EBC Markets Briefing | Investors take profits from Hong Kong stocks

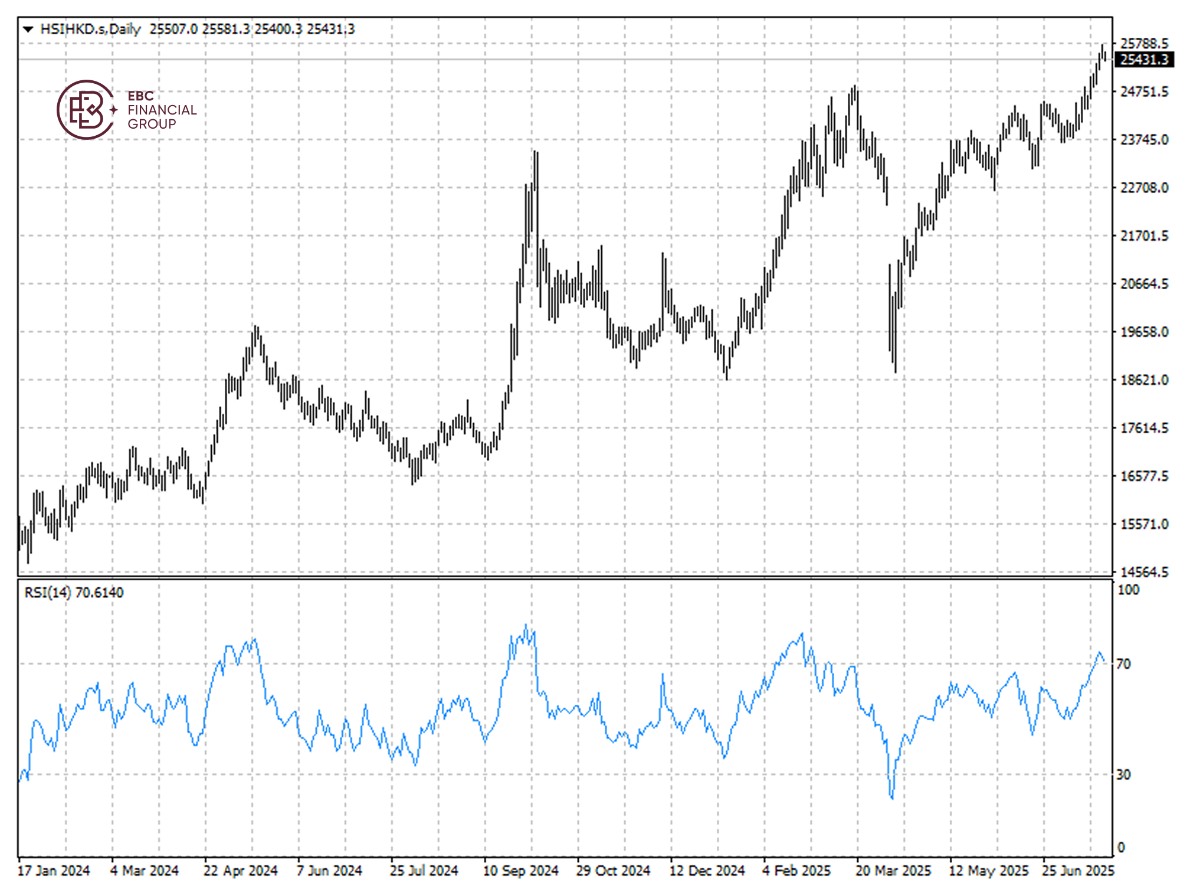

Asian markets eased from highs on Friday, with the Hang Seng index down more than 1%, as investors locked in profits ahead of a crucial week that includes Trump's tariff deadline.

Hong Kong's equity benchmark is trading at its highest level in years, thanks to a rally sparked by a breakthrough in AI earlier in the year as well as strong demand from mainland investors.

The index jumped 20% in the first six months, among the world's best performers. The A50 Index just hit a new high for the year this week, driven by a plan to build the world's biggest hydropower station.

Hedge funds focused on Chinese equities posted double-digit returns in the first half of the year, outperforming global peers While near-term volatility may rise as the deadline for a tariff truce approaches, they stay bullish.

Investor sentiment has also improved as geopolitical tensions between China and the US begin to ease. Nvidia and AMD's renewed sales of some AI chips to China reinforced the perception.

TikTok may come up in trade talks with China next week, but if Beijing does not approve a divestment deal for ByteDance, the app will soon go dark in the US, US Commerce Secretary Howard Lutnick said.

The Hang Seng index is on course to get out of overbought territory, but the low of 25354.3 is expected to provide solid support. The uptrend may well continue further down the line.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.