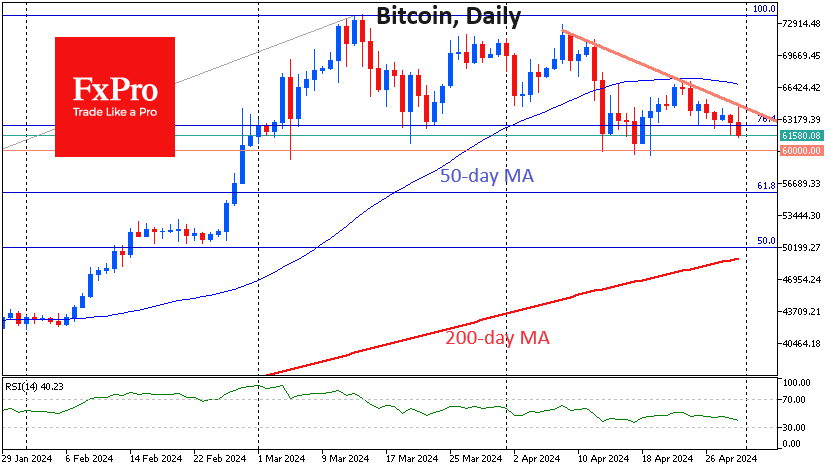

The crypto market capitalisation decreased by another 1.5% to $2.27 trillion, getting closer and closer to the April lows just above $2.22 trillion. Contrary to expectations, after the halving, the pressure on the market increased, in full accordance with the adage "buy the rumour, sell the news".

It seems that the strongest altcoins started to give up. Ethereum and Solana are both losing about 4% each in the last 24 hours - higher than most of the top altcoins.

Bitcoin is losing 1.5% to $61.6K, reversing sharply to the downside as active Asian trading begins. This reversal also coincides with downside resistance that has been in place since 8 April.

According to CoinShares data, crypto fund investments decreased $435M last week after outflows of $206M the week before; this is the third consecutive week of outflows. Bitcoin investments were down $423M, Ethereum investments were down $38M, and Solana investments were up $4M.

The bulk of the outflows (totalling $440M) came from Grayscale's bitcoin fund. At the same time, the inflow of funds to other bitcoin-ETFs fell sharply, while a wide range of altcoins saw an inflow of investments, CoinShares noted.

News background

The slowdown in inflows into bitcoin-ETFs may be short-lived before BTC resumes its rally toward $150,000, Bernstein expects. It's a short-term pause before ETFs become more integrated with the platforms of private banks, wealth advisers and brokers.

A crypto analyst under the pseudonym TechDev said bitcoin, despite a temporary decline, is poised to repeat the parabolic rally of November 2020 and soar nearly 120 per cent.

Bloomberg reported on the possible approval of a spot bitcoin-ETF in Australia by the end of 2024. Australian pension funds with $2.3 trillion in assets may be interested in the product.

According to Visa, the USDC stablecoin has overtaken the segment leader, Tether's USDT, in terms of the number of transactions per month. At the same time, USDT capitalisation is more than three times ahead of USDC.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)