WTI crude oil breaks above 61.00

WTI crude oil prices are advancing amid robust buying interest and escalating geopolitical tensions, following the imposition of US sanctions on Russian oil majors Lukoil and Rosneft. The commodity opened with a bullish gap today, building on yesterday’s strong upward momentum and decisively breaching the key resistance zone of 60.13–60.60.

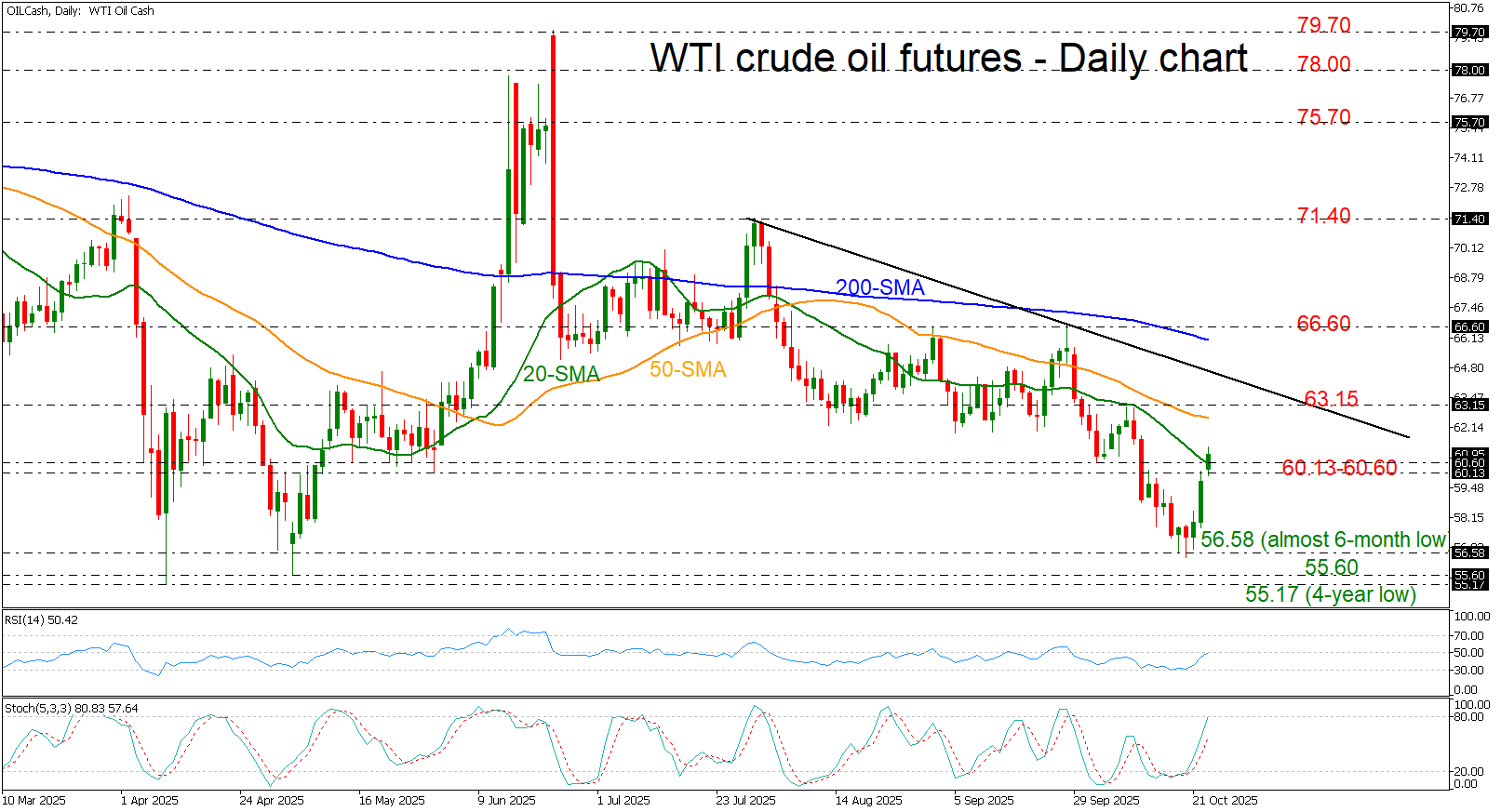

Currently trading above 61.00, technical indicators support the short-term bullish outlook. The RSI is attempting to cross above the 50 threshold, while the stochastic oscillator is approaching overbought territory, suggesting continued upward pressure.

Should the rally persist, the 50-day simple moving average (SMA) at 62.60 and the resistance level at 63.15 may act as potential barriers. However, the broader short-term trend remains tilted to the downside, and a pullback near the descending trendline cannot be ruled out.

On the downside, a break below the six-month low of 56.58, an unbreakable support level since 2021, would reinforce the long-term bearish scenario. A daily close beneath this threshold could pave the way for further declines toward the 55.60–55.17 region.

Summarizing, the short-term technical signals point to continued bullish momentum, but the broader trend remains fragile. Traders should monitor key resistance levels and geopolitical developments closely, as a failure to sustain gains above 61.00 may trigger renewed selling pressure.