Renewed tensions keep risk appetite under wraps

Weaker risk appetite

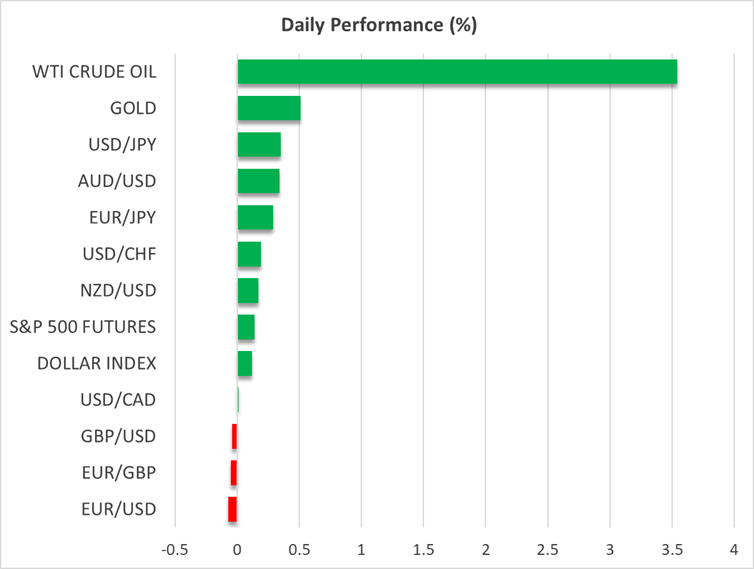

The market’s tone appears to have slightly altered this week. Following Tuesday's extraordinary correction in gold, risk markets are gradually suffering from weaker risk appetite. Despite yesterday’s late-session rally, US equities are almost flat this week. Meanwhile, corporate earnings continue to surprise on the upside, apart from heavyweights like Tesla, which reported an aggressive drop in profits yesterday despite record vehicle sales.

Similarly, cryptocurrencies are struggling to overcome the current weakness and build a basis for another rally. Bitcoin is trading just below $110k at the time of writing, with ether failing to reclaim the $4,000 mark. Both cryptocurrencies are down in October, but still faring much better than the 18% decline posted by XRP.

Interestingly, the positive one-month correlation between gold and risk assets persists, albeit a touch weaker following this week’s movements. The precious metal is edging higher today, testing its ability to hold above the $4,100 level, as Tuesday’s dip appears to have attracted new buying interest.

Sanctions and tariffs in the spotlight again

A common factor in these market moves is the latest geopolitical tensions. Despite expectations of a pivotal meeting between the US and Russian presidents to discuss the Ukraine conflict, Trump cancelled the meeting, with additional sanctions on Russian oil expected today or tomorrow, on top of the already-announced sanctions targeting Rosneft and Lukoil.

Realistically, Trump is following a textbook negotiating tactic, threatening sanctions to achieve his targets, although his strategy has not proved fruitful with Putin. Therefore, it will not be surprising – on the contrary, it remains the key scenario – if a new meeting is scheduled between the two leaders, potentially after the APEC meeting in South Korea, where Trump is expected to hold extensive talks with Chinese President Xi.

There is a plethora of unresolved issues on the US-China agenda, with the imminent meeting between US Treasury Secretary Bessent and Chinese officials in Malaysia potentially setting the tone for this negotiating round. The November 1 deadline – when Trump has threatened to impose an extra 100% tariffs on Chinese imports – is still looming, but markets feel confident that an extension will be granted if an agreement is not reached in time.

Oil jumps above $60

The renewed trade tensions appear to have boosted oil, which, after a retest of the early May lows, has quickly jumped above $60. This rally was supported by the bullish drawdown in crude oil inventories in Wednesday’s EIA report. Alternatively, oil investors may have taken US Energy Secretary Wright’s recommendation that “it is a great time to buy” at face value.

That said, the move feels slightly hasty considering that little has fundamentally changed this week. A normalization in US-China relations and a Trump-Putin meeting could quickly erase these oil gains. Notably, the last thing that the Fed needs now is a sharp oil rally, that would fuel supply-side inflationary pressures.

Dollar remains bid; yen feels the pressure

Meanwhile, the US dollar remains on the front foot, posting gains across the board this week. The most noticeable move is against the yen. Despite comments from incoming Finance Minister Katayama that “the Takaichi trade has calmed down somewhat”, dollar/yen continues to climb, potentially preparing to test its recent eight-month high.

Interestingly, while most economists believe that the new PM will not delay the BoJ’s rate hikes, it is evident that Ueda et al. do not have a carte blanche to implement their tightening strategy.