Dollar gets a boost by US inflation numbers

US prices feel the heat of tariffs

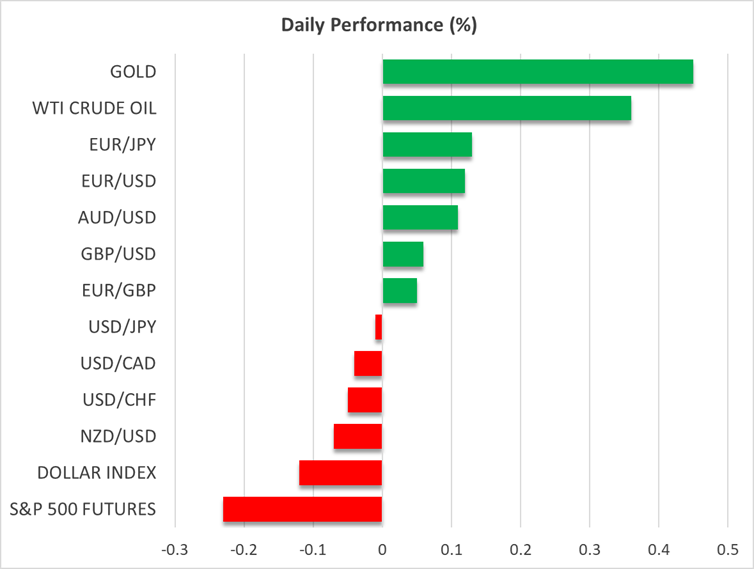

The dollar finished higher against all the other major currencies on Tuesday, drawing support from rising Treasury yields after the US CPI data revealed that inflation in the US accelerated in June. Today, the greenback is pulling back.

The headline CPI accelerated to 2.7% y/y from 2.4%, marginally exceeding estimates of 2.6%. The core rate rose as well, but not as much as projected. It ticked up to 2.9% from 2.8%. The initial reaction in the dollar was a small slide, perhaps as the first thing investors noticed was the lower-than-expected core CPI rate.

However, the greenback was quick to recover and outperform all its major peers as soon as market participants dug into the details of the report, where they found out that underlying inflation was mainly driven by a 0.7% increase in core goods, which was seen as proof of tariff-driven inflation.

Fed’s patience justified, PPI data in focus

The data added extra credence to Fed Chair Powell’s view that patience was the wisest strategy when it comes to interest rates as he anticipated that the inflationary impact of tariffs to start appearing in the summer. And with that in mind, investors scaled back their rate cut bets, taking the probability of a July reduction down to 2.5% and the total number of basis points expected to be cut this year to 43.

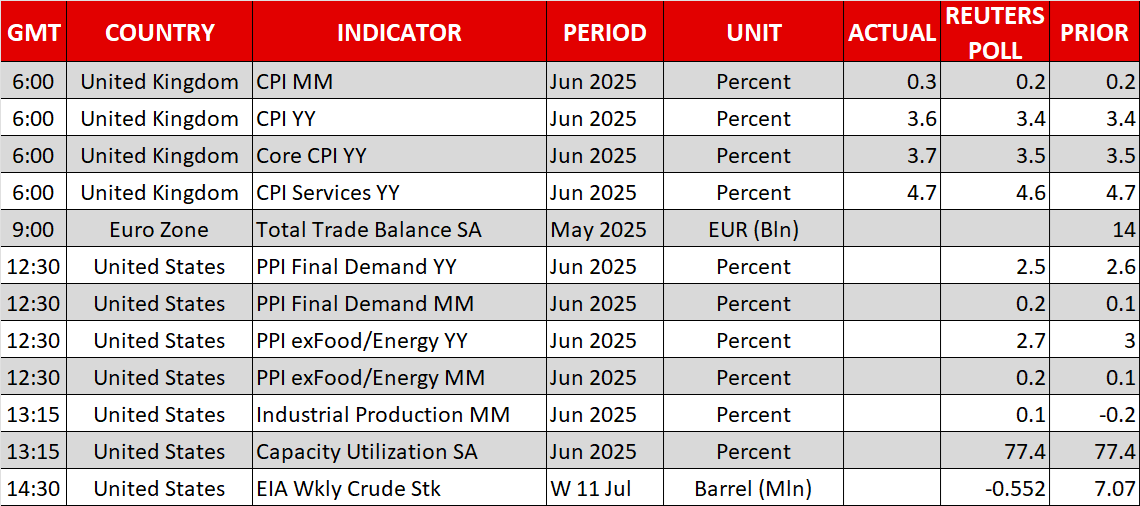

Today, the spotlight is likely to fall on the PPI numbers for June. Producer prices may provide a clearer picture as to how tariffs have been affecting inflation and thus, should the concerns ignited by the CPI data be confirmed, the dollar may extend its recovery as traders start flirting with the idea that even two 25bps rate cuts may be too many for this year.

Having said that though, it is too early to start arguing about a major trend reversal in the dollar. Firstly, should tariffs reach a point where they revive recession fears, the dollar may switch back to falling whenever Trump hardens his stance. And secondly, Trump has been ramping up his attacks against Powell recently. Yesterday, he noted that cost overruns for a renovation of the Fed’s headquarters could constitute a firing offence. This increases anxiety about the potential of an early departure of Fed Chair Powell and his replacement with a more dovish official.

BoE seen cutting in August despite accelerating inflation

Today, the UK released its own CPI figures, with both the headline and core rates accelerating and exceeding expectations of flat prints. Nonetheless, although both rates are way above the BoE’s 2% objective, at 3.6% and 3.7% respectively, investors kept bets about a 25bps interest rate reduction at the Bank’s upcoming meeting on August 7 firmly on the table.

The reason for that may be that the Bank has been sounding dovish lately amid a deteriorating labour market, being already aware that inflation is likely to accelerate further this year. Specifically, policymakers have been projecting a 3.7% inflation rate in 2025. The pound rebounded after the data, but the recovery was not strong enough to convince traders about the resumption of its prevailing uptrend against the US dollar.

Stocks slide due to sticky inflation, gold and bitcoin retreat

On Wall Street, both the S&P 500 and the Dow Jones slipped yesterday, with the latter losing nearly 1%, while the Nasdaq finished the session slightly in the green. Today, stock futures are pointing to a lower open and should the PPI numbers corroborate the notion that interest rates should stay high for longer, another red session may be possible.

Gold surrendered to the dollar’s gains yesterday, confirming once again that it is not as strong of a safe haven as the greenback when it comes to tariffs, while Bitcoin pulled back after hitting a record high on Monday. That said, the crypto king is on the rise again today, perhaps as traders saw the dip as an opportunity to buy at more attractive levels.

.jpg)